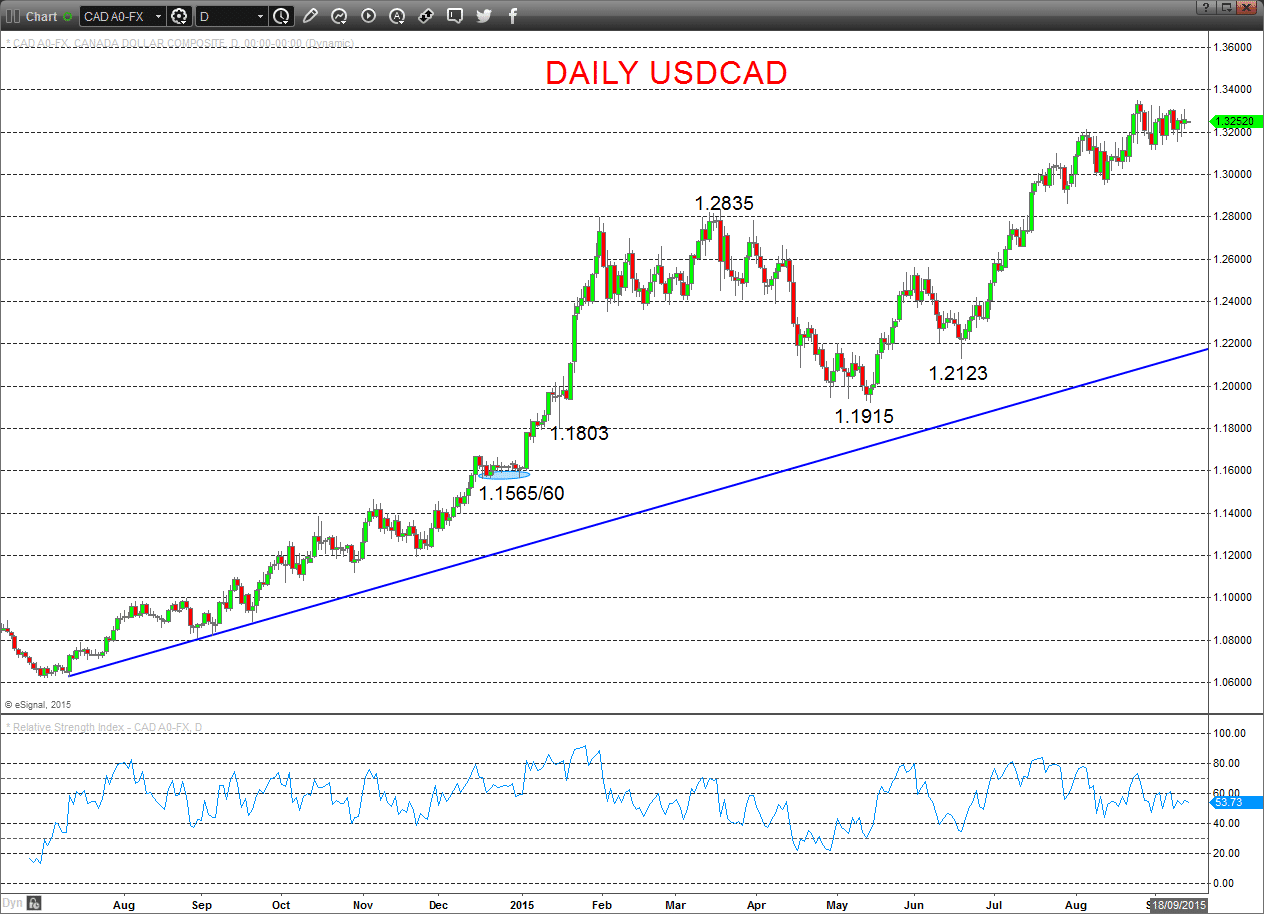

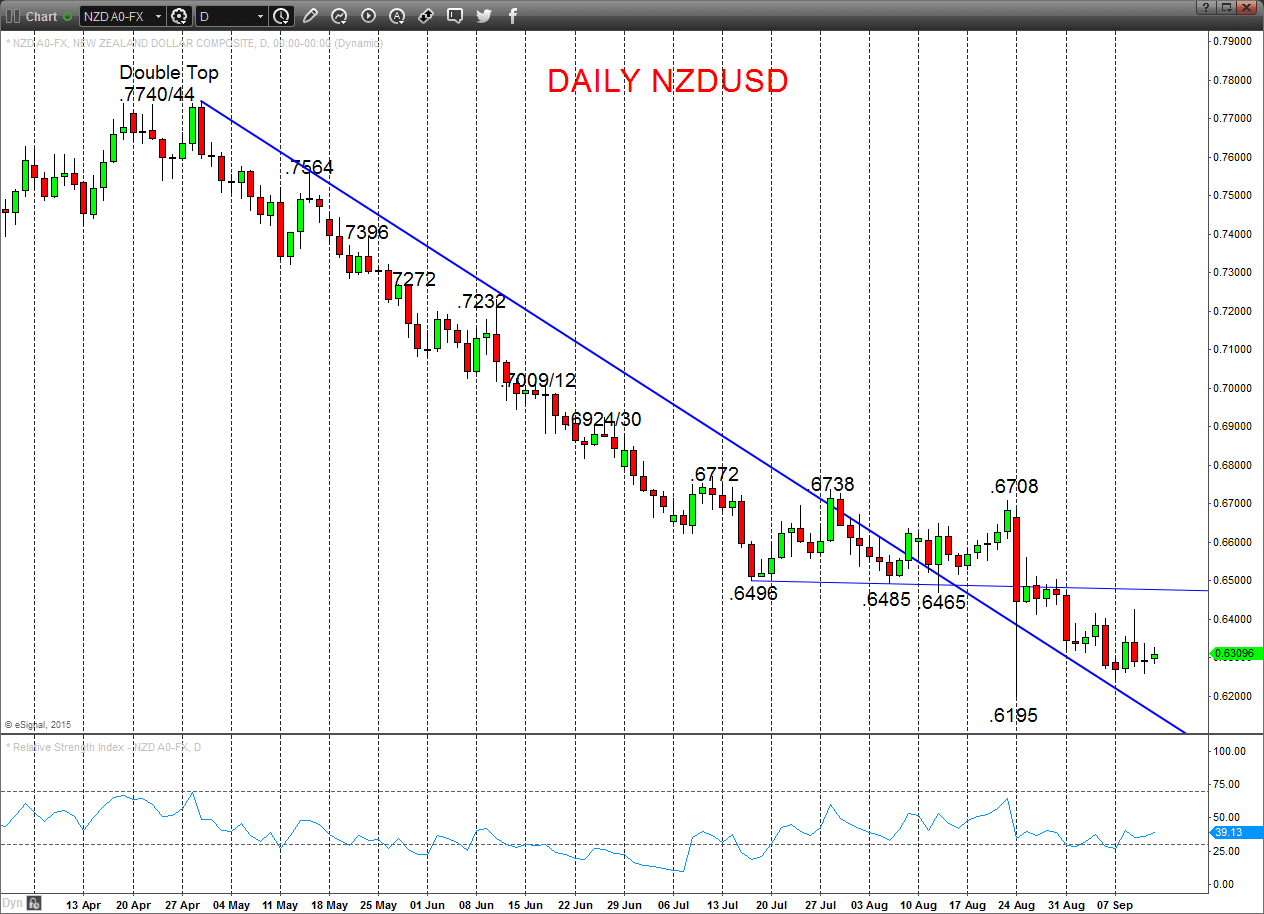

Pockets of US$ strength have emerged over the past week and for September so far, with particular note the ongoing weakness of the Canadian & New Zealand Dollars against the Greenback. USDCAD has remained resiliently at the top of of a multi-month and multi-year bull trend, whilst NZDUSD is poised to re-energize the plunge lower seen in latter August with the equity market sell offs.

USDCAD

- A still hesitant, but resilient tone; cautious ahead of the late August cycle high at 1.3353 (setting back from 1.3325/27 last week), but firm ahead of 1.3150/32 support since the BoC last Wednesday, to leave an upside bias.

- Furthermore, the strong July advance above the 2009 peak at 1.3064 to a 10 year high, leaves risks for a push higher into early August, to aim for further, long term upside targets.

Early this week:

- We see an upside bias for 1.3325/27 and 1.3353; break here aims for 1.3400.

- But below 1.3150/32 opens risk down to 1.3113/05 and maybe 1.3057/66.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a more positive tone with the bullish threat to 1.3454.

- Above here targets longer term levels at 1.3819 and 1.4000.

Daily USDCAD Chart

NZDUSD

- Consolidation Thursday-Friday after the breakdown after the RBNZ rate cut through midweek, leaves a sideways tone for Monday (with a negative bias).

- However, the break below supports after the RBNZ rate cut last week reinforced the previous aggressive plunge to a new cycle and multi-year low in latter August, through a long term support at .6404 and leaves bias for a push lower into mid-September and beyond.

Early this week:

We see a neutral tone between .6338/52 and .6278 (with a negative bias)

- Break above .6338/52 aims for .6425/29, which we would look to try to cap.

- Break below .6278 aims for .6253 and .6240, which we would look to try to hold.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to longer term targets at .6196/54.

- Overshoot threat is lower to .6000, maybe .5741.

Daily NZDUSD Chart

GBPUSD

- The anticipated break last week through 1.5327 saw a bearish shift into September

- The Wednesday stall back from 1.5326 and as expected the push below 1.5189/69 firm support reinforces a more negative theme for Monday.

Short/ Intermediate-term Outlook – Downside Risks:

- We now see a more negative tone with the bearish threat to 1.5189/69.

- Below here targets 1.5087 and 1.5000.

What Changes This? Above 1.5509 signals a neutral tone, only shifting positive above 1.5819.