eXcentral is a forex and CFDs broker founded in 2019. The broker provides a wide range of products including over 28 forex pairs and over 300 CFDs in stock, commodities, indices, and cryptocurrencies. eXcentral is registered in Cyprus and authorised by the Cyprus Securities and Exchange Commission (CySEC).

Regarding jurisdiction of operation, this broker accepts clients from the European Economic Area (EEA) and Switzerland. Moreover, it has its headquarters in Limassol, Cyprus. This broker does not have offices in other countries.

eXCentral website platforms and customer service are available in multiple languages, which include English, Spanish, Italian, Portuguese, Danish, Dutch, Czech, and Polish. Its customer service is available through phone, live chat, and email. Users can also request a call-back by filling in the request form provided on eXCentral’s website. While direct calls and live chat are answered almost immediately, call-backs and emails can take up to 24 hours to get a reply.

Rating Overview

| Overall rating | ⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐ |

When it comes to trading platforms, this broker provides the revered MT4 and cTrader. Also available is a highly-intuitive and fully equipped demo trader. You do not have to deposit to access the demo account. Furthermore, eXcentral provides comprehensive educational materials for both beginner and experienced traders. Moreover, beginner traders are assigned a dedicated account manager to guide them through the first steps of trading.

Free Demo Account

No Deposit Required

Features of Trading with eXcentral

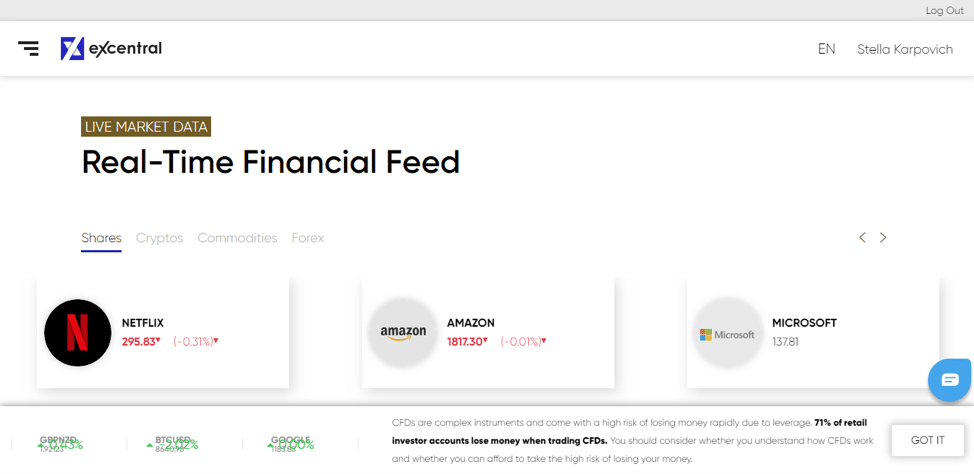

As mentioned above, eXcentral provides over 300 CFDs in stock, indices, ETFs, commodities, and crypto. The forex offerings include all the majors and a few minors and exotics. Most brokers in the same category as eXcentral offer up to 60 currency pairs.

However, when it comes to CFDs, this broker ranks among those with the highest number of products. eXcentral provides over 100 stock CFDs that include shares such as Amazon (NASDAQ:AMZN), Microsoft (Nasdaq:MSFT), Coca Cola (NYSE:KO), Facebook (NASDAQ:FB), and Netflix (NASDAQ:NFLX).

The commodity-CFD offerings, on the other hand, include precious metals, energies, and grains. Some of the commodities offered by this broker include USOIL, BRENT, XPTUSD, XPDUSD, and XADUSD. When it comes to crypto-CFDs, eXcentral provides BTC/USD and ETH/USD pairs only. Traders looking for a variety of options in crypto CFDs are better off trading with another broker.

Also, as mentioned in the introduction, eXcentral is regulated by CySEC under CIF license number 226/14. This regulatory body is among the most popular in online trading and is ranked as tier-one in terms of trustworthiness. Consequently, it is well revered by traders all over the globe. eXcentral is a brand of Mount Nico Corp Ltd, an investment firm registered in Cyprus.

When compared to other brokers, we can say that eXcentral is adequately regulated. However, some of its competitors have regulations in multiple jurisdictions and hence can be considered to be safer. Even so, the CySEC authorisation is a guarantee to users that this broker takes its safety seriously. CySEC regulated brokers are required to segregate deposits and submit audit reports.

Regarding its reputation, this broker has an average rating of 4.2/5 on Trustpilot. Most reviewers praise this broker for its trading conditions and customer service.

- Offers over 28 currency pairs and over 300 CFDs

- Regulated by CySEC

- Highly reputable with a TrustPilot rating of 4.2/5

eXcentral Spreads and Leverage

eXcentral provides four types of accounts, namely Classic, Silver, Gold, and VIP. Each account type comes with its advantages — the VIP one being the epitome. With the Classic and Silver account types, traders get a leverage of up to 1:400 a spread, starting from as low as 2.5 pips for the EUR/USD pair.

The Gold account, on the other hand, provides free access to all educational materials with full account overview and VIP webinars. This account type also provides a leverage of 1:400 and spreads from as low as 1.8 pips for the EUR/USD pair. The VIP account comes with all the advantages of other accounts plus specialised customer services. Moreover, the VIP account offers spreads that start from 0.9 pips for the EUR/USD pair.

When compared to other brokers, eXcentral is averagely priced. Its competitors offer spreads from as low as 0.2 pips for the same pair. The average industry spread for the EUR/USD pair is 1.2 pips. Spreads should not be the only aspect that you consider when choosing a broker. There are many other factors to take into account.

eXcentral is a dealing-desk broker meaning that it makes money through spreads only. This broker does charge inactivity fees for accounts that stay idle for more than two months. Those that are inactive for two to three months incur an inactivity fee of £80, while those that stay inactive for three to six months incur a fee of £120. Those that remain inactive for more than six months incur a £200 fee.

A maintenance fee of 10 USD/GBP/EUR must also be paid every month irrespective of whether there are transactions on the trading account. eXcentral does charge a commission fee of 0.8% of the asset’s notional value on equities and cryptocurrencies. A rollover fee is also charged for positions held overnight.

This broker offers a bonus of up to 50% for new deposits. You can learn more about its bonuses and promotions by contacting its customer service personnel.

eXcentral Trading Platform

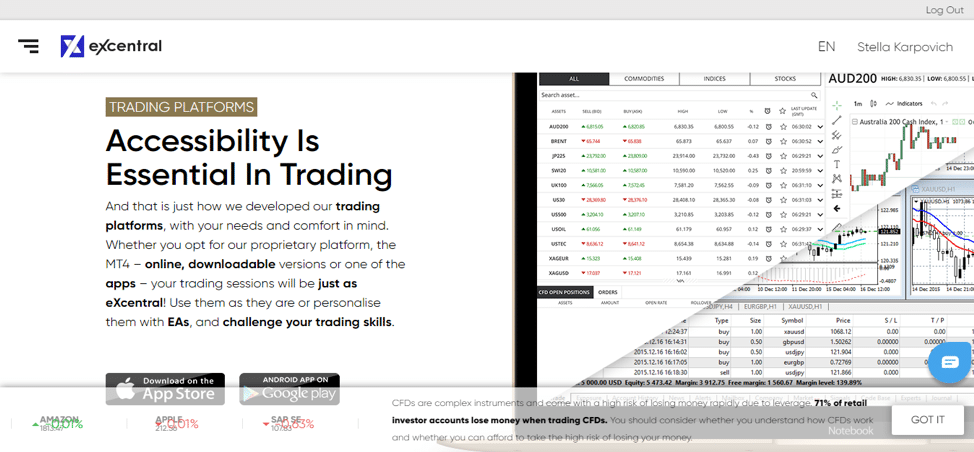

As already mentioned, eXcentral provides both the MT4 and the cTrader platforms. MT4 is the most popular trading platform for forex and CFD trading and it is no wonder that it is offered by over 95% of brokers. MT4’s popularity is as a result of its many features and trading tools and the fact that it can be customised to meet traders’ needs. The features available through MT4 include over 30 technical indicators, nine time frames, and a myriad of drawing tools.

Moreover, MT4 is available in web, desktop, and mobile versions. The web-version is compatible with all browsers and Windows, Mac, and Linux operating systems. Additionally, its web-trader is equipped with all the functions found in the desktop and mobile versions. The desktop version is also compatible with Windows, Linux, and Mac operating systems.

Furthermore, the software is lightweight and hence does not take a lot of space or computing resources. eXCentral’s MT4 is also available as a mobile app for both Android and iOS. You can download the apps on the Google Play Store and Apple App Store, respectively. You can start trading with eXcentral demo account in less than a minute by searching for the broker on the manage account section and registering with them through the app. With the mobile app demo trader, beginners can practice trading while on the go.

The cTrader is another popular and highly intuitive trading platform. It comes with advanced charting tools, over 50 indicators, and features such as customisable c-bots and depth of the market. The platform is available in web, desktop, and mobile versions.

Start Trading Today

Easy Sign Up Process

eXcentral Deposits and Withdrawals

As mentioned earlier, eXcentral accepts deposits through Visa, Master Card, wire transfer, Skrill and Neteller. The minimum you can deposit is $250, and the maximum is $10,000 (daily) and $40,000 (monthly) for credit cards. There is no minimum deposit for those who deposit through wire transfer, Neteller, and Skrill.

eXcentral’s accepted currencies include USD, GBP, and EUR. It takes a few seconds for deposits to reflect in the trader’s account. This broker does not charge any deposit fees, however, it is recommended to contact eXcentral’s customer service team for guidance and enquire about its bonuses before making a deposit.

Regarding withdrawals, eXcentral requires users to apply the same method that they used to make their deposit. For instance, if you deposited through wire transfer, you can only withdraw by this method. Moreover, if you are withdrawing through a credit card and your amount exceeds what you deposited, you will receive the original amount back in your credit card and the rest through wire transfer.

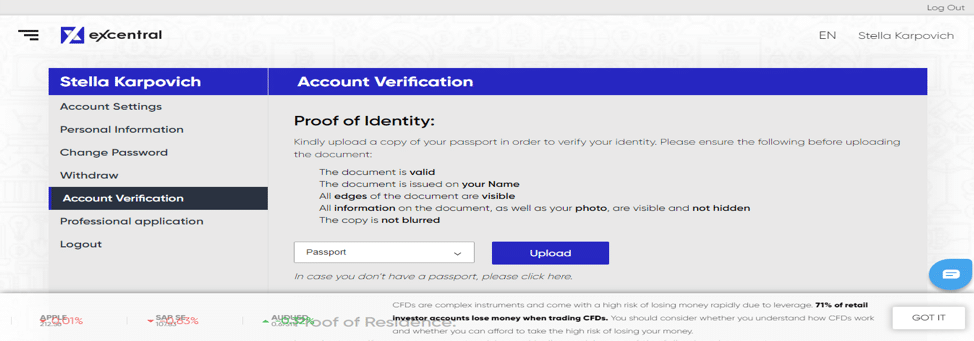

In order to withdraw, it is worth mentioning that you need to verify your identity and submit proof of your current address. This measure is mandatory with all well-regulated brokers. You need to upload a government-issued ID or driving license and also a recent utility bill that has your current address. Furthermore, all ID verification documentation should have a clear photo, and both sides should be uploaded.

You also need to verify your payment method. For credit cards, you need to upload a coloured photo of both sides of your card with the 12 digits on the front and the CVV on the backside covered. For e-wallets (Skrill and Neteller) take a screenshot of showing your name, email, and e-wallet ID.

In order to withdraw, the user must also complete the eXcentral’s assessment of appropriateness. This test determines if you are fit for trading. eXcentral charges a withdrawal fee of 3.5% for debit and credit cards and 30 USD/EUR/GBP for wire transfer. Withdrawals through Neteller also incur a fee of 3.5% while those through Skrill incur a fee of 2%.

Beginner Trader and eXcentral Customer Support

eXcentral is popular with beginners and experienced traders alike. Its educational centre is fully equipped with materials ranging from beginner to advanced lessons. The materials include e-books, structured courses, trading manuals, and video tutorials, and cover both forex and CFDs trading. Most of these materials are only accessible after registration.

Moreover, eXcentral provides free webinars every week to update traders on the latest market developments. The webinars are recorded and uploaded on its website for future reference. At the very least, the user needs to register with a Silver account to access unlimited trading webinars.

With eXcentral, beginner traders can not only enjoy well-structured trading courses but are also assigned a dedicated account manager. The role of the manager is to help the trader to grasp the basics of trading. Furthermore, the managers are readily available to answer any questions that the beginner trader may have — you can engage them even when on demo account, provided that you have made a deposit.

Regarding customer service, eXcentral is available 24/5. Its customer service agents appear to be friendly and knowledgeable. As mentioned earlier, traders can reach them via phone, email, and live chat. While emails can take up to 24 hours to receive a response. Telephone and live chats are answered almost immediately. There is also a call-back option, but we do not recommend it for urgent communication.

When compared to other brokers, eXcentral ranks fairly well on education and customer service. It seems to have almost everything that a trader needs to become successful. Moreover, its customer service centre is well-equipped and readily available. The only downside is that its FAQ page is disorganised and does not cover all trading areas.

Compare eXcentral with other approved brokers

|  |  |  | |

| Regulation | CySEC | ASIC, MiFID, FSA, FSCA | FSPR | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC |

| Customer Support | email, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $250 | $100 | $200 | $200 |

| Leverage | 1:30 retail, 1:400 professional | 400:1 | 1:500 | 1:30 |

| Total Markets | 150+ | 1260 | 182 | 1200 |

| Total Currency Pairs | 47 | 55 | 72 | 62 |

| Total Cryptocurrencies | 11 | 17 | 0 | 18 |

Crypto Offerings with eXcentral

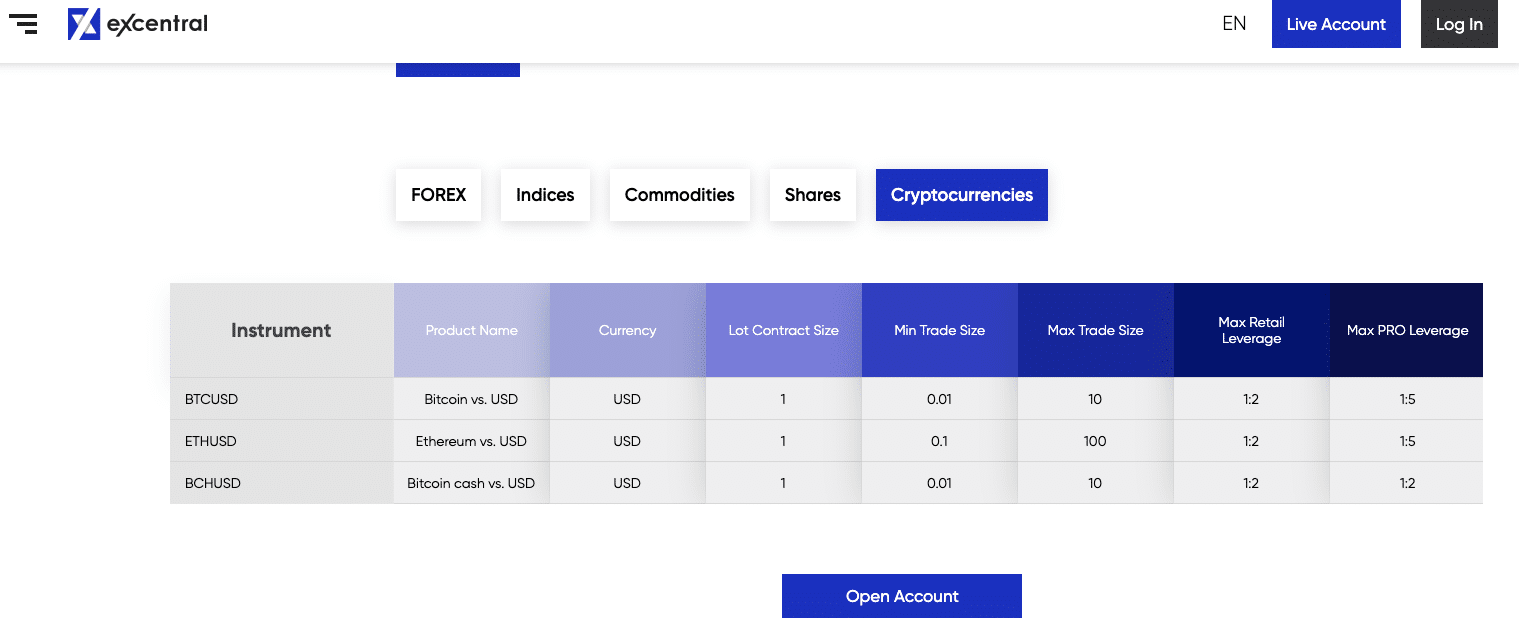

This broker offers CFDs on crypto in three pairs, namely BTCUSD, ETHUSD, and BCHUSD. Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH) are currently among the top five biggest cryptos in terms of market capitalisation. Being highly volatile, these digital currencies present the best opportunities for CFD trading.

This broker provides crypto CFDs pairs in USD at a lot contract size of 1.00. Moreover, the minimum trade size for BTCUSD and the BCHUSD pairs is 0.01, while that of the ETHUSD pair is 0.1. The maximum trade size, on the other hand, is 10 for both the BTCUSD and BCHUSD pairs, while that of ETHUSD pairs is 100.

Furthermore, the minimum retail leverage for the three pairs is 1:2 while the maximum pro leverage is 1:5 for BTCUSD and ETHUSD and 1:2 for BCHUSD. This broker provides adequate educational resources for crypto CFDs trading.

When compared to what competitors offer, eXcentral’s crypto CFD offerings can be said to be minimal. For instance, FxPro provides up to five pairs. However, the three pairs offered by eXcentral are the most popular. eXcentral’s pricing is in line with what most competitors offer.

Trade Crypto With eXcentral

The Most Popular Pairs

eXcentral Review Conclusion

We find eXcentral to be a legitimate and highly trustworthy broker. As explained in this review, this broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) — one of the most trusted regulators across the globe. eXcentral is also a member of the Investor Compensation Fund (ICF), a scheme that protects investors by ensuring that they get compensation if the broker fails to meet its financial obligation.

This broker is also a member of the European Securities and Markets Authority (ESMA), an independent body that contributes to the protection and stability of the European Union’s financial system. eXcentral is also compliant to MiFID II directives and also observes the EU General Data Protection Regulation (GDPR).

This broker provides a wide range of products, mostly in CFD trading. Its trading conditions can be termed as competitive when compared to what competitor brokers offer. Furthermore, this brokers trading platforms include the renowned MT4 and cTrader .

When it comes to trading resources, this broker provides comprehensive guides for both beginner and experienced traders. As explained earlier in this review, beginner traders are assigned a dedicated account manager to guide them through. Traders must go through the identity verification and proof of address process to be able to use this broker. The registration and ID verification process is quite straightforward.

Open Your eXcentral Account

Forexfraud Trusted Broker

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts