Written by Theunis Kruger, FX Trainer at FXTM

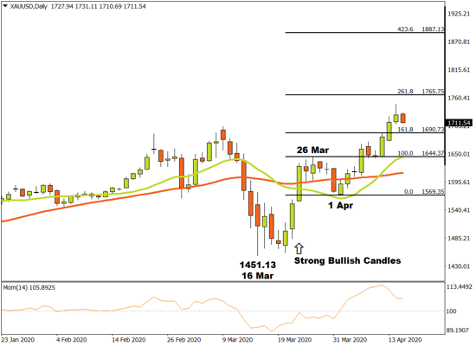

The price of gold, on the D1 time-frame, made a short-lived downward shift until March the 16th when a lower bottom was recorded at 1451.13. Buyers found the price attractive at that level and took control of the market.

After the bottom at 1451.13, the market rushed through the 15 and 34 Simple Moving Averages and the Momentum Oscillator pierced the zero baseline into positive terrain. This might have warned technical traders of a likely price reversal or early formation of a new trend.

The possible reversal was supported by a series of Strong Bullish Japanese Candlesticks that occurred during the upward market drive.

A probable critical resistance level formed when a top was recorded on March the 26th at 1644.37. Bears then tried to drive the market lower but after forming a bottom on April the 1st at 1569.35, bulls overcame the selling pressure and the market surged upwards again.

On April the 6th, the gold market broke through the critical resistance level at 1644.37 and three possible price targets were calculated from there. Applying the Fibonacci tool to the top of the resistance level at 1644.37 and dragging it to the support level at 1569.35, the following targets were calculated: the first target was estimated at 1690.73 (161 %) and the target had been breached on April the 13th. The second price target is calculated at 1765.75 (261.8%) and the third target is projected at 1887.13 (423.6%).

If the 1569.35 support level or one of the subsequent higher bottoms formed by the current uptrend are broken, the price targets anticipated above are therefore nullified.

As long as the price continues making higher tops and bottoms, thus confirming an uptrend is in place and demand is overcoming supply, the outlook for gold on the Daily time-frame will remain bullish.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox