Expert’s Viewpoint

IC Markets isn’t just one of only a few True ECN brokers; it is also a reputable operation. It’s been building a loyal client base in its home market, Australia, and has recently gained popularity with global traders. The firm has been operating for just under 15 years, is regulated by a Tier-1 authority and has some neat features which give it an edge over the opposition. IC Markets is a broker that Forex Fraud rates as a ‘Trusted Broker’, but the firm is not just legit; it is also good at what it does.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

When it launched in 2007, IC Markets’ mission statement was to make institution-grade trading standards available to more people. Its primary tool for achieving that aim is ECN (Electronic Communication Network) trade execution. ECN networks are what the big players in the market use. Those brokers lucky enough to join the network can tap into the deep pools of liquidity found off the exchange. That drives down trading costs, improves execution efficiency, and operates even when the official exchanges are closed.

IC Markets take a lot of pride in bridging the gap between retail and institutional-grade trading. Its management team are experienced industry professionals with the intention of filling an obvious hole in the market.

With an eye on supporting traders who have strategies that run around the clock, the IC Markets customer services team are available on a 24/7 basis. That’s a big plus point for traders who fit trading in with their everyday commitments and carry out off-line research outside standard office hours.

The trading platforms on offer are the market-leading cTrader and MT4. Having both of the industry stalwarts on hand is ideal, and the ECN functionality, which works in the background, takes the trading experience up a notch. Throw in super tight trading spreads, and as per the mission statement, IC Markets are indeed bringing institutional grade trading to a broader audience.

Broker Summary

The firm is privately owned, giving its backers and management team greater control over its direction.

The corporate entity behind the IC Markets brand is International Capital Markets Pty Ltd, a company incorporated in Sydney, Australia. As such, ICM is a registered Australian company. Its ACN number is 123 289 109. The Sydney office address is Level 4, 50 Carrington Street, Sydney, NSW 2000

Australia.

- With registration number 123 289 109, International Capital Markets Pty Ltd is regulated by the Australian Securities and Investments Commission with Licence No. 335692.

- IC Markets (EU) Ltd is a limited company registered in Cyprus. It is regulated by the Cyprus Securities and Exchange Commission with Licence No. 362/18.

- IC Markets Ltd, registered in The Bahamas with registration number 76823 C, is regulated by the Securities Commission of The Bahamas with License No. SIA-F214.

- Raw Trading Ltd, registered in Seychelles with registration number: 8419879-2, is regulated by the Financial Services Authority of Seychelles with Licence number: SD018.

Broker Introduction

The broker targets active day traders and scalpers, but the site has functionality that is at the same time very beginner-friendly. Once you are up and running, the platform can help you take your trading journey a long, long way.

Market coverage focuses on major markets, where liquidity levels are most robust, and clients can trade forex, CFD and equity instruments. The trading experience is first class and is also backed up by an evident focus on customer satisfaction. The firm stating its core principles to be:

- Integrity and Trust

- Honesty and Fairness

- Transparency

- Commitments and Responsibility

- Reliability

- Flexibility

- Constant Innovation

- Strong Corporate Governance

Spreads & Leverage

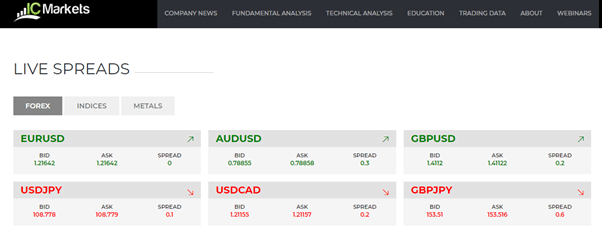

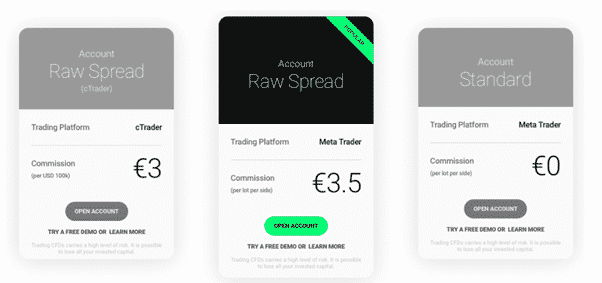

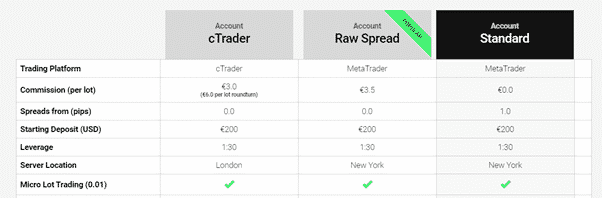

IC Markets offers spreads as tight as 0.0pips on both the MT4 and cTrader platforms. The broker scores well in terms of spreads and leverage, and as the different accounts on offer are tailored to different types of traders, the T&Cs vary between them.

The Standard Account is the most accessible. With a minimum deposit requirement of only $200, this account type features spreads starting from 1 pip and maximum leverage of 1:500. This account type does not charge any commission, and it supports no fewer than 64 currency pairs.

The True ECN Account does feature a commission ($3.5 per lot), but its spreads start from 0 pips. The minimum required deposit is $200 in this case too, and the maximum leverage is also 1:500.

The cTrader Account offers more or less the same trading conditions, and its minimum deposit requirement is $200. The commission it charges is $3/$100k.

Platform & Tools

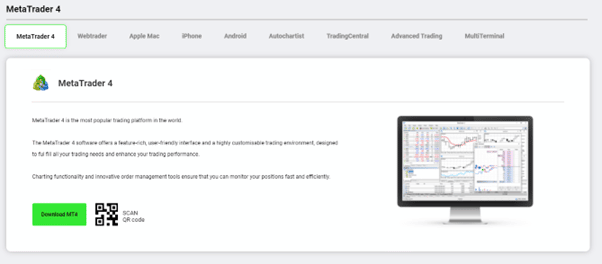

The IC Markets trading platform offer is based around the market-leading MT4 and cTrader platforms.

MT4’s qualities need no praise from anyone versed in online trading. This most popular retail forex trading platform is a blend of user-friendly functionality and powerful software tools. It’s highly customisable and comes equipped with a superb selection of analytical tools and features.

The platform can be downloaded directly from the IC Markets website for free, and the default settings include scores of pre-installed technical indicators and drawing tools. New indicators can also be added, and users are free to install off-the-shelf tools or develop their own code.

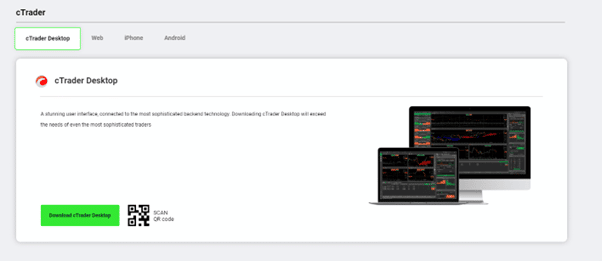

The cTrader platform has a more colourful aesthetic, and it specialises in Electronic Communications Network (ECN) trading. It is a very powerful trading platform that offers VWAP trading and depth of market monitors – the kind of reports found at institutional investment companies.

Trade execution speeds on the cTrader platform are aided by its servers being hosted close to the major global exchanges in New York and London.

Both platforms are available in desktop, webtrader and mobile App format. One neat feature of the cTrader platform is that it’s possible to set up a custom workspace that allows you to keep your profile settings if transferring your account from another broker or device. All you have to do is log in, and your favourite workspace is automatically restored.

The MT4 platform is exceptionally popular with investors looking to trade their own models. You can now also access cTrader’s cTID service, an excellent resource for finding and sharing trading robots, indicators and for tapping into a vibrant community of people who specialise in systematic auto-trading.

Compare IC Markets with other approved brokers

|  |  |  | |

| Regulation | ASIC, CySEC | FCA, ASIC, CIMA | ASIC, MiFID, FSA, FSCA | FCA, FSCA, CMA and FSC |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, Mobile Apps | MT4, MT5, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5 |

