- An erratic tone for both GBPUSD and EURUSD, impacted by the Fed, MPC of the Bank of England and the ECB all in play. But, we still see risks skewed for US Dollar strength and for downside risks for both the GB Pound and Euro versus the US$.

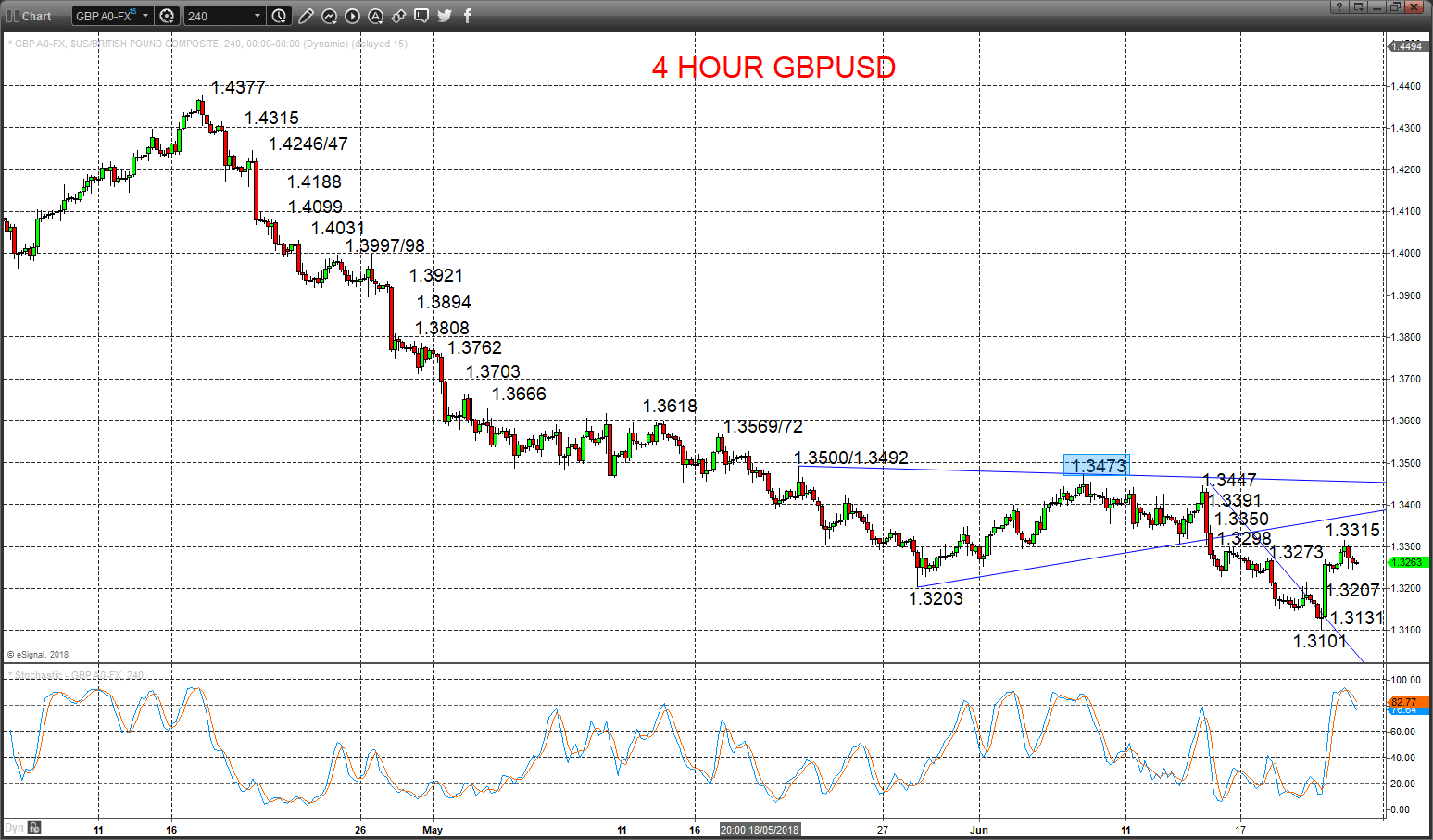

- GBPUSD has seen a significant selloff in June, initially in reaction to a more dovish ECB, and despite a recent rebound after the Bank of England Meeting last week, we still see an intermediate-term bear trend and look for further GBPUSD losses for late June and into July.

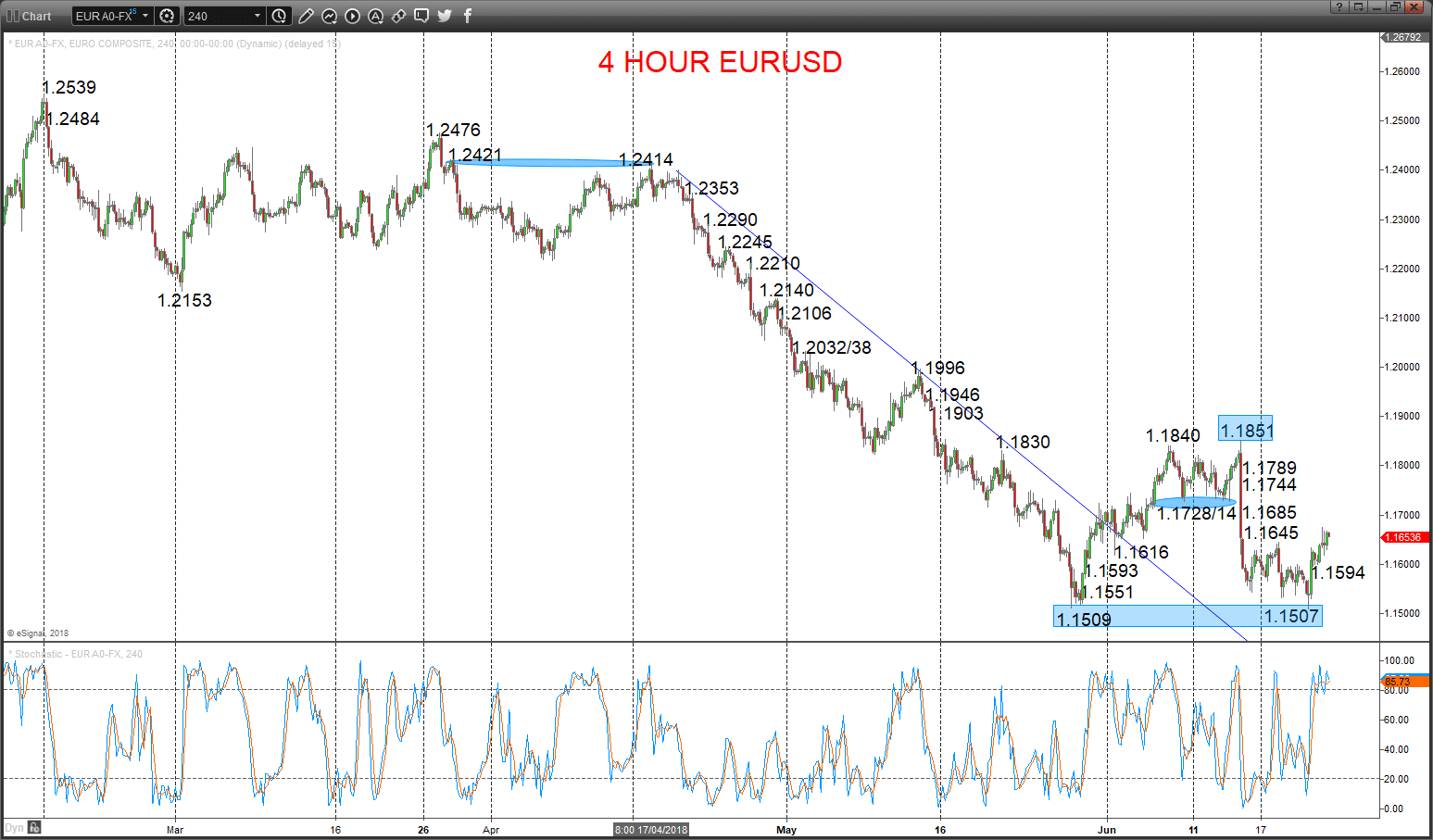

- For EURUSD, the selloff after the mid-June ECB decision, which was seen as dovish, did not quite resume an intermediate-term bear trend and we still see a boarder range phase, But with skewed bias for a bearish theme, only below 1.1507.

See more forex trading articles

GBPUSD Intraday setback Friday leaves bias lower

A spike higher Friday through notable resistance at 1.3298, but then an intraday setback for a potentially negative candlestick, trying to reject Thursday’s strong rally after the Bank of England decision, leaving risk for a roll back lower for Monday.

The early May plunge through 1.3710 set an intermediate-term bear trend.

For Today:

- We see a downside bias for 1.3207; break here aims for 1.3131 and 1.3101/00.

- But above 1.3315 aims at 1.3350 and maybe towards 1.3391.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.3040/27 and 1.3000.

- Lower targets would be 1.2773 and 1.2587.

- What Changes This? Above 1.3473 shifts the intermediate-term outlook from bearish straight to bullish.

Resistance and Support:

| 1.3315* | 1.3350 | 1.3391 | 1.3447** | 1.3473*** |

| 1.3207 | 1.3131* | 1.3101/00* | 1.3069 | 1.3040/27*** |

4 Hour GBPUSD Chart

EURUSD Upside bias

A solid recovery effort Friday through 1.1645 resistance for a very mini-base, easing bear forces from Thursday’s nudge at key support at 1.1509 (to 1.1507), shifting the bias for a further rebound Monday.

We see an intermediate-term range, 1.1996 to 1.1507.

For Today:

- We see an upside bias for 1.1685, maybe towards 1.1744; break here aims for 1.1789.

- But below 1.1594 opens risk down to 1.1559, maybe closer to 1.1509/07.

Intermediate-term Range Breakout Parameters: Range seen as 1.1851 to 1.1507.

- Upside Risks: Above 1.1851 sets a bull trend to aim for 1.2210, 1.2414/21 and 1.2529.

- Downside Risks: Below 1.1507 sees a bear trend to target 1.1312 and 1.1134.

Resistance and Support:

| 1.1685* | 1.1744 | 1.1789 | 1.1851*** | 1.1903 |

| 1.1594 | 1.1559 | 1.1509/07*** | 1.1479* | 1.1435 |

4 Hour EURUSD Chart

Are you ready to trade?

Sign up with 51% of retail CFD accounts lose money

51% of retail CFD accounts lose money