- Broad US dollar weakness has returned in early September.

- The Australian Dollar has surged to a new recovery high versus the US dollar in early September, reinforcing the intermediate term bullish outlook.

- Despite a NZDUSD rebound attempt, August losses damage the intermediate term bullish outlook, leaving NZDUSD vulnerable.

See all forex trading articles.

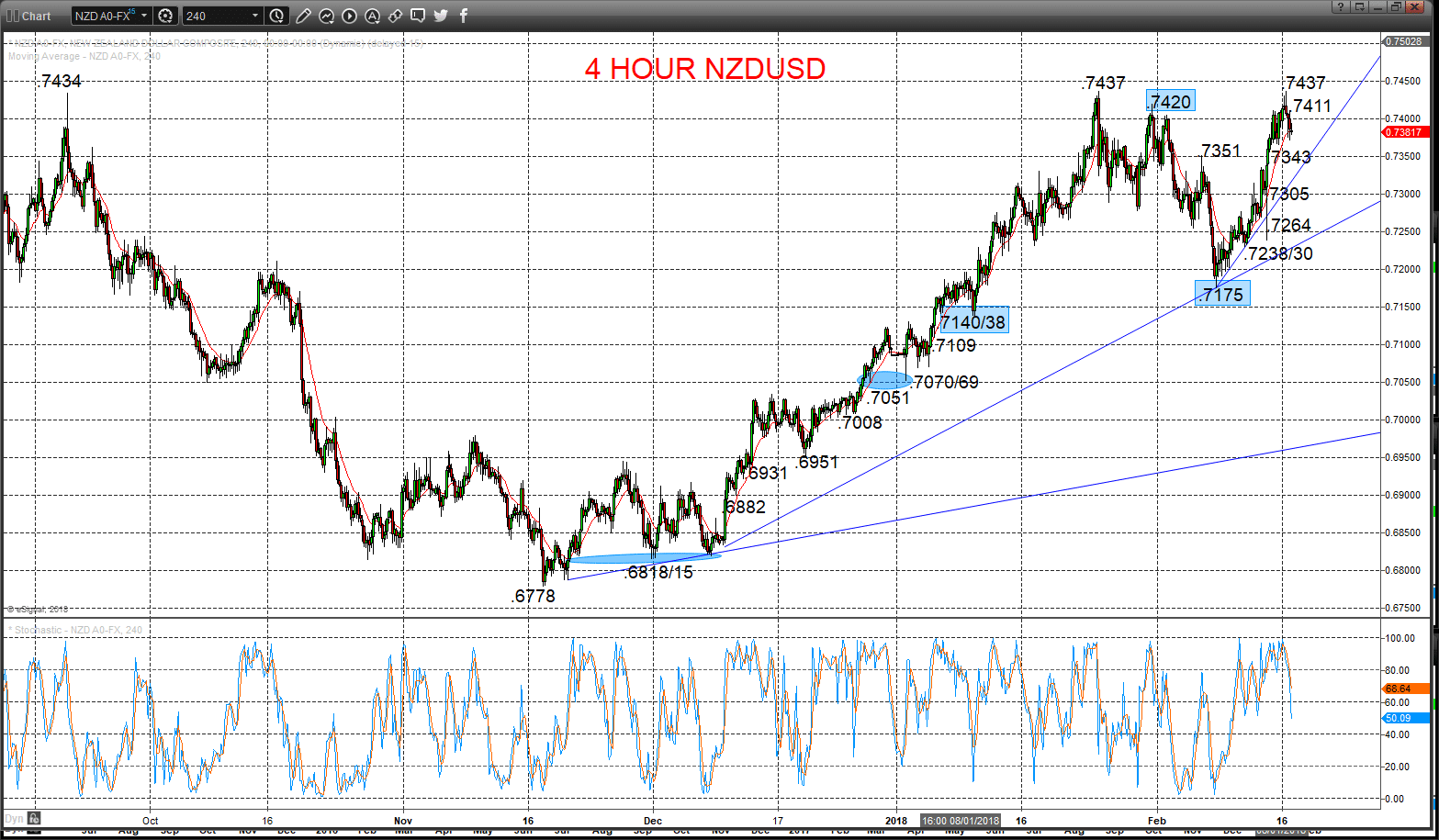

AUDUSD – Bullish extension

A strong push higher Friday through the cycle high at .8065 and next target at .8105 to reinforce upside pressures and despite the intraday setback, whilst above .8024 we see upside risks for Monday.

Furthermore, the robust July advance through the psychological/option target at .8000 reinforced the intermediate term bullish outlook.

For Today:

l We see an upside bias for .8125; break here aims for another key cycle peak from 2016 at .8164.

l But below .8024 opens risk down to .7973, which we would look to try to hold.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to the 2015 high at .8164.

l Above here targets .8295 and the .8452/82 area.

What Changes This? Below .7784 signals a neutral tone, only shifting negative below .7568.

Daily AUDUSD Chart

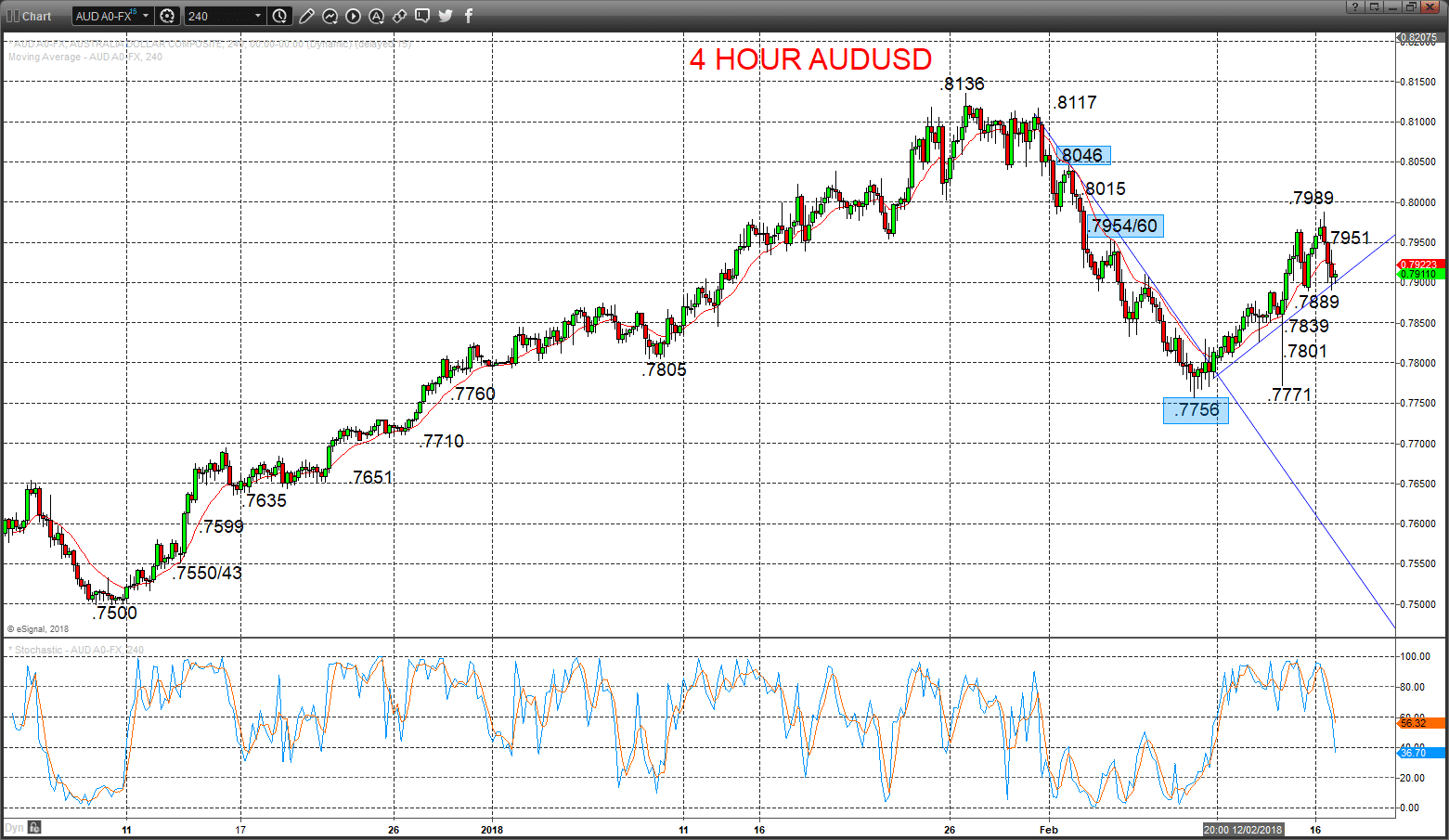

NZDUSD – Upside bias

Yet another strong rebound effort Friday through .7263 and .7199/7200 resistances to hit our .7337 target, sustaining the recovery from late August from .7172, aiming higher Monday.

The recent push down below the July low at .7198 signalled an intermediate shift from bullish to neutral.

For Today:

l We see an upside bias for .7300/02; break here aims for .7337.

l But below .7226 opens risk down to .7172, which we will look to try to hold.

Intermediate-term Range Parameters: We see the range defined by .7558 and .7003.

Range Breakout Challenge

l Upside: Above .7558 aims higher for. 7744 and .8000/45 area.

l Downside: Below .7003 sees risk lower for .6814.

4 Hour NZDUSD Chart