- The US Dollar has seen a corrective setback in the first half of May against major currencies, but bullish US$ pressures have recently resurfaced through mid-May, once more in reaction to higher US Treasury yields and the expectation of a potentially hawkish FOMC.

- In our article published 30th April we highlighted AUDUSD and NZDUSD intermediate-term bear trends, triggered by the AUDUSD currency rate plunge below the key .7640 level and the NZDUSD FX spot rate surrender of .7151.

- Recent negative price action for these FX rates leaves the risk for further AUDUSD and NZDUSD weakness into the second half of May.

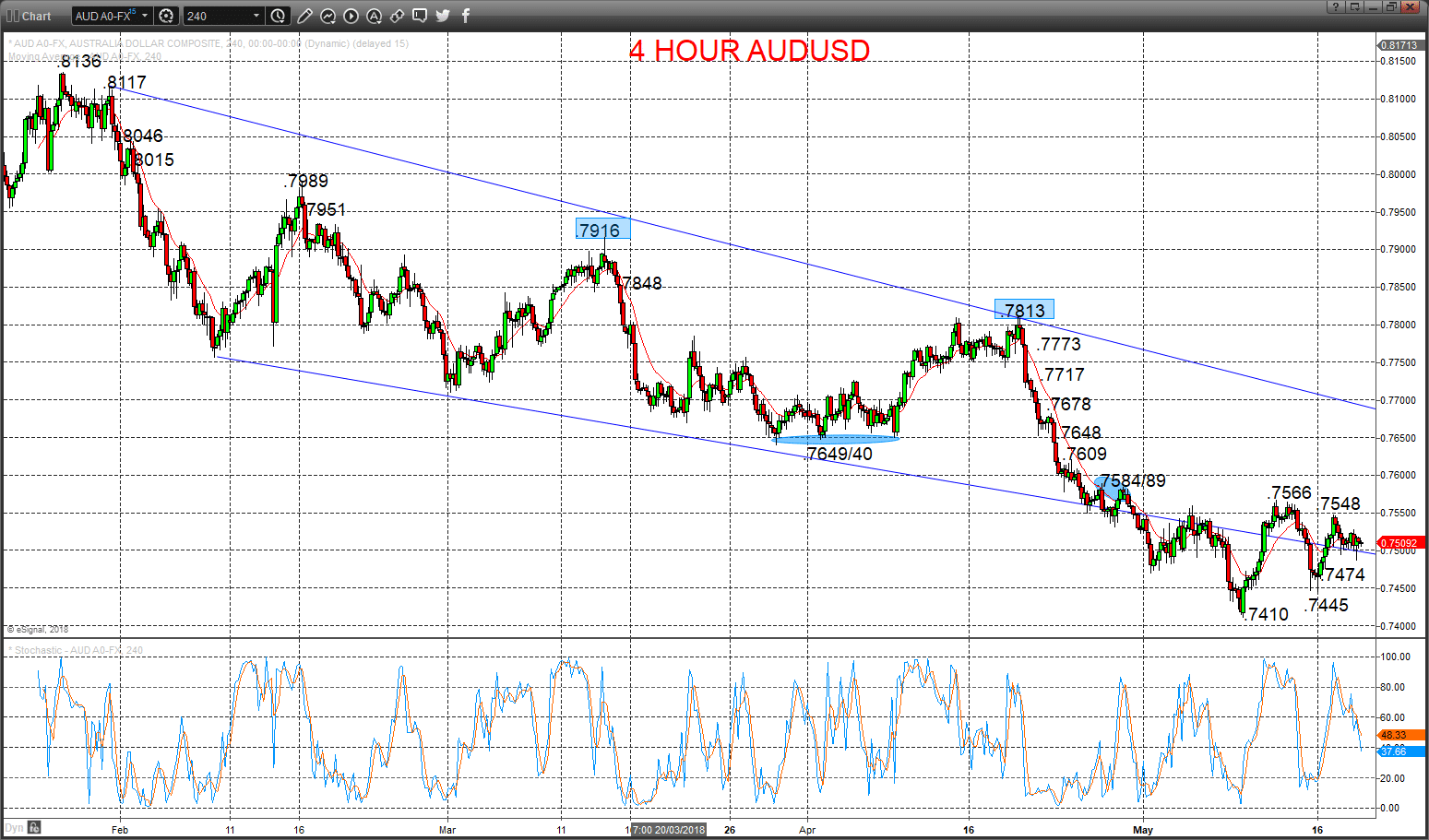

AUDUSD Bear theme reinforced

A narrow consolidation Friday after Thursday’s notable setback that rejected Wednesday’s prod above resistance at .7538, sustaining bear pressures from last Tuesday’s plunge (through supports at 7526 and .7452), to aim lower again Monday.

The latter April surrender of key .7640 support set an intermediate-term bear trend again, reinforced by the surrender of .7500.

For Today:

- We see a downside bias for .7474 and .7446; break here aims for the .7410/00 area.

- Above .7548 quickly aims for .7566, maybe to the .7584/89.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .7368/31.

- Lower targets would be .7155/41 and .7000.

- What Changes This? Above .7813 shifts the outlook back to neutral; above .7916 is needed for a bull theme.

Resistance and Support:

| .7548 | .7566** | .7584/89** | .7609** | .7648 |

| .7474 | .7445* | .7410/00* | .7368** | .7331*** |

4 Hour AUDUSD Chart

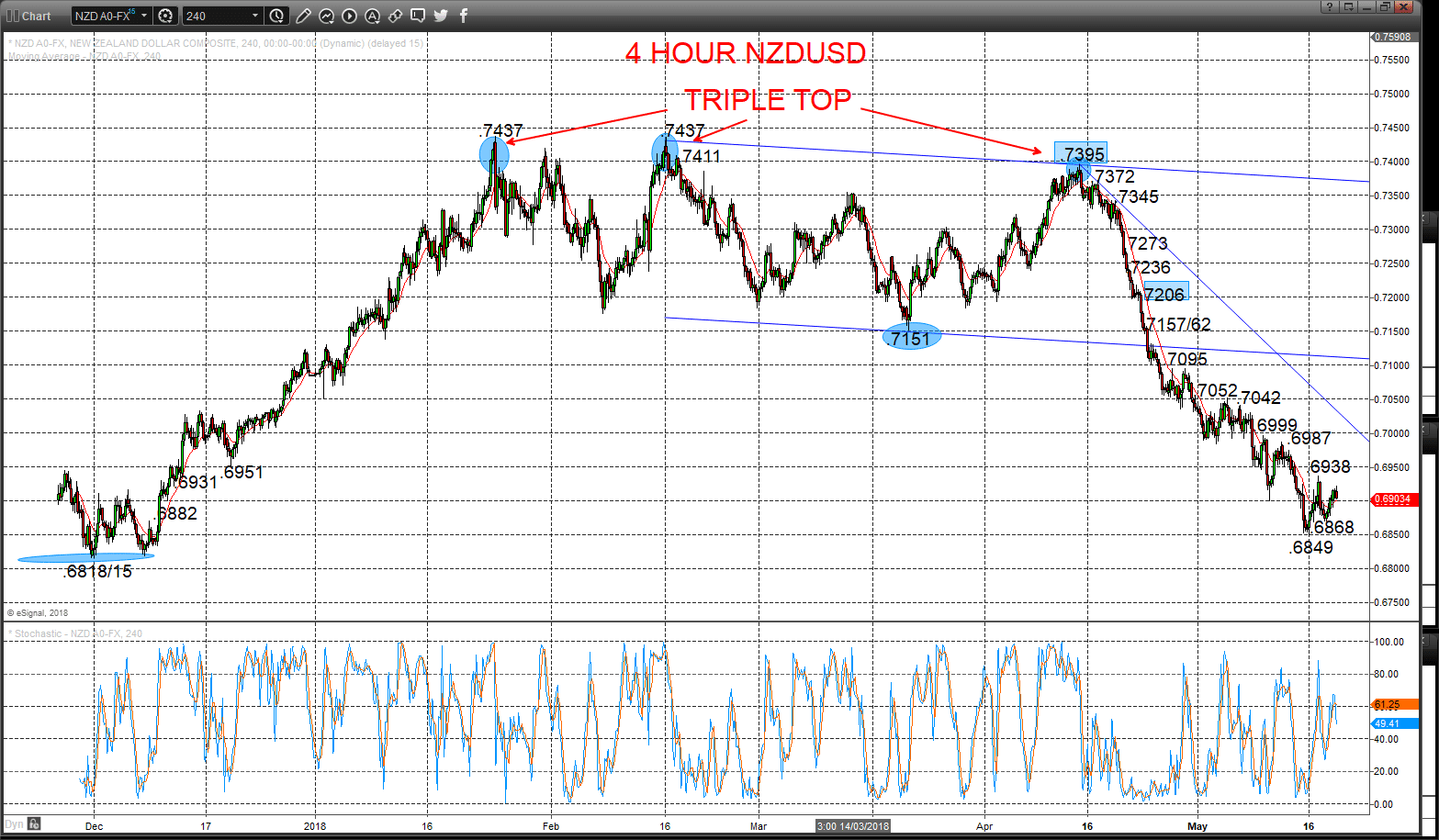

NZDUSD Bear trend intact, despite bounce

A Friday rebound, but contained by initial resistance at .6938, thereby sustaining bear forces from Thursday’s selloff and the earlier mid-May bear extension, keeping risks lower Monday.

The latter April plunge through key .7151 signalled a large topping pattern (Triple Top) and shifted the intermediate-term outlook from bullish to bearish.

For Today:

- We see a downside bias for .6868 and .6852; below here targets the .6818/15 area and maybe towards key .6781.

- But above .6938 targets .6987 and .6999.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .6778.

- Lower targets would be .6676/64 and .6343.

- What Changes This? Above .7206 shifts the outlook back to neutral; above .7395 is needed for a bull theme.

Resistance and Support:

| .6938* | .6987* | .6999** | .7042 | .7052* |

| .6868 | .6849* | .6818/15** | .6800 | .6818/15** |

4 Hour NZDUSD Chart

Are you ready to trade?

Sign up with 61% of retail CFD accounts lose money

61% of retail CFD accounts lose money