Interested in HFTrading? Our experts have reviewed both, and their tests show that FXTM is a stronger broker right now.

Find Out Why

Expert’s Viewpoint

Following our extensive Review of HFTrading, we are delighted to tell our readers that the CFD broker is legitimate, and it is safe to invest your funds. The basis for our analysis is that HFTrading is authorised and regulated by the Australian Securities and Investments Commission (ASIC), and the New Zealand Financial Markets Authority (NZFMA). While the regulators endorse the authenticity of the broker, they also have a stringent framework in place that includes maintaining sufficient capital, regular audits, client privacy, and security of deposits.

In this section, we have highlighted some of the main features of HFTrading, and while all of them may not be great, you have to recognise that it is only a few months since the launch of the brokerage.

Beginning with the website, it is available only in English. We found the site easy to navigate, and all the info related to each of the topics was easily accessible. The account opening process is straightforward, and on opening the account, we could easily access all the info from the Client Area. For now, only residents of Australia and New Zealand can open an HFTrading brokerage account, so if you don’t reside in either of those countries, you will have to look for another broker.

On the product front, the brokerage has covered all the major asset classes, with the HFTrading stocks and the cryptocurrencies range standing out. The cutting-edge MT4 platform with its variety of analytical tools and trading parameters enhances the trading experience. The trading terminal allows users to execute manual orders, automate strategies or copy trades of professionals. When it comes to trading conditions, there is a bit of inconsistency in the stated and verified experience, especially with the spreads and leverage. However, when it comes to the order execution speed, we found them to be in line with the broker’s statement on the website.

This broker is expensive when it comes to client trading costs, despite not charging commissions. In our HFTrading Brokerage Review, we have highlighted all the reasons. Also, the processing time for withdrawals is a little slow compared to the competition. Finally, the quality of the client helpdesk could be boosted a bit, especially in terms of responding speedily to clients.

HFTrading Summary

HFTrading is one of the newest entrants in the Australian CFD broking industry. The trading brand of CTRL Investments Limited emerged from the takeover of MahiFX by LGT Solutions Limited in the second half of 2019. Operating out of New Zealand, HFTrading is a market-making broker, offering hundreds of CFD products on the globally renowned MetaTrader 4 platforms. The product mix includes 50 FX pairs, 51 cryptocurrencies, 17 commodities, 20 global stock and volatility indices, 214 share CFDs, and three ETFs. To access the offerings, you have to create a client area log in by filling out a simple to complete account opening form. Once your HFTrading brokerage account is open, go to the client area to view your profile, to deposit/withdraw funds, download trading platforms, or connect with the client helpdesk.

When it comes to trading conditions, HFTrading offers variable spreads and leverage, which largely depend on the kind of trader you are. Novice traders are charged a higher spread and lower leverage compared to professional clients, which is more or less in line with the offerings of other CFD brokers. Besides, HFTrading does not charge a commission, although there are costs in the form of fees, that eventually compound client trading costs, making them an expensive broker. HFTrading is multi-regulated, covers all the major asset classes, offers a range of trading tools, provides several resources for learning, and runs an 11/5 customer support desk.

HFTrading Introduction

HFTrading is the trading name of CTRL Investments Limited, a New Zealand based multi-asset forex CFD broker, incorporated in 2019, following the acquisition of MahiFX. Before being sold-off, MahiFX, founded by David and Susan Cooney in 2010, was a well-renowned CFD brokerage in New Zealand and Australia. The multi-regulated, multi-asset broker was supervised by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the New Zealand Financial Markets Authority (NZFMA).

HFTrading offers more than 350 CFD products comprised of FX, shares, commodities, indices, cryptocurrencies, and ETF’s. Users can access the financial instruments from the most widely used MetaTrader 4 platforms from a choice of three HFTrading brokerage accounts- Silver, Gold, and Platinum, each designed to meet the specific needs of the broad trading community. You can start trading by filling out a simple registration form, submitting your KYC documents and depositing a minimum of A$250; it’s that simple.

The HFTrading broker is subject to the tight regulations of the Australian Securities and Investments Commission (ASIC), and the New Zealand Financial Markets Authority (NZFMA). Those financial watchdogs have mandated stringent guidelines for all their members to ensure client privacy and the security of deposits.

