Avoiding today’s sophisticated con games requires more attention than ever before. We live in the Cyber Age, where face-to-face contact, a key necessity for evaluating the trust level of an unsolicited contact, is not present. We must resort to our own best intuitive insights, which can easily be manipulated, due to the fact that our brains are actually wired against us. Per the experts: “Successful fraudsters use a cunning combination of persuasion and flattery to lure unsuspecting victims into their trap. Fraud is an unusual crime because it depends on co-operation from the victim. It’s always some action of ours that enable the fraudsters to get away with our money.” Read on to learn about the psychology of fraud…

How do the fraudsters so easily manipulate our minds for their nefarious ends? The trick lies in getting us to make one habitual response, whether to click on an ad link on the Internet, reply to an innocuous but tempting email, or grabbing at a deal that seems too good to be true. That initial “hook” must be set, which suggests that the scammer is very accomplished at the art of persuasion, an extreme kind of marketing where the products or services do not exist or are worthless. We are predestined for disappointment, unless we are prepared to resist the psychology behind the conman’s persuasive techniques.

Online schemes, however, are more insidious by nature. Take it from this psychologist: “Because the Internet allows criminals to target many more victims, in the last 10 years we have witnessed scams on a global scale. In the UK in 2016, it was reported in the National Crime Survey that citizens are 10 times more likely to be robbed while at their computer by a criminal based overseas than to fall victim of physical theft. Online deception can be a threat to people’s mental and physical health.”

We also must abandon our old ways of thinking that the crooks only target the elderly and infirm. In today’s modern technology world, everyone is potential prey, especially those that spend a great deal of time on social media. Victim demographics have been shifting. The young and old are susceptible. Age discrimination is no longer the dividing line that it once was: “It doesn’t matter if someone’s brilliant and worldly or stupid and naïve — everyone’s susceptible to con artists. There’s one thing in particular that makes anyone, intelligent or not, a good victim, and that isn’t a personality trait. It’s not a demographic trait. It’s a situational kind of thing: Where are you at this point in your life? People who are going through life transitions become more emotionally vulnerable and con artists can spot that.”

How do we protect ourselves from today’s modern day fraud attacks? As always, your first line of defense is yourself. In that vein, it helps to be aware of your own vulnerabilities, what personal characteristics send signals to the fraudster that you are ripe for the picking, and what principles do the conmen follow after they have identified you as a potential mark and set the hook. It is you, who must remain skeptical and vigilant when approached by anyone that attempts to gain your trust at the outset. If you are prepared, alarm bells will go off in your head, and you can choose to walk away.

Read more articles about forex fraud

What are the characteristics that attract today’s conman?

From time to time, studies have been conducted to determine why we are so susceptible to an otherwise simple hoax that, on the face of it, would seem so obvious at first glance. A few years back the Office of Fair Trading in the UK, in conjunction with the University of Exeter, carried out extensive research and psychological interviews with over 10,000 people that had been previously victimized on average out of £1,000. One of the basic notions that they discovered was that our natural intelligence can work against us. We assume that we understand a specific subject matter, exactly what the crook needs in order to implement his plan. Here are the study’s surprising conclusions regarding common victim character traits:

- A good background knowledge of the subject of a scam offer, such as experience of investments, may actually increase the risk of becoming a victim through over-confidence. Victims are not, in general, poor decision-makers;

- A “lack of emotional control” which could make them impulsive;

- A degree of isolation, either by living alone or by not sharing their decision to invest, which suggests that they are partly aware that the offer is fundamentally suspect;

- A history of being scammed — Some 10% to 20 % of the population is deemed vulnerable to scams by the OFT because they are serial victims, who are often recruited by organized crime to be “mules” for illicit money movement;

- Being vulnerable to certain psychological triggers – such as the building of relationships, often through phone calls, with apparently obliging people (who turn out to be scamsters); being impressed by authority (as many scam letters use words, fonts and other techniques to give themselves gravitas); and feeling “a strong inclination to give something back” if they receive a small gift.

Lastly, the study also noted that the smart ones, who learned to walk away from an apparent scam, were wise enough to not even give any materials the time of day. Victims, on the other hand, were quick to delve into any materials and pour over them, as if challenged, even though their natural intuition is telling them to let go. On the dark side, survey takers admitted that, “Some of the victims we interviewed appeared to have been seriously damaged by their experience. Common reactions to being scammed include shame, guilt, embarrassment, depression, grief, anxiety and loss of trust.”

What are the principles that are included in the conman’s playbook?

Believe it or not, the psychology of scamming has become a thriving field of late. It is now common to read an article by someone claiming to be a “Cyber-psychologist”, who focuses on the behavioral patterns that enable today’s cyber-fraudster. Can these studies help to imprison the crooks at large? Sadly not — today’s modern online crook typically operates from another country, his whereabouts are difficult to trace, and assembling evidence against the perpetrator is often a time consuming affair. Crooks can easily move to another virtual jurisdiction, while law enforcement officials are left to grab at virtual “bytes of dust”.

Therefore, prevention comes back to recognition of basic patterns at play. Can you identify with any of these primary principles of the conman’s playbook:

- Time: There is always an urgency to act present in most scams. Crooks do not want you to have time to ask questions or exhibit self-control;

- Deference to Authority: Crooks want you to trust them immediately, and what better way than to appear as a doctor, lawyer, investment advisor, or professor, for that matter, to bring an air of legitimacy to the scheme;

- Herd Behavior: One of our evolutionary survival traits is to move about in herds, i.e., safety and strength in numbers, the reason why the conman will claim that others are rushing to this deal;

- Distraction: Just like a magician, a conman will resort to distraction to block your mind from delving into the details. There is a reason why his extremely attractive accomplice cannot take his/her eyes off of you;

- Deepest Desires: If the crook can ascertain our deepest desires, he will use them against us, the reason why many victims fall prey to dating website scams;

- Innate Dishonesty: Yes, unfortunately, our “inner crook” would love to make a fast buck, even if it involved a bit of untraceable larceny. The infamous Nigerian Email Scam is based on your willingness to launder money for a percentage;

- Innate Kindness: On the flipside of the previous coin, we also are innately kind, the reason why many ruses involve sending money to help a friend in distress. Be on the lookout for email scams for money following a natural disaster.

Frank Stajano, a security and privacy researcher at the University of Cambridge, noted that, “I am surprised at the ingenuity of scammers who, perhaps subconsciously, have discovered such principles themselves without scientific studies. Many of the vulnerabilities that scammers exploit are actually human strengths rather than weaknesses. The authority principle, for example, is actually very helpful for surviving peacefully in human society. We shouldn’t see scam victims as stupid –they’re acting in a way that’s beneficial for our survival most of the time. We can protect ourselves to some degree by learning to think like a scammer.”

Here is one particular case study that will bring home the point

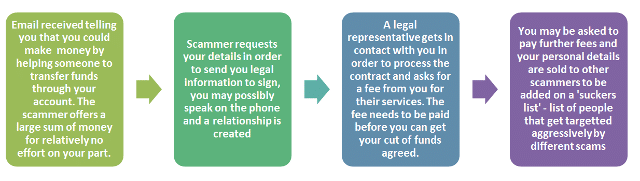

Perhaps, a case study is in order to drive home how one of these scenarios might play out. We noted the infamous Nigerian Email Scam above, the one where you are given a rare opportunity to help a government official move money out of the country, if you would only help with a few details. Here is a schematic of the process:

These steps might follow from an email from a surreptitious official from Nigeria, a tip-off that a potential fraud was in process, but what if the email came from an aggressive marketer of binary options, complete with promises of heavy bonuses, actual examples of how easy it is to get rich, and the allure of getting rich in a short period of time. Client testimonials soon attest to every aspect of the sales pitch. Do you jump in with both feet, or do you back away? Tens of thousands of victims across the globe wish that they had done the latter.

Yes, there are legitimate digital option brokers in the industry, but, unfortunately, this sector was overrun by organized crime in its quest to separate unsuspecting consumers from their capital and life’s savings. Casualty rates in the binary options arena exceed 90%. If you wish to tread in these shark-infested waters, be sure that you do it in a disciplined fashion with your eyes wide open. The risks are enormous, even after you mitigate the potential for fraud.

Concluding Remarks

Why are we so susceptible to the fraudster’s siren call? Our gullibility and greed have a lot to do with it, but there are other behavioral factors at work, as well. Conmen are well versed in these behavioral traps and how to use them to manipulate us to their benefit. If our basic intuition is to protect us, then we must give it a framework upon which to work.

Stay aware, skeptical, and don’t become a victim!