Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

EverFX apparently consider their traders teammates and partners and they truly want to see them succeed. Obviously, this sort of sales talk only really makes sense if the broker is not a market maker and, in this instance, that is apparently not the case indeed.

Is EverFX really as caring in regard to its clients though? The user feedback regarding the quality of the services offered by the brokerage is quite mixed, and at the end of the day: not particularly impressive.

There are some positive reviews mixed in, some of which have been identified as the postings of the EverFX staff, and there are a handful of complaints as well. Withdrawal issues (which we consider some of the most serious) have been featured in complaints. One trader says that instead of a transfer into his account upon withdrawal, the broker tried to charge the said account.

Another person had a $250 deposit made with EverFX, through a 3rd party, and he failed to recover that money from the broker.

The bottom line in this regard is that there do not seem to be any regular and systemic problems with EverFX, and bar some isolated incidents here and there, the broker’s reputation seems to be an OK (albeit not a impressive) one.

The company behind the EverFX brand is ICC Intercertus Capital Limited and it is based at Antheon 2, Monovoliko, Kato Polemidia Limassol, 4151, Cyprus. As a CIF (Cyprus Investment Firm) the broker is licensed and authorized by CySEC (its license number is 301/16). The registration number of the corporate entity is HE 346662.

EverFX traders are protected by the Investor Compensation Scheme and CySEC regulation translates to MiFID compliance as well. As such, the broker would normally be able to peddle its services all through the EEA, however, it is forbidden to do so in Belgium. Other countries from which the broker does not accept traders are the US, Canada, Iran and North Korea. If that truly does exhaust the list of forbidden locations, it is safe to say that EverFX’s global reach is very impressive.

Why would you want to opt for EverFX over other brokers of similar caliber though?

Though the EverFX support is only available 24/5, it is excellent and there is actual user feedback attesting to that. Most online FX/CFD brokers’ support is lousy – there’s no better way to describe the situation – and EverFX are a welcome exception in this regard.

In addition to that, the brokerage offers an extensive education section and dedicated account managers, ready to guide traders through every step they take in the world of online trading.

The trading platforms offered by EverFX are very solid as well: they have MT4, and STATUS. Perhaps most importantly though: the trading conditions featured by the broker are very competitive.

EverFX Market Coverage

In this regard, the broker has thus far been rather conservative. While all the “traditional” tradable asset-classes are represented, there’s no trace of cryptocurrency-based CFDs, which have been all the rage lately.

There are scores of FX pairs offered, and the trading conditions on every one of them are displayed at the site. The spreads on these 50+ pairs start from as little as 0.2 pips on the EUR/USD but they can be quite a bit more substantial on less popular currency pairs, such as the EUR/TRY (where the minimum spread is 13.5 pips).

The trading conditions are also public on the indices-based CFDs. There are a total of 10 such indices offered and the spreads on them start from 0.4 pips.

The spot metals category hosts assets such as Copper, XAG and XAU, paired with USD as well as EUR. Platinum and Palladium are also available. The spreads in this asset class are much more substantial, starting from 12 points.

The Energies section offers Brent, WTI and Natural Gas. Spreads start from 0.03 points here.

Scores of stocks can be traded through CFDs too. The commission on most US stocks is set to $5/lot.

The bottom line in this regard is that while the broker features plenty of tradable assets, there would indeed be room for some cryptos to spice up the market coverage.

New Spreads are available for EU customers. More information below:

|

EverFX Trading Platforms

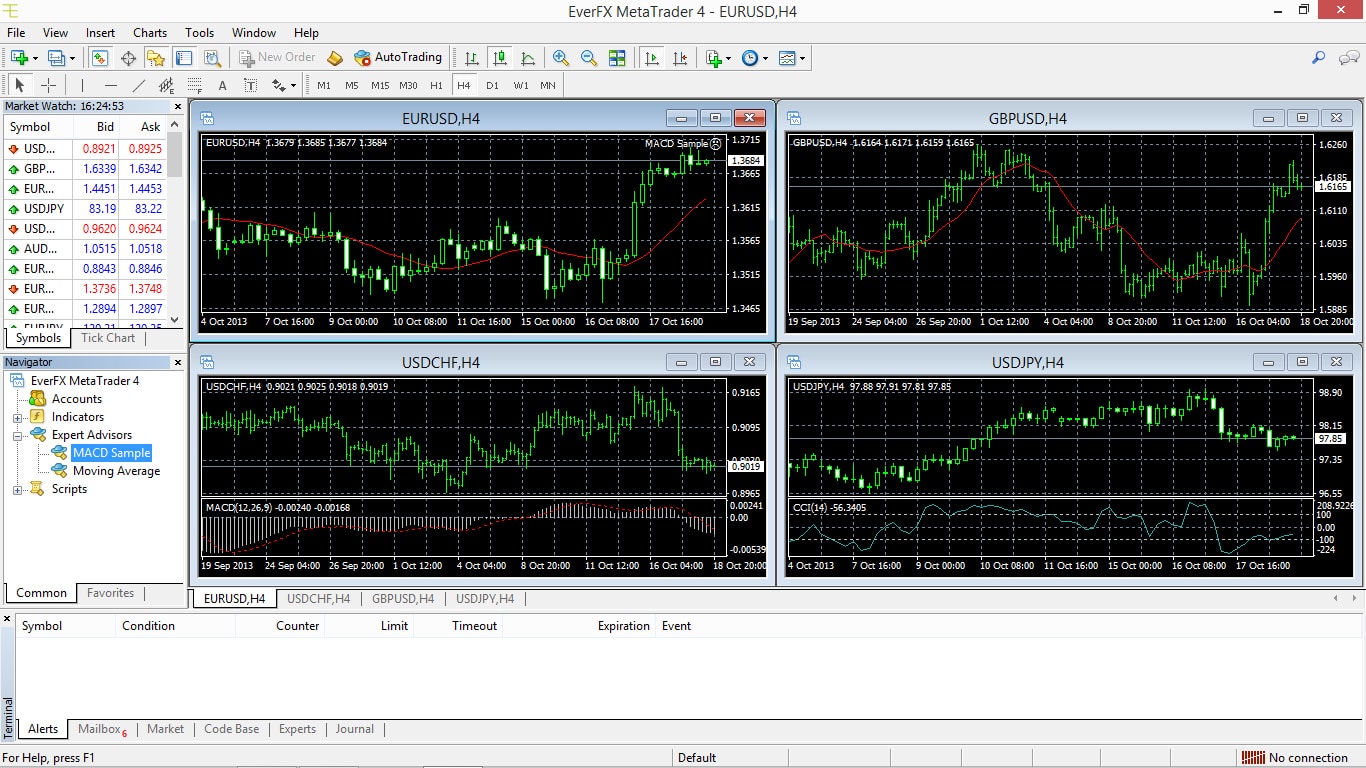

As already mentioned above, EverFX offer two trading platforms: MT4 and STATUS.

MT4 is perhaps the best-known and most popular trading platform out there, and there are scores of reasons behind its popularity. It is easy to install and to handle, and it allows traders to set up fully customized trading environments.

When it comes to charting, MT4’s capabilities are unparalleled: it supports scores of time frames and chart-types and it works superbly on the PC as well as various tablets and mobile devices.

One click trading is possible, directly from the charts and the platform comes with an impressive number of preinstalled technical indicators. Traders can code and create their own indicators too, and they can purchase them from 3rd party creators.

MT4’s most popular feature – from the perspective of expert traders – is its support for EAs (Expert Advisors). Traders are also free to create and to add their own EAs, so customization knows no bounds on this platform. EAs work best with a proper VPS service, that can keep them running around the clock.

One of the most attractive features of the Status platform is its social trading support. By clicking the Social Status option, one will gain access to the positions taken by other traders and to their win/loss percentages. Social traders can then copy the trades of their peers, or simply double-check their own positions against those of other traders.

In addition to that, Status also offers on-platform trader education and a handy economic calendar.

EverFX Account Types

This forex broker features three account types, beginning with the Standard one. The minimum deposit on the Standard Account has been set to $250, so it is indeed the most accessible one. The spreads on this account start from 1.2 pips and the maximum leverage is set to 1:500. The margin call is set to 50%, both trading platforms are available and EAs are supported.

The Premium Account ups the stakes minimum deposit-wise by quite a bit. Those who want to open such an account, need to make a deposit of at least $5,000. The spreads on this account start from 0.8 pips and no commission is charged. The maximum available leverage is 1:500.

The margin call is 50% on this account too, and EAs as well as hedging is supported. VPS trading is free and the account is available in an Islamic version too.

The VIP Account is the “extreme” option in regards to minimum deposit and features. The minimum in this instance is $30,000, and for that money, traders who opt for this account, will get to trade with spreads from 0 pips. The commission however is $2 per lot traded and the leverage is 1:200.

Expert Advisors and hedging are both supported, together with phone trading.

EverFX Review Conclusion

EverFX is a decent trading destination, which is rapidly improving its reputation.

Its market coverage is solid, as is its trading platform offer. The broker supports EAs (automated trading) and it features an Islamic option for all its account types.

Furthermore, the broker seems keen on giving its traders proper education.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2024

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts