- We last looked at the EURUSD and GBPUSD currency pairs on 18th February and highlighted downside risks for both.

- Since then the EURUSD FX rate rebounded in a range up to 1.1420, BUT the subsequent selloff through early March and acceleration lower last Thursday after a dovish tone from the European Central Bank (ECB) after the ECB Meeting, has seen an intermediate-term bearish shift below the late 2018 and multi-year cycle low at 1.1214.

- For Cable, the GBPUSD Forex rate, a combination of US Dollar strength (seen as a safe haven with global growth concerns) and GBP weakness, ahead of concerns around key Brexit votes this week, has seen a push lower, through an intermediate-term, technical bull theme stays just intact whilst holding above 1.2967.

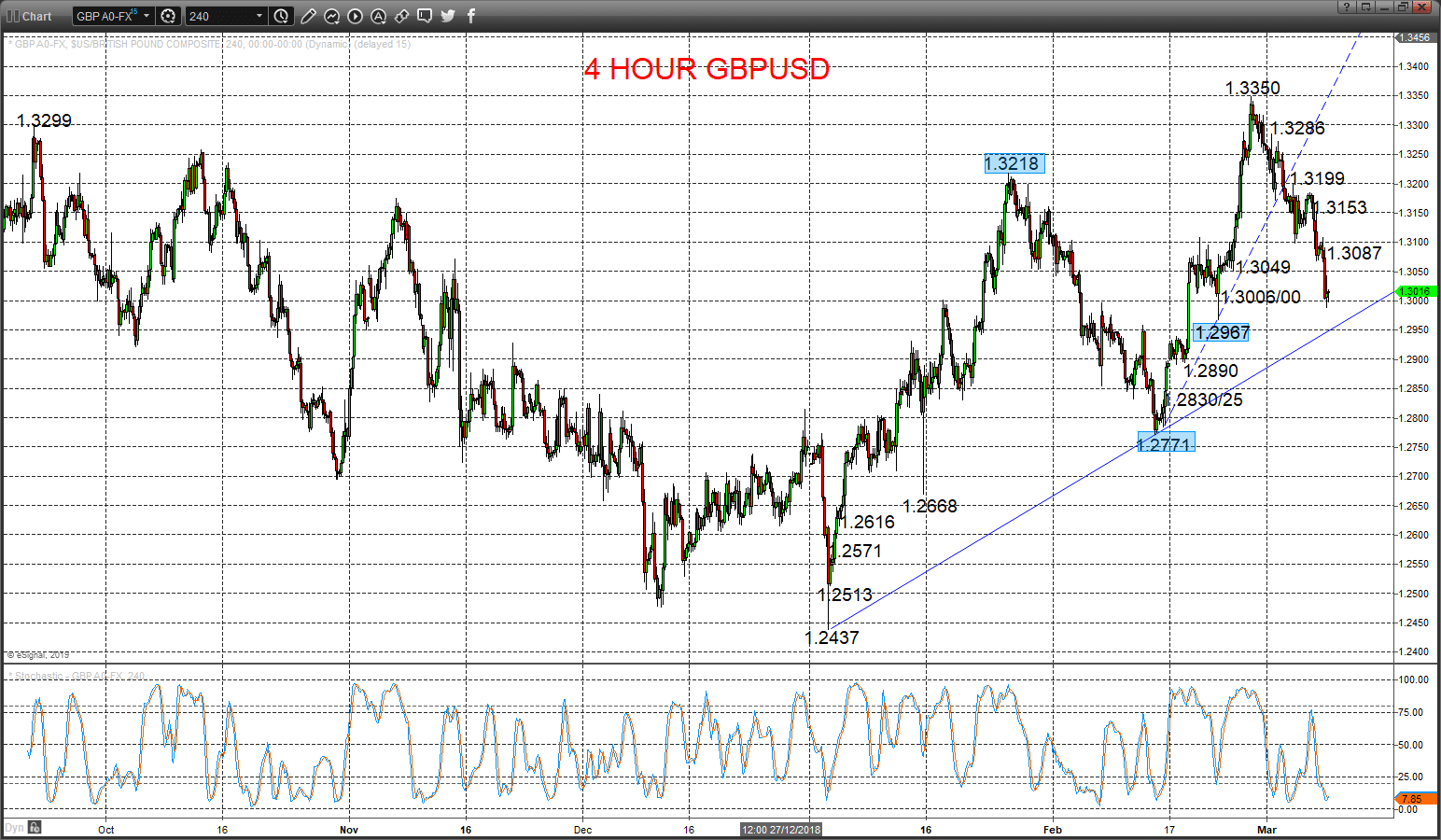

EURUSD Intermediate-term bearish shift intact

A bounce Friday to just probe our initial, minor resistance at 1.1243, but whilst capped by the better 1.1288 resistance level, but we see bearish forces intact from Thursday’s plunge below key 1.1214 support and prior negative forces from early March through various supports, to keep risks lower for Monday.

The early March, post-ECB plunge through 1.1214 saw an intermediate-term move to a bear trend.

For Today:

- We see a downside bias for 1.1213/11 and 1.1175/71; break here aims for 1.1143 and 1.1119.

- But above 1.1288 opens risk up to 1.1325, which we would look to try to cap.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.1119.

- Lower targets would be 1.1000 and 1.0839

- What Changes This? Above 1.1420 shifts the outlook back to neutral; above 1.1509 is needed for a bull theme.

Resistance and Support:

| 1.1246 | 1.1288 | 1.1325* | 1.1389 | 1.1420/34* |

| 1.1213/11 | 1.1175/71* | 1.1143 | 1.1119** | 1.1079 |

4 Hour EURUSD Chart

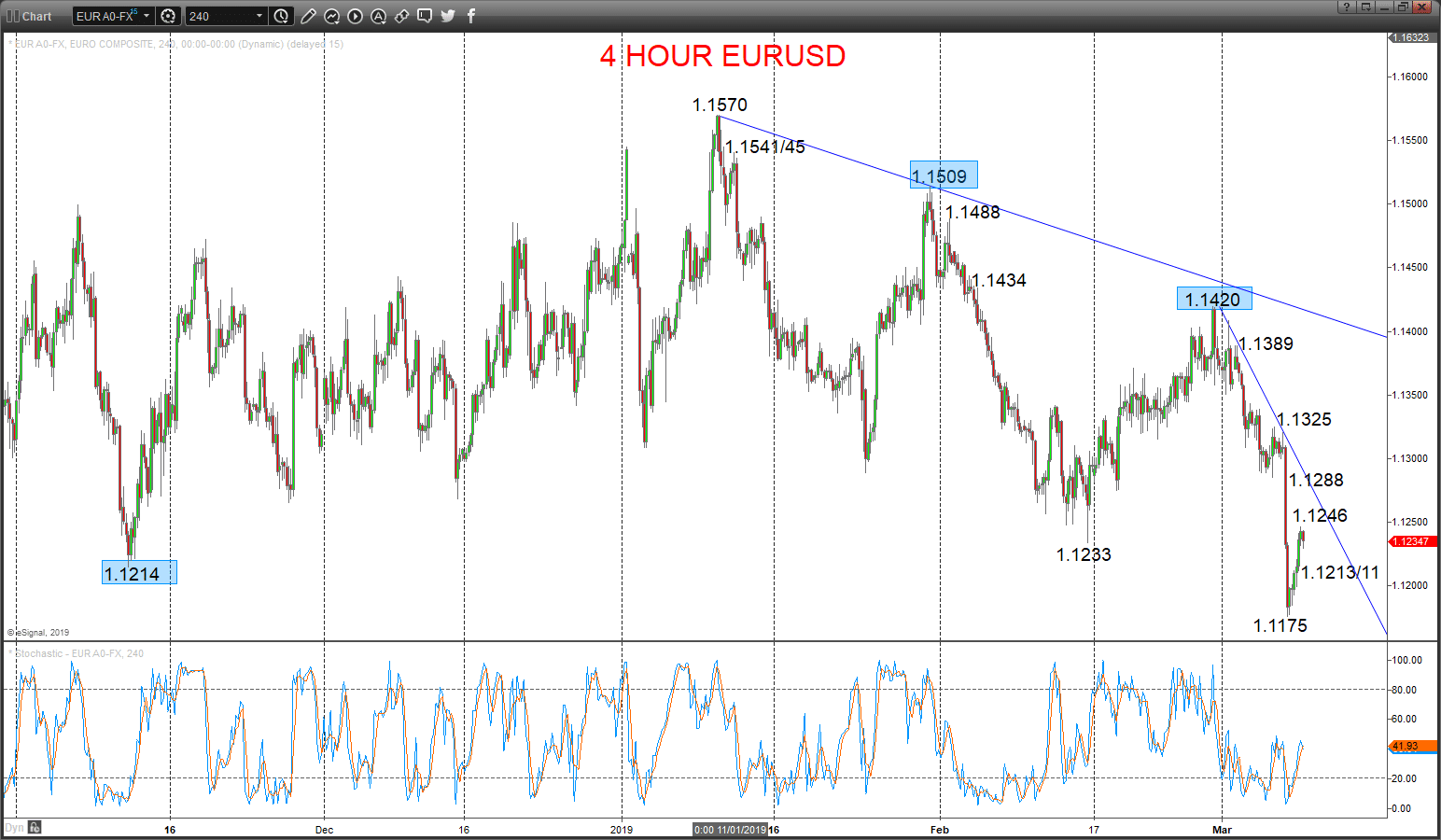

GBPUSD Downside risks reinforced

Another plunge lower Friday through important supports at 1.3049 and 1.3006/00, reinforcing early March losses we have previously anticipated through various supports since the reversal below the up trend line from mid-February, to keep risks lower for Monday.

The late February surge through 1.3218 set an intermediate-term bullish trend

For Today:

- We see a downside bias for 1.2988; break here quickly aims for key 1.2967, maybe 1.2890.

- But above 1.3087 opens risk up to 1.3153, which we would look to try to cap.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 1.3473 and 1.3608

- What Changes This? Below 1.2967 shifts the outlook back to neutral; through 1.2771 is needed for a bear theme.

Resistance and Support:

| 1.3087 | 1.3153 | 1.3199* | 1.3286 | 1.3350/63** |

| 1.2988 | 1.2967*** | 1.2890* | 1.28030/25 | 1.2771*** |

4 Hour GBPUSD Chart