The US$ has resumed a more bullish tone since late February, primarily a reaction to a more hawkish tone from some members of the Federal Reserve Open Market Committee, which has seen higher yields across the US Treasury curve.

This leaves bearish pressures with a broad range environment for GBPUSD, threatening a move below psychological 1.2000 to challenge key support at 1.1982 and 1.1943.

For EURUSD, however, although the intermediate term outlook remains bearish, the Friday rebound activity sees upside correction threat potentially for this week before bigger bearish pressures maybe return into the second half of March.

Read more forex trading articles.

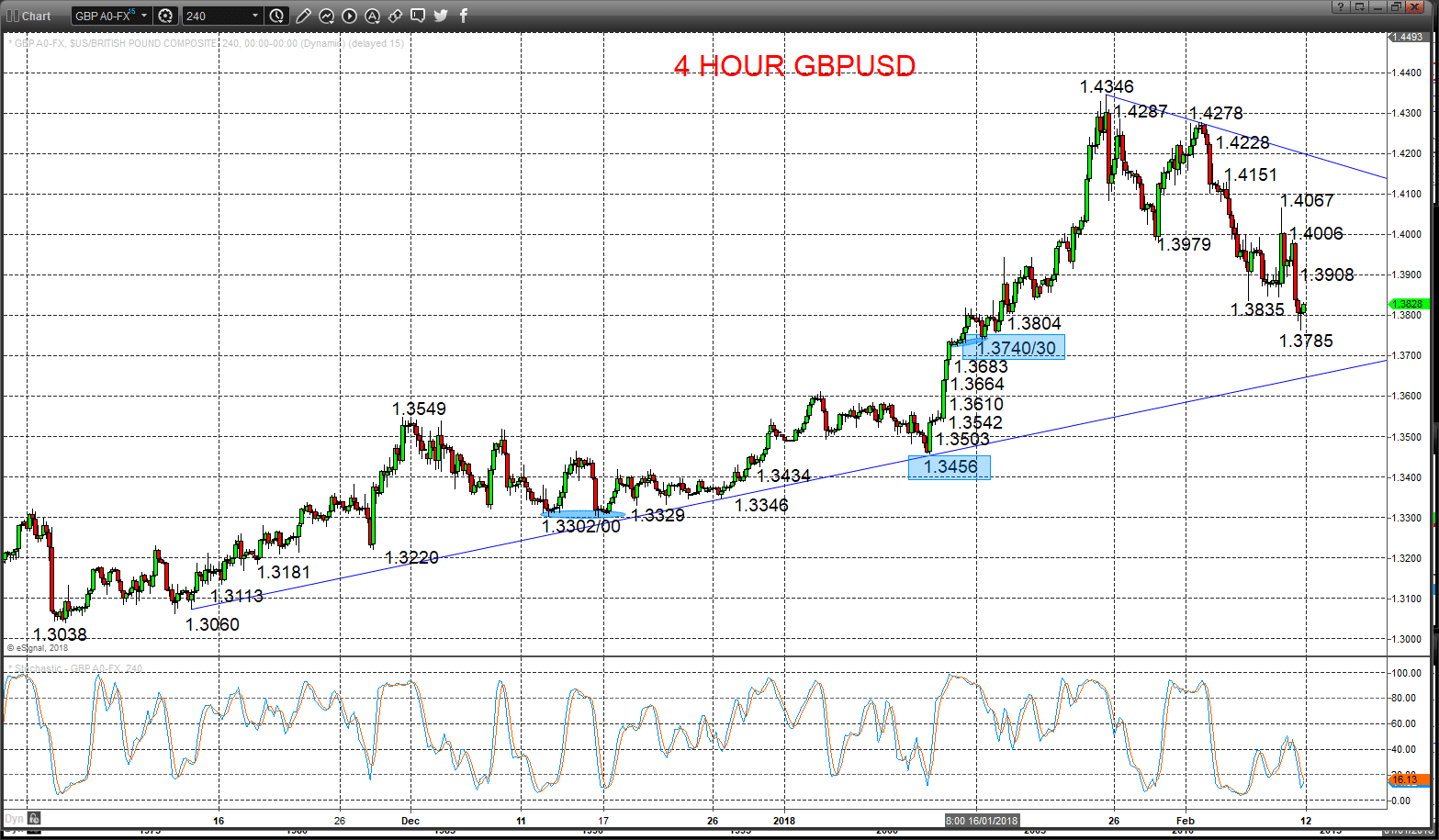

GBPUSD

A low-level consolidation on Thursday and Friday and to end last week, maintaining negative pressures from the Tuesday plunge through the January chart support at 1.2210, keeping risks lower Monday.

Furthermore, we now see a declining threat into March for a push up to the key 1.2775 level; only through here would see an intermediate-term bullish shift.

For Today:

- We see a downside bias for 1.2136 and 1.2116; break here aims for 1.2065, maybe down to 1.2016.

- But above 1.2214 targets 1.2249 and opens risk up to 1.2300.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.1982 and 1.2775.

Range Breakout Challenge

- Upside: Above 1.2775 aims higher for 1.3000, 1.3121 and 1.3455/3534 area.

- Downside: Below 1.1982 sees risk lower for 1.1943, 1.1880 and 1.1500.

Daily GBPUSD Chart

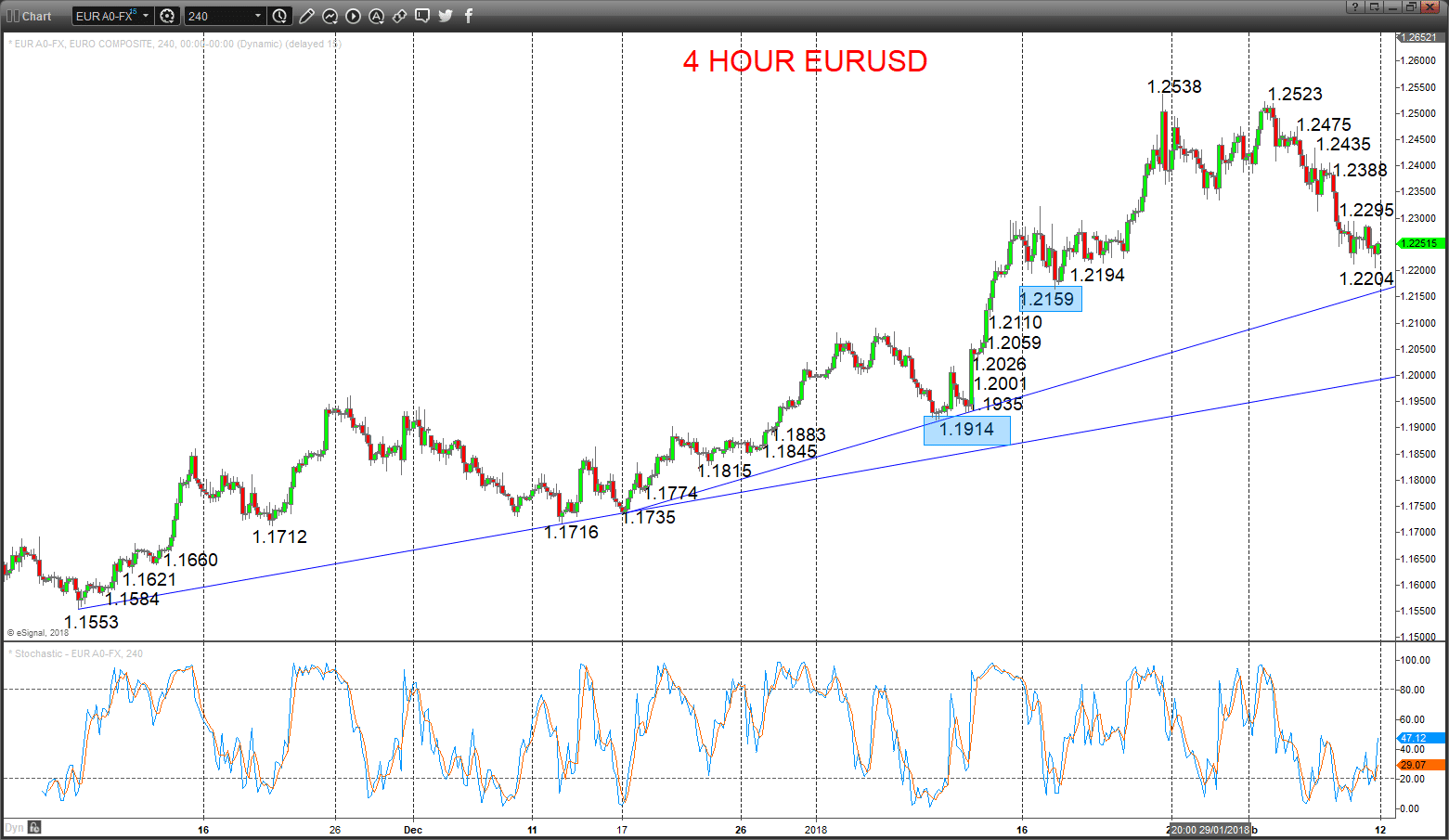

EURUSD

An unexpected recovery effort both before and after Friday’s US Employment report, surging up through resistances at 1.0640 and 1.0680, shifting the immediate risk back up to the topside into Monday.

For Today:

- We see an upside bias for 1.0699 and 1.0714; break here aims for 1.0755.

- But below 1.0618 opens risk down to 1.0570.

However, the February break below 1.0577 confirmed an intermediate-term top and a bearish theme.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0339 and parity (1.0000).

What Changes This? Above 1.0829 signals a neutral tone, only shifting positive above 1.0874.

Daily EURUSD Chart