- The US Dollar has continued its slide lower against the major global currencies, the weakening really starting since the December 2017 rate hike, with significant losses for the US in January.

- We look for this bearish USD outlook to extend into late January and likely into February.

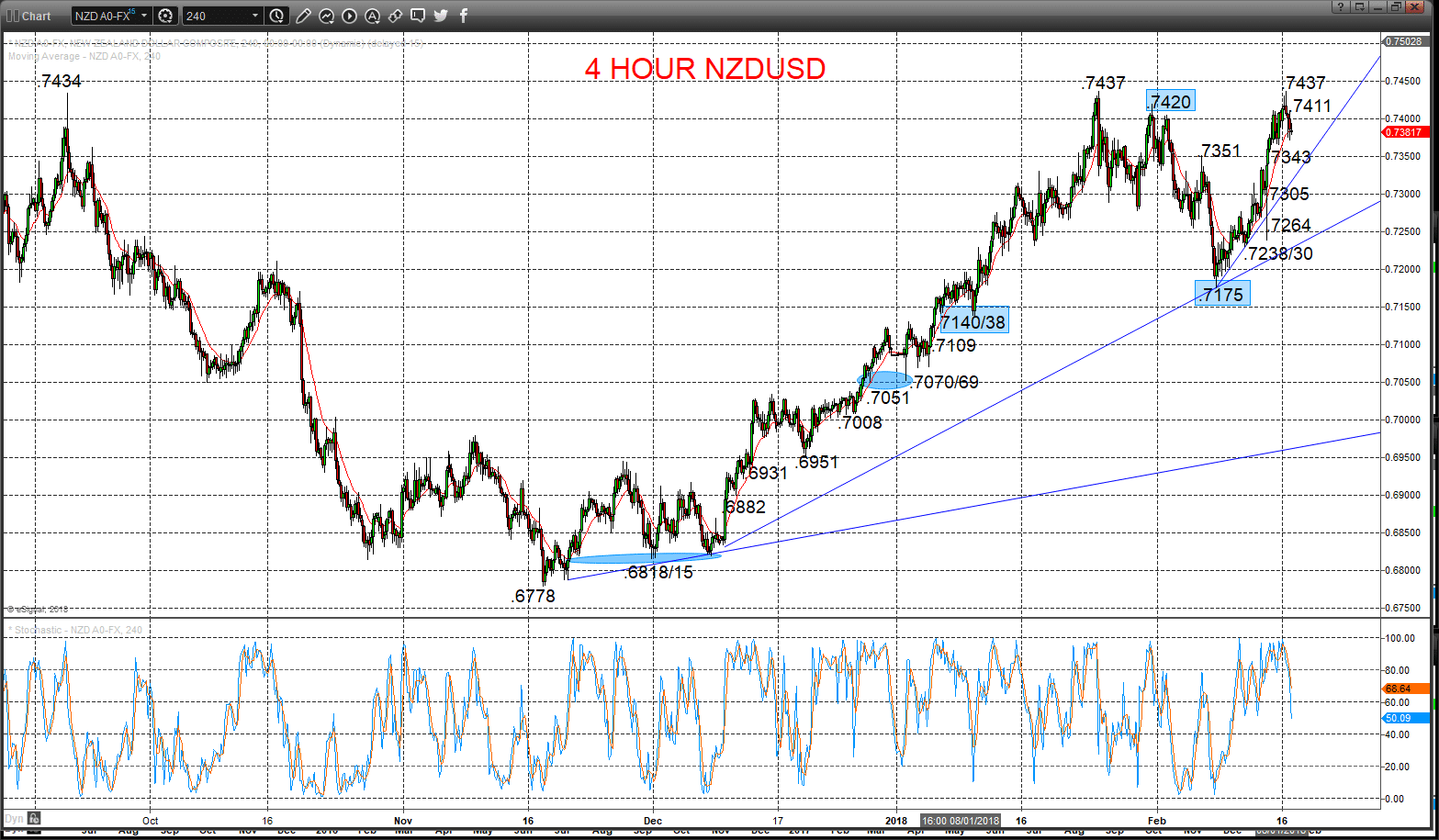

- The AUDUSD surge has produced a push above a key multi-year from peak September 2017 at .8125, that has reinforced the bullish intermediate-term outlook.

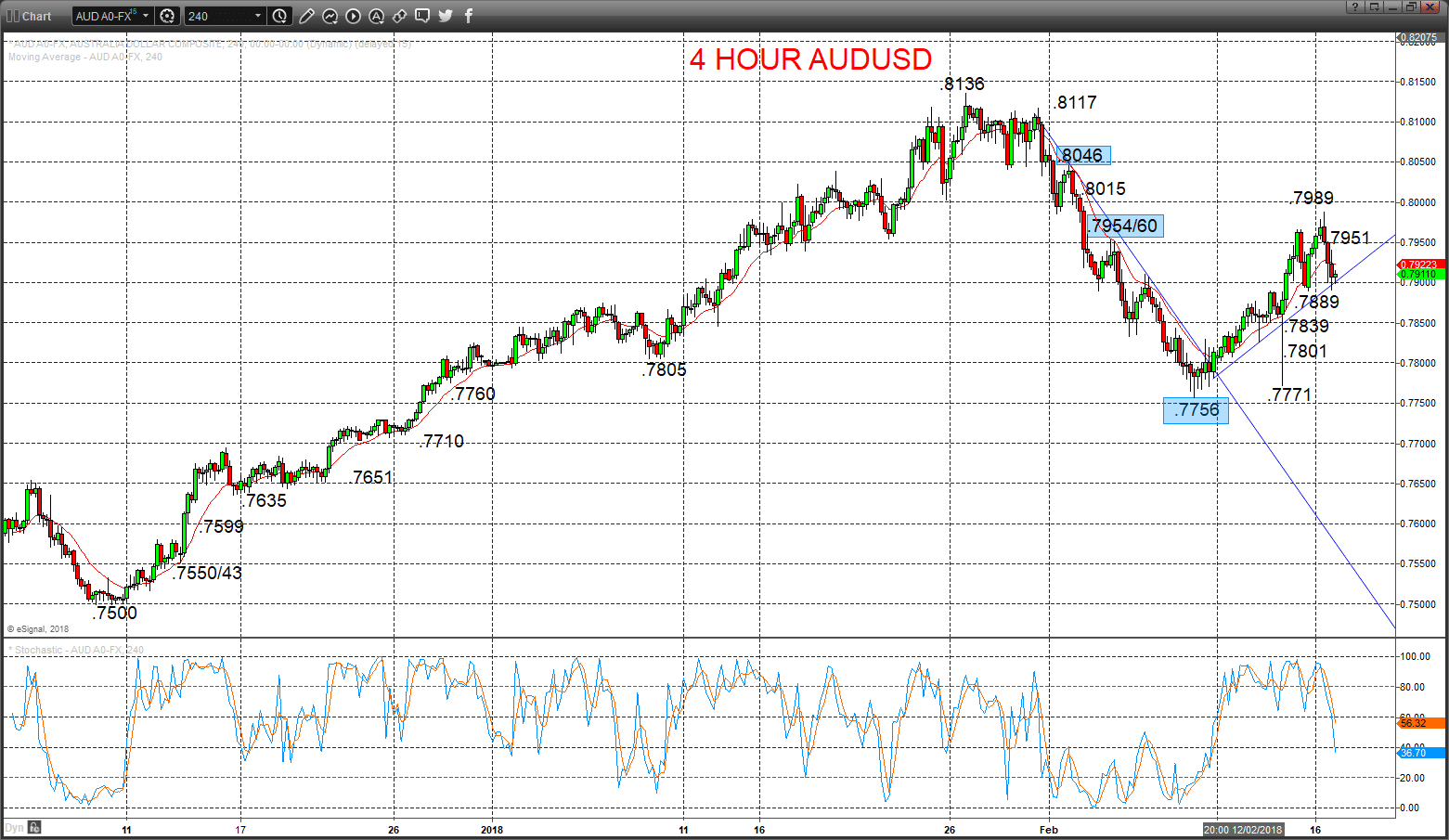

- For the NZDUSD FX rate, the advance from rally from December through .6980 saw an intermediate-term bullish shift, whilst the probe in late January above the multi-year peak at .7434 sustains an upside bias into mid-Q1 2018.

Read all forex articles and trading news.

AUDUSD New multi-year peak!

A dip and a string rebound on Frida, initially down through support at .8033, but then a bounce from ahead of the .7990 level (off of .8002), to hit another new cycle high just above a key multi-year from peak September 2017 at .8125, leaving risks higher Monday.

The December break above the .7730 level shifted the intermediate-term view to bullish.

For Today:

- We see an upside bias for the new cycle peak at .8136; above targets a further critical resistance area at .8164/66.

- But below .8059 targets .8002 and maybe .7990.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to targets ..8164/66, .8295 and the .8452/82 key retracement target area.

- What Changes This? Below .7954 signals a neutral tone, only shifting bearish below .7805.

Resistance and Support:

| .8136 | .8164/66*** | .8200* | .8243 | .8295*** |

| .8059 | .8002** | .7990* | .7954*** | .7935/34** |

4 Hour AUDUSD Chart

NZDUSD Rebound bias

A setback from midweek due to a weak CPI release (after a prod above the multi-month peak from September 2017 at .7434 to .7437), but despite the surrender of .7323 and .7302 supports, the end of week rebound from above a better support foundation at .7265 and from the up trend line from December (from .7288), sets the risk higher for Monday.

The mid-December push above .6980 produced an intermediate-term shift to a bullish theme, reinforced by the early 2018 extension rally.

For Today:

- We see an upside bias through .7393 then for the key peaks at .7434/37; above here targets .7455.

- But below .7288 aims quickly at .7365, which we would look to try to hold. Below targets .7231.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to targets .7558 and .7744.

- What Changes This? Below .7231 signals a neutral tone, quickly shifting bearish below .7069.

Resistance and Support:

| .7393 | .7434/37** | .7455* | .7500** | .7526 |

| .7288 | .7265** | .7231*** | .7217* | .7200 |

4 Hour NZDUSD Chart