- April recovery activity by European and Asian equity indices and basing patterns by US equity average highlight a shift towards “risk on”.

- This has been echoed in Forex markets with the US Dollar weakening against major “risk” currencies (the Canadian, New Zealand and to a lesser extent Australian Dollars) and rallying against the safe haven Yen (USDJPY higher).

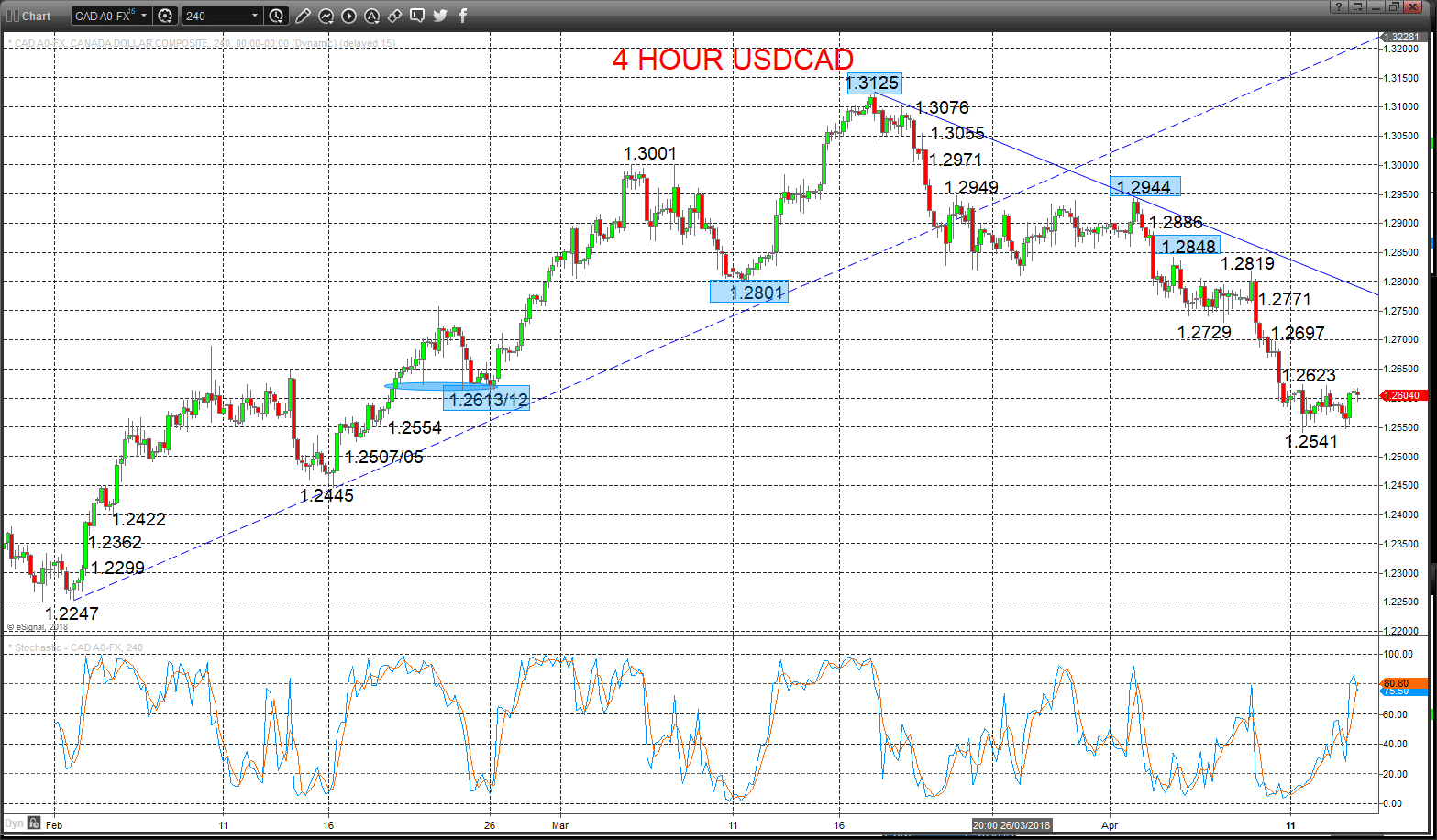

- The USDCAD surrender of 1.2612 set an intermediate-term bear trend.

- USDJPY Is seen in an intermediate-term range, BUT with the asymmetrical risk for an intermediate-term bullish shift above 107.90.

Read all forex analyses.

USDCAD Negative pressures intact

Another low-level consolidation Friday (as also seen Thursday) after last Wednesday’s break lower (through 1.2584 and 1.2554 supports), sustaining bear pressures from the earlier April plunge below key 1.2612 support, keeping risks lower Monday.

The mid-April surrender of key 1.2613/12 support area shifted the intermediate-term outlook to bearish.

For Today:

- We see a downside bias for 1.2541 and 1.2507/05; break here aims for key 1.24451.2554 and maybe towards 1.2422.

- But above 1.2623 aims at 1.2697 and opens risk up to 1.2771.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2445.

- Lower targets would be 1.2247 and 1.2000.

- What Changes This? Above 1.2848 shifts the outlook back to neutral; above 1.2944 is needed for a bull theme.

Resistance and Support:

| 1.2623 | 1.2697* | 1.2771 | 1.2819** | 1.2848** |

| 1.2541 | 1.2507/05 | 1.2445** | 1.2422 | 1.2362 |

4 Hour USDCAD Chart

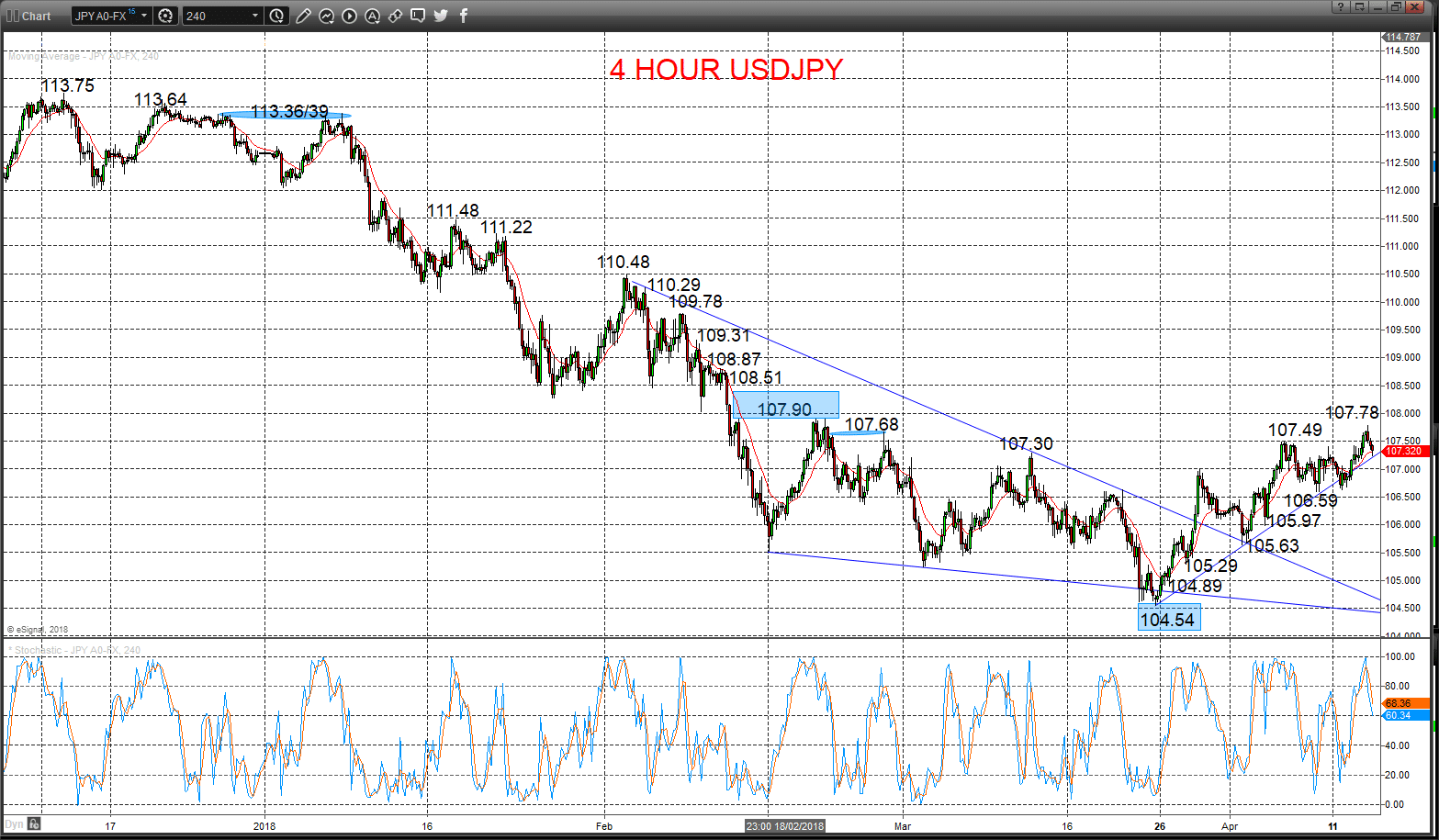

USDJPY Bull threat to 107.90

Another prod higher Friday and despite an intraday setback and likely dip to start this week, we see upside pressures having held above our 106.59 support level last week and from the early April push above key 107.30 resistance, keeping the bias higher Monday.

We see an intermediate-term range theme (seen as 107.90 to 104.54), BUT with the strong bias for a bullish intermediate-term shift above 107.90.

For Today:

- We see an upside bias for 107.78; above here aims for key 107.90, maybe 108.51.

- But below 106.59 opens risk down to 105.97, maybe 105.63.

Intermediate-term Range Breakout Parameters: Range seen as 107.90 and 104.54.

- Upside Risks: Above 108.00 sets a bull trend to aim for 110/48, 111.48 and maybe 113.75.

Downside Risks: Below 104.54 sees a bear trend to target 101.15 and 100.00.

Resistance and Support:

| 107.78 | 107.90*** | 108.51* | 108.87 | 109.00 |

| 106.59 | 105.97* | 105.63** | 105.29* | 104.89* |

4 Hour USDJPY Chart