- A more positive US Dollar theme has surfaced through late January into early February driven by a rise in US yields across the yield curve to multi-year yield highs and also encouraged by a global equity correction.

- This has seen USDCAD and USDJPY both move higher above some modest resistance levels.

- But the underlying US Dollar weakness seen from latter 2017 remains intact, and we would look for USDCAD and USDJOY weakness to resume into February.

Read all forex articles and forecasts.

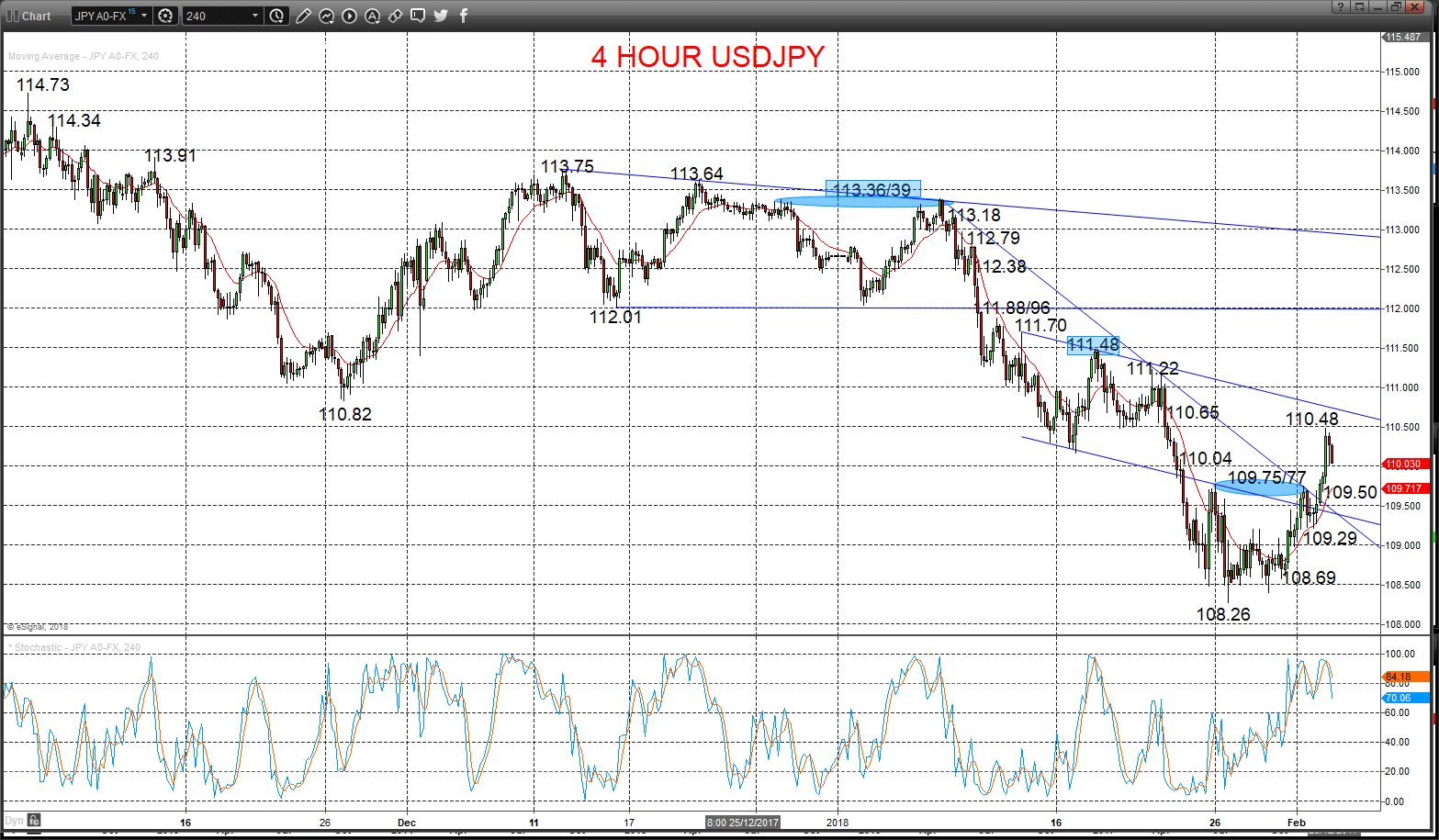

USDCAD Bear trend intact, but corrective rebound risk

A solid rebound on Friday up through the down trend line from early 2018 and also through 1.2392 swing high, easing the immediate downside threat, to shift the bias higher for Monday.

A negative breakout through 1.2620 in late 2017 shifted the intermediate-term outlook to the downside for January, withrisk now fading for a shift back to neutral, seen above 1.2589.

For Today:

- We see an upside bias for 1.2455; break here aims for 1.2491.

- But below 1.2362 opens risk down to 1.2299

Intermediate-term Outlook – Downside Risks:

- Whilst below 1.2589 we see a negative tone with the bearish threat to target 1.2429, possibly 1.2194 and 1.2060.

What Changes This? Above 1.2589 signals a neutral tone, only positive above 1.2728.

Resistance and Support:

| 1.2455 | 1.2491** | 1.2541 | 1.2553 | 1.2589*** |

| 1.2362 | 1.2299 | 1.2247** | 1.2194** | 1.2141 |

4 Hour USDCAD Chart

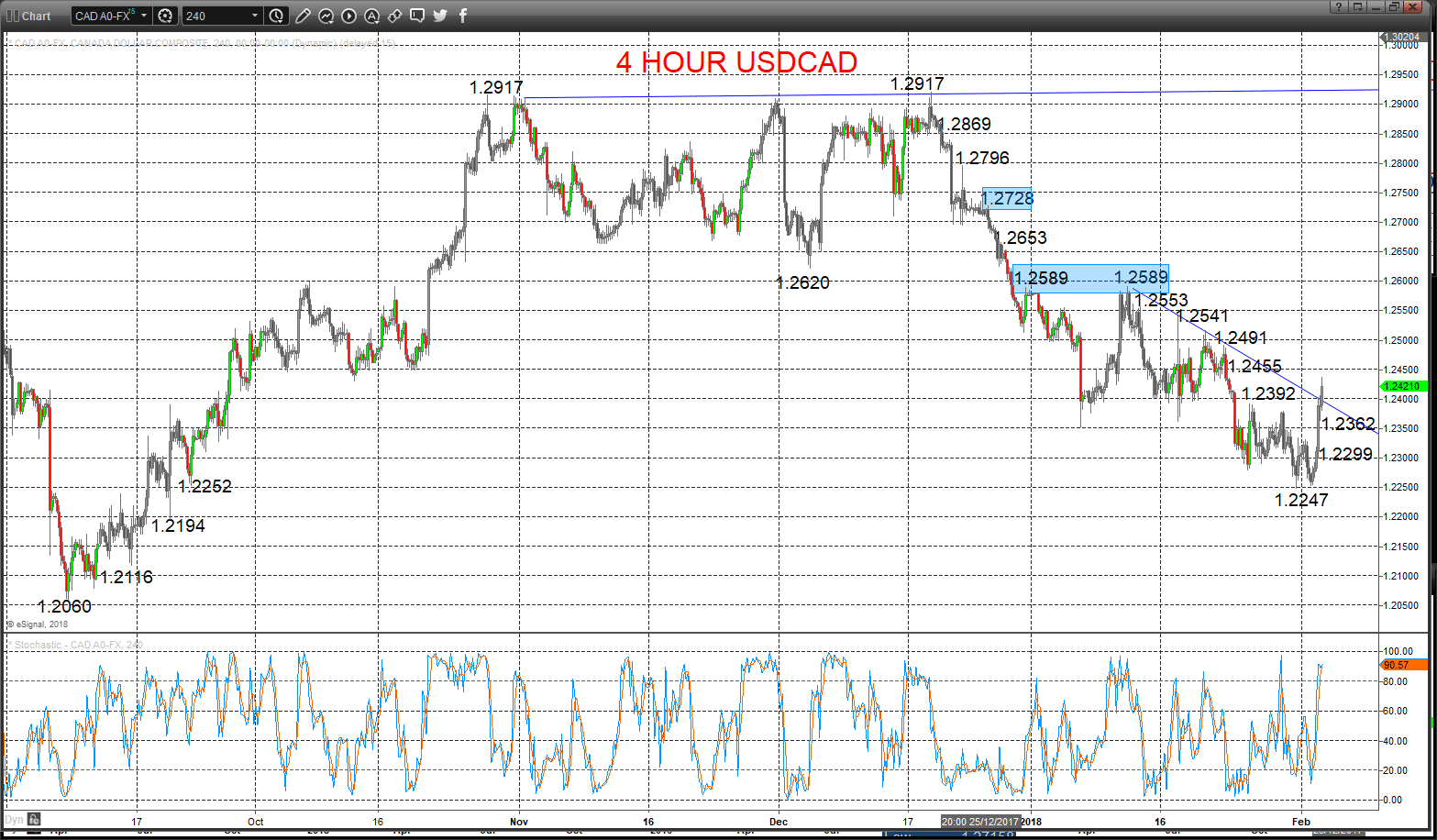

USDJPY Small base, upside bias

A stronger corrective advance on Friday above 109.75/77 and 110.04 resistances, to build on Wednesday’s rebound effort above 109.21 resistance for a small base pattern, for now rejecting downside pressures from the latter January bearish outside pattern to a new bear move low (108.26), to switch risks higher for Monday.

The selloff below 112.01 produced an intermediate-term bearish range breakout, setting a bear theme into at least January (whilst below 111.48).

For Today:

- We see an upside bias for 110.48 and 110.65; break here aims for 111.22, maybe even critical 111.48.

- But below 109.50 opens risk down to 109/29, maybe towards 108.69.

Intermediate-term Outlook – Downside Risks:

- Whilst below 111.48 we see a bear theme with the downside threat to 110.82, 110.00, 109.53 and potentially closer to 107.29.

What Changes This? Above 111.48 signals a neutral tone, shifting bullish below 113.39.

Resistance and Support:

| 110.48 | 110.65* | 111.22 | 111.48*** | 111.70* |

| 109.50 | 109.29* | 108.69** | 108.26** | 108.11 |

4 Hour USDJPY Chart