In this HFTrading Review, we carried out a comprehensive analysis of all the primary parameters of one of the recent players in the ‘Over the Counter’ broking and how they stand out against the competition.

Spreads and leverage

The trading conditions at CFD brokers primarily comprise the spread and leverage, and in this HFTrading Brokerage Review, we evaluated the factors shaping them.

Individuals registering with the HFTrading broker are subject to variable spreads and leverage, although the extent of this offering depends on the account type. As stated earlier, HFTrading offers its clients the choice of three account types- Silver, Gold and Platinum. The Silver Account is for beginners or novice trades, while the Gold and Platinum Account is for advanced and professional traders respectively.

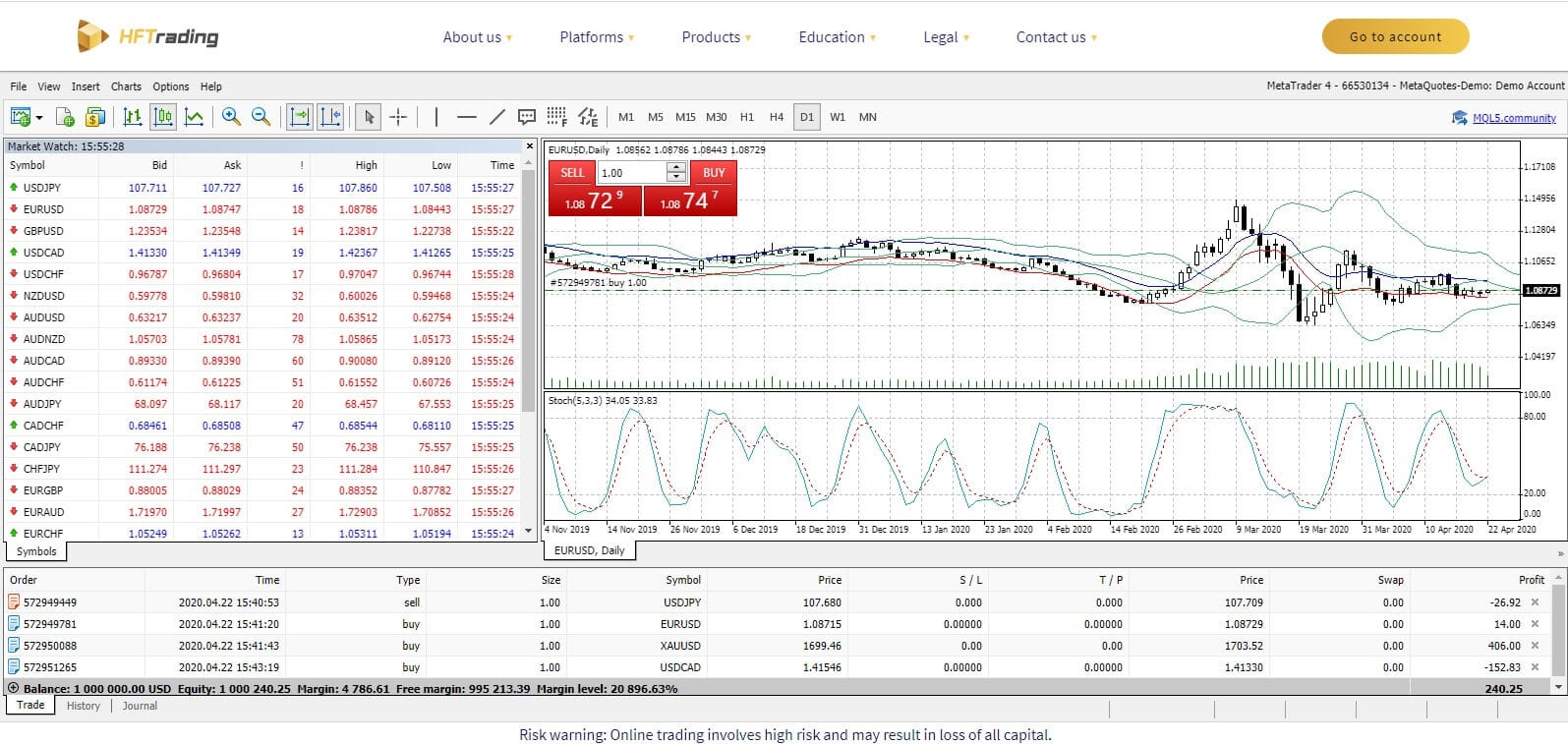

In the ‘trading account’ page on the website, HFTrading has stated a minimum spread of 1.8 pips for all the account types. However, the variable minimum spreads are displayed differently under the ‘Products’ menu. Besides, in the HFTrading demo MT4 Web platform (shown under Platform and Tools), we received spreads as low at 1.3 pips on the EURCHF and a couple of other currency pairs.

When it comes to leverage, they vary on the account/product type. Traders signing- up for the Silver Account receive max leverage of 200:1 while professional traders registering for the Platinum Account receive max leverage of 500:1.

| Product | Max Leverage |

| Forex | 500:1 |

| Cryptocurrencies | 1:1 |

| Commodities | 125:1 |

| Indices & ETFs | 125:1 |

| Shares | 10:1 |

Platform and tools

Individuals registering with the HFTrading broker can access the world-class MetaTrader 4 platforms across computers and mobile devices. While the demo HFTrading MT4 web platform is accessible from the client area, you have to request your account manager to activate the demo desktop and mobile applications.

The trading platform from MetaQuotes is accessible on all browsers, Android and iPhones, and supports Windows, Linux and Mac operating systems. It doesn’t matter if you are an FX trader or are trading stocks on the HFTrading platform, you would still have access to a massive cache of analytical tools on one of the most user-friendly CFD platforms.

In our Review of HFTrading, we analysed the platforms and found that the CFD broker does not offer anything additional in terms of plug-ins for tools or third-party software like Autochartist. All you get is the regular MT4 offering with the in-built features and the option to download or purchase the additional tools from the Code Base. Despite that, the MT4 provides several options for traders besides supporting manual, automated, and copy trading.

Here are some of the main features of the HFTrading MT4 platforms:

The Web terminal is accessible on all the browsers without the need to download and install the software. The default workspace consists of the watchlist, chart, and the toolbox. You can use the additional menu buttons to monitor historical trades, reach out to the broker’s client support or connect to the MQL5 community. When it comes to trading tools, the MT4 charting is available in three modes and nine-time frames; one minute – one month. Also, chartists can access 30 technical tools, including trends, oscillators, and volume-based indicators, besides the 24 graphic objects to carry out extensive chart analysis. The platform also supports all order types; instant, market, pending and trailing orders with the stop loss/take profit (SL/TP) option.

The MT4 desktop version is far more advanced in comparison with the browser-based terminal and also supports multiple operating systems. Besides placing manual orders, users can also carry out fully automated and copy trading, monitor various charts, place trading alerts, and access the best bids and offers from the market depth panel. Individuals not familiar with programming have the choice to learn and build their EAs from the MQL4 IDE development environment, or download, rent, purchase, and order robots from the Codebase.

The mobile app, on the other hand, features real-time streaming quotes with in-built charts, technical indicators, trading alerts, and push notifications. Users can monitor live prices and positions, access a range of order types, stay tuned to the latest events, and trade on the go.

Commission and fees

HFTrading is a zero-commission broker, which is one of the USP’s of the CFD broking firm. So, regardless of the financial instrument or the trading volumes, the primary client trading cost is the bid-ask spread. However, clients signing up with the CFD broker have to bear high subsidiary costs in the form of fees. These include the swap fee, typically charged on overnight positions.

While some brokers pay clients a swap or interest depending on the asset and the direction of the trade, HFTrading charges a daily swap fee on all open positions at midnight (GMT+3). The good news is that clients with Gold and Platinum Accounts are eligible for a 25% and 50% discount on the swap charges correspondingly. Secondly, if the trading account is inactive for more than 60 days, be prepared to pay an inactivity fee, ranging from A$80-200 per month, depending on how long the account has been inactive. HFTrading could also charge clients a withdrawal fee of A$50 if the trading activity is low or the withdrawal amount is less than A$100.

You can find all info related to the swap charges from the following link:

So, while you stand to benefit from zero commissions, our Review of HFTrading threw up some interesting facts, indicating that HFTrading is somewhat expensive when it comes to client trading costs.

Education

The resources provided by HFTrading to educate traders on the various aspects of the markets is elaborate and covers everything from the glossary of financial terms to eBooks and tutorials. In this Trading Review, we cover all the educational material provided by the brokerage, which is accessible on the website. They include:

Video on demand – Short audio-video films for beginners and advanced traders on the various market parameters like risk, trading style, market analysis, chart patterns, and several other topics.

Ebooks – Online reading material combined with pictures, graphs, images on strategies for beginners, trading psychology, capital management, technical analysis, and a few more.

Courses – Short films on the overview of the markets, CFDs and stocks, trading strategies, social trading and a few more, all of them aimed at assisting beginners to gain adequate insight into the features of the markets.

Tutorials- If you are new to the MetaTrader platforms or require assistance with the functionalities or tools, the tutorials should be able to guide you through all the features of the MT computer, mobile applications.

Besides educational material, users can also access the live global economic calendar, and the earning’s reports of listed companies to assist with your stock trading on the HFTrading platforms.

Customer Service

Users can access HFTrading Broker’s customer support via live chat, phone, email, or by simply filling and sending out the Contact Us form. All the support channels are open from 2.00 am -1.00 pm GMT, Monday through Friday, although the brokerage claims 24/5 full support, in the website.

If you are unhappy with the services of the support team, you can also contact the management via email.

To evaluate the response time, quality and the professionalism of the support desk, we were in touch with the live chat team during our Review of HFTrading. Based on our frequent interaction, we found the team to be professional in their approach, although we were not satisfied with the speed of replies, including the initial reaction time. We think this is one area where the brokerage should improve dramatically, especially since they are open only 11 hours a day.

Final thoughts

As we wind up our unbiased HFTrading Brokerage Review, we would like to let our readers know that the brokerage is legitimate despite some inconsistencies on the website. The key takeaways are the range of products, the cutting-edge platform, the low account opening charges, and the stringent regulations.

It doesn’t matter if you want to carry out FX, cryptocurrencies, commodities, or stock trading with HFTrading, the broker has a wide range of products across all the asset classes. Likewise, the trading platform caters for all types of traders, be it beginners, experienced, or algo traders. While users can choose the mode of trading, from manual, automated, or social, the hundreds of in-built and downloadable analytical tools are more than adequate to carry out an in-depth analysis of the markets. All this comes with the ASIC and NZFMA regulations that mandate ample capital requirements, regular audits, appropriate risk management policies, client and data privacy.

Contact Information

You can contact the HFTrading broker from 2.00 am – 1.00 pm GMT with the following methods

| Phone | +44 2035196864 |

| +64 48895407 | |

| [email protected] | |

| [email protected] |

FAQs

Who is the hedging counterparty for HFTrading?

To manage its credit, liquidity, and market risk, HFTrading hedges all client positions with CTRL Capital Limited, an associate company of CTRL Investments Limited. The hedging activity carried out by HFTrading consists of opening equal and opposite trades of its clients with CTRL Capital.

How does HFTrading collect your personal information, and what does it do with it?

HFTrading collects your details when you register for a demo/ live account, post on the CTRL blog or community, post enquiries/feedback, subscribe to newsletters, enrol for promotions, or apply for a job.

The purpose of collecting your info is to build a broker-client relationship, provide services and advise on several subjects, answering queries, conduct statistical analysis on customer satisfaction, and for several other reasons. Besides, some of the info collected is required by law to monitor for anti-money laundering, and in some instances, it could be a requirement by the regulatory agency.

How do I make a withdrawal request, and how long does it take for the application to be processed?

Clients can submit withdrawal requests from the client area. However, to process the application, you must provide your private details, trading account info, withdrawal amount and the payment method. In the case of withdrawal requests for joint accounts, all the account holders should sign-off for processing the payout. Once the application is approved, HFTrading takes seven days to process withdrawals.

Where does HFTrading hold client funds?

According to Trading, client funds are held in trust accounts, segregated from the operational funds of HFTrading. Besides, the CFD broker claims to maintain customers’ deposits with some of the big banking institutions, although they have not mentioned the names. However, the funds can be held, used and withdrawn in line with applicable laws and the broker’s Terms of Use.

Client deposits are in AUD, NZD, EUR, GBP, USD, JPY, and CAD.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts