ForexTB is another commission-free forex broker available to residents of the EU (excluding Belgium), the UK and Switzerland. Aside from forex pairs, the broker supports the trading of five different financial assets, including an impressive collection of cryptocurrencies. The average floating spread on the EUR/USD pair varies from 1.8 to 3.2 pips depending on the account type chosen. Similarly, minimum deposit amounts range from $250 to $250,000.

In line with industry standards, ForexTB uses MetaTrader 4 as its main trading platform, though browser-based and mobile options are also available.

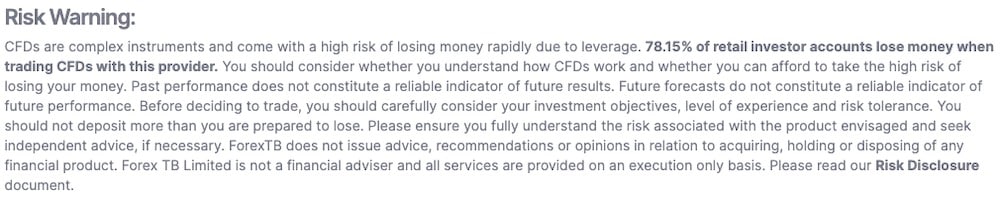

One thing to note is that because ForexTB provides clients with the ability to buy and sell CFDs, the broker cannot accept American, Canadian and Australian customers.

When looking at the company’s history, we can see that ForexTB has been in business for over six years, which shows that it is able to maintain and grow its client list, though there is no daily information available.

Lastly, ForexTB provides clients with an impressive daily market analysis, which goes beyond the standard major pairs, and also spends time analysing cryptocurrencies and stocks.

Broker Summary

Founded in 2015, ForexTB is a Cyprus-based forex broker focused on CFDs and forex. Because the company is based in Cyprus, it is regulated by the Cyprus Securities and Exchange Commission (CySEC), which oversees thousands of forex brokers each year.

Traders have access to the largest global indices, including the Nasdaq, S&P 500 and FTSE 100. There are over 300 financial instruments to choose from, including CFDs on forex, commodities, stocks and cryptocurrencies.

In addition, ForexTB makes it very easy to make deposits and withdrawals and, unlike many other brokers, does not charge fees for either action.

Another point of interest regarding ForexTB is that it caters to both retail and professional traders, offering account options catering to both. As you will see, the difference between the retail and professional accounts is quite significant, with vastly different spreads and max leverage amounts offered.

Broker Introduction

ForexTB is a relatively new broker operating out of Cyprus. Since it focuses on targeting European markets, the broker’s website is currently available in several languages, including English, Dutch, Spanish, Italian, German, Swedish and Polish.

Aside from an impressive array of languages, ForexTB also provides traders with the options of trading CFDs in six different financial instruments, including stocks, indices, commodities, ETFs, cryptocurrencies and forex. While it may offer more options than the standard forex broker, make no mistake: ForexTB caters primarily to forex traders.

At the time of writing this review, ForexTB offers trading in over 200 different pairs and provides customers with the lax leverage allowed by European law, 1:30.

Separate from the ability to trade CFDs in six financial instruments, ForexTB provides traders with the option to buy and sell cryptocurrency. Although it is true that this has become common among forex brokers, ForexTB supports a more impressive collection of coins and tokens in comparison to many of its competitors. As of now, the broker supports the buying and selling of Bitcoin, Ethereum, Dash, BitcoinGold, Ripple, Cardano, Litecoin, Ethereum Classic, Monero, Stellar lumens, and Dogecoin.

Free Demo Account

No Purchase NecessarySpreads & Leverage

Spreads vary depending upon the type of account chosen, but the average spread for EUR/USD ranges from 1.8 to 3.2 pips. When signing up, traders have the option of four different account types – Basic, Gold, Platinum and VIP – all of which come with different spreads, minimum deposit amounts and leverage limits.

The first two accounts, Basic and Gold, are intended for retail use. As can be seen from the image below, the two accounts differ quite a bit in the minimum deposit amounts and the average floating spreads. One difference not shown in this image is that the Basic account only comes with a single free withdrawal, whereas the Gold account gives traders one free withdrawal per month. Both the Basic and Gold accounts give traders access to a maximum leverage of 1:30, the most permitted under European law.

The next two accounts, Platinum and VIP, are marketed for professional use and require a much higher minimum deposit than their retail counterparts and a much larger leverage allowance (1:400). Aside from the vast difference in minimum deposit, these two accounts also have noticeably lower average floating spreads, coming in at 2.3 and 1.8 pips respectively for EUR/USD. Furthermore, the Platinum account provides users with three free withdrawals per month, whereas the VIP account allows for unlimited withdrawals.

Aside from real-money accounts, ForexTB also provides traders with an option to create a paper or demo account. These demo accounts can be beneficial for new or novice users who are still learning how the world of forex and CFD trading works. Aside from new users, paper accounts also allow experienced users to test new trading strategies without risking any real money.

Platforms & Tools

ForexTB provides its clients with an option of three different trading platforms, the powerful MetaTrader 4, the browser-based WebTrader, and a customised mobile trading platform, all of which we will explore in further depth below.

MetaTrader 4: Considered by many to be the gold standard when it comes to trading software, MetaTrader 4 is likely the most widely used platform in the world of forex and CFDs, and for good reason. Not only does it offer an easy-to-use interface available in over 30 languages, but the platform also provides a robust array of technical indicators, drawing tools and charting options. On top of all this, MetaTrader 4 also supports automated bot trading, which many serious traders consider to be an essential feature in this day and age.

Those traders who enjoy social and copy trading will also be happy to know that MetaTrader 4 has its own copy trading platform called Trading Signals, allowing users to pick different trading pools based on risk and past performance.

WebTrader: The main disadvantage of MetaTrader 4 is that it requires traders to download the software and run it on their computer. Although this is not likely to be a major issue for most traders, some prefer browser-based trading platforms such as those that have become popular among stock and cryptocurrency traders. Because of this, WebTrader has grown in popularity over the last several years as it is one of the few products to offer a browser-based option that is comparable to MetaTrader 4. Upon opening WebTrader, traders will find that they have access to most of the standard features offered to them by MetaTrader 4 and other popular trading platforms.

Free Demo Account

No Purchase NecessaryCustomised Mobile Trading Platform: As is standard practice these days, ForexTB has its own mobile trading platform that traders can access on the go. Although very basic compared to MetaTrader 4 and WebTrader, it nevertheless provides traders with the capacity to place buy and sell orders on the go.

Commission & Fees

One of the best aspects of ForexTB is the commission-free trades, something that is becoming more and more standard among forex brokers. On top of this, ForexTB does not charge any fees to deposit funds in your trading account. However, there are some services for which the broker does charge a fee, the most important of which are listed below:

- Withdrawal Fee: Although ForexTB does not charge its clients for making withdrawals, the process does come at a cost, which all prospective clients should be aware of. Those transferring funds directly to their debit or credit card can expect to pay a fee equal to 3.5% of the total transaction.

- Wire Transfer: As most people are likely aware, all wire transfers come with a fee, which can vary greatly depending on the sending and receiving bank. However, on average, traders can expect to pay 30 USD, 30 EUR or 30 GBP depending upon where they live.

- Neteller: Any withdrawals made through the popular UK-based payment processor Neteller will be subject to a 3.5% charge.

- Skrill: ForexTB allows customers to withdraw funds to the popular online wallet service Skrill. All withdrawals come with a 2.0% fee.

- PayPal: The final and most popular withdrawal option is PayPal, a service that most people are likely to be familiar with. Although PayPal is highly convenient, as it can be linked directly to your bank account, the processing fee for this transaction is 4.5%. On top of this, PayPal is not known for offering favourable exchange rates, so anyone transferring a currency other than their bank account’s base currency can expect to lose a few percentage points more on the conversion.

Inactivity Fee: Most forex brokers will charge their clients an inactivity fee if no trades have been made within a given period of time, and ForexTB is no different. In the terms of service agreement, the company states that any account that does not make at least one trade within the span of a single month will be subject to an inactivity fee of €80 each month until the account becomes active again.

Education

Most brokers make some sort of training and educational materials available to their clients, but very few offer the volume provided by ForexTB. On its website, this educational material is divided into 11 different categories, which we will explore in depth below.

Trading Central: The first educational module is called ‘Trading Central’ and includes eight different articles on trading-related topics.

TipRanks: Founded in 2012, TipRanks is an investment information site geared towards high-frequency traders that allows users to gauge the performance of different financial advisors online. It does this through a complex algorithm that analyses blog posts, newsletters, hedge funds, and any other available data points to make a qualified judgment of a public financial advisor. TipRanks is typically a paid service, but can be accessed by those who sign up and trade with ForexTB.

Trading eBooks: Perhaps the most valuable portion of the provided educational material, the eBook section hosts a total of 11 eBooks, with some notable titles including ‘Advanced Trading Strategies’, ‘Basic Technical Analysis’ and ‘Advanced Technical Analysis’.

CFD Trading Tips: The following section is a little underwhelming compared to the previous instalments and includes a few short paragraphs introducing basic CFD trading strategies. Aside from its short length and limited scope, the information provided in this section will undoubtedly help those who have a poor understanding of CFD trading.

Glossary: The glossary section contains a lengthy list of the most important investing and trading terms that every trader should be aware of. Unlike some of the other sections, the glossary can be accessed without having an account, meaning that it is available to everyone.

Technical/Fundamental Analysis: The next two sections are short introductions to the differences between technical and fundamental analysis, a concept of which most prospective CFD traders are likely to have an understanding.

Leverage and Margin: Like the sections that come before it, the leverage and margin module comprises only a few paragraphs and explains the concepts of leverage, margin, and margin calls to the reader.

Non-Farm Payroll: Interestingly, the following section covers the topic of Non-Farm Payroll (NFP), which is an important economic indicator of the US economy. The NFP is released on the first Friday of each month by the Bureau of Labor Statistics (BLS) and is watched heavily by those trading the USD. The vast majority of forex brokers do not take the time to introduce this concept to their clients, and ForexTB deserves credit for taking the time to do so.

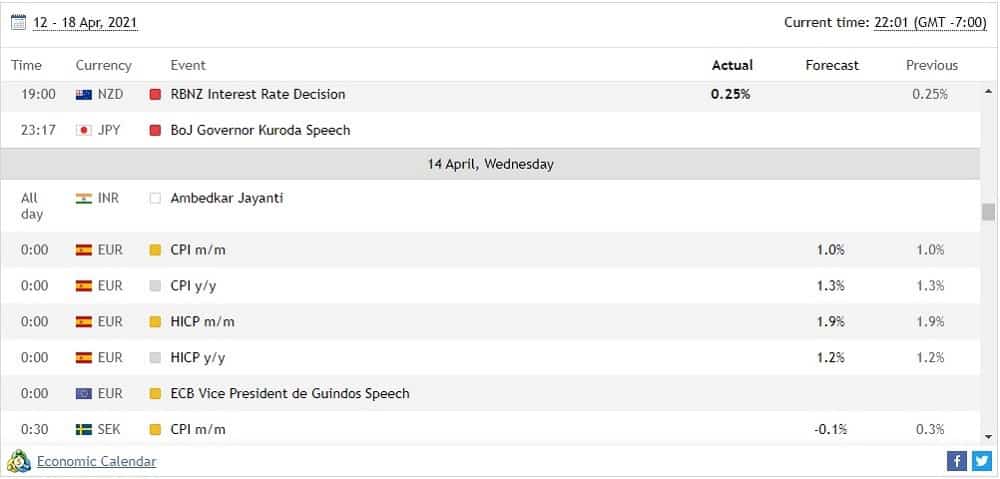

Economic Calendar: The economic calendar is an extremely powerful tool that informs users of dates and events relevant to the financial sector. Some examples of the type of items the economic calendar lists include:

- IMF meetings

- The release of the WASDE Report

- Full-time employment change for different countries

Webinars: The final educational section, webinars, informs ForexTB of the date and time of upcoming webinars.

Aside from these 11 sections, ForexTB also provides users with six short articles explaining the difference between the financial instruments that can be bought and sold on the platform. These articles can be found under the heading ‘CFD’ on the main webpage, and the current article titles include:

- What Are CFDs?

- What Is Forex?

- What Is A Commodity

- What Is A Stock

- What Is An Index

- What Is A Cryptocurrency

Free Demo Account

No Purchase NecessaryCustomer Service

ForexTB provides several channels through which customers can contact them. The first is a phone number registered in Cyprus, which is attended on a 24/5 basis. The second option is email.

On the front page, ForexTB does have a chat option, but it is automated and not attended by a customer service agent. As a result, most users will find its usability limited.

Final Thoughts

ForexTB presents itself as another quality option for forex traders living in the EU and Switzerland. Aside from its competitive spreads, max leverage offerings and zero-commission trades, the broker also provides access to a higher-than-average selection of cryptocurrencies, a financial asset towards which high-frequency traders have been devoting a large amount of attention.

Broker Details

ForexTB is registered in the Republic of Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the CIF licence number 272/15. Furthermore, the ForexTB brand is owned by Forex TB Limited, which is also registered in Cyprus.

At the time of writing, ForexTB is accessible to all clients living in the EU (excluding Belgium), the UK, and those residing in Switzerland. However, CFDs on virtual currencies (cryptocurrencies) are not offered to UK residents.

Contacts

Main Website: https://www.forextb.com/

Telephone Number: +357 2 222 2353

Email: [email protected]

FAQs

Is ForexTB a regulated broker?

ForexTB is operated by Forex TB Ltd, a Cyprus Investment Firm. It is regulated by the Cyprus Securities and Exchange Commission under CIF licence number 272/15.

How do I fund my ForexTB account?

There are various deposit options available when it comes to funding your ForexTB account. You can use a credit card, bank wire transfer or e-wallet transfer. All deposits are free from broker-levied fees, but check if your bank, card provider or payment processor charges any transaction fees on such payments.

How can I change leverage with ForexTB?

Leverage limits are determined based on an individual’s available assets, credit score, and the amount of cash collateral they can provide.

How do I close my ForexTB account?

To close your account, you will need to make a full withdrawal request. First, you will need to make sure that you have no open trades on your account. Submit your withdrawal request via Banking – Withdrawal. When the funds have been returned to your account, contact the Customer Support team via live chat or at: [email protected].

Safest Forex Brokers 2024

-

-

-

-

-

4.9-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts