The US currency retains a very positive outlook against the major commodity currencies; the Canadian, Australian and New Zealand Dollars. Furthermore, a more positive tone against the Euro and the Japanese Yen for the US Dollar in late July aims EURUSD lower and USDJPY higher. GBPUSD, however, remains solid.

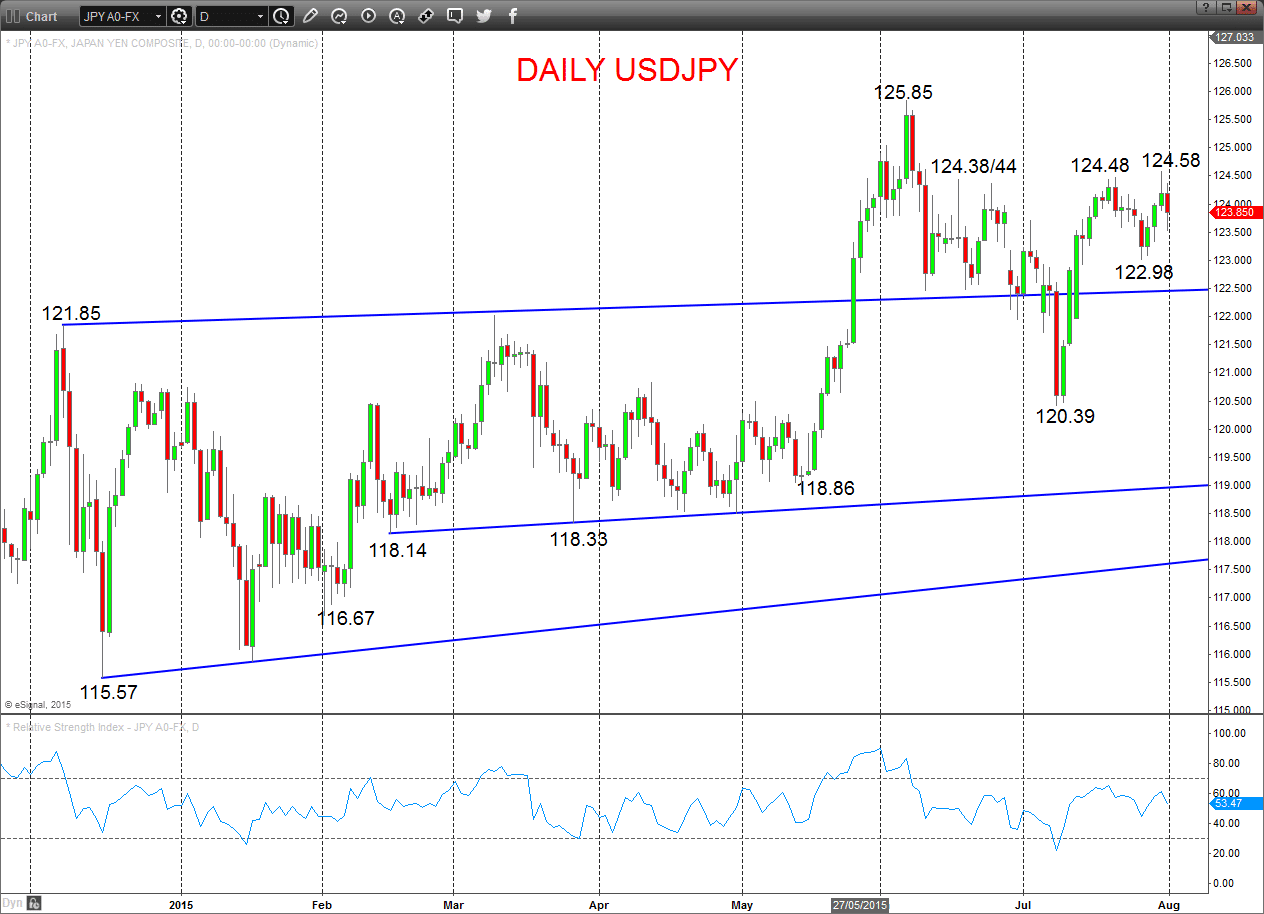

USDJPY

- The rally from our support area at 122.90/85, to probe above 124.48 last Thursday (as we had been expecting into late July) set a bullish outlook for August.

- Whipsaw price action Friday saw a dip and a bounce, to reject a roll back lower to the breakout range and leave the bias back higher for Monday.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a bull theme with threat to 125.85.

- Above targets 129.08, 130.00 and 132.23.

Daily USDJPY Chart

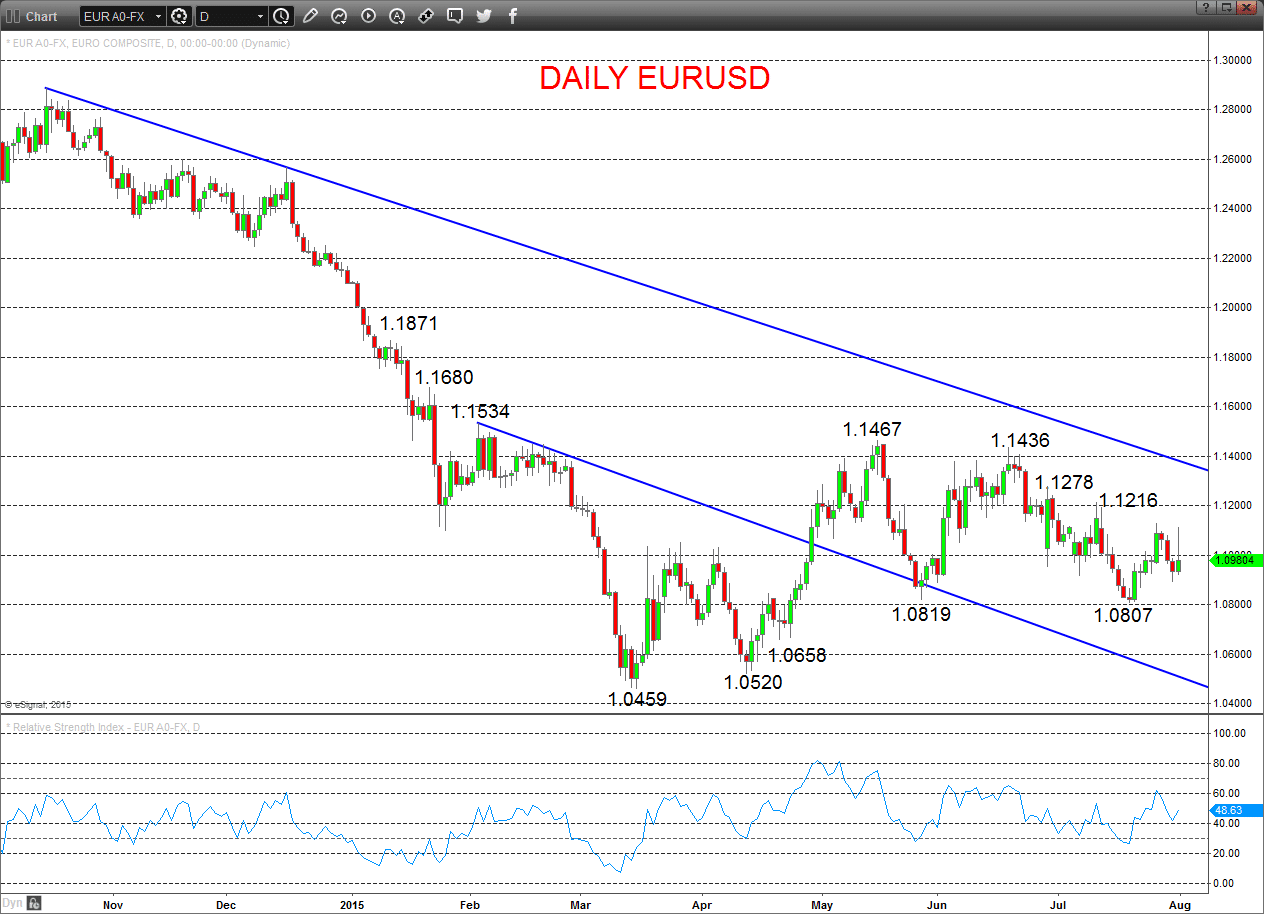

EURUSD

- Despite a whipsaw session Friday, bigger picture bearish pressures from the July push below 1.0819 and more recent stall back from ahead of 1.1216 have been reinforced by the price erosion last week.

- The Thursday probe below 1.0922/21 leaves risk lower for early August.

Short/ Intermediate-term Outlook – Downside Risks:

- Whilst 1.1216 caps we see a negative theme with bear risk to 1.0807.

- Through here targets 1.0658, 1.0520 and 1.0459.

Daily EURUSD Chart

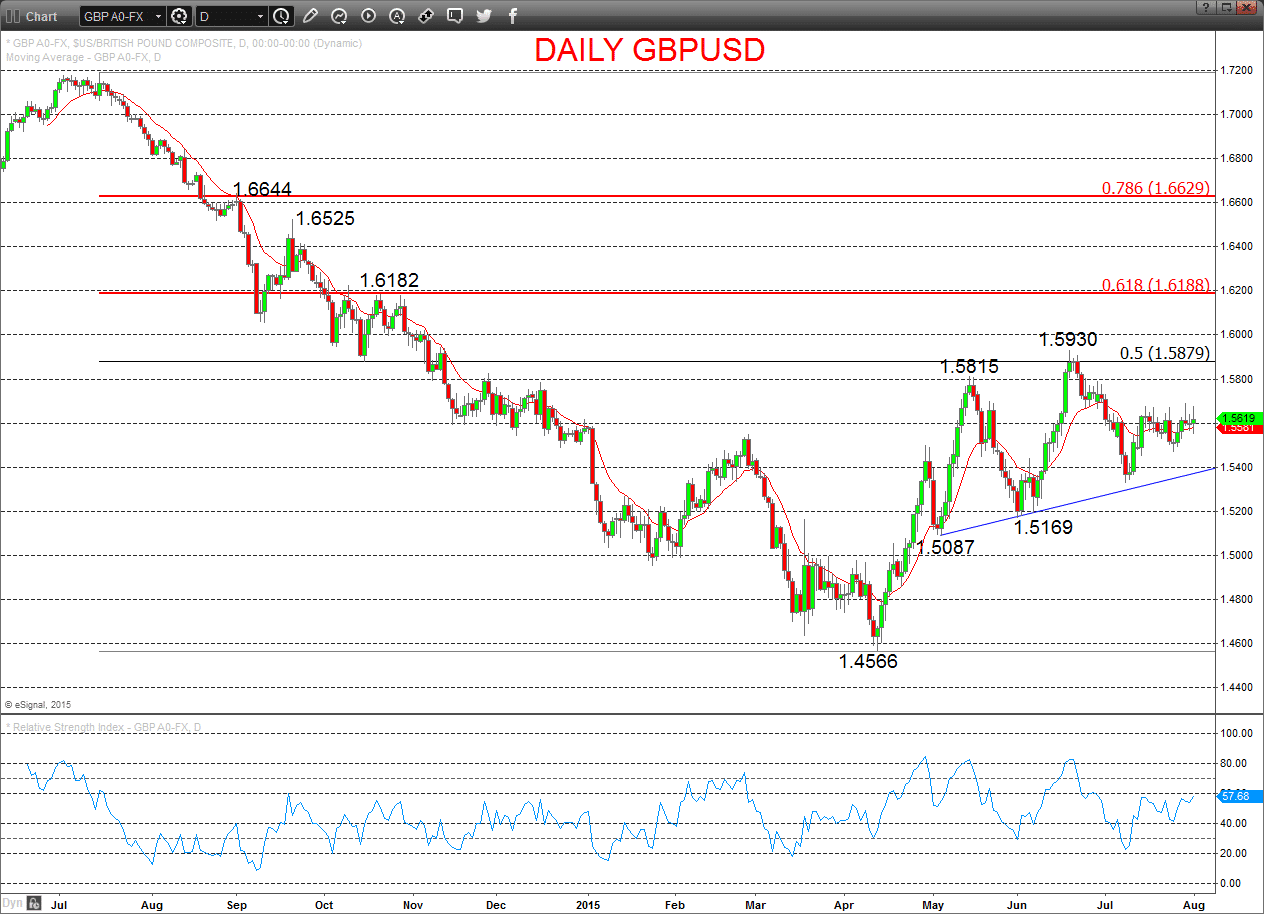

GBPUSD

- An erratic, whipsaw Friday reinforces the consolation phase that has dominated since mid-July to maintain a consolidation theme for early August.

- However, the early July push through resistances from June and the rally from our 1.5327 retrace support, leaves an upside risk into August.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a bullish rebound bias for 1.5671/76 and 1.5789.

- Above targets 1.5930, 1.6000 and 1.6182/88.

Daily GBPUSD Chart