| Minimum Deposit | $200 | $200 | $100 | $200 |

| Leverage | 1:500 | 1:500 | 400:1 | Flexible |

| Total Markets | 1944 | 339 | 1260 | 252 |

| Total Currency Pairs | 61 | 44 | 55 | 62 |

| Total Cryptocurrencies | 21 | 34 | 17 | 4 |

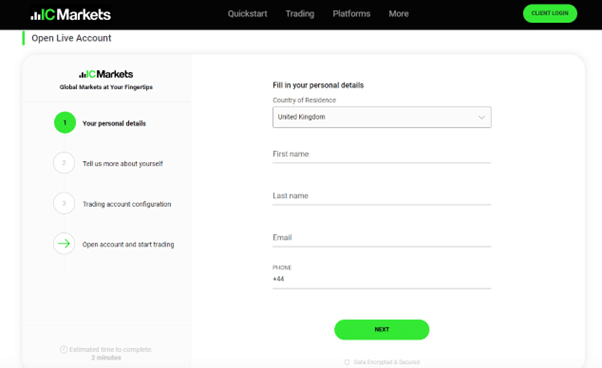

Opening an Account

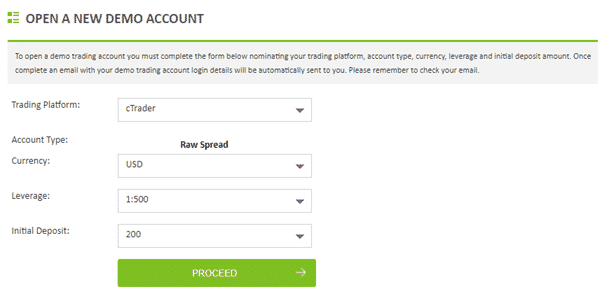

The process of opening an account with IC Markets starts at the broker’s homepage, where there is the option of setting up a Live or Demo account.

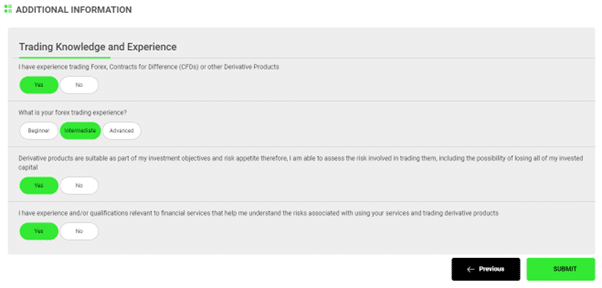

After clicking on the ‘Start Trading’ button, new clients are taken straight into the first stage of the onboarding process. This requires inputting basic details, including a phone number. Additional information, such as whether the account is for an individual or corporate entity, is also required, as is selecting if the account needs to be Shariah compliant.

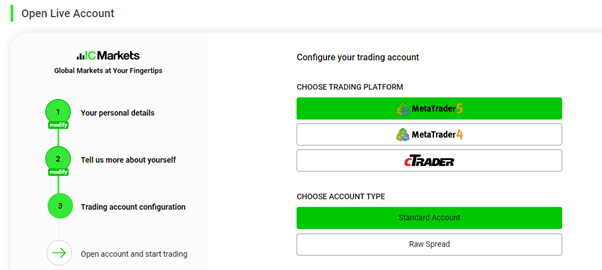

IC clients then need to select which trading platform to use. MetaTrader’s MT4 and MT5 are both available, with the cTrader platform being a neat alternative for traders who prefer the layout of that platform’s dashboard.

Some thought needs to be given to the question of the ‘Type of Account’ required. The T&Cs of the different accounts make them suitable for particular trading styles, but even with that workload factored in, the time taken to set up an account was less than two minutes.

All new users are then required to verify their email address. Login details and passwords for the new account are then sent via email. The time interval between the broker receiving and authorising the account was impressively short, which meant we could move on to live trading.

Making a Deposit

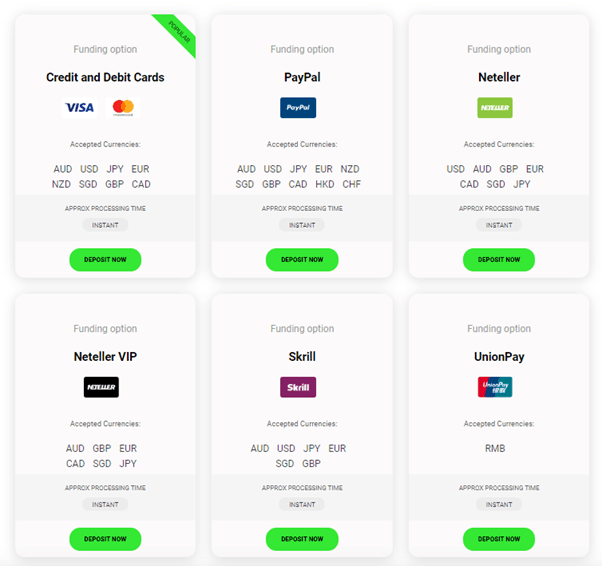

IC Markets has one of the best ranges of payment options in the sector. Information on the separate ways of sending funds to your IC Markets account is neatly laid out. It includes credit/debit cards, bank transfers, PayPal, Neteller, Skrill, UnionPay, Bpay, Poli, Rapidpay, and Klarna.

The site provides a clear breakdown of the time it might take for payments to be processed and if third-party agents might charge a fee. IC Markets does not charge additional fees for deposits or withdrawals and provides clients with an impressive range of base currency options with ten different currencies supported, ranging from USD to Hong Kong dollar.

Not all the payment options support all currencies; some, such as UnionPay, support only one (RMB), but the fact that there are 13 to choose from ensures IC Market clients can fund their account using a best-fit agent.

The minimum deposit requirement at IC Markets is $200 or the equivalent. This is in line with the sector. That is a realistic amount considering the need to be able to provide margin on trades, which at IC Markets can take advantage of leverage terms which extend to 1:500.

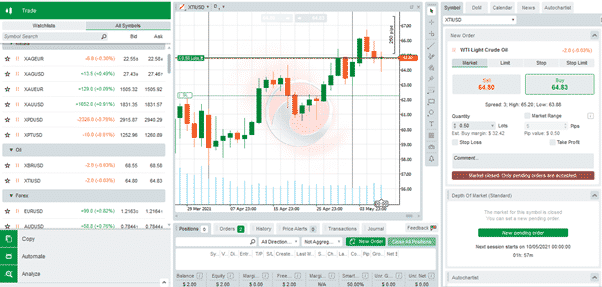

Placing a Trade

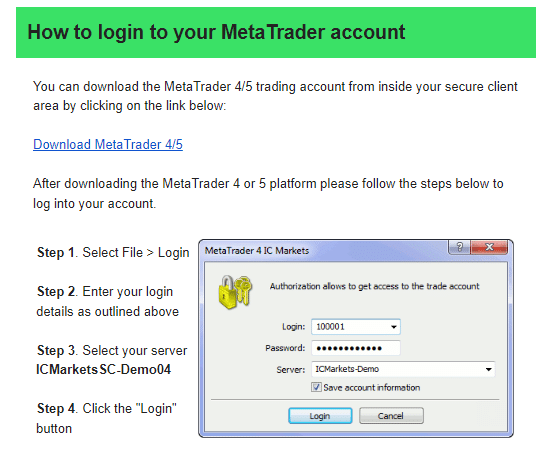

The platforms provided for IC Markets clients are the ever-popular MetaTrader MT4 and MT5, and cTrader. As these are provided under licence from a third party, there is a need to complete some additional online paperwork and accept a Terms of Service agreement between the platform provider and user.

IC Markets email the platform login details to new clients and provides a step-by-step guide on how to proceed. That email was sent instantly, so we could start trading immediately. The login details to the MT4, MT5, or cTrader platforms are different to the login details of your IC Markets account, so they need to be stored safely.

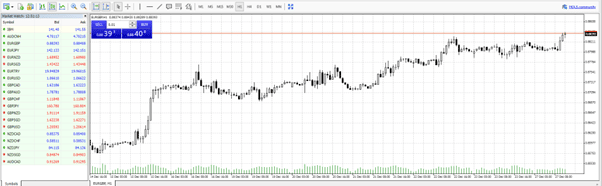

MetaTrader platforms have been used by traders for decades and are known for being reliable and impressively effective. The clear aesthetic makes them a natural fit for chart-based trading and helps make navigation easy. During our testing, we could navigate to the trading monitors and start booking trades within seconds of signing in.

To try it out, we booked test trades in EURGBP and GBPUSD. These were executed instantly and reported as open positions in the Portfolio section of the trading dashboard. The profit/loss on each position is recorded in real-time thanks to the live price feed.

Commissions & Fees

IC Markets swap rates are amongst the most competitive in the market.

Those looking to start a trading account at IC Markets have an impressive range of deposit methods at their disposal.

Various credit- and debit cards are accepted, as well as bank wires. Interestingly, one can also use PayPal to deposit funds with the broker. In addition to all the above, scores of other regional solutions can be used, such as Qiwi, FasaPay, BPAY, WebMoney, and Neteller. Broker-to-broker transfers are also accepted.

Education

Both the MT4 and cTrader platforms are packed full of additional research tools. Autochartist is one example of the high-quality third-party tools made available to IC clients. MetaTrader users can also take advantage of the MQL5 online community of traders. There’s little risk of running out of trading ideas.

It’s possible to set up the platforms to do a lot of the heavy lifting for you. You can set up your account to be instantly notified about what is happening with your trading positions. Market news notifications are managed using one easy and simple settings panel, which can reset your email notifications for any of your trading accounts.

Other learning focussed services include educational webinars, a database of market reports, videos and notes on fundamental, technical and risk management analysis.

Customer Service

The IC Markets website provides several options for traders to leave feedback, to ask support a question and to chat with support staff members. During testing we found the staff to be knowledgeable and client focussed, but the real selling point is that IC Markets provide customer support on a 24/7 basis. This is a step up from the majority of the market where 24/5 coverage is the standard offering.

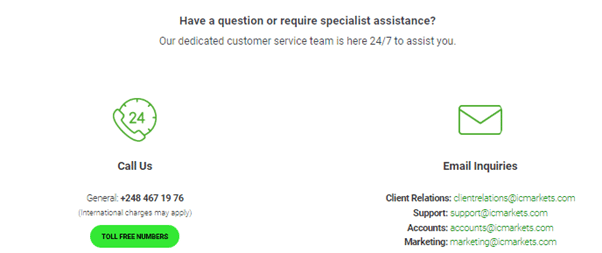

Scores of regional phone numbers are available, for every one of the countries where the broker operates. Those who prefer Live Chat can take advantage of that service and the general support email is [email protected].

Contacting Customer Support

The IC Markets customer support team operates 24/7 out of Seychelles, Australia, and Cyprus offices. They can be contacted by clicking the “Live Chat” icon, phone, and email. The FAQ section of the platform is also helpful. It contains an easy-to-use list of the most commonly asked questions.

Initial contact with the Live Chat team involves working past an automated bot which does a satisfactory job of trying to answer questions. If that does not result in any issues being immediately resolved, it is then possible to transfer to a human agent. During our testing, we found response times almost instant, which is impressive given the round-the-clock, 24/7 nature of the service. The staff were well informed, client-focussed, and able to resolve our queries the first time of asking.

The call-back service offered was also useful. That allowed us to log queries relating to beginner and advanced-level aspects of trading and to continue trading in anticipation of a member of the IC Markets team contacting us directly.

Final Thoughts

IC Markets is a professional outfit. It is trusted thanks to it being authorised and regulated by Cyprus Securities and Exchange Commission (CySEC) with Registration no: 362/18. Trade with peace of mind by knowing that IC Markets is monitored by one of the strictest financial European regulatory bodies.

The user interface is institution grade and the third-party research tools mean you’re highly unlikely to run out of trading ideas. When you do enter into the markets your trading is backed up by competitive pricing and high-spec platforms.

Broker Details

IC Markets is a trading name of IC MARKETS (EU) LTD. IC Markets (EU) Ltd is deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.

Contacts

IC Markets address: 141 Omonoias Avenue, The Maritime Centre, Block B, 1st floor, 3045 Limassol, Cyprus

- Telephone +357 (25) 123 504

- Online 24/7 Live Chat

FAQs

How can I open a demo account with IC Markets?

Demo accounts at IC Markets are free to set up and give you access to all the services offered by IC. To open a demo account, you will need to provide your name, email address and telephone number.

Is IC Markets a regulated broker?

IC Markets is regulated by CySec and the FSA in Seychelles. The regulatory protection for clients is determined by where they live.

What are the deposit options for IC Markets?

You can transfer funds into an IC account via one of 15 different payment methods. Some of them are instant. The broker offers a larger than average number of base currencies with clients able to choose from 10 currency options.

How do I withdraw money from IC Markets?

You need to access your Secure Client Area to withdraw funds from your brokerage account. Withdrawal requests using some processing agents are paid on the same day. No charges are made for deposits or withdrawals.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts