- When we last looked at both the AUDUSD and NZDUSD spot Forex rates on 26th November we highlighted intermediate-term bullish shifts.

- However subsequent “risk off” activity across global capital markets in reaction to concerns regarding a global slowdown has seen the US dollar rally with a flight to quality, whilst both the Australian and New Zealand Dollars have weakened.

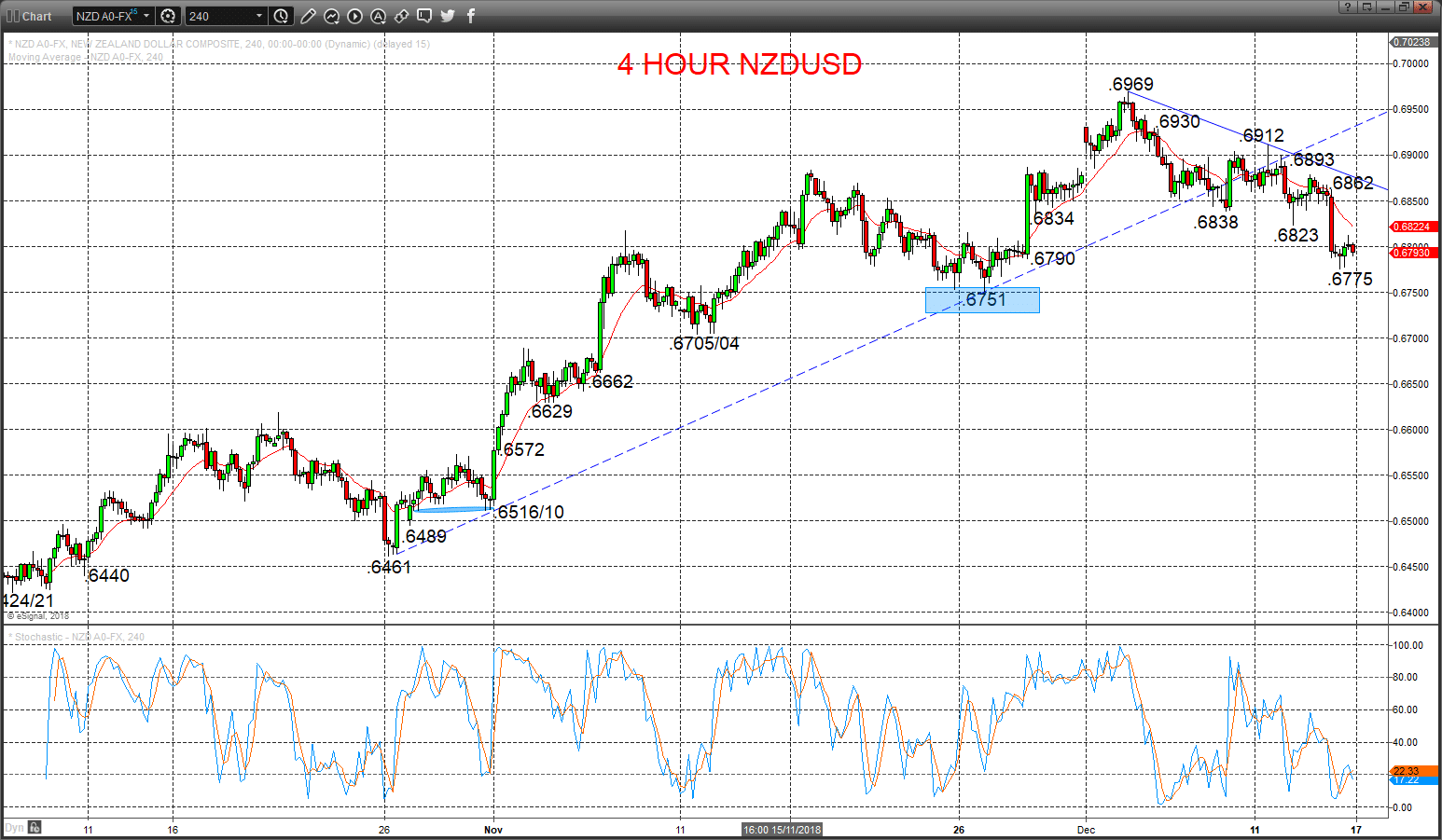

- For the AUDUSD currency pair, this has seen a plunge through important supports (notably .7161), which has shifted the intermediate-term outlook from bullish, to neutral and now to bearish

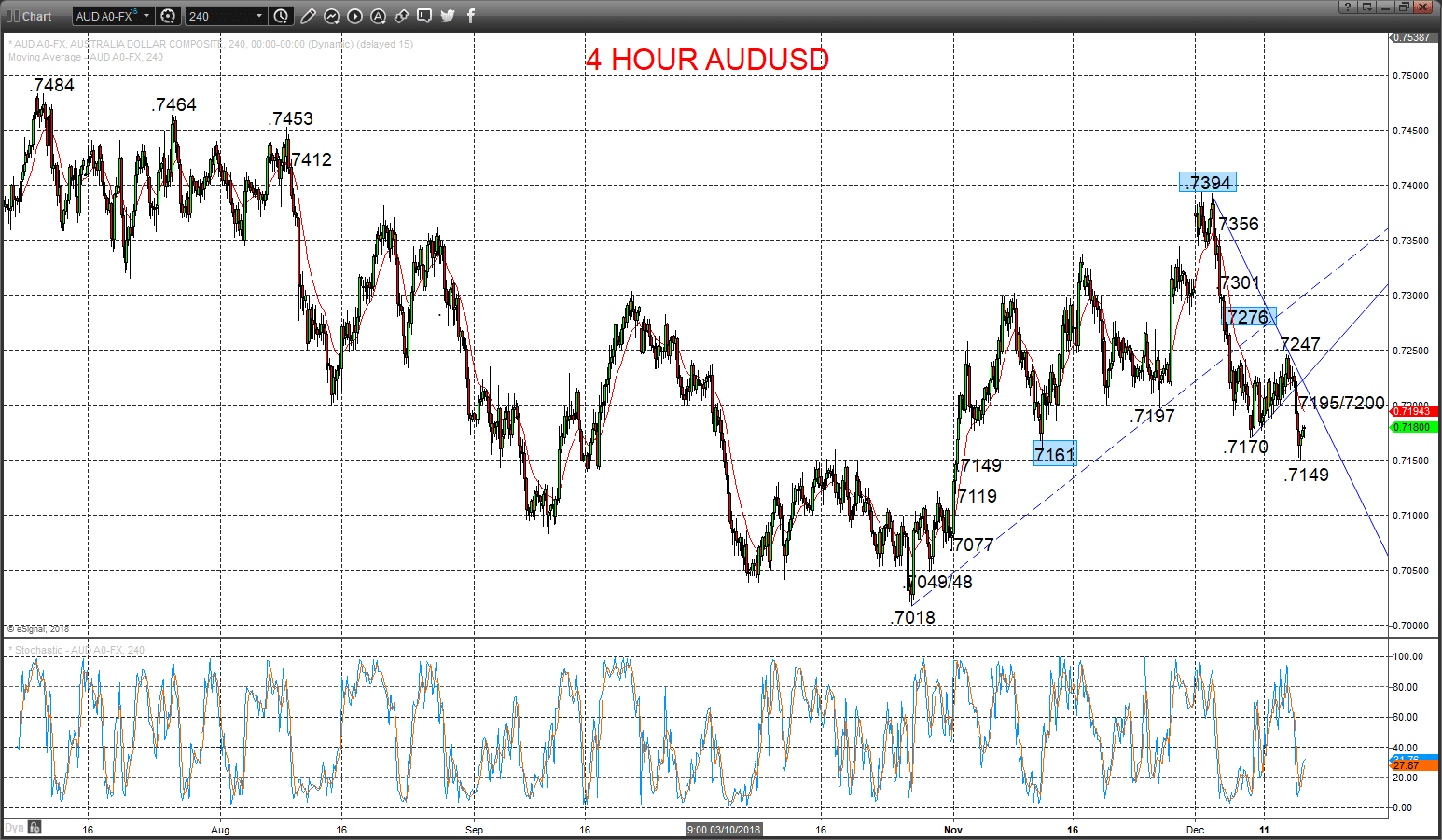

- The NZDUSD Forex rates has not, as yet, seen an equivalently negative technical development, but is poised for a similarly bearish, intermediate-term signal, but only below .6751.

AUDUSD Intermediate-term bearish shift (as flagged)

We have stressed in recent reports that “the early December plunge below .7197 switched the intermediate-term view to a range theme (defined as .7394 to .7161), BUT with risks skewed towards an intermediate-term bearish shift” and Friday’s plunge through here now sets an intermediate-term bear trend.

Furthermore, the Friday plunge through key .7161 reinforced last week’s reluctant rebound and then failure from .7247, to keep the bias lower Monday.

For Today:

- We see a downside bias for .7149; break here quickly aims for .7170 and key .7161.

- But above .7195/7200 targets .7247 and opens risk up towards .7276.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .7077.

- Lower targets would be 7018/00 and .6827.

- What Changes This? Above .7276 shifts the outlook back to neutral; above .7394 is needed for a bull theme.

Resistance and Support:

| .7195/7200 | .7247** | .7276* | .7301* | .7356 |

| .7149* | .7119 | 7077** | .7049/48* | 7018*** |

4 Hour AUDUSD Chart

NZDUSD Downside risks increasing

A plunge Friday out of the recent sideways consolidation through supports as low as .6790, to reinforce Wednesday’s spike lower below the .6838/34 supports and prior failure and setback again from below .6930 resistance (from .6912), PLUS the reversal down below the up trend line from late October, to leave the bias for a further selloff Monday.

The early November aggressive surge above .6618 set an intermediate-term bull trend, BUT risk is growing for a push below .6751, which would shift the intermediate-term outlook from bullish straight to bearish.

For Today:

- We see a downside bias for .6775; break here quickly aims for key .6751, then towards .6723/22 and critical .6704.

- But above .6825 opens risk up to .6862 and maybe .6893.

Intermediate-term Outlook – Upside Risks: We see an upside risk for be .7060.

- Higher targets would be .7437 and .7558.

- What Changes This? Below .6751 shifts the intermediate-term outlook from bullish straight to a bear theme.

Resistance and Support:

| .6825 | .6862 | .6912* | .6930 | .6969** |

| .6775 | .6751*** | .6723/22 | .6704** | .6662* |

4 Hour NZDUSD Chart