- The negative US Dollar tone from latter 2017 has re-energized into early 2018, with the US currency suffering erosion against G10 FX currencies.

- The USD has in fact been broadly weakening since the Fed hiked interest rates back in December 2017.

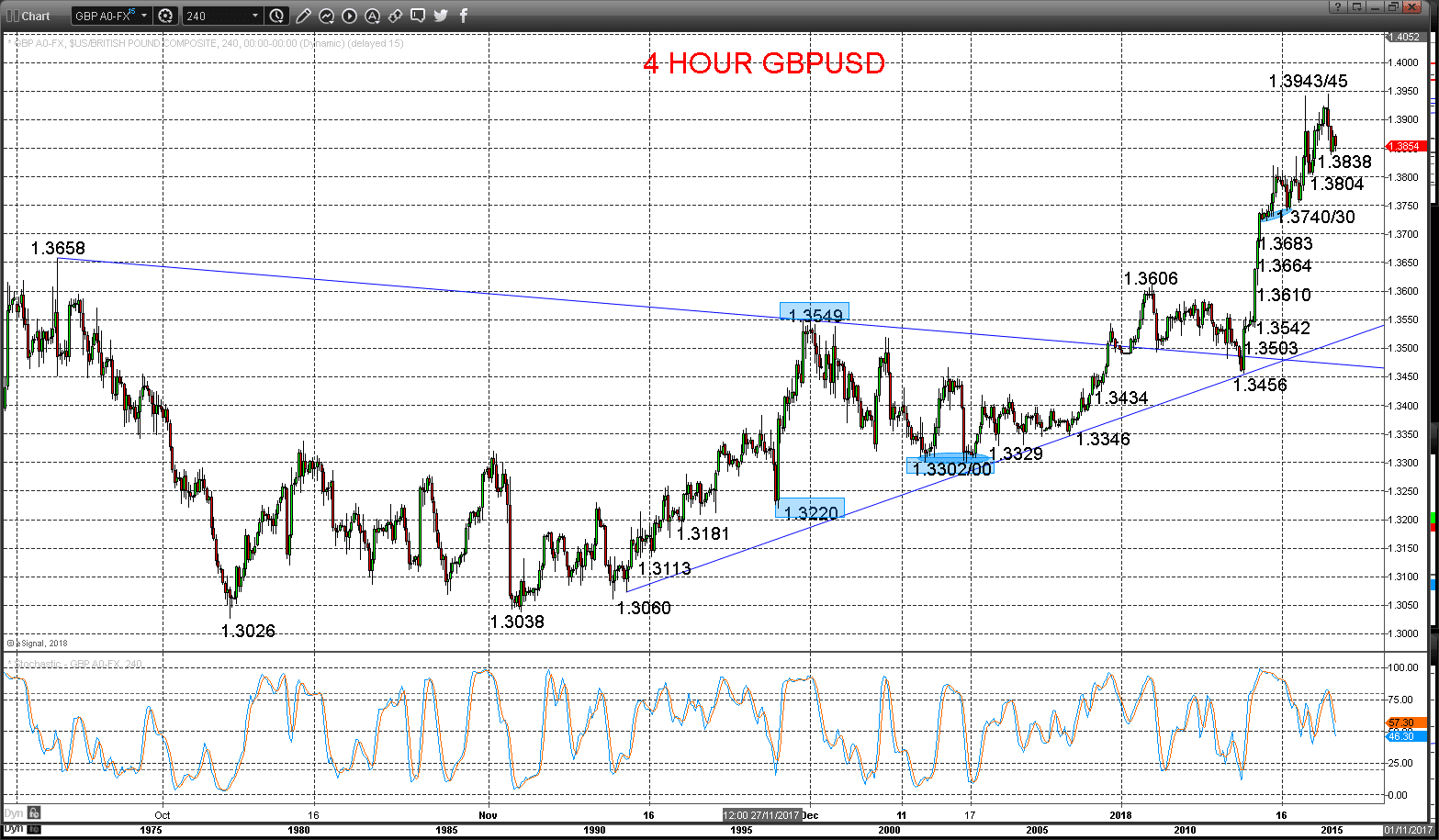

- For EURUSD the intermediate-term bullish trend has been reinforced by the January surge above 1.2090, driven by hints of a more hawkish outlook by the ECB.

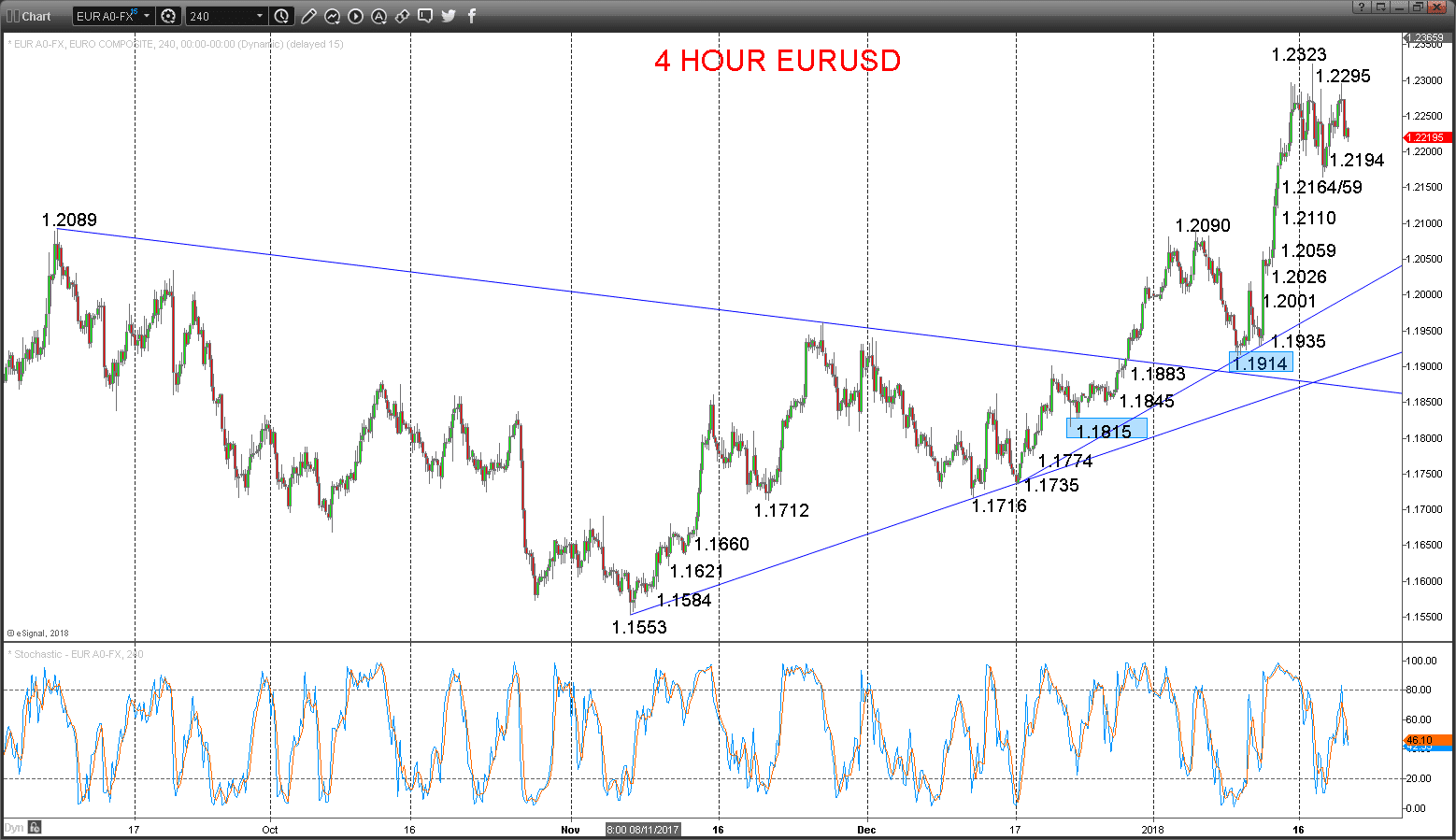

- GBPUSD has extended higher, more a reflection of US Dollar weakness than anything particularly bullish for the GB Pound, but nevertheless the move to post-Brexit highs leaves the threat to push back above 1.4000.

Read all forex articles.

EURUSD Bull theme intact

A firm push higher Friday to probe above .12281 resistance, and despite an intraday setback, whilst above 1.2194 we see upside pressures from the surge higher earlier in January in the wake of a more hawkish ECB tone, keeping risks higher Monday.

The end of 2017 push through 1.1961 saw an intermediate-term bullish shift to set an upside bias for January.

For Today:

- We see an upside bias towards 1.2295 and maybe 1.2323.

- But below 1.2194 aims at 1.2161/59 and maybe targets 1.2110.

Intermediate-term Outlook – Upside Risks:

- Whilst above 1.1914, we see a positive tone with the bullish threat up to 1.2600, maybe towards 1.3000.

What Changes This? Below 1.1914 signals a neutral tone, only shifting negative below 1.1815.

Resistance and Support:

| 1.2295 | 1.2323** | 1.2355 | 1.2412 | 1.2455 |

| 1.2194 | 1.2164/59** | 1.2110* | 1.2059 | 1.2026 |

4 Hour EURUSD Chart

GBPUSD Bullish trend targets 1.4000

A prod to another new multi-month to post-Brexit high on Friday and despite an intraday setback, whilst minimally above 1.3838 we see a bullish theme from the aggressive rally last Wednesday through a key resistance area at 1.3837/41 and also 1.3936, to keeps risks to the upside Monday.

The prior break above 1.3549 shifted the intermediate-term outlook from neutral to bullish and sees upside risks for January.

For Today:

- We see an upside bias for 1.3905 and then quickly back to 1.3943/45, maybe 1.4000.

- But below 1.3838 aims at 1.3804 and maybe targets 1.3740/30, which we would look to try to hold.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat back up to 1.4000.

- Above target 1.4275 and 1.4465.

What Changes This? Below 1.3300 signals a neutral tone, only shifting negative below 1.3220.

Resistance and Support:

| 1.3905 | 1.3943/45* | 1.4000*** | 1.4055 | 1.4107 |

| 1.3838 | 1.3804** | 1.3740/30** | 1.3683 | 1.3664* |

4 Hour GBPUSD Chart