Expert Summary

FXPro Group Limited founded in 2006, the subsidiaries include FxPro Financial Services Ltd, FxPro UK Limited and FxPro Global Markets Ltd.

The multi-regulated broker is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) and the Securities Commission of The Bahamas (SCB).

Individuals registering with the CFD broker can trade in 430+ financial instruments across 6 asset classes – FX, Metals, Shares, Indices, Energies & Futures. Crypto CFDs are also available,

but not to clients of FxPro UK Ltd due to regulatory restrictions.

The product range is accessible from four trading platforms: FxPro platform (EDGE), MT4, MT5 & cTrader. The platforms come with the best inclass trading tools and EAs/cBots can be used on desktop platforms. Each platform also has its own iOS/Android mobile application, for trading on the go.

When it comes to the trading conditions, the no dealing desk intervention broker offers a choice between fixed/variable spreads, zero commission on specific instruments, and instant/market execution. The spreads depend on the order execution type and the trading platform. The leverage, on the other hand, depends on the regulator. Retail clients under SCB have a maximum of 1:200 leverage and clients who are deemed as being professional are eligible for higher leverage.

FXPro is one of the most widely regulated brokers in the industry, not only making them legit but also a go-to broker due to the full range of trading platforms & tools, services and excellent trading conditions. All account types come with stop-out levels, micro accounts, and VIP services.

However, the broker does not offer CFDs in cryptocurrencies, the one drawback that is likely to put off the digital currencies traders. With a 24/5 customer helpdesk in over 21 languages, quick deposits/withdrawals, negative balance protection and investor compensation schemes, FxPro’s 90 international awards are just the icing on the cake.

The firm is estimated to have about 1,866,000 clients, operates in over 170 countries, employs more than 200 individuals and is fully transparent in its business practices.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐⭐ |

Open Your Account Now

Simple Sign Up ProcessIs FxPro Safe to Use?

All client funds are segregated from operating capital in Tier-1 accounts with major global banks.

FxPro Account Types & Deposits

FxPro offers MT4 account types with Instant or Market Execution, and also a Fixed Spread option.

MT5, cTrader and Supertrader accounts are also provided with Market Execution.

All orders are executed with No Dealing Desk (NDD) operation.

Free unlimited Demo Accounts are Available.

No U.S. clients accepted.

Beginner Trader Support

FxPro is committed to quality and providing the highest standard for customer support. Each rep has been expertly trained to handle a wide assortment of issues and to get you going quickly on to your path for success, 24 hours a day, 5 days a week.

FxPro offers dedicated support in 21 languages.

New brand product of 2019 – Educational section on the official website: fxpro.com/help-section/education All information is presented in the form of cards with text, picture or other media. New topics, as well as tests and trading checklists are added every week.

Learn To Trade For Free

With A No Obligation Demo AccountAdvantages of Trading with FxPro

- 70+ currency pairs, 1700+ shares, 24 futures, 19 indices, 7 spot metals, 3 spot energies, as well as crypto* coins are available to trade (*not available to clients of FxPro UK Ltd.).

- No dealer intervention;

- Tight spreads, high liquidity, no slippage on Instant Execution and no re-quotes on Market Execution;

- Metatrader4, MT5 and cTrader platforms offered and FxPro Platform (EDGE);

- Usage of automated Expert Advisors and scalping strategies permitted;

- Trading platforms can accommodate a host of environments, and each provides mobile trading apps;

- Clients of FxPro UK Limited may open a trading account in USD, EUR, GBP, AUD, CHF, JPY and PLN. Clients of FxPro Financial Services Limited & FxPro Global Markets Limited may also open a trading account in ZAR.

- Clients of FxPro Financial Services are covered by the Investor Compensation Scheme up to 20,000 EUR and clients of FxPro UK are covered by the Financial Services Compensation Scheme up to 85,000 GBP.

- Negative Balance Protection;

- Fast and convenient Deposit/Withdrawal options exist using payment cards, wire transfer, or other local payment methods;

- Daily market commentary, network sharing, and technical analysis support ensure that decisions are based on timely information;

- Customer Service representatives are on duty “24X5” and cover 20+ languages at present;

- The FxPro Educational section includes materials ranging from webinars, to cards-designed free courses;

- The FxPro.News blog contains daily updated authors’ analytics and technical analysis tips

Compare FxPro with other approved brokers

|  |  |  | |

| Regulation | FCA, CySEC, FSCA, SCB | ASIC, MiFID, FSA, FSCA | FCA (FRN 509909), ASIC, FMA, and FSCA | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC |

| Customer Support | email, phone, live chat | email, phone, live chat | email, whatsapp, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, cTrader, FX Pro Trading Platform | MT4, MT5, Mobile App | desktop and mobile via brokers own platform | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $100 | $100 | 100GBP/AUD/EUR/USD | $200 |

| Leverage | From 1:5 to 1:30 | 400:1 | 1:30 | 1:30 |

| Total Markets | 2100+ | 1260 | 2800+ | 1200 |

| Total Currency Pairs | 70 | 55 | 65 CFD Forex pairs | 62 |

| Total Cryptocurrencies | 0 | 17 | 19 | 18 |

FxPro Mobile Apps

FxPro team determined which elements of trading technology were used most frequently by their clients and created “FxPro Tools” – a very useful browser extension for Chrome, Safari, Mozilla and Opera. FxPro Tools offers real-time quotes, economic calendar, daily insights and analysis as well as FxPro Calculators that allow users to work out the required margin, pip value and swaps along with performing live currency conversions.

The desktop version is available at fxpro.com and the mobile applications for iOs and Android are available to download on mobile devices.

Another high-end application is “FxPro Direct” – the trading account management app. At its core is the FxPro Wallet, which keeps the clients’ funds from participating in the trading process and safe from market risks. It can be topped up via a Bank Transfer, Neteller, Skrill, NganLuong or Bank Cards. All these payment methods have 0% commission.

Both mobile applications are connected by internal easy-to-use transition buttons.

FxPro Trading Platform

FxPro allows you to choose your preferred operating environment. In addition to the highly popular Metatrader4 set-ups, the firm also offers MT5, FxPro Edge and cTrader. Additional support is also provided for the trader on the go by means of mobile applications for the iPhone, iPad and the Android devices.

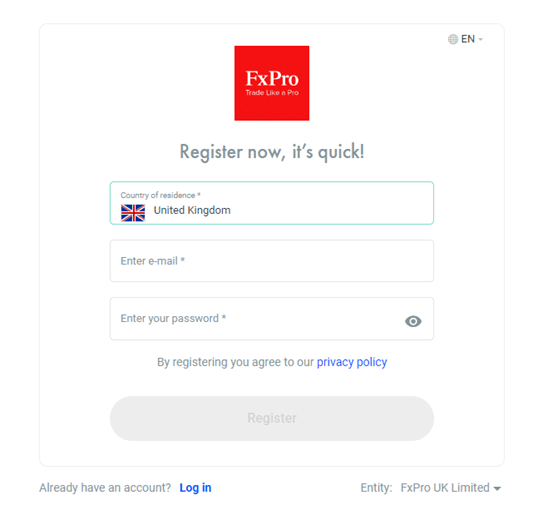

Opening an Account

The procedure for setting up a new CFD trading account with FX Pro is one of the smoothest and fastest in the sector. The ‘push-button’ style questions ensure new clients are walked through the questions regulators require to be asked at a high tempo. The answers to those questions help the broker establish your trading experience, level of education, and source of income.

That is standard procedure for a well-regulated broker as it helps them build up a profile of their users and comply with crucial KYC (Know Your Client) rules and regulations.

The onboarding process also asks new clients to select what type of trading account they’d like to set up. The options include Standard, Instant, and Fixed Spread. There is also a section where newbies have to choose the trading platform they want to use, with MetaTrader’s MT4 and MT5, cTrader, and FxPro Edge being available. That is an impressive range and helps FxPro stand out from the competition.

Another core trading metric that needs to be set is your preferred level of leverage. For many clients, that will be capped at 1:30, but traders in some locations can expand on that and adopt a more aggressive approach.

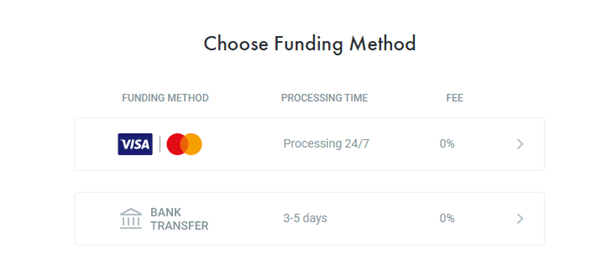

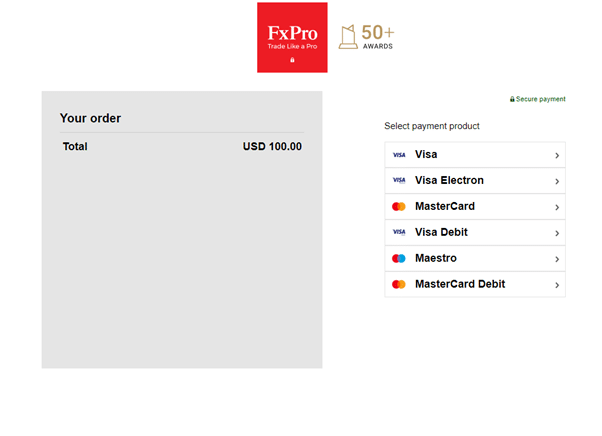

Making a Deposit

Before depositing funds, new clients are required to provide some form of ID. It can be a driving licence or identity card. They must also take a selfie. Once done, funds can be sent to the new account using a debit or credit card or bank transfer. The processing times for card transactions are nearly instant but are referenced by the broker as taking up to ten minutes. Wire transfers can take up to five days to clear. There are no fees on cash deposits.

The interface set up to support the payment process is user-friendly and can be navigated within seconds. There is also the option to save your details to your account to make future payments even more straightforward.

Cash withdrawals are equally easy to make. Refunds do not incur a fee, provided that the refund is made within six months of the initial funding taking place. A fee of up to 2.6% is incurred if a withdrawal is requested without having traded. Some processing agents may charge third-party fees, so it is worth checking the small print when funding your account at FxPro.

FxPro accounts can be set up in various base currencies. UK-based clients of FxPro UK Limited can set up their trading account in USD, EUR, GBP, AUD, CHF, JPY or PLN. Clients of FxPro Financial Services Limited & FxPro Global Markets Limited have the option of opening their accounts using EUR, USD, GBP, AUD, CHF, JPY, PLN and ZAR.

Placing a Trade

As previously mentioned FxPro offer a wide range of trading platforms, and all of them are highly regarded by members of the trading community. That choice can help traders find a best-fit platform for their trading style, with many opting for one of MetaTrader’s MT4 and MT5 platforms.

MT4’s reputation for reliable, fast execution has made it one of the world’s most widely used trading platforms. During our testing, the FxPro version performed as expected. Trades in GBPUSD, EURUSD, and stock indices were executed immediately and reported in the Portfolio section of the trading dashboard.

MetaTrader MT4 was first developed in 2003 and has been extensively tested by millions of active traders. Its clean aesthetic is ideal for those using chart-based strategies, and the extensive pack of trade signal indicators and automated trading functionality are two other reasons it stands out from the crowd.

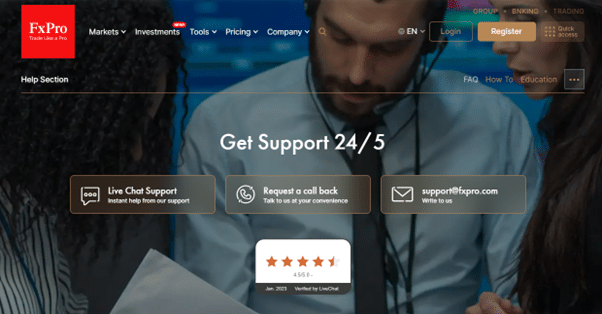

Contacting Customer Support

A comprehensive customer support service backs up the extensive range of features available at FxPro. During our testing, we took advantage of all three ways of contacting the help desk, email, Live Chat, and telephone call back, with all three being available on an impressive 24/5 basis.

The telephone call-back system allows clients to set a time for FxPro staff to contact them. That proved to be a reliable way of interacting with the broker’s team, with all of our call-back target times being met. There is also an option to request a call back as soon as possible.

The FAQ’s style section of the broker’s site is laid out as a series of ‘Featured Articles’. That allows for each issue to be expanded upon to a greater extent. Each item goes into greater depth on subjects ranging from ‘Can I open more than one account with FxPro?’ to ‘Do you offer Demo accounts?’ In both instances, the answer is yes.

FxPro Review Conclusion

A veteran management team of financial experts created FxPro in 2006, and they have never looked back. Most orders executed in less than 14ms. The firm has won multiple awards for its expertise and leadership in the foreign exchange industry since it entered the fray, and regulatory compliance and best practices are always the rule. As their mission states, “FxPro’s mission is to provide superior trading services for all clients, irrespective of the size of their account balances; to educate people about the markets, empowering them to take control of their finances by making forex accessible to all; and to promote transparency and fair trading practices by leading the way and campaigning for their adoption across the entire industry.” FxPro has definitely achieved elite status, such that, if you strive to be with the best, then FxPro may be the broker for you.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts