Bitcoin and other cryptos continue to chart the course that some said they would, something that many in the establishment thought impossible. With Bitcoin, Ethereum, Dogecoin, and others approaching a tipping point in terms of general acceptance, there is increasing interest from newcomers. Some of the traditional red flags remain, and safety is still a priority, but these are the things to consider now that cryptocurrency can no longer be ignored.

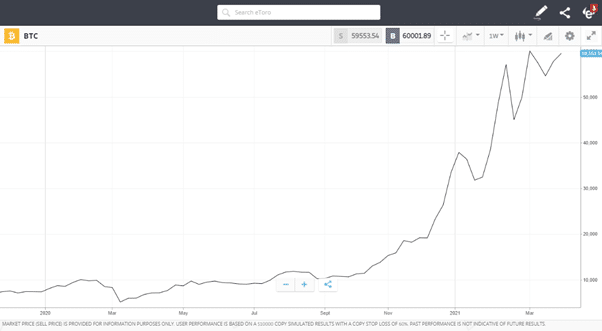

Do Prices Point to Cryptocurrencies Being in a Bubble?

The Dutch tulip bulb price bubble of 1634 -1637 is an often referred to warning for investors. At the height of the bubble, tulips changed hands at prices equal to the value of a mansion on the Amsterdam Grand Canal. At the point where holders of bulbs couldn’t find a ‘greater fool’ to buy them, the market collapsed, and by 1638 prices had returned to pre-boom levels.

Source: eToro

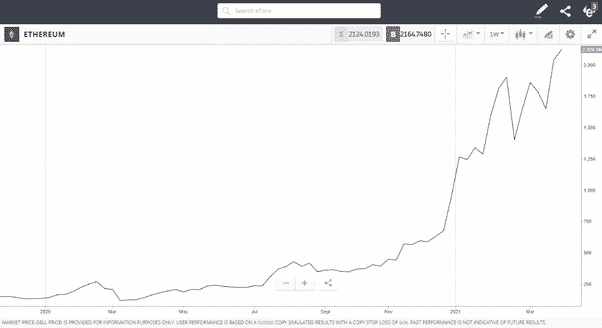

Cryptocurrencies as a Store of Wealth

Investors can form a view on how the crypto revolution meets the criteria to justify ‘this time it’s different’. But if the bottom falls out of cryptos, there won’t even be any flowers in the garden; crypto assets are ultimately no more than lines of computer code.

Cryptocurrencies as a Means of Payment

Bulbs in 17th Century Holland and crypto-coins today both represent an effective store of wealth. The difference for cryptos is that they have a secondary function as a means of exchange.

The blockchain technology used by crypto networks allows participants to exchange wealth. It even has some technical advantages over traditional payment networks. It’s just a question of whether there is a critical mass of users who accept it as a legit means of transfer.

Then there is the fact that Bitcoin payments currently take more than nine minutes to clear. Buy a coffee with Bitcoin and it could be cold by the time you get to drink it.

The debate about price has a long way to run. However, the more that institutional investors and corporations such as Tesla buy into the Bitcoin story, the greater the chance of prices rising. Market risk and the potential for a price crash looks built-in, but some other risks can be more easily managed.

Source: eToro

Brokers

The crypto markets themselves are unregulated. That is a plus point for many who want to get away from fiat currencies which central bankers and governments can manipulate. The good news is that some regulated brokers offer the chance to buy cryptos. eToro, for example, allows clients to purchase the coins outright and hold them in an account regulated by the Financial Conduct Authority (FCA).

Exchanges

Unregulated exchanges still operate. Their selling point is that they have a lot of existing users and market flow. That could change as crypto goes mainstream and more regulated brokers offer the chance to buy coins and regulatory rubber-stamping as well.

Wallets

These articles explain the difference between the different hardware and software wallets. Each has its pros and cons in terms of security and pricing. If you want to avoid the hassle of special wallets altogether, then a regulated online broker offers a chance to access the market using something much more like a standard bank account.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]