Expert’s Viewpoint

ForexFraud recommends that traders think carefully before using DeltaMarket given that there are some concerns about regulation and other important safety and security aspects. The broker does not appear to display any prominent evidence that it is regulated by any legitimate financial authorisation body, though it does say that it follows local laws in the Republic of the Marshall Islands. This lack of regulation is a potential red flag in terms of its safety. It is up to the individual trader to make a decision about whether or not they wish to proceed with opening an account at this broker. The information contained in this review might help, while sections of the broker’s website – such as its ‘Documents’ page – could also be useful.

If the trader does go ahead and sign up, then they are likely to enjoy a number of benefits. This broker states on its website that it offers a variety of account types, for example – meaning that traders can select their preferred account type based on how much minimum deposit they’re comfortable paying, what sort of spreads they require, and other variations. In addition, this broker offers a suite of tools designed to help traders make effective decisions about how to trade – such as MetaTrader 4 (MT4) with its suite of custom indicators, as well as a mobile app designed to help improve trading on the go.

However, not all is positive for DeltaMarket. The firm does not provide any of the very latest, cutting-edge tools for trading, such as MetaTrader 5 (MT5): while there is an option to switch to MT5 in the web-trader, it is mostly greyed out and does not appear to be active. Also, material is quite thin on the ground in the education section of its website. As this review will go on to show, there are several reasons to think twice before using DeltaMarket.

Broker Summary

DeltaMarket is an online broker that offers a wide variety of asset classes to traders – such as foreign exchange pairs, indices and metals. The broker also offers a number of other options, including shares and futures. It provides these assets as contracts for difference (CFDs) – which means that leverage is involved.

Broker Introduction

Founded in 2019, DeltaMarket is a multi-asset broker with a range of options for traders. One of its main offerings lies in the world of foreign exchange currencies. The broker offers more than 50 currency pairs (in CFD format), including the well-known range of major household name pairs. In addition, the broker also provides some indices (again in CFD format). Big names from across the finance world are represented here, and indices from as far afield as the UK and the US can be traded.

In terms of the metal commodities on offer, meanwhile, this broker offers everything from precious metals such as silver and gold to industrial metals such as copper. And with a variety of energy assets, shares and futures all available to trade via CFD, this broker certainly does offer a diversity of investment options.

Spreads & Leverage

One of the most important pieces of information for a prospective trader at any broker is the sort of spreads on offer. Many brokers use a business model anchored around spreads, and DeltaMarket appears to be no exception.

In short, the spread is the difference between the price at which an asset was sold and the price at which it was bought. DeltaMarket, like many brokers in the finance sphere, charges traders a proportion of this price in order to make money.

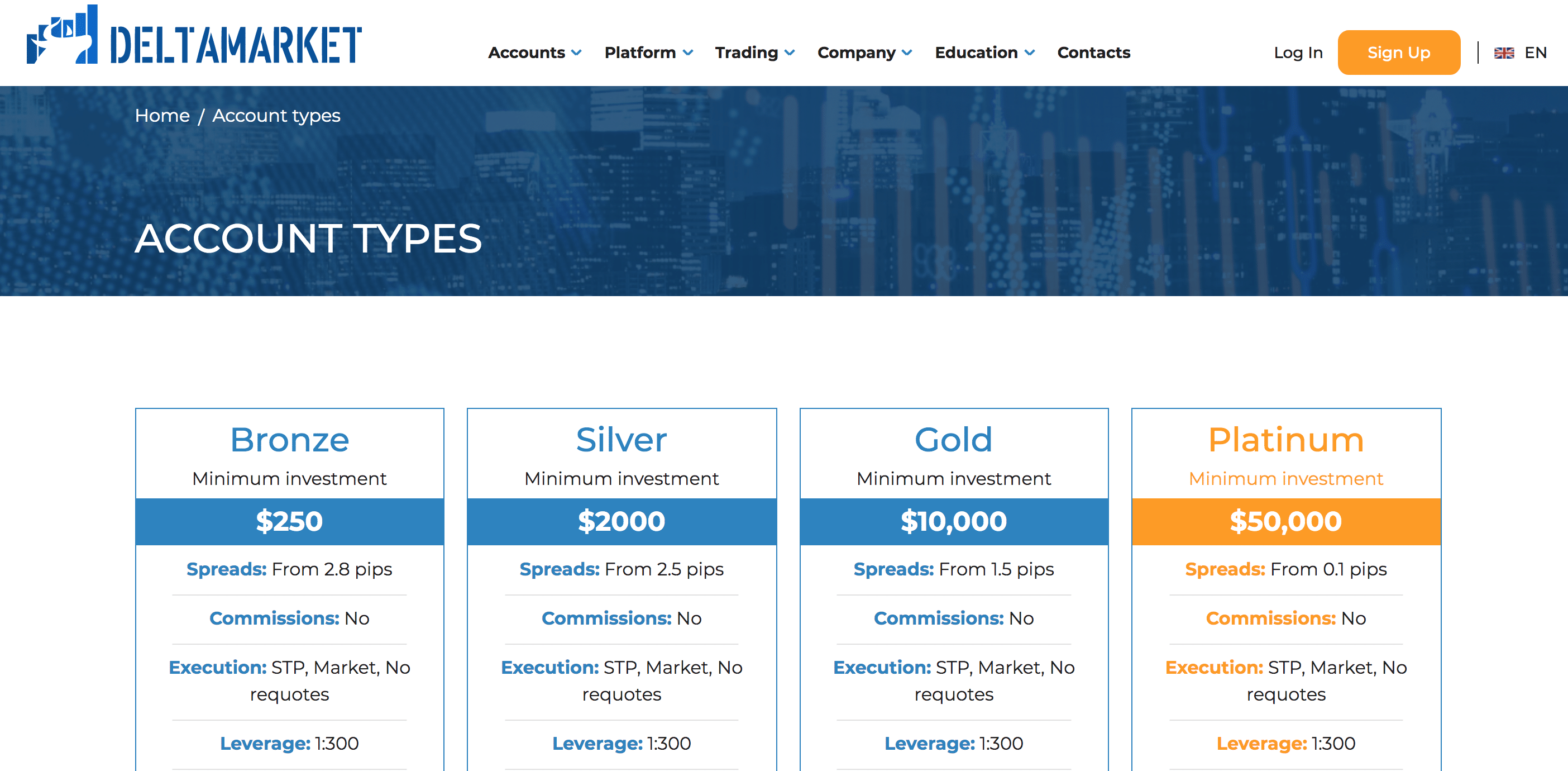

The picture of spreads at this broker is far from simple. The minimum spread levels vary depending on the account type chosen by the user. A Bronze account, for example, sees spreads begin at 2.8 pips – which is quite high. A Silver account has a slightly tighter spread, at 2.5 pips. Gold accounts see spreads of 1.5 pips, while Platinum accounts have spreads as tight as just 0.1 pips.

The picture of spreads at this broker is far from simple. The minimum spread levels vary depending on the account type chosen by the user. A Bronze account, for example, sees spreads begin at 2.8 pips – which is quite high. A Silver account has a slightly tighter spread, at 2.5 pips. Gold accounts see spreads of 1.5 pips, while Platinum accounts have spreads as tight as just 0.1 pips.

The picture is a little clearer when it comes to leverage, however. The broker sells CFDs, which are financial instruments traded ‘on the margins’ – meaning that you borrow money from a broker in order to purchase stock. The levels of magnitude can be significant – and this is certainly true here at DeltaMarket. No matter which account type a trader chooses to go for, the leverage on offer is strong at 1:300.

Platform & Tools

DeltaMarket offers MT4, which is a well-known trading platform that many traders across the world are likely to have used on occasion. It has a wide range of significant features, including over 2,000 free custom indicators as well as a range of technical analysis tools.

Another positive of the DeltaMarket approach is the way that MT4 can be accessed on the go through the use of a mobile app. This has the potential to make a significant difference when it comes to fast-paced trading environments: without it, traders may miss key market swings and fail to open or close a position as a result. Those who are based on a computer but don’t have the processing power or inclination to download the whole MetaTrader package are also catered for. The MetaTrader 4 WebTrader can be used from most basic website browsers, and contains many of the same positive features as the downloadable version.

The main drawback to the DeltaMarket suite of platforms and tools, though, is the absence of a useable version of MT5. The most recent iteration of the popular trading tool brand comes with a variety of additional features, including additional pending order types for order management – such as buy stop-limits and sell stop-limits. MT5 also has a more advanced trading language laced into its systems. Savvy trading users who are looking for the best possible experience when organising their open positions, then, may find the offer from MT4 somewhat lacking.

Commissions & Fees

As explained earlier in this review, the main way that DeltaMarket makes money is through charging a particular proportion on the spread between the sale and purchase prices of the assets you trade. In terms of additional fees, information on this can be somewhat difficult to pin down. However, it’s definitely the case that fees are not charged on some account-related procedures, which are commonly expensive at other brokers. Withdrawing money via a credit card from a DeltaMarket account, for example, is not chargeable at this broker.

On top of charges, spread fees and other fees, some brokers have also been known to charge separate commissions. At DeltaMarket, the account pages state that there is no such commission charged – and this applies whichever sort of trading account the user holds. However, the ‘Indices’ page of the ‘Trading’ section goes on to say that there are in fact “low commissions” in place. For this reason, it may be worth a potential trader checking with DeltaMarket’s customer support team before beginning to use the service.

Education

Trading education is, of course, not the responsibility of the broker but rather the responsibility of the trader. Some brokers, however, choose to provide additional value for money for their traders by offering a suite of educational information.

Unfortunately, DeltaMarket does not appear to provide much in the way of foreign exchange trading education. There are only two sub-sections in its education category. One of these is a ‘Frequently asked questions’ page, which in fairness does cover a range of both technical and account-related questions. These include topics such as how long it will take a user to set up an account, as well as information on what trading experience will be required to get started. There are only four questions listed.

The other educational resource offered by this broker is a foreign exchange glossary organised from A to Z, which may be useful for those who are new and are looking to get instant, short answers to key definition questions.

The other educational resource offered by this broker is a foreign exchange glossary organised from A to Z, which may be useful for those who are new and are looking to get instant, short answers to key definition questions.

Some of the services that traders might expect from other providers, such as video content explaining how to use the trading platform or articles explaining what trading patterns are important, do not exist here.

Customer Service

There is a range of customer service options available to customers at DeltaMarket. First off, customers can ramp up the convenience by requesting a call back if they are unable to place a direct call to the DeltaMarket customer support team themselves. If they would prefer, they can approach the company via phone directly using a phone number with a UK country calling code. Customer service support is also available via email.

It is unclear what the precise opening hours of the customer service department is, or whether this changes based on the customer service method used. Traders ought to bear this in mind, as it could make all the difference if there is a problem with an urgent trade that needs to be rectified right away.

In terms of translation, meanwhile, customers are able to view the website in either English or Russian. This provision of a second language is to be welcomed, though there are plenty of competitors on the market that offer far more language translation options than this.

Final Thoughts: DeltaMarket Review Conclusion

Overall, it is recommended to exercise some caution when trading with this broker. The broker does not appear to be regulated by a relevant body, for example – and while this is not necessarily a deal breaker, it does mean that there is a higher risk of fraud than there might be with a broker that is more regulated and better overseen by others.

That said, there are some potential benefits to using this broker. DeltaMarket offers the well-established platform MT4, for example, and it also has a range of account type options and a commitment to not charging commissions. In terms of user experience, there are several customer options to choose from – including both phone and email.

On the whole, this broker could well work out to serve a trader’s purposes – but it is a good idea to use some caution.

Broker Details

Traders ought to be aware that DeltaMarket is simply a brand name, and does not refer to the owner. The firm is in fact owned and run by a company named Bi-Global World Ltd. According to the broker’s website, it is based in the Republic of the Marshall Islands, where its registered number is 105143. It gives its address as Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, MH 96960.

It is important to note that DeltaMarket does not appear to be a licensed broker. There is no clear evidence of the broker being regulated by one of the major regulatory bodies in key markets, such as the Financial Conduct Authority in the UK. This does not necessarily mean that the broker is fraudulent, but it may mean that the company has not gone through as stringent a set of checks as other brokers on the market. As a result, traders should exercise caution and do their research before proceeding with this broker.

Contacts

Contacting the team behind DeltaMarket is easy, and there are several ways to do so.

Those who want to get in touch via phone can do so by calling +441507243012.

It is possible to use the DeltaMarket website’s contact form to submit a question via email. This can be found at https://deltamarket.net/contact-info. Alternatively, traders or members of the public are able to reach DeltaMarket on [email protected].

Finally, the broker can be contacted via post at Bi-Global World Ltd, Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, MH 96960.

FAQ

How can I open a demo account with DeltaMarket?

First of all, a trader who wishes to use a demo account at DeltaMarket will need to set up an account in the usual way. Once that has been done, and before any real money is deposited, the default state of the account is demo-focused – so a trader can get started with their practice just by logging in.

Does DeltaMarket offer an Islamic account?

DeltaMarket does indeed offer an Islamic account, which does not charge swap fees. This is to ensure that the trader can comply with Sharia law. In order to set up an Islamic account, traders are advised to get in touch with the DeltaMarket customer services team.

What bonus terms does DeltaMarket offer?

DeltaMarket makes its bonus policy very clear on its website. It insists, for example, that all those who pick up bonuses must be over 18 years of age – and they must also agree to the website’s bonus terms and conditions. One of these is that bonuses cannot be delivered on a pro rata basis: instead, traders who wish to claim a bonus must do so in full, and place the requisite number of open positions to meet trading volume requirements. No withdrawals will be permitted until this has happened.

The complexity of these bonus regulations means that it is prudent for traders to check out the full list of rules before going ahead or relying on a bonus to trade.

It is also worth remembering that bonuses are not necessarily available at DeltaMarket at any given time. They can be taken away or put back into service at short notice, so it is worth keeping an eye on the website homepage to see what is available when you sign up.

How do I withdraw money from DeltaMarket?

To take money out of a DeltaMarket account, a trader needs to first head over to the ‘Payments’ icon when they are logged in. From there, they can find the relevant withdrawal function.

In order to take out money via a credit card or debit card, traders will need to wait over a week. The minimum amount of time that it takes for the withdrawal to be processed is five days, though it can go as long as eight days. Bank transfer may be faster, though there is no guarantee of this. In order to withdraw money in a timely fashion, traders are advised to submit their withdrawal request as early as possible.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts