The Australian and New Zealand Dollars have attempted to rebound through late November and early December, but these recovery efforts have been at best lacklustre, leaving the risk for renewed bearish pressures into December.

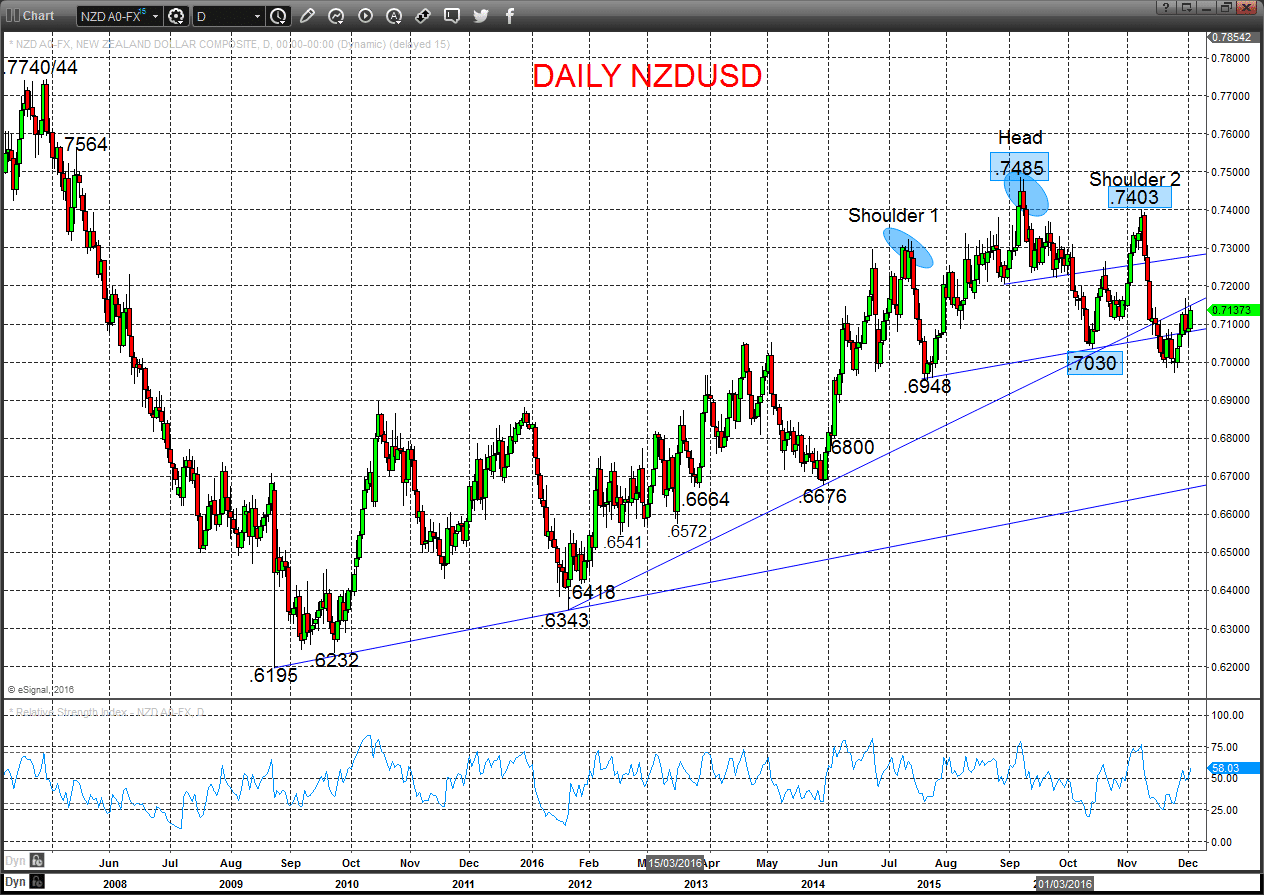

For previous AUDUSD break below the .7438 level completed a multiple high and multi-month top pointing to more significant losses into year-end and likely 4 January 2017.

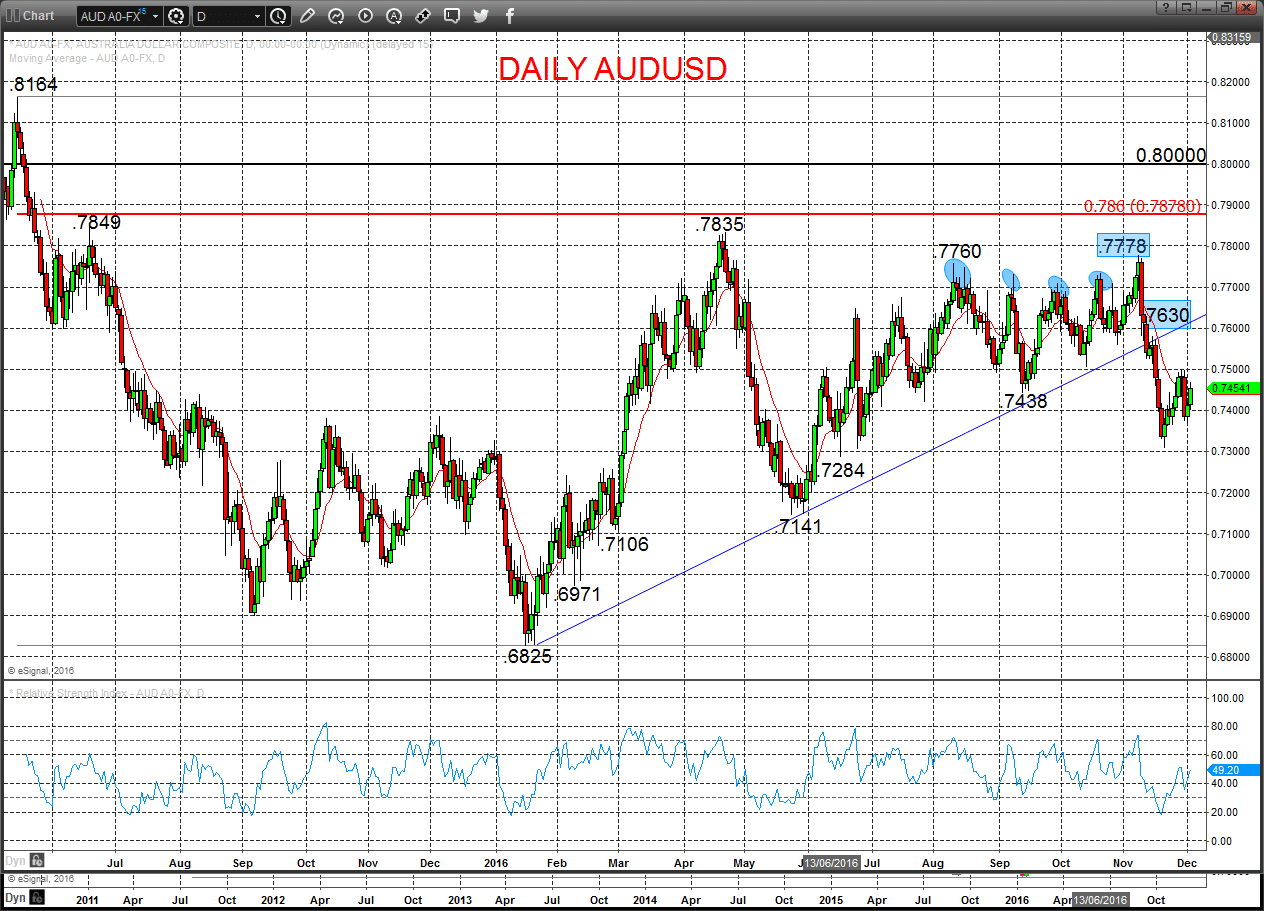

For NZDUSD, the surrender of .7030 reinforced multi-month Head and Shoulders pattern. This leaves the FX forecast for NZDUSD lower into early December and likely through to the end of 2016 (and beyond).

Read more forex trading news.

AUDUSD

A rebound Friday up through .7448 resistance, to ease the recent bear bias and shift to a neural consolidation tone into Monday.

However, the mid-November break of .7438 completed a multiple peak topping pattern, which leaves an intermediate-term bearish theme.

For Monday: We see a neutral tone between .7498/7502 and .7367/60 (with a positive bias)

- Break above .7498/7502 aims for .7542, which we would look to try to cap.

- Break below .7367/60 aims for .7334, maybe .7306, which we would look to try to hold.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to .7284 and .7141.

- Below here targets .7000, .6971 and .6825.

What Changes This? Above .7630 signals a neutral tone, only shifting positive above .7778.

Daily AUDUSD Chart

NZDUSD

An unexpected rebound effort Friday to overcome resistance at.7105 and .7139, to reject the immediate negative tone and shift to a neutral theme into Monday.

But the mid-November breakdown through the multi-month “neckline” of the Head and Shoulders top from July, signalled an intermediate-term bearish shift, confirmed below .7030.

For Monday: We see a neutral tone between .7170 and .7042 (with a positive bias)

- Break above .7170 aims for .7198, maybe .7228, which we would look to try to cap.

- Break below .7042 aims for .7029 and .7010, which we would look to try to hold.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to .6948.

- Below here targets 6800 and .6676/64.

What Changes This? Above .7403 signals a neutral tone, only shifting positive above .7485.

Daily NZDUSD Chart