- Again a more positive US Dollar tone has resumed in the second half of February versus most G10 currencies, driven by a rise in US yields, alongside a more hawkish tone from the FOMC amid increasing inflationary pressures.

- This has seen USDCAD push above notable resistances at 1.2529 and 1.2728, initially rejecting a more bearish tone and now setting a more bullish theme into March.

- Against the Japanese Yen, however, underlying US Dollar weakness seen since late 2017 remains intact, and we look for further USDJPY losses into March.

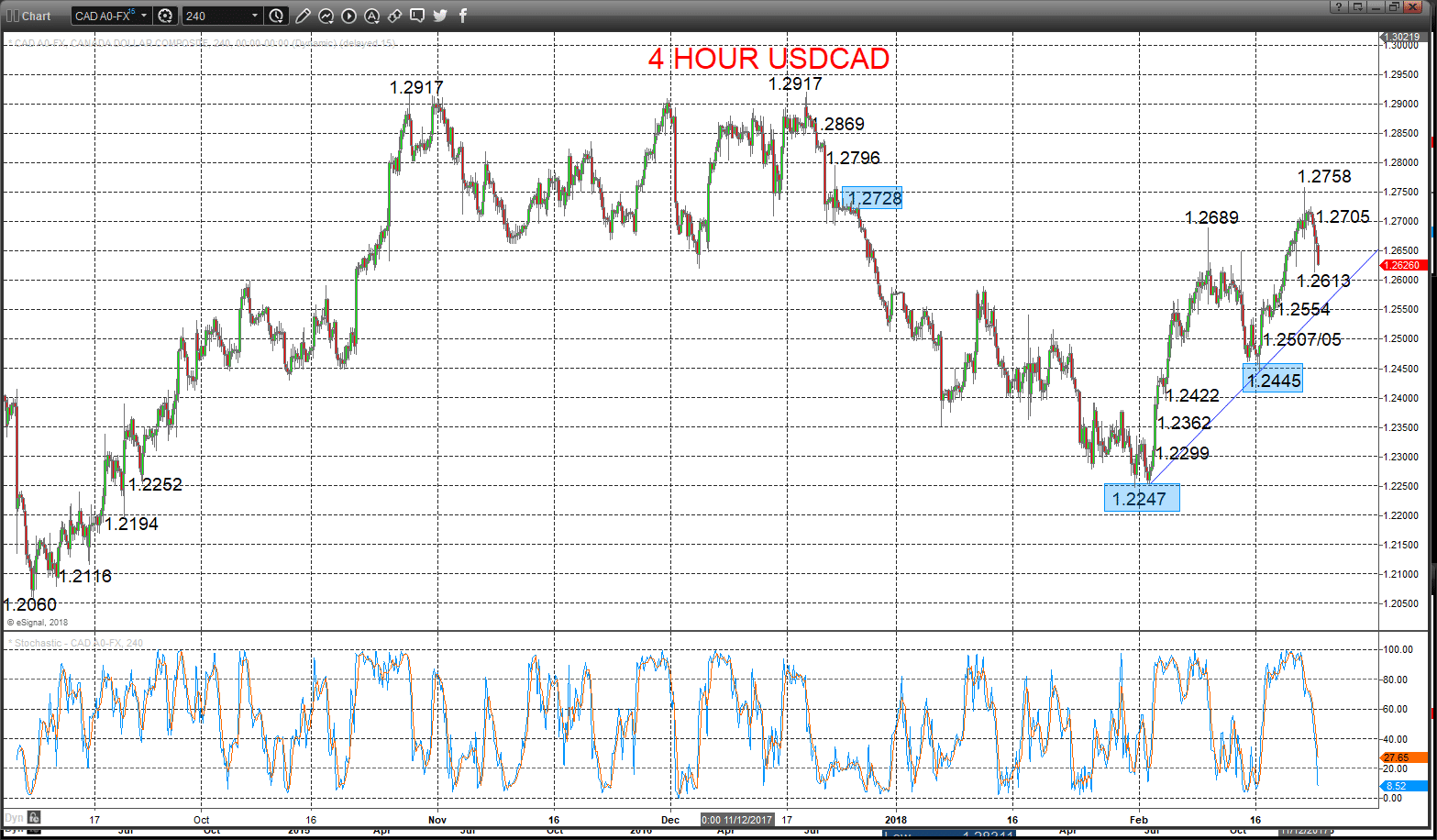

USDCAD

Upside bias, despite setback

A notable setback Friday through 1.2670 support, but whilst holding above 1.2613 we still see bullish pressures from the recent push above the key 1.2728 level, to keep another firm push to the topside Wednesday above the spike high at 1.2689, to the bias higher for Monday.

The latter February break above 1.2728 set a bullish intermediate-term view.

For Today:

- We see an upside bias for 1.2705 and then towards 1.2758/60; break here maybe aims for 1.2796.

- But below 1.2613 opens risk down to 1.2554.

Intermediate-term Outlook – Upside Risks:

- Whilst above 1.2445 we see a positive tone with the bullish threat back up the cycle high at 1.2917 and 1.3000.

What Changes This? Below 1.2445 signals a neutral tone, only shifting negative below 1.2247.

Resistance and Support:

| 1.2758/60 | 1.2796* | 1.2869** | 1.2917*** | 1.2955 |

| 1.2613** | 1.2554* | 1.2507/05 | 1.2445*** | 1.2422 |

4 Hour Chart

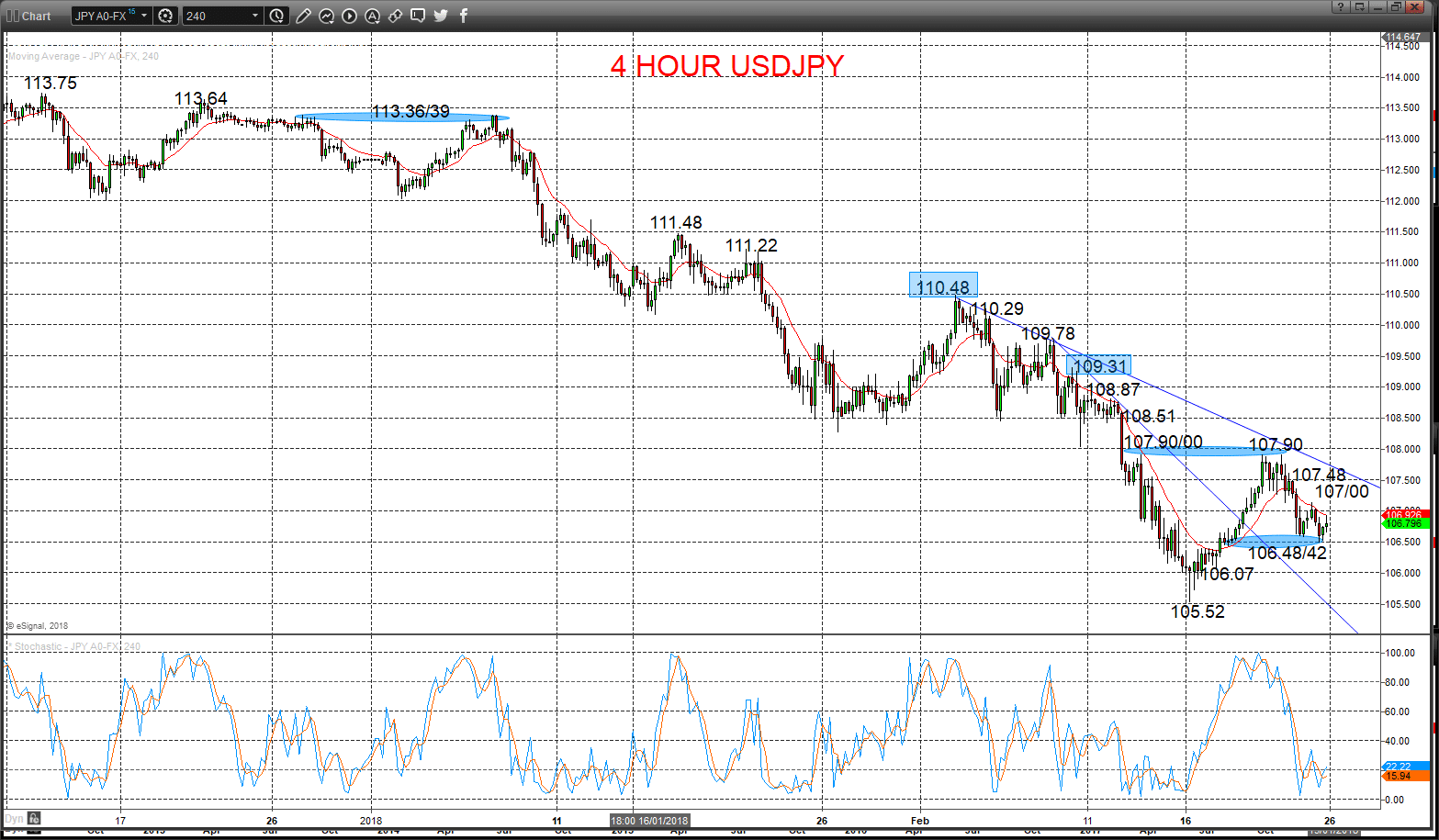

USDJPY

Downside forces intact

A low-level consolidation Friday after Thursday’s significant sell off through 107.19 and 106.82 supports, reinforcing Wednesday’s stall and setback from our 107.90/108.00 resistance area, keeping the risks lower Monday .

The mid-January selloff below 112.01 produced an intermediate-term bearish range breakout, with losses this year sustaining a bear theme into February (whilst below 110.48).

For Today:

- We see a downside bias for 106.48/42; break here aims for 106.07 and maybe closer to the cycle low at 105.52.

- But above 107.00 opens risk up to 107.48, maybe towards 107.90/108.00, which we would look to try to cap.

Intermediate-term Outlook – Downside Risks:

- Whilst below 109.31 we see a bear theme with the downside threat to 104.93,104.06 and 101.15.

What Changes This? Above 109.31 signals a neutral tone, shifting bullish below 110.48.

Resistance and Support:

| 107.00 | 107.48 | 107.90/108.00 ** | 108.51* | 108.87* |

| 106.48/42* | 106.07* | 105.52** | 105.16 | 105.00/104.93*** |

4 Hour Chart