- Both the AUDUSD and NZDUSD currency pairs have shifted to intermediate-term bull themes in late June/ early July, pushing through notable resistance levels

- This has been driven by a combination of lower US yields, weakening the US Dollar and a “risk on” environment before and after the resumption of US-Sino trade talks (see the surging global equity markets in Jun into July).

- Although both the AUDUSD Forex rate and NZDUSD FX rate dipped lower in early July, the threat currently remains for further upside into the month.

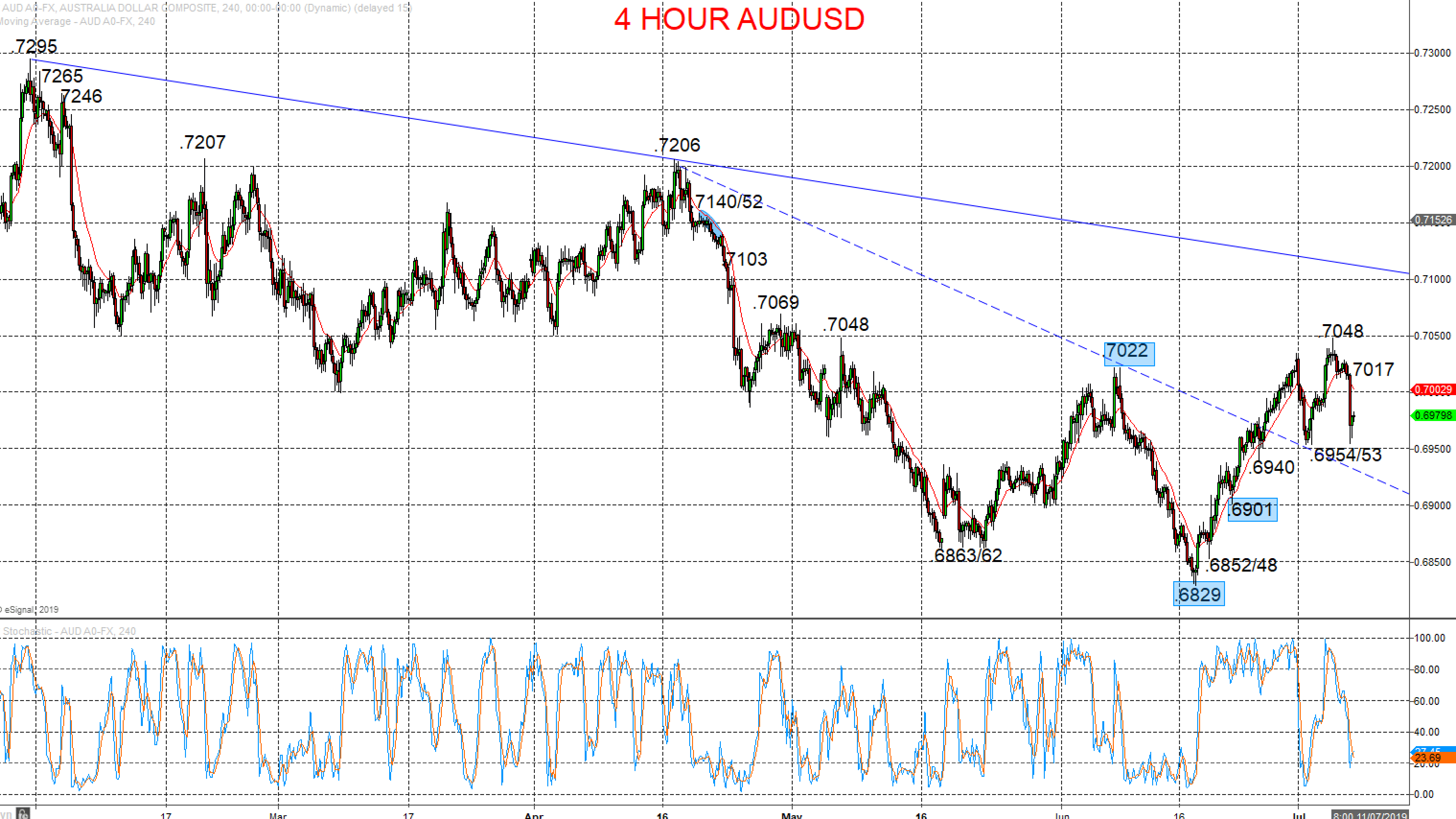

AUDUSD rebound risks

A plunge Friday after the US Employment report through .6986 support but holding the more notable .6953 level (at .6954), to hang onto the early July recovery efforts to .7048 and the entire June rally, for a rebound bias higher Monday.

The early July push through .7022 has seen a bullish intermediate-term shift.

For Today:

- We see an upside bias for .7017 and .7048; break here aims for .7069 and maybe .7103.

- But below 6954/53 opens risk down to .6940 and key .6901.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 7206 and .7295.

- What Changes This? Below .6901 shifts the intermediate-term outlook back to neutral; through .6829 is needed for an intermediate-term bear theme.

4 Hour AUDUSD Chart

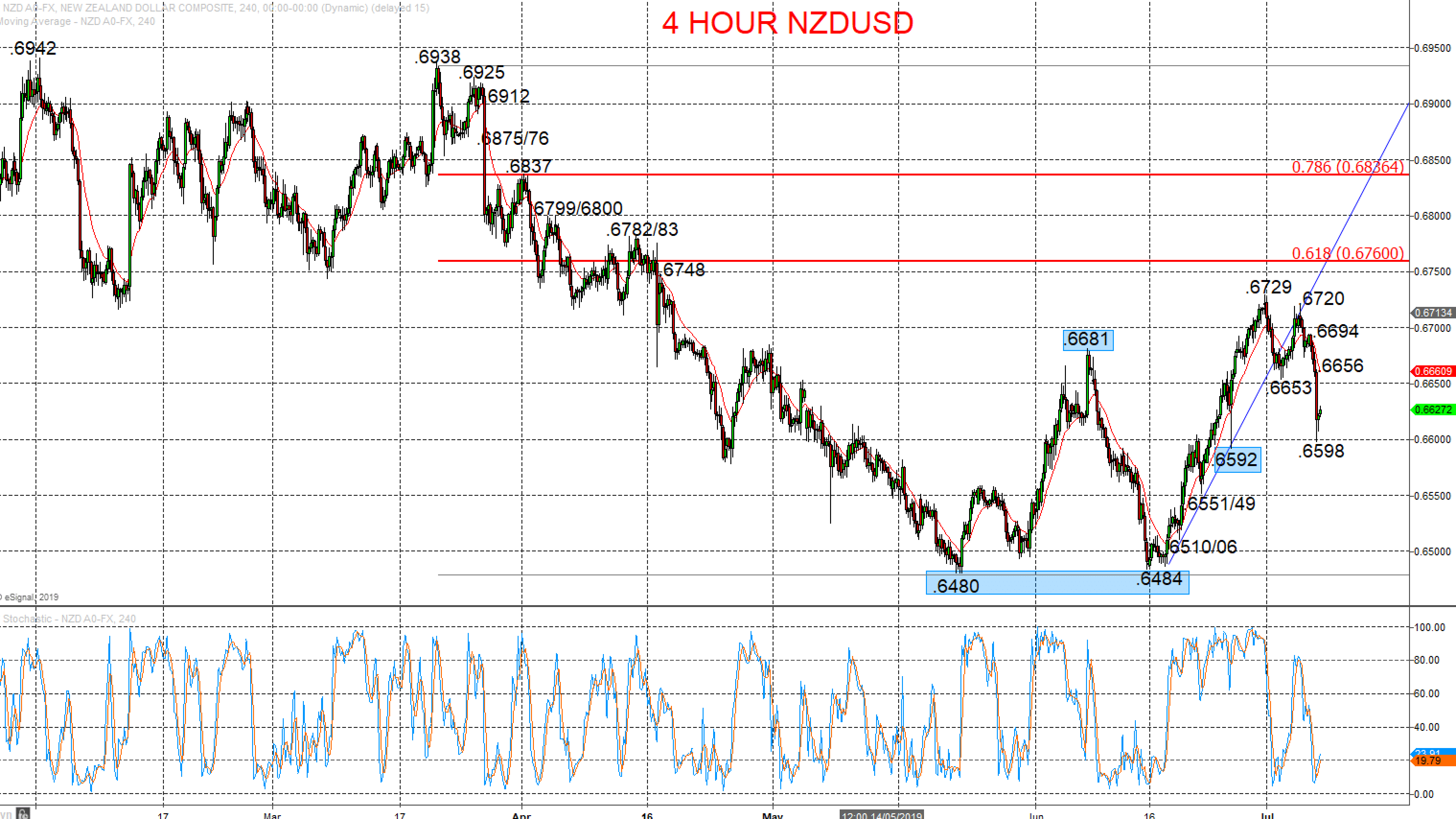

NZDUSD looking for a rebound

A Friday plunge post US Employment report to reflect an already correcting theme, through notable supports, BUT holding just above our key level at .6592 (to avoid neutralising the intermediate-term bull trend, and whilst above here just holding onto a bounce bias for Monday.

The late June break .6681 set a multiweek Double Bottom and an intermediate-term bull trend.

For Today:

- We see an upside bias for .6656; break here aims for .6694 and maybe .6720.

- But below .6598/92 opens risk down to .6551/49.

Intermediate-term Outlook – Upside Risks: We see an upside risk for .6782/83.

- Higher targets would be .6836/37 and .6938/42.

- What Changes This? Below .6592 shifts the intermediate-term outlook back to neutral; through .6484/80 is needed for an intermediate-term bear theme.

4 Hour NZDUSD Chart