- Both the Euro and GB Pound have made new multi-month highs against the US Dollar through mid-July.

- This activity reinforces bullish signals already sent back in Q2 for both EURUSD and GBPUSD.

- Risk into July is for a EURUSD move towards 1.1714, maybe closer to psychological/ option target at 1.2000

- For GBPUSD the bias is up for the 1.34/1.35 area.

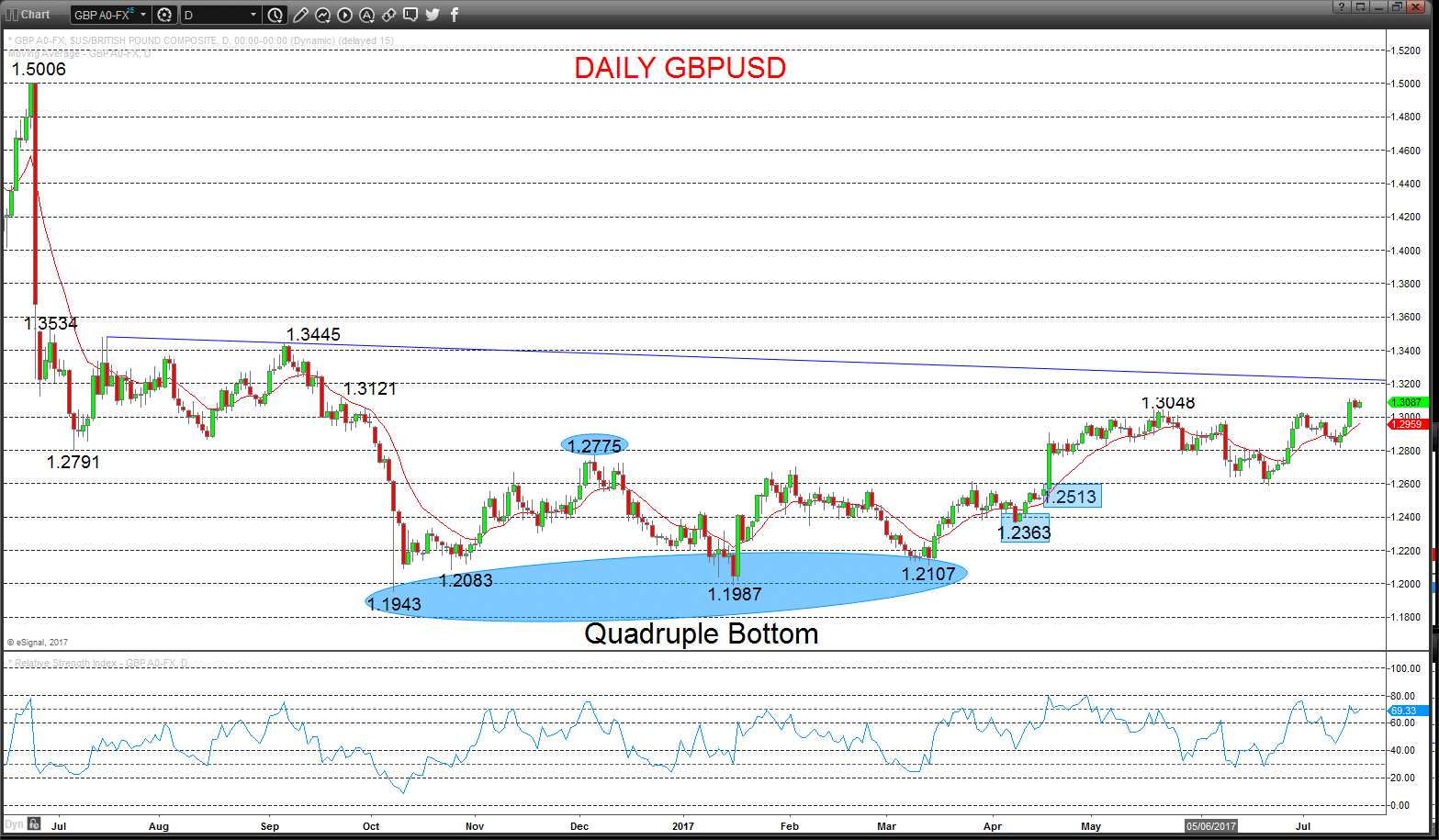

EURUSD – Bullish threat

A high-level consolidation Monday to match the 1.1490 peak, then to push through this level and psychological/option target at 1.1500 overnight, reinforcing the Friday rebound and maintaining bullish pressures into Tuesday.

Moreover, we still see a bullish intermediate-term outlook into July.

For Today:

l We see an upside bias through 1.1537 for 1.1555; break here aims for a key peak at 1.1616.

l But below 1.1473 opens risk down to 1.1409.

Intermediate-term Outlook – Upside Risks:

l Whilst above 1.1107, we see a positive tone with the bullish threat to 1.1366.

l Above here targets 1.1428/47, 1.1616 and 1.1714.

What Changes This? Below 1.1107 signals a neutral tone, only shifting negative below 1.0837.

Daily EURUSD Chart

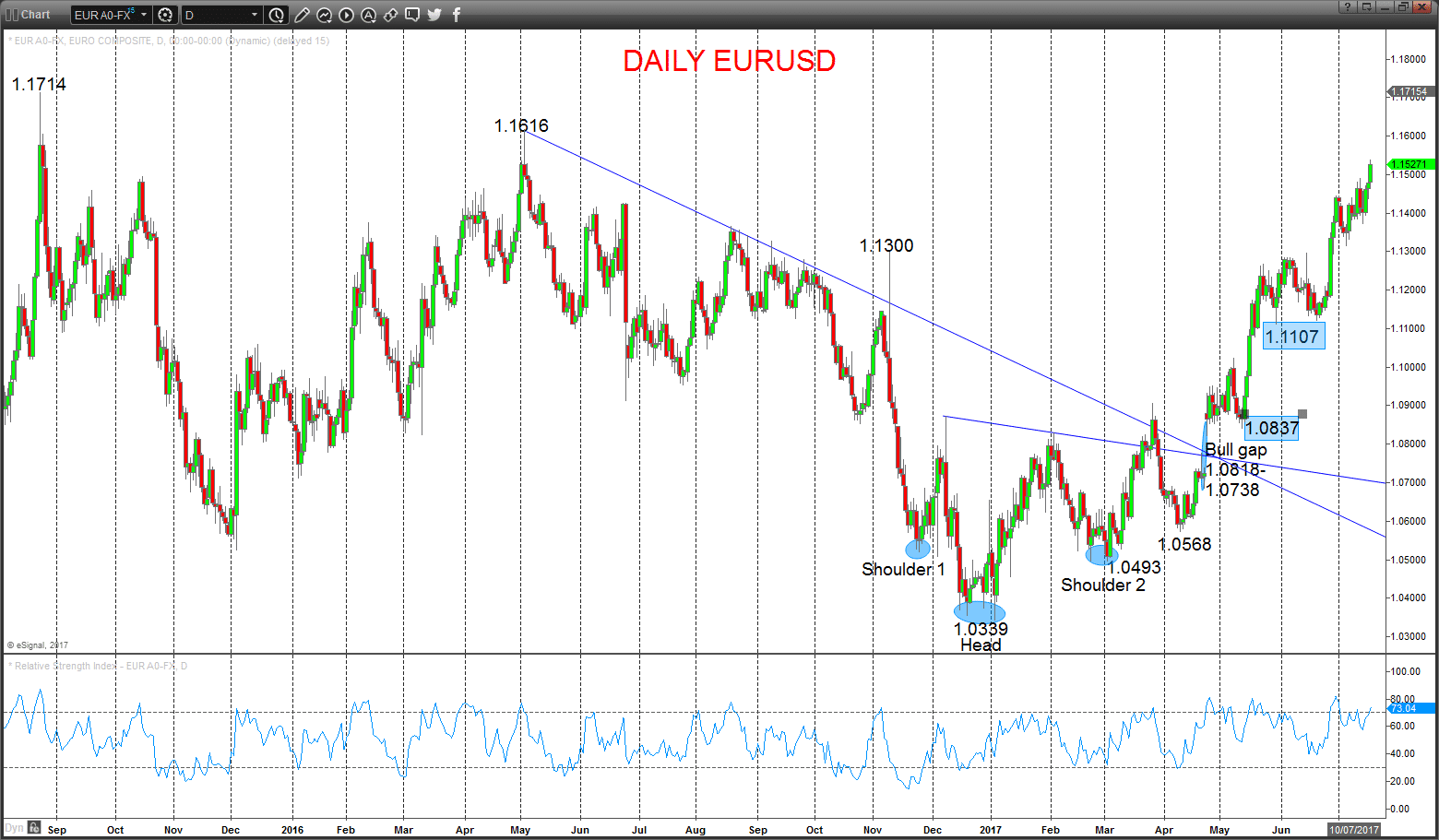

GBPUSD – Bullish trend re-energised

Despite a setback just below initial support at 1.3052 we contingency upside pressures from the Friday surging rally through the May multi-month peak at 1.3048, re-energising the intermediate term bullish view and again aiming higher into Tuesday.

For Today:

l We see an upside bias up to and through 1.3114 and a key high from September 2015 at 1.3121; break here aims for 1.3165.

l But only below 1.3048 opens risk down to 1.2998, maybe 1.2947.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to 1.3121.

l Above here targets the 1.3455/3534 area.

What Changes This? Below 1.2513 signals a neutral tone, only shifting negative below 1.2363.

Daily GBPUSD Chart