The annual United Nations Climate Change Conference COP26 held in Glasgow this year has drawn to a close and succeeded in finding a loose-fitting consensus among its participants. Voices at different ends of the debating spectrum will have plenty of material to fire up their lobbying efforts. However, there is still the question of how to get the most out of ethical investing for everyday investors.

Sectors associated with more socially conscious investment aims are now big business. A groundswell of public interest has resulted in brokers offering a more comprehensive range of ethical investment products. In turn, that has driven down the fees associated with investing in them and made them easier to buy. Accordingly, the price of the assets has sky-rocketed, making green investments good for the head as well as the heart.

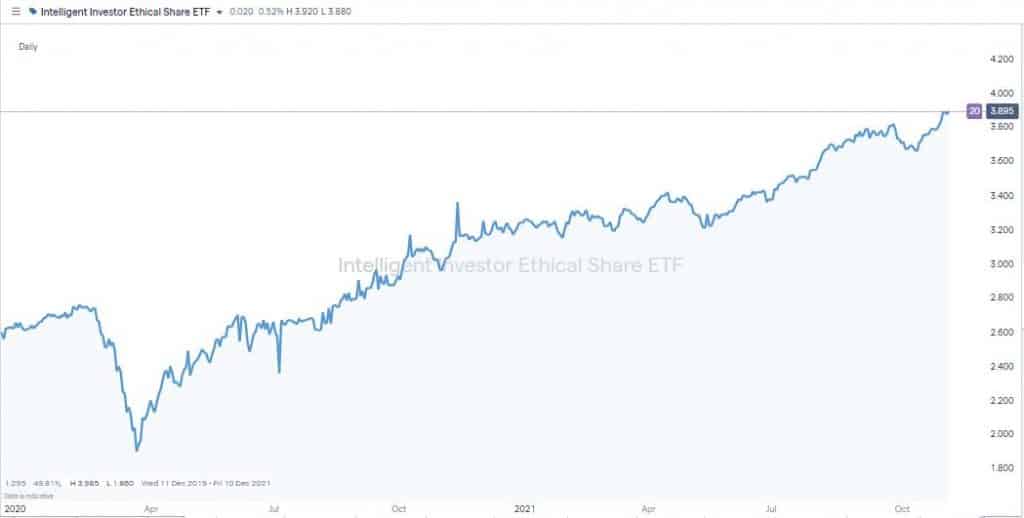

Intelligent Investor Ethical Share ETF – Price Chart

Source: IG

How to Avoid Greenwash When Investing

The COP26 summit was the political epicentre of environmental policymaking, but the corporate world has also caught up with the trend. One of the buzzwords of the moment is ESG – Environmental, Social and Governance policy. The exact definition of what this means is hard to pin down. Each firm can choose its metrics and, to a large extent, mark its own work. As a result, there is a feeling that it is more complicated than it ought to be to evaluate a firm’s greenness independently.

Does a mining firm such as Freeport-McMoRan, which has a particularly progressive ESG policy, and a massive spend on that area, merit investment over a firm that is not involved in resource extraction but is more passive in terms of ESG?

Ethical Investing – Tips From Inside The Industry

The answer, according to one industry insider, is to simplify the selection process. Tariq Fancy, who used to hold the position of Head of Sustainable Investment at BlackRock, spoke with the press during the COP26 conference and shared his ideas on how investing can play a part in stopping climate change.

Fancy spent years in charge of the eco-investing arm of the world’s largest investment manager, and even he was sometimes confused by the proposition.

“Having spent years digging through ESG data and trying to understand and disaggregate it I would actually say that sometimes the level of work going into it is almost counterproductive. It tries to put precision onto things which are quite hard to measure.”

The approach he came around to using would work as well for retail investors as it does for the institutions.

“The simplest thing is to run a test that if this company doubles in size, is it good or bad for the world? Well, if it’s an electric vehicle maker it’s probably good for the world … and if Exxon Mobile doubles in size it’s probably not good for the world.”

Final Thoughts

The good news in that respect is that brokers have begun meeting the retail investor-led increased demand for greener products.

Those looking to invest in single stocks can pick up on growth sectors such as renewable energy firms listed here. Fund based investing strategies is also catered for with Exchange Traded Funds (ETFs), allowing investors to buy a basket of stocks with just one trade. They diversify the risk of one single stock going bad, and they spread investment across an entire sector.

There are now so many sustainable ETFs in the market that it’s possible to build a healthy-sized shortlist of candidates for investment. With the outcome from COP26 being decidedly ‘middling’ rather than spectacular, it could come down to individual investors applying more pressure on the corporate world.

While many eco-investors may give more weight to the feel-good factor than the financial returns, applying the fundamentals of risk management and protection of funds is essential.

Step-1 for those who are new to investing is to ensure they use a regulated broker. This list of trusted brokers reviewed by the Forex Fraud team is an excellent place to start.

Further Reading:

- Learn more about ESG

- Head here to compare the CSR policies of big-name stocks

- The best renewable energy shares to buy now

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox