- When we last analysed AUDUSD and NZDUSD here on 24th September we saw potential for intermediate-term bullish shifts.

- Subsequent risk off activity across global asset has seen renewed bearish forces and bear extensions for both AUDUSD and NZDUSD.

- However, the past week has seen short-term bases and very near-term bullish reversals for AUDUSD and NZDUSD, threatening further upside challenges into October, again questioning the intermediate-term bear trends.

- AUDUSD needs a break above .715 for an intermediate-term bull shift and NZDUSD requires a push above .6608.

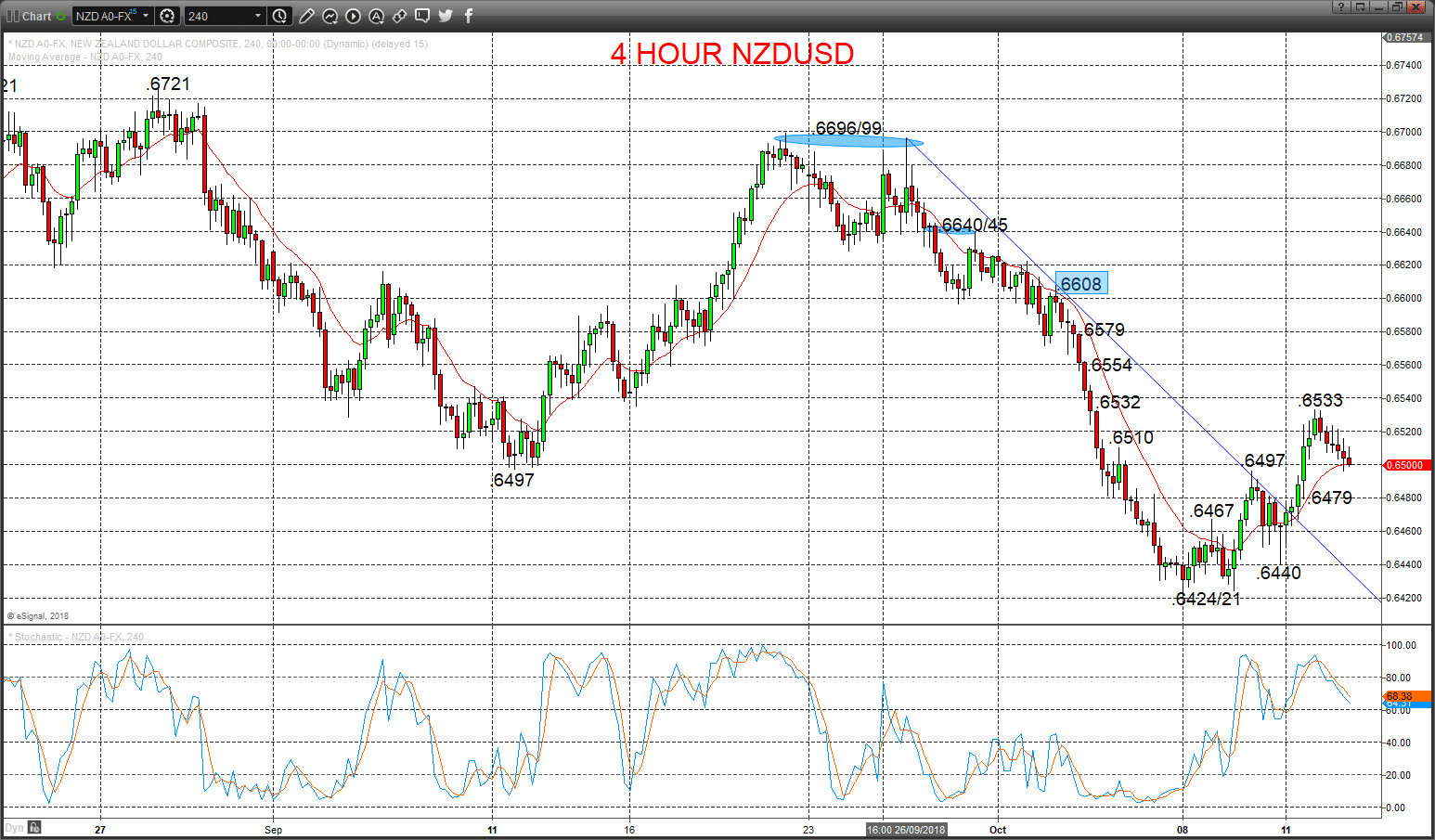

AUDUSD Double Bottom sustains upside risks

A rebound again Friday to probe above the .7130 level for a very short-term Double Bottom, building on the reversal of the down trend line from late September and previous mini-base, keeping risks higher for Monday.

We see an intact, intermediate-term bear trend.

For Today:

- We see an upside bias for .7139; break here aims for .7155, maybe towards .7175.

- But below .7089 aims for .7041/39 and maybe opens risk down to the psychological/ option target at .7000.

Intermediate-term Outlook – Downside Risks: Whilst below .7315 we see a downside risk for .7000.

- Lower targets would be .6825 and maybe towards .6500

- What Changes This? Above .7315 shifts the intermediate-term view straight to bullish.

Resistance and Support:

| .7139 | .7155* | .7175 | .7203* | .7238/41** |

| .7089 | .7041/39** | .7000** | .6969 | .6941 |

4 Hour AUD/USD Chart

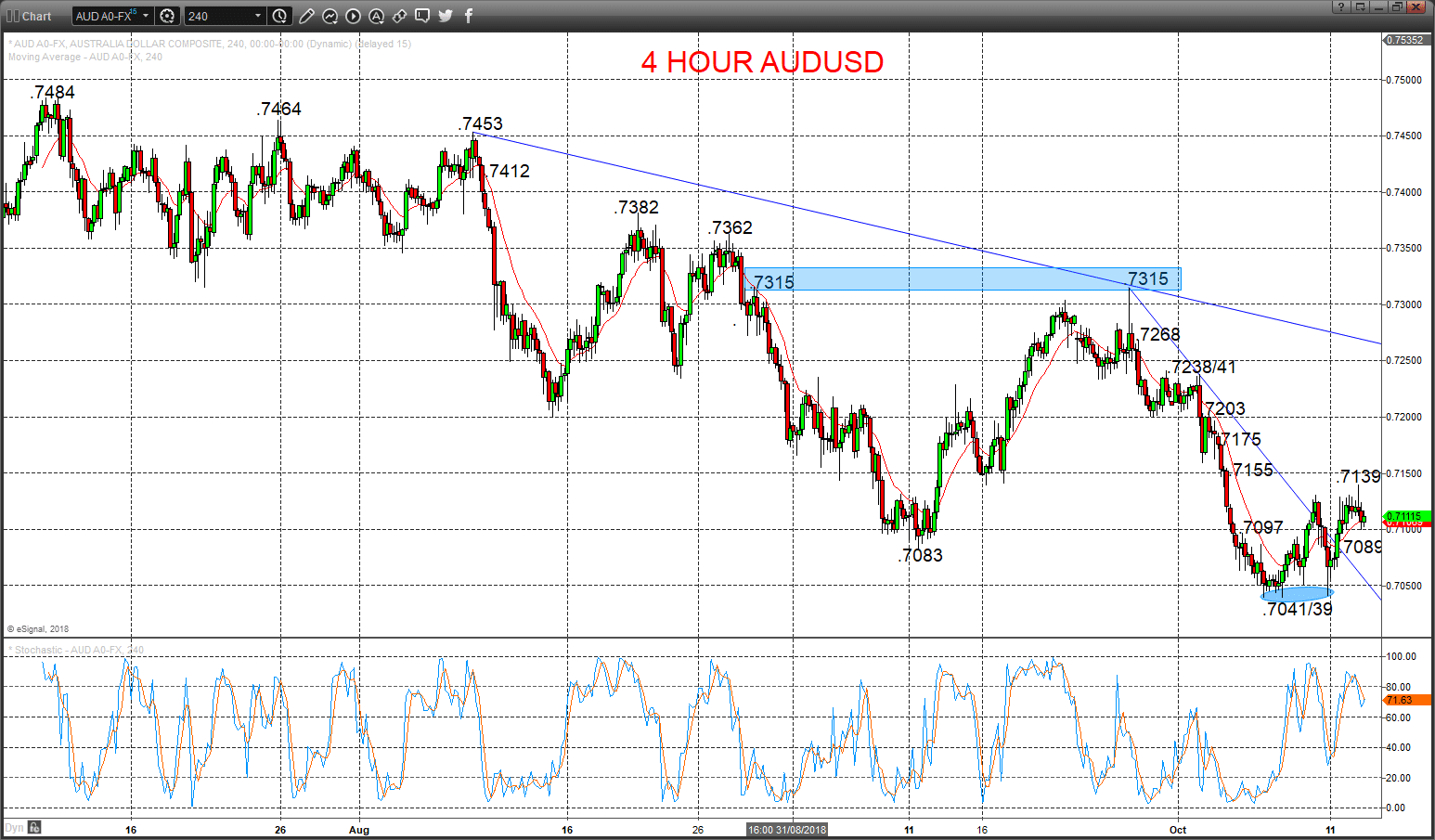

NZDUSD Short-term bottom and upside correction risks

As we had flagged for Friday a further advance through resistances from the prior October selloff at .6497, .6510 and to just prod .6532, to reinforce the reversal above the down trend line from late September AND the small Double Bottom (above .6467), to keep the risks higher Monday.

We see a fully intact intermediate-term bear trend.

For Today:

- We see an upside bias for .6497; break here quickly aims for .6510 and opens risk up towards .6532.

- But below .6479 targets .6440 and maybe aims for .6424/21.

Intermediate-term Outlook – Downside Risks: Whilst below .6608 we see a downside risk for .6347.

- Lower targets would be .6195 and .6000.

- What Changes This? Above .6608 switches the intermediate-term straight to bullish.

Resistance and Support:

| .6533 | .6554 | .6579* | .6608*** | .6640/45* |

| .6479 | .6440* | .6424/21** | .6403/00 | .6377 |

4 Hour NZD/USD Chart