USDCAD H4 – Bulls giving chase

Press Release written on 20/05/2021 by Theunis Kruger, FX Trainer at FXTM

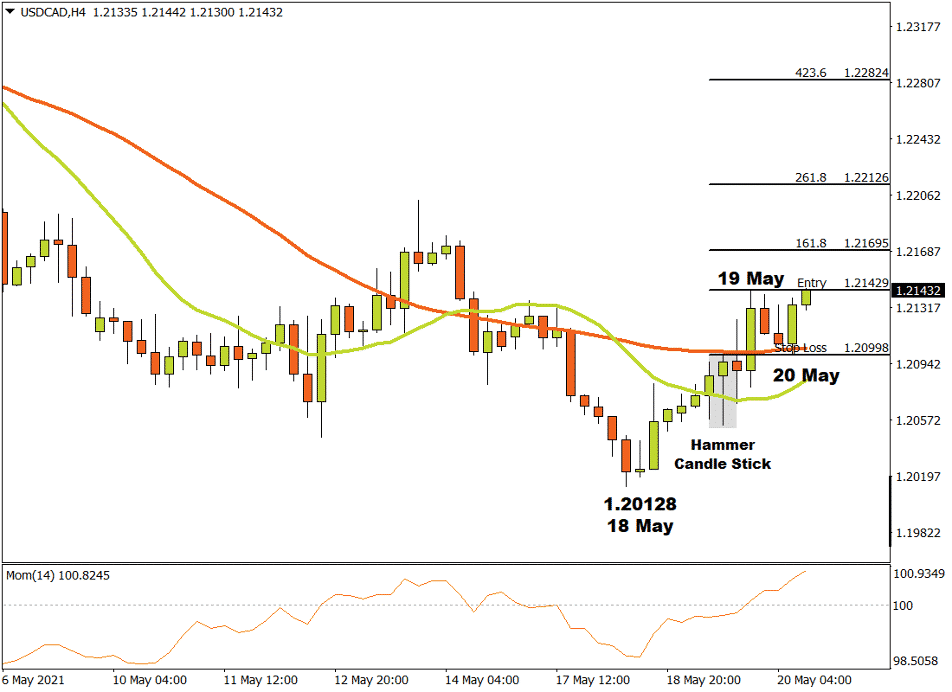

The USDCAD currency pair on the H4 timeframe was in a downtrend until 18 May when a lower bottom formed at 1.20128. Subsequently, bullish sentiment started to triumph.

After the lower bottom at 1.20128, the price moved progressively upwards. The change in momentum was confirmed by the crossing of both the 15 and 34 Simple Moving Averages as well as a Hammer Japanese Candle Stick that formed during the upward drive. The Momentum Oscillator also pierced through the zero baseline into positive terrain, and all these could have alerted technical traders of a possible shift in market momentum.

A likely critical resistance level formed on 19 May at 1.21429 and the bears tried to pull the market lower. A higher bottom however formed on 20 May at 1.20998 and currently the market is being drawn toward the “north” of the price chart.

Later during 20 May, the USDCAD currency pair crossed the critical resistance level at 1.21429, triggering a long signal. Three possible price targets could have been considered from there. Applying the Fibonacci Tool to the higher top at 1.21429 and dragging it to the support area at 1.20998, the following targets may have been considered. The first target was projected at 1.21695 (161%) and the second price target might be likely at 1.22126 (261.8%). The third and final target may well be expected at 1.22824 (423.6%) if the upward momentum continues.

If the 1.20998 support level is reached, the bullish scenario discussed above is invalidated and needs to be reviewed.

As long as the upward bias remains intact and demand overcomes supply, the outlook for the USDCAD on the H4 timeframe will remain bullish.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.