LegacyFX is a forex broker with seven years of experience that also offers signal services on the side.

Generally, most traders that have used their services have had positive things to say about them, and the broker has a good overall reputation. There have only been a few miscommunications along the line with the brokers and traders. But, overall, their signal service is one to write home about.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

Many traders like, and have made good profits from, the signal services of LegacyFX according to users’ comments. Let us say that in this regard, we can’t cast judgment. The service seems to have lived up to expectations for the most part. With that being said, most traders count the few losses with the signal service as negligible.

LegacyFX launched way back in 2012 and, with that in mind, it is safe to conclude that it has a decent user feedback score. Since its launch, it has received plenty of reviews from customers – with positive ones outweighing the bad.

A.N. (All New Investments Limited) is the corporate operator behind the LegacyFX brand. This company got registered as a CIF (Cyprus Investment Firm) and is also a member of the investor compensation scheme.

The permanent office address of LegacyFX is Q Tower, 5th floor, Ioanni Kondylaki 47, 6042, Larnaca, Cyprus.

LegacyFX is a regulated broker, primarily under the CySEC body, with a licence number of 344/17. This means that the operator is biddable with MiFID, which gives it the theoretical right to peddle its financial services all through the EEA. On a practical level, though, the broker took its time to register and complete its regulatory processes with most of the national regulatory agencies of the EEA.

But that’s not all. To give traders more security and insurance, LegacyFX took their regulation umbrella further by aligning with other reputable bodies in Europe. For the UK, they got regulated by the FCA with the license no: 797343. For Germany, they have been given the registration no. 348194 by BaFin. LegacyFX even went as far as getting regulated by the Belarus NBRB with a license no: 193180778. Additionally, the broker is regulated by the VFSC and has the license no. 14579.

With that being said, the broker cannot allow all traders from the EEA. Also, traders from the US and Canada are not accepted either.

So, why will a trader want to use the LegacyFX brokerage firm?

First off, the broker provides an easy withdrawal and deposit system for all its clients. As a trader, you know this feature isn’t negotiable. Also, you stand a high chance of having access to over 80 trading videos, webinars, and other educational resources—all hosted by LegacyFX academy.

You’re open to making good profits, whether you’re a newbie or professional trader with LegacyFX, thanks to its market insights and exclusive professional trading tools. Plus, traders that have used their service have given great reports about their customer service and support system. Many traders have spoken highly of the “dedicated support staff that is always willing to help all through trading hours.”

The broker boasts of its low trading costs, as well as its matchless liquidity. The trading conditions of the broker are undeniably very competitive. However, these competitive streaks are only on the higher-tier account types. Those with the cheapest accounts cannot expect to trade under industry-best conditions.

That brings us to the account types:

The Different LegacyFX Account Types

The broker has a total of three account types that cover the needs of every single trader that registers.

The handiest trader account is the Silver one, which features a minimum deposit requirement of just $250. This seems to be decent enough for a newbie trader when compared to the minimum deposit requirements.

Surprisingly, the Silver account is generous when it comes to features: it covers everything higher-tier accounts do, except for Dealing Room direct line, advanced analysis, and 1-on-1 support.

All the accounts types of the broker are 0-swaps. The Silver account provides access to all trading platforms of the broker. Technical analysis and educational bonuses are also included in the Silver category.

The maximum leverage on the silver category is 1:200.

Traders that want to register for the (supposedly) most popular account option of the broker will have to be ready to spend up to $5,000 without looking back.

The Gold package takes the trading game to a whole new level, delivering a Dealing Room hotline, analysis insights, and 1-on-1 support. It also comprises all the features of the Silver package.

While the Silver account holders get spreads starting from 1.6 pips (depending on the major currency pair), Gold account holders, get spreads starting from 1.0 pips.

The maximum leverage on the gold category is 1:200.

To further enhance trading conditions, traders can resort to the Platinum account, which drives spreads as low as 0.6 pips.

The maximum leverage of the Gold package remains the same, and all the possible incentives and features are part of the “VIP” package. To get such mouth-watering trading conditions, though, traders need to be ready to spend up to $25,000.

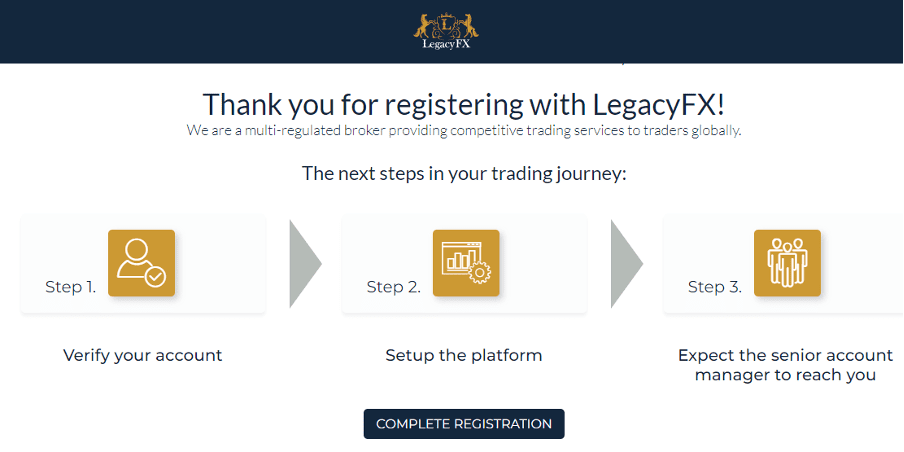

Opening an Account

The homepage of Legacy FX offers an easy route to starting trading. It has a clearly marked ‘Open Real Account’ button, which is the starting point for those looking to sign up and trade on a cash basis. Next to it is an ‘Open Demo Account’ option for those who want to start off trading virtually.

After setting up a log-in there was a Captcha check, obviously set up to avoid bots penetrating the site. It was easy to work through, and a nod to Legacy FX being strong in terms of site security. Soon after providing details, a member of the Legacy FX team sent a WhatsApp message to check how the process was going and to offer advice on how to make the process as easy as possible.

The rest of the onboarding process for Live Legacy FX accounts is dependent on your country of residence. Those setting up with the Vanuatu-regulated entity can create an account within seconds. Those onboarding with the UK-registered entity will find the process takes a few minutes longer.

Traders setting up a Demo account should note it is only active for one month. Legacy FX provides Islamic trading accounts that enable clients of the Muslim faith to trade global financial markets without compromising Sharia laws. Selecting for that type of account is done during the onboarding process.

In line with standard market practice, new clients to the FCA-regulated entity are required to disclose their country of domicile and provide basic details relating to trading experience (if any) and educational background. The functionality of the site made setting up a profile simple to do, with the standard questions about employment status and source of funds being easy to navigate.

As platform choice at Legacy FX is limited to MetaTrader’s MT5, there is no need to consider different options.

Making a Deposit

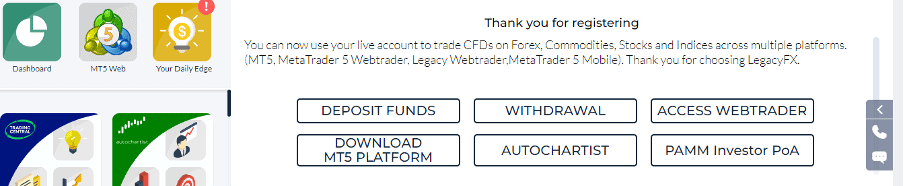

The ways of adding funds to a Legacy FX account are fast and cost-effective. The process starts by clicking on the payment button at the top of the WebTrader platform, or the Trader Toolbar sidebar on the Legacy FX web page. There are plenty of payment options to choose from, including credit/debit cards and multiple e-Payment agents.

Those funding via Credit Card need to provide a photocopy of the front and back of the card, showing the last four digits on the front and the first four digits on the back. The minimum deposit amount is $500 for the Silver account, while for the Platinum account the minimum is $50,000.

Processing times for withdrawals range between 1-3 days, which is in line with standard market practice. Legacy FX don’t charge any withdrawal fees, but all the paperwork relating to your account must be completed before the broker is allowed to release funds.

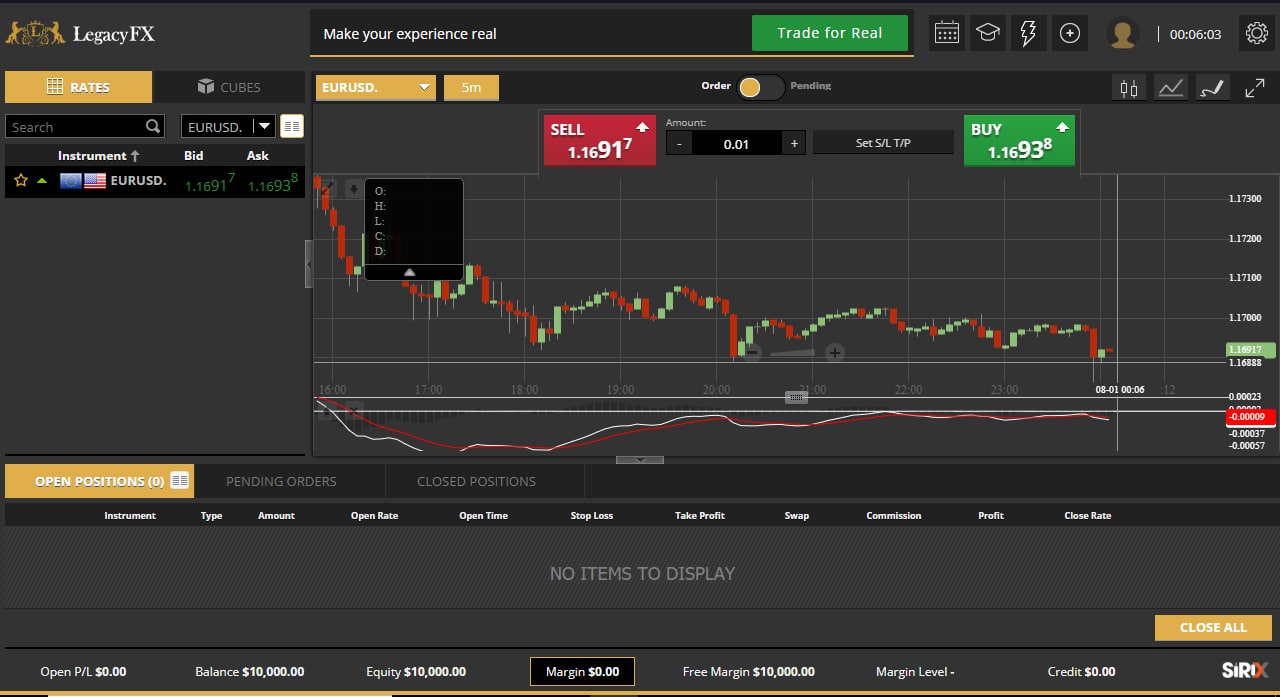

Placing a Trade

The platform provided to Legacy FX clients is the ever-popular MetaTrader MT5. As this software is offered under license by a third-party (MetaTrader), it’s necessary to complete some additional online paperwork and accept a Terms of Service agreement. Legacy FX do well to provide a helpful breakdown of what is needed in the FAQ section of their site.

After registering for an MT5 account you’ll be sent the login details to the MT platform. These are different to the log-in details of your Legacy FX account, so need to be stored safely. MetaTrader platforms have been operating for decades and are a finely tuned operation, so it was no surprise that this part of the process took only moments to complete.

While waiting for our account to be verified by Legacy FX staff, we took tried out the Demo account. This has all the same functionality of the Live account and features real-time price feeds, so we were able to familiarise ourselves with how things work.

The functionality of MetaTrader MT5 has been developed over many years of live trading. It’s robust, easy to use, packed full of trading signal indicators and has a clean aesthetic.

To try it out we booked test trades in AUDUSD and EURGBP. These were executed first time, and reported accurately in the Portfolio section of the main dashboard.

Contacting Customer Support

Legacy FX customer support work extended business hours five days a week. They can be contacted 24/7 via Live Chat, WhatsApp, and email.

During our testing of Live Chat, we found the service to be high quality. Response times were immediate, staff were well informed and professional, and there was no first stage of interaction with a bot. If you prefer to discuss queries over the phone, then it’s possible to contact customer support or the broker’s dealing desk to speak to staff equipped to help you book trades.

The FAQ sections of a broker website can vary in quality, but the one at Legacy FX was pitched at the right level and answered a lot of questions we could imagine new users having. Email queries that we sent on subjects that required detailed analysis were resolved within 24 hours, again to our complete satisfaction.

LegacyFX Trading Platform Software

This broker runs on the MT5 trading platform that supports both mobile and computer users.

The MT5 is, without doubt, the world’s most cutting-edge trading platform and it represents a significant upgrade on the MT4 platform. trading platform of the MT4 platform. It also offers features that cannot be contested that most of its competitors.

Its charting capabilities are simply outstanding. It covers a vast range of chart types, technical indicators and time frames. MT5 is a fully customisable trading environment. It comes with 50+ technical indicators that come pre-installed with the downloadable platform. Plus, traders can freely install their technical indicators, acquired from other third-party creators. Much more, traders can even generate their own technical indicators via the platform.

The same thing goes for the EAs, which are some of the most valued assets of MT5. Through such custom scripts and expert advisors, traders can set up their trading methods to a point where their direct intervention is hardly needed.

Mind you; EAs have nothing in common with auto-trading scams that used to be the rage a year or two ago. They execute strategies defined by traders, in a manner specified by traders, without outside intervention.

MT4 also supports multiple order types, such as market orders, trailing stops, and Stop limits.

Compare LegacyFX with other approved brokers

|  |  |  | |

| Regulation | CySEC, BaFin, FCA, VFSC, NBRB | FSPR | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT5, WebTrader, Mobile Apps | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, WebTrader | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $500 | $200 | $100 | $200 |

| Leverage | 1:30 | 1:500 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | 1:30 |

| Total Markets | 425 | 182 | 637 | 1200 |

| Total Currency Pairs | 41 | 72 | 62 | 62 |

| Total Cryptocurrencies | 5 | 0 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 18 |

LegacyFX Review Conclusion

Whether you are a newbie or a professional forex trader, you can rest assured that you’ll be experiencing decent trading conditions with LegacyFX – plus the broker allows traders to choose from three different account types.

If you’re a professional or amateur trader that wants to enjoy the experience of using professional trading tools that will enhance your trades, then it’s advisable to go for LegacyFX. It also represents a good choice for those looking for a regulated broker that runs ECN accounts with a maximum leverage of 1:200.

However, if you’re looking for a broker with high leverage of up to 1:1000 – 1:300, which is riskier, then this broker may not be suitable for you.

Please be advised that some specific products and/or multiplier levels may not be accessible for traders from EEA countries due to strict legal restrictions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts