Expert Summary

With over twenty years of experience in the industry, the Alpari brand is one of the larger players on the online trading scene. Having been established a little over two decades ago, Alpari has since gone on two help a total of two million clients through their network of eight offices across three continents.

But why, exactly, have over two million clients chosen to trade with Alpari? Alpari provides a forex trading environment that places a strong emphasis on trustworthiness, customer safety, and using technology that is both reliable and innovative. It is this emphasis on the customer experience that has seen so many clients return to the Alpari trading platform over the years.

This focused customer approach sees Alpari put their clients at the heart of everything it does. As such, the level of customer support at Alpari is incredibly high, with their highly skilled customer support team contactable through the website, or by phone or email, twenty-four hours a day during the week and on the weekends at slightly reduced hours.

In terms of what you can trade on Alpari, it puts on emphasis on providing you the means to diversify your trading and investment options. This means you can trade hundreds of financial instruments across forex, metals, cryptocurrencies, commodities, futures, and a range of other CFDs. Most importantly, Alpari put an emphasis on allowing you to trade and invest in a way that suits you best. As such, you are given the option of choosing from two Standard Accounts and two ECN Accounts.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐⭐ |

The standard accounts are aimed more at the casual retail trader and consequently has a lower minimum deposit requirement and slightly higher spreads on average. In contrast, the ECN accounts are geared towards professional day traders and have lower spreads, but require a higher minimum account deposit.

One of Alpari’s company missions is to help traders using the platform to realise their full potential. As such, not only are the trading conditions very favourable, it also has a full-featured ‘Learn to Trade’ section on their website, which provides both rookie and more experienced traders a number of educational resources to level up their trading skills. This includes webinars, beginners guides, and trading strategy guides for forex, commodities, and precious metals.

Another added bonus is that Alpari has a ‘Refer a Friend’ promotion on the website, which allows you to earn up to $50 for each person you refer to the platform—a great way to give yourself some extra funds to play with! Additionally, Alpari also runs a number of limited-time promotions through their website, including a cashback scheme for loyal users.

When combined with the stringent customer trusty and safety measures they have in place, Alpari is an easy choice for the novice or intermediate trader looking for a platform with favourable trading conditions and a stable, reliable platform.

The Alpari brand is a true heavyweight of the trading industry. With over 20 years under its belt, the brand boasts two million clients, offices in 8 global locations across 3 continents and an offering of over 250 trading instruments. The most recent addition to the Alpari family, Alpari International, is set to provide a fresh, dynamic alternative to the giants of financial trading. Equipped with some of the tightest spreads available – from just 0.9 pips on major currency pairs – Alpari International is distinguishing itself as a go-to broker for superior trading conditions.

Alpari International’s mission is to realize the full potential of every kind of trader – and with that in mind, its products and services have all been updated and improved, including a modern, easy-to-use website. Now, Alpari International adds a new chapter to one of the most recognizable names in the business.

Alpari International are well-known for their outstanding commitment to customer satisfaction. The broker offers specialised help and guidance as and when required, and can be contacted by phone, email and live chat. Their website is available in nine different languages, including English, Chinese and Persian.

Alpari International provides services to every country in the world with the following exceptions: USA, Mauritius, Japan, British Columbia, Quebec, Saskatchewan Haiti, Suriname, the Democratic Republic of Korea, Russia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Armenia, Moldova, Tajikistan, Uzbekistan, Turkmenistan, Ukraine and Georgia.

Trading with Alpari International

Alpari International’s excellent trading conditions are extremely appealing for both new and experienced traders. The financial markets are accessible to both large and small investors alike, as Alpari’s most popular account type has a minimum deposit requirement of just USD/EUR 5. Leverage spreads and margins are also extremely competitive with floating leverage from 1:1000 offered on the Standard Account.

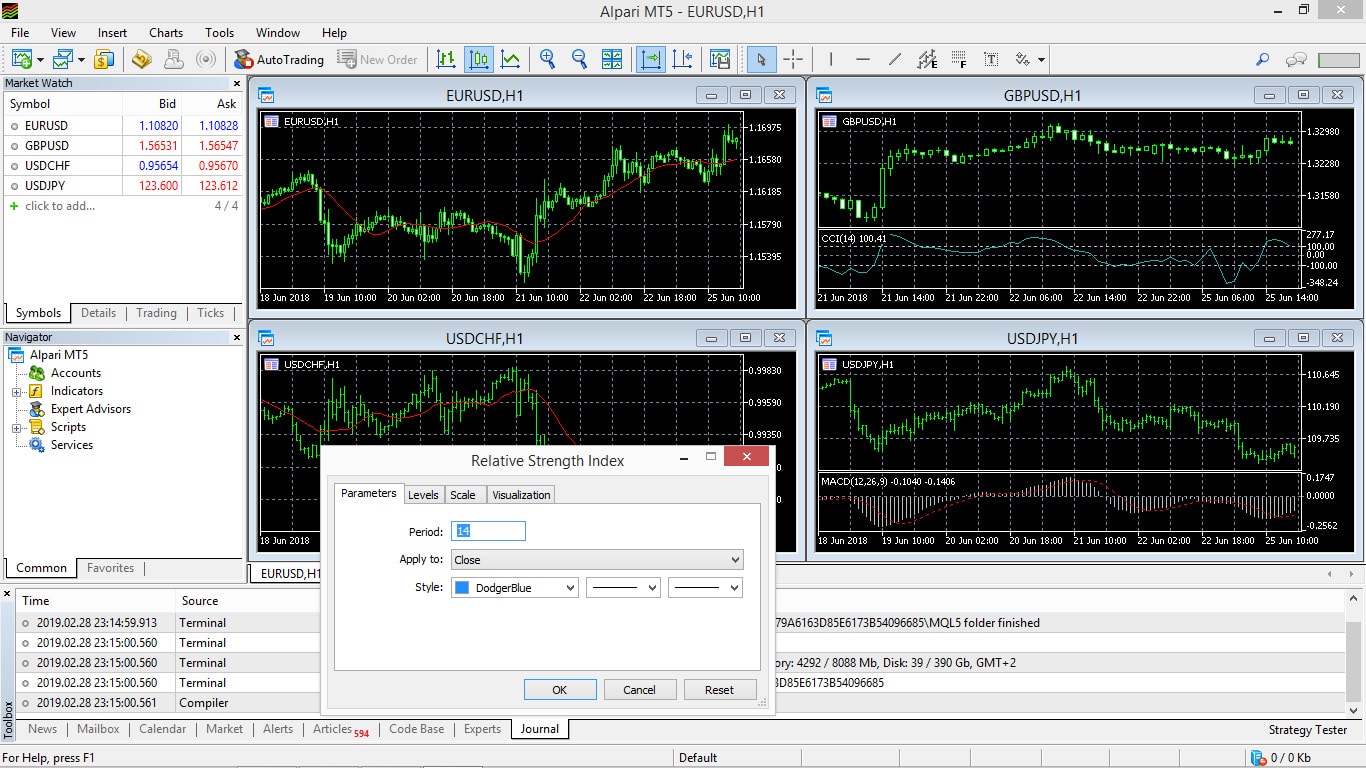

With regards to trading platforms, the broker uses MetaTrader 4 and MetaTrader 5; both of which offer great flexibility, state-of-the-art charting tools and an easily-navigated interface. There are 4 different versions available: WebTrader, Desktop, iOS and Android. For higher volumes, the Alpari International Direct platform is available, which offers enhanced features for advanced investors.

Compare Alpari International with other approved brokers

|  |  |  | |

| Regulation | FSC | ASIC, MiFID, FSA, FSCA | FCA, FSCA, CMA and FSC | FSPR |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5 | MT4, MT5, WebTrader, Mobile Apps |

| Minimum Deposit | $/€/£ 1, ₦1000 | $100 | $200 | $200 |

| Leverage | up to 1:3000 (for Pro-Clients) | 400:1 | Flexible | 1:500 |

| Total Markets | 70+ | 1260 | 252 | 182 |

| Total Currency Pairs | 50 | 55 | 62 | 72 |

| Total Cryptocurrencies | 19 | 17 | 4 | 0 |

Account Types

As well as the Demo account, Alpari International offers four ‘real-money’ account times – two of which are Standards Accounts and two which are ECN types. The MT4 MicroAccount only requires a minimum deposit of EUR/USD 5. Spreads on this account start from 1.7 pips on major FX pairs. The maximum available leverage is 1:400. Micro Account traders get instant order execution, margin calls set to 50% and stop outs to 30%. The Standard MT4 Account requires a minimum deposit of EUR/USD 100. For that money, traders get spreads from 1.2 pips on majors, as well as instant execution and margin calls at 60%. The maximum available leverage on this account type is 1:1,000.

More experienced traders may find the ECN accounts more appealing. The ECN Account requires a minimum deposit of EUR/USD 500 and spreads here start from just 0.4 pips. Margin calls are at 100%, and a swap-free option is available on MT4 only. Pending orders are limited to 300. The maximum leverage is 1:1,000.

The ECN Pro Account is designed for professional traders, with a required deposit of at least EUR/USD 25,000.

More Reasons to Join Alpari International

There are a variety of trading options available to suit the needs of each individual investor. For those that lack the time or confidence to trade but still wish to experience the thrill of the markets, the broker offers Alpari Copy Trading. This innovative investment service allows you to automatically copy the trades of more experienced traders. After browsing throughout the broker’s Top-Ranking Strategy Manager page and choosing a Strategy Manager to follow, their trades will instantly be copied into your account.

Visit this page for more details on Alpari Copy Trading and how it works: https://www.alpari.org/investments/alpari-invest/copy-trading

Alpari International also offer a Loyalty Cashback program and other regular promotions to its clients.

As a forward-thinking broker, Alpari International has a proven client-centric philosophy. From first-timers to professionals, the broker’s broad range of services appeals to all types of investors and strives to provide the best possible guidance, advice and resources. Alpari is certainly shining amongst the vast competition, and its determination to remain a modern and exemplary broker is making the company an extremely attractive choice for today’s investors.

Free phone +442 080 896 850

11th Floor, Maeva Tower, Silicon Avenue, Cybercity, Ebene, 72201, Republic of Mauritius.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts