Expert Summary

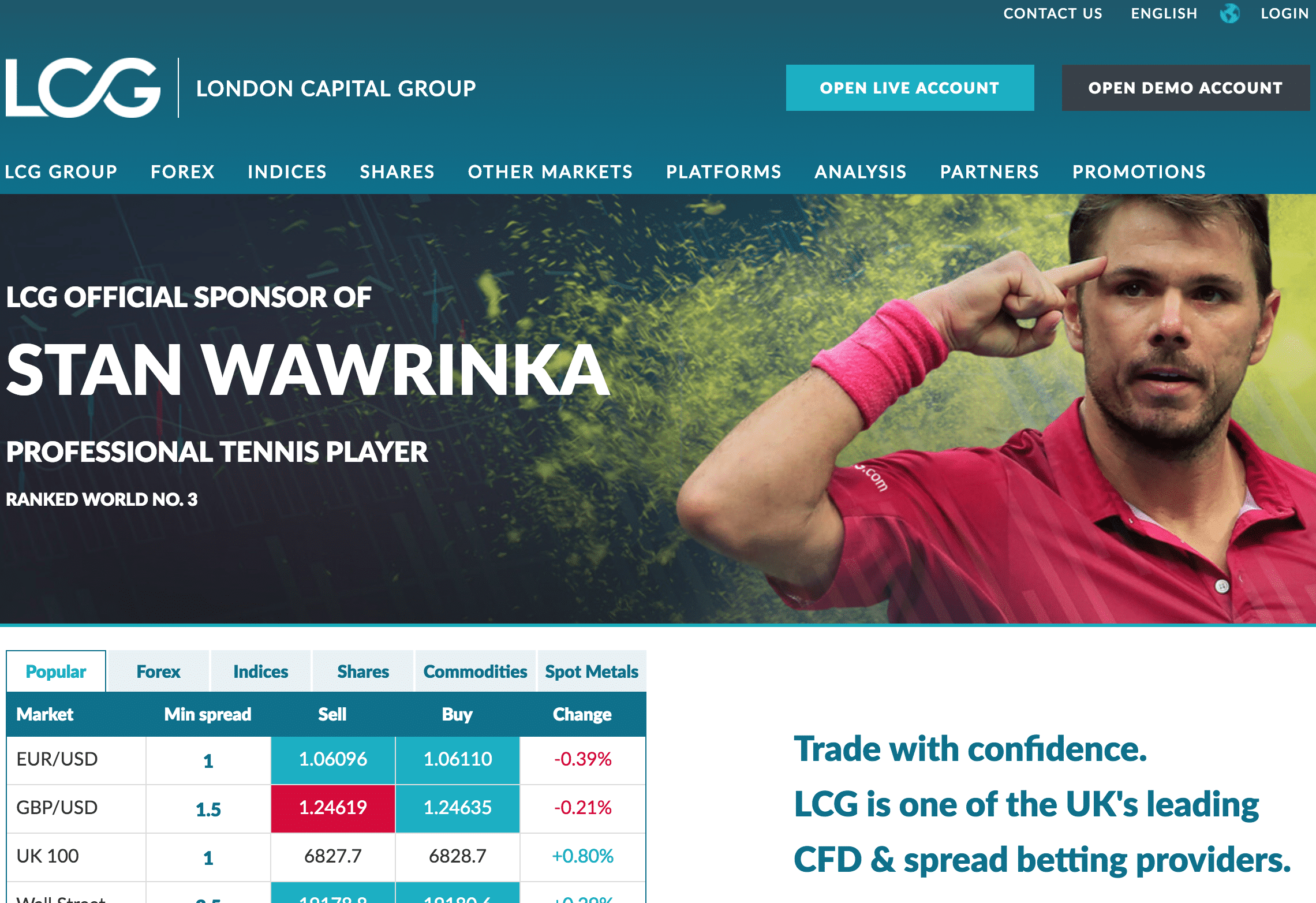

In an industry defined by scrappy start-ups bursting onto the scene, few players have been in the game for as long as the London Capital Group have. But with over twenty years of operation behind them, London Capital Group is now one of the most experienced online brokers around. Since first being founded in 1996 in—as you might be able to tell from the name—London, the London Capital Group have truly gone from strength to strength.

Although its origins began in a time before online retail trading was really a thing, with the rise of fintech and online brokerages, London Capital Group has proved more than up to the task of transitioning into this digital age. After first launching its online spread-betting brokerage service in 2003, the London Capital Group have grown to be one of the most trusted names in the online CFD space.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

In just over two decades in operation, London Capital Group has amassed a number of industry awards in both UK based and international competitions. These awards include recognition for its desktop and mobile apps, innovation, and overall platform awards for CFD trading and financial betting.

But the awards London Capital Group have won are only indicators of a successful platform and don’t necessarily tell us a huge amount about the platform itself. Thankfully, however, when it comes to performance, London Capital Group deliver. Its innovative, multi-asset class trading platform—LCG Trader—offers a fast, reliable, and stable trading experience that includes an impressive charting package.

This allows you to trade thousands of financial instruments across 9 asset classes, which includes forex, indices, shares, commodities, bonds and interest rates, vanilla options, and ETFs. In total, users are given access to over 7,000 markets. The spreads offered are generally quite tight when compared to the industry averages, which makes CFD trading with London Capital Group a solid choice all-round. Generally speaking, pip spreads on majors start from the 0.6 pips mark, whilst leverages vary from 1:5 to 1:30 depending on your location and account type.

Customer trust and security are evidently something London Capital Group take very seriously, and in its twenty years of trading, it has looked after over $1 billion in deposits and over $20 trillion in executed trading volume. These are staggering figures which many other brokerages could only hope to replicate.

More importantly, still, these figures show that London Capital Group takes its regulatory obligations seriously. Customer trust and confidence is improved with the knowledge that all the investment funds overseen by the London Capital Group are held securely in Tier 1 banks. Additionally, from a customer safety perspective, its listed publicly following its IPO in 2005, London Capital Group are now under more stringent reporting and capital maintenance requirements, which provides clients with an added layer of confidence.

Although it still has a number of institutional clients and third-party partnering arrangements, London Capital Group is still very much focused on delivery a high-quality retail and professional day trader experience. When combined with its extensive industry experience, this means the London Capital Group are well worth checking out.

Many of today’s forex brokers inundate you with a flood of promotions and innovative features that do little more than confuse and distract. Londoncapitalgroup.com (LCG) is not one of those brokers. On the contrary, they earned their stripes in the nineties handling a proprietary trading operation that catered to large institutional clients. Their focus, as most traders would hope, is fixated on providing reliable service with quick execution speeds at the lowest prices in town. Combine these facts with being regulated by the Financial Conduct Authority (FCA) and being traded on the London Stock Exchange, and you have a winning formula that only few can match in today’s industry.

The firm’s holding company began financial trading operations in 1996. In 2003, it launched its financial spread-betting broker, “Capitalspreads.com”, and in 2005 after a management buyout and IPO, it launched its traditional forex trading offering, LCG. As an additional assurance for the trading community, public companies must also adhere to stricter reporting standards and maintain capital levels that are public knowledge each and every day. The current market cap for the publicly traded holding company is nearly £20 million at last reading. LCG offers a broad array of currency pairs, together with futures trading in indices and commodities. U.S. clients are not accepted at this time.

This market execution setup enables a spread-plus-commission pricing model that, when combined with Tier-1 liquidity providers, yields transaction pricing that is difficult to find elsewhere. Leverage varies by asset class, starting at 1:5 for shares, and declining to as low as 1:30 for some indices. LCG uses the Metatrader4 set of trading platforms with market execution of orders. Expert Advisors are allowed for automated trading. Customer Support and Sales Team staff members are excellent, and daily emails get you ready for each day’s action. To cap off the offering, LCG also awards a 10% welcome bonus, up to a max of $5,000 on your initial deposit. What’s not to like about this top-of-the-line broker?

As of August 1st 2018 LCG has new maximum leverage. It starts from 1:5 for shares and goes up.

Unique Features of Trading with London Capital Group

Why trade with Londoncapitalgroup.com? The firm lists these reasons:

- Proprietary trading operation began in 1996 in London;

- Regulated and licensed by the Financial Conduct Authority (FCA);

- Holding company is publicly traded on the London Stock Exchange with a market cap of roughly £20 million;

- Asset choices range from major and minor currency pairs (39) to indices (12) and commodities (15);

- Spread/Commission pricing structure rivals the lowest in town; LCG low commission charges are included in the FX spreads and there are no hidden fees

- Promotional welcome bonus of 10% up to $5,000 with a $3 credit to funds available for withdrawal with each trade that follows;

- Pip spread on majors; from 0.6 pips

- Leverage varies from 1:5 to 1:30.

- Metatrader4 trading platform supports desktop and mobile access;

- ECN/STP processor for swift order execution and tight spreads;

- One account classification that comes with a free demo account;

- Daily emails with market commentary and analysis prepare for each trading day’s action;

- Customer service reps are available 24X7 while trading markets are open.

Spreads & Leverage

Since LCG is a full-on ECN/STP broker, its system matches client orders directly with market liquidity providers, which vary in spread and open amount appetites. For this reason market execution may deliver the lowest price in town, but there may be minor slippage when an order exceeds the market limit available. The website explains this complexity, but in any event, the spreads are very competitive. Leverage varies by asset choice selection. The amount of leverage used also determines the minimum trade amount, based on the selected lot size. Pip spread on majors; from 0.6 pips.

Compare London Capital Group with other approved brokers

|  |  |  | |

| Regulation | FCA, CySEC, CYMA | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FCA, CySEC, ASIC, Seychelles FSAS, | ASIC, MiFID, FSA, FSCA |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | |

| Trading Platforms | MT4, WebTrader, Mobile Apps | MT4, MT5, WebTrader | desktop and mobile via brokers own platform | MT4, MT5, Mobile App |

| Minimum Deposit | $100 | $100 | $50 (varying by Country) | $100 |

| Leverage | From 1:5 up to 1:500 (for pro-clients) | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | From 1:2 to 1:30 | 400:1 |

| Total Markets | 7000+ | 637 | 2368 | 1260 |

| Total Currency Pairs | 60+ | 62 | 49 | 55 |

| Total Cryptocurrencies | 0 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 37 | 17 |

Platform

In order to provide swift order execution at extremely low prices, LCG management elected to go with Metatrader4 trading platform protocols, the most popular setup in the industry. The MT4 products align well with ECN market execution usage, and each trader can avail themselves of the online user guide and MT4 community of traders for answers to questions or to share information with other interested traders. Mobile applications are also supported, and the latest in 256-bit SSL technology is employed to encrypt all sensitive data for purposes of safety and security.

Deposits and Withdrawals

Visa or Mastercard credit cards or selected debit cards may be used for deposits, but banking wire transfers are the preferred method. Deposits and accounts may be maintained in USD, GBP, or EUR. While there is no minimum deposit for an account, your minimum trade amount will depend on the asset chosen, lot size, and leverage. The website illustrates with examples as to how this computation is made. Withdrawal requests will be approved and processed within 24 hours, but only if internationally mandated personal identity information is already on file, as required by regulations.

Beginner Support

Customer and Sales Support specialists have trading experience and the ability to answer any questions that you might have about getting started. You may access them on any trading day while markets are open on a 24X7 basis, either by direct phone or email. If you are a beginner and need to brush up on the basics, then the companion website at Capitalspreads.com provides an abundance of video tutorials, webinars, and ebooks for your review and use. LCG also initiates each trading day with an informative email, delivered to all clients that includes complete commentary and analysis for the forex, commodity, and indices markets, highlighting what you might encounter during the trading day.

Conclusion

London Capital Group still maintains a hefty market share of institutional clients and third-party partnering arrangements, but for the professional trader that is looking for something exceptional without having to pay for a lot of glitz that he does not need or want, LCG is waiting for your patronage. LCG ensures that low fees, service reliability, excellent support, and the peace of mind that comes with FCA regulation in London are all packaged together for one no-nonsense deal that focuses on your results. The firm’s website speaks to pride and commitment: “At LCG we’re proud of our key strengths… But we won’t stop there because we’re constantly looking at ways we can improve our offering.” Trust, transparency, and reliability at a very low cost – tough to beat in today’s forex marketplace!

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts