Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

Expert Summary

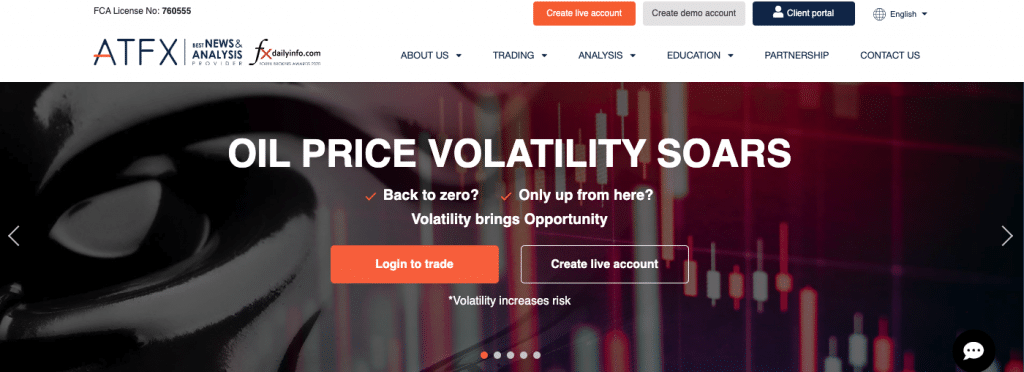

ATFX, formerly Positiva Market (CY) Ltd is a CFD and spread betting broker operating from London. The firm is the subsidiary of ATFX Global Markets (CY) Ltd, authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC).

In the UK, Financial Conduct Authority (FCA) regulates the activities of ATFX. Retail clients registering with ATFX come under the monitoring agency’s Investor Compensation Fund (ICF) in Europe and the Financial Services Compensation Scheme (FSCS) in the UK. The Compensation schemes protect retail investors up to €20,000 and £85,000 respectively if the broker goes into administration.

ATFX has about 100 products on offer, all of them accessible from three account types- Premium, Edge and Standard, with the minimum deposit on the Standard Account at $€£500. Also, the tier-I regulated broker provides only the MetaTrader 4 platforms for all its customers.

So, irrespective of your experience or trading style, you are covered. Coming to the asset classes, you can choose from a range of CFDs in FX, commodities, indices, and cryptocurrencies. For some reason, ATFX has not included CFDs in shares or ETFs, one of the reasons for the small number of financial instruments on offer.

The trading conditions are a factor of the account types. Due to regulatory constraints, retail clients can expect max leverage of 30:1 while the leverage for professionals goes up to 400:1. Likewise, the spread for the Premium Account starts from zero pips and increases to 1 pip for the Standard Account. Besides, the broker does not charge for deposits/withdrawals, provides free VPS and 1-1 sessions for Premium and Edge account holders.

When it comes to educational resources, you can access tons of learning material directly from the website, under the ‘Education’ tab or sign-up for a one-on-one coaching session.

Besides, the broker’s Web TV provides financial markets commentary, market overview and trade ideas. You can also register for the seminars, webinars which the broker conducts from time to time.

ATFX is a multi-regulated tier-I broker. So, when it comes to the safety of your funds, you can be assured that you are completely secure. Although the broker may not be at the top when it comes to the product range or the choice of client support options, ATFX makes up for it with a cutting edge platform and excellent trading conditions.

ATFX is an FCA regulated broker based in London offering multi asset trading including Forex, Commodities, Indices, Cryptos and Shares. You can trade raw spreads starting from 0.0 pips, free VPS and 3D Technical Analysis*. ATFX offers up to 1:400 for professional clients** and 1:30 for retail clients. ATFX doesn’t charge commission on trades.

*Subject to account type **Subject to eligibility.

Although ATFX was launched in late 2014, the operator is a genuine veteran of the online Forex/CFD scene. Before its stint as ATFX, it used to be known as Positiva Market (CY) Ltd, racking up experience under that name. As a matter of fact, the Positiva name still shows up at various points throughout the official ATFX website, atfxgm.eu, most prominently in their Terms and Conditions section.

The corporate entity behind the Forex/CFD brokerage is ATFX Global Markets (CY) Ltd, which is based in Cyprus, at Silver House, 19 Spyrou Kyprianou Avenue, Ground Floor, 3070, Limassol. The company is a registered and regulated investment services firm. Its registration number is HE 340674 and its CySEC license number is 285/15. It is also said to be fully MiFID compliant, which means that it is allowed to sell its services in all the countries of the European Economic Area. As a Cyprus investment firm, the company is covered by the Investor Compensation Scheme, which in essence means that the state will compensate losses incurred by its clients, if the said losses come about on account of a sudden bankruptcy for instance. With ATFX trading, such scenarios are not really likely though, as the operation is well funded and it features superb liquidity.

From a regulatory perspective, ATFX’s main “partner” is obviously CySEC. According to the above mentioned license, the operation is entitled to offer investment services covering investment advice, portfolio management as well as the reception, transmission and execution of orders on behalf of its clients.

Ancillary services (like the granting of loans needed for margin/leverage) are also included in the package.

Besides CySEC, ATFX Global Markets Ltd. are registered with the UK’s FCA too (reference number: 750501), which gives them the right to offer certain financial services in the UK.

Besides the FCA, the operation is registered with most national financial authorities of the EEA member countries.

According to the requirements of MiFID, the operator keeps the monies of its users in segregated accounts, with top European financial institutions. In accordance with the same guidelines, the activity of the operation is subjected to regular third-party audits, its capital adequacy requirements are fulfilled at all times (according to the official website, this ratio is kept above the minimum required by European regulators) and various customer fund protection measures are observed. The operation also observes strict AML and KYC policies. The group AT Global Markets (UK) is also a member of the Financial Services Compensation Scheme (FSCS), which covers eligible investments of up to £85,00 per person, per firm.

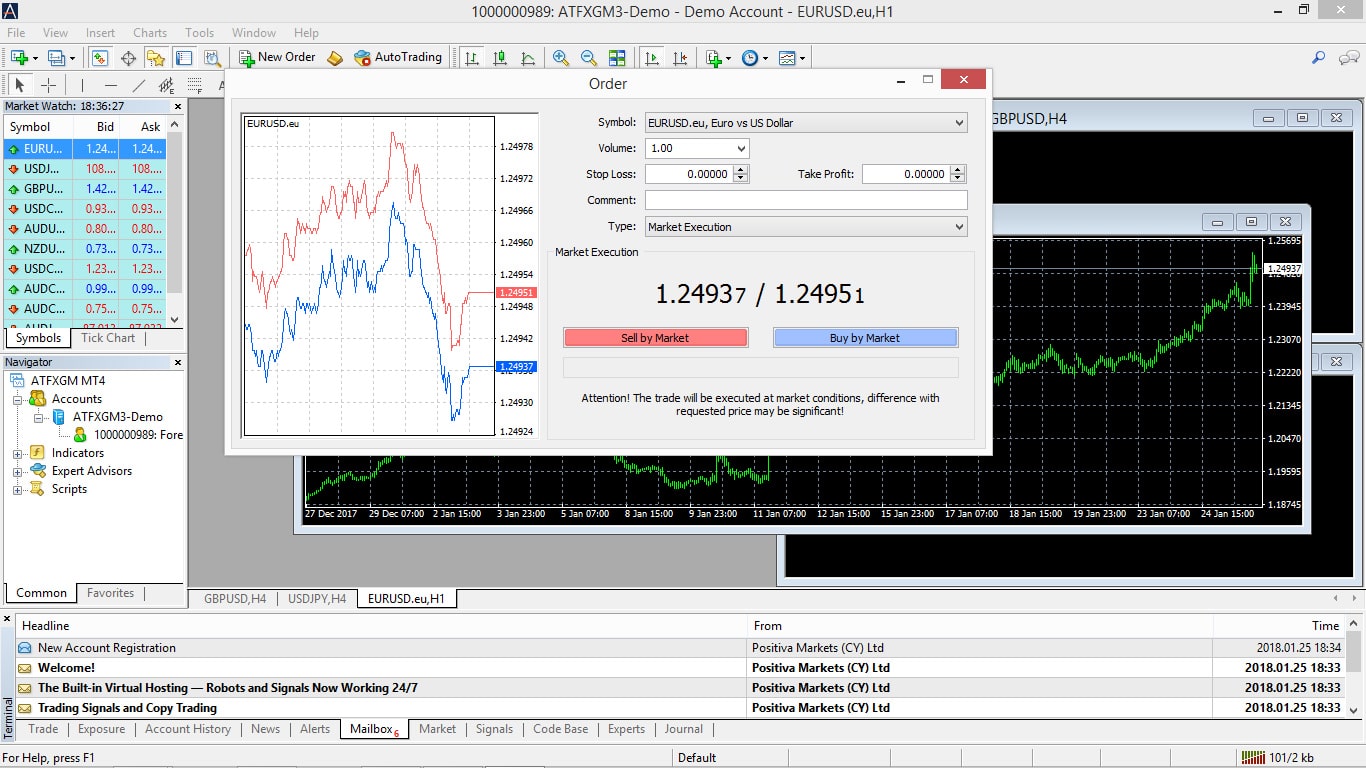

The ATFX Trading Platform

Some reviewers out there say that ATFX is plagued by a lack of platform variety… Exactly what need is there for such variety though, when you have the best of the best set up, firing on all cylinders, in several different versions? We are of course talking about MT4.

First off, we have the also-MT4-based Web Trader, which, while it looks a little tame and underpowered compared to the full version, is extremely handy, and can be reached within a few clicks from the homepage of the brokerage. Opening positions, using technical indicators and various other trading tools, and checking one’s trading history is possible through the Web Trader as well. While the Web Trader is a simpler version of the full MT4 platform, it does offer full market coverage, one-click trading and advanced charting features.

The full, downloadable version of the platform is obviously more powerful and it delivers all the features one might expect from MT4. The package can be downloaded for free, from the ATFX website, and it comes with more than 30 preinstalled technical indicators, 31 chart analysis tools, as well as MQL4, the programming language traders can use to code their own indictors and expert advisors. Indeed, ATFX supports the use of expert advisors.

The charting features of MT4 are well known, and in ATFX’s version, all these features are supported. Viewing positions directly on the chart, trading from the chart and placing quick orders is possible. Charts can be customised, and templates can be saved for later use. Warning sounds can be added as well.

The mobile versions of ATFX’s MT4 offer full Android, iOS and Windows compatibility. In addition to intelligent chart analysis and a simple and easy-to-use interface, the mobile trading platforms allow for the restraint-less setting up of positions, including stop losses, take profits and order resting.

ATFX Account Types and Trading Conditions

While some say that ATFX do not offer a proper selection of trading accounts, this is far from the truth. While the account selection could in fact be larger, we have found that all trading needs are catered for, through the 4 currently available account types for retail customers.

For starters, we have the ATFX Demo Account, which gives traders a risk-free way to put the trading platforms and trading conditions to the test. Registering for such a Demo Account is quick and simple. Demo Accounts come loaded with some $100,000 in virtual money.

The basic version of the real money account is the Standard Account. The minimum deposit for such accounts is just $500, so they are indeed very accessible. The problem is that the trading conditions associated with the Standard account are not particularly attractive. On major currency pairs (such as the most popular EUR/USD), spreads start from 1.0 pips – which is indeed above the industry-average. With margin calls set to 100% and with maximum leverage at 1:400, scalping, hedging and EAs are all allowed. The execution is said to be STP (Straight Through Processing)- based.

The advanced account version is the Edge account, which takes things to an entirely new level. The minimum required deposit for this one is $5,000, and for that money, the spread on the USD/EUR starts from as little as 0.6 pips. While the Standard account is commission free, there are commissions charged on the Edge account, but still, its trading conditions remain vastly superior. The execution, the maximum leverage and the margin call are the same as with the Standard account. Interestingly, the negative balance protection and the free trading tools deal stands for both accounts as well.

The final account type is the Premium account, aimed at top level traders. It requires a deposit of $10,000 and offers a minimum spread on the benchmark EUR/USD currency pair of 0.0 pips. Like the Edge account, this one does charge commission, but also various advantages, including access to Premium education and resources.

The four retail accounts offer plenty of choice for individual traders. For traders who meet the right criteria the broker also offers a professional account. This account allows trading on all instruments with higher leverage. You must qualify as an elective professional, and evidence will be required when applying. The professional account does not, however, offer negative balance protection, as the retail accounts do.

Long story short: while the spreads on the Standard account are much bigger, there are no commissions and the initial deposit requirement makes up for it. Given these benefits, it is indeed still the right choice for beginners and recreational traders.

ATFX Product Selection

The Trading Products section at ATFX offers a comprehensive choice of financial assets to trade, including FX and CFDs in shares, cryptocurrencies, indices, and commodities. The Forex section offers a wide array of tradable assets. A total of 43 currency pairs are on offer, including majors, minors and exotics. You can also trade cryptocurrency, with Bitcoin, Ethereum, Litecoin, and Ripple all available. The exact trading conditions are listed separately for each currency pair at the site.

The precious metals section is about Gold, Silver, and Palladium, while crude oil lists a couple of assets called US WTI Oil and UK BRENT Oil, as well as US Natural Gas Futures.

The indices section features a number of tradable assets as indices-based CFDs, including:

- CHI50

- HK50

- AUS200

- EU50

- ESP35

- FRA40

- GER30

- IT40

- JP225

- UK100

- US30

- US100

- US500

ATFX Customer Support

The broker offers award-winning customer support, having won the Best Customer Service award from ADVFN in 2019. Customer service is available in several languages and support professionals seem very dedicated to building and maintaining client relationships.

Learn Trading with ATFX

ATFX trader training offers a range of educational resources for brokers at all levels they include:

- Daily webinars

- One-to-one coaching

- An online forex education centre

- Advanced education offerings for Premium account holders

The ATFX educational programme is aimed at making sure clients have all the resources they need to make informed trading decisions.

ATFX Review Conclusion

Generally speaking, ATFX is a decent trading destination. Sure, the spreads are a bit on the wild-side with their standard account, but that is countered by the lack of commissions. There are plenty of advantages to trading with ATFX, as overall, they offer:

- Competitive Spreads on Edge and Premium accounts

- No commission on standard accounts

- Regulation by CySEC and the FCA

- A wide range of financial instruments

- MT4 trading

- Free VPS (subject to account type)

- Excellent educational resources

- Multi asset trading – FX, Commodities, Indices, Stocks and some Cryptocurrencies

- Award winning customer support

Read more forex broker reviews.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts