Introduction

Although there are around 180 currencies recognised as legal tender by member states of the United Nations, only a handful of these currencies are traded actively in what is known as the foreign exchange (also known as the ‘forex’) market.

That is even though the forex market is by far the biggest financial market in the world, accounting for an average of $6.6 trillion worth of trades each day—according to a 2019 report by the Bank for International Settlements. And while this figure ebbs and flows each day, with the precise value of individual currencies constantly fluctuating as they get traded on the open markets, it nevertheless gives us an understanding of just how important this market is to the global economy.

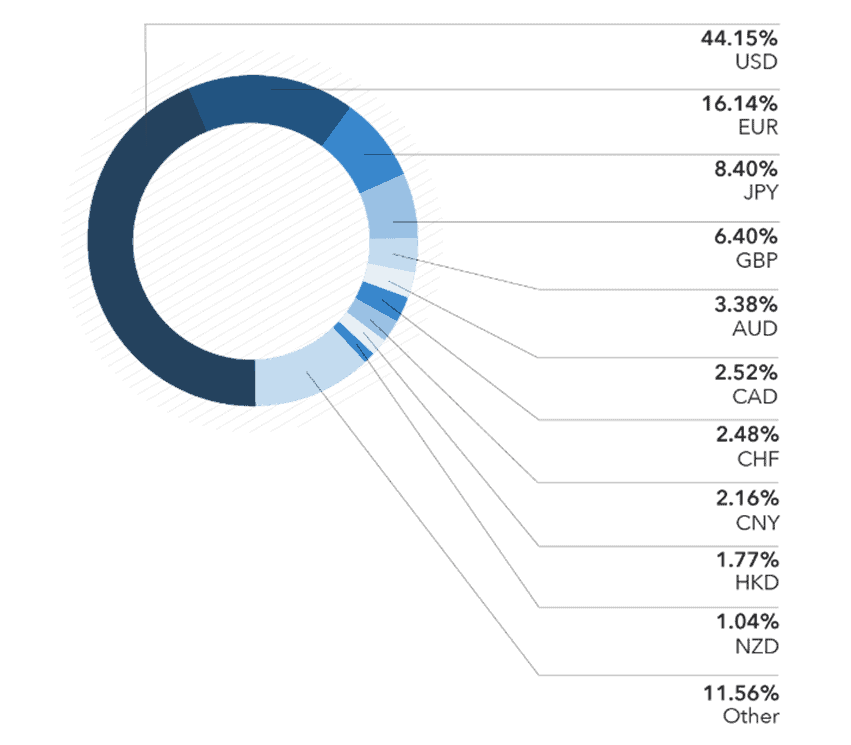

Source IG

Perhaps most interestingly, of this estimated $6.6 trillion in daily trading volume, around 90% of the figure is made up of just ten currencies. This is a revealing figure, as it indicates where wealth tends to be concentrated at a global level. It also gives us a sense of what countries hold the levers of economic power in the global economy.

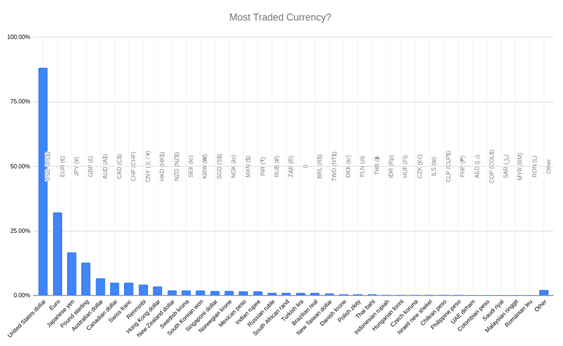

Source IG

Currencies are traded through different types of transactions, including spot transactions between two parties, forward contracts to buy currency in the future, and swaps and options contracts where the underlying financial instrument is a currency pair. These trades occur continuously during the working week, with a brief weekend pause as exchanges shut down.

There are many different types of players and individuals involved in this process, consisting of institutional investors, companies and other corporate entities, and individuals.

The institutional investors involved in buying and selling currencies include commercial and investment banks, government central banks, investment managers, and hedge funds. On the non-institutional side, multinational corporations acquire currency to keep their businesses running smoothly, whilst individual retail investors might trade currencies hoping to make a profit through what is known as arbitrage.

What you will learn

With this basic understanding of how the forex market works in mind, this short article will give you a quick overview of the most traded currencies and explain their role in the forex market.

This information should give you a better understanding of how the forex market works. should you decide to dip your toe into the market, you won’t feel completely overwhelmed by what can often be an intimidating trading environment for beginners. We have put together a list of the most traded currencies and will explore why they are so commonly traded the economies backing them and their position on the global market.

Most traded currencies in the world

Here is a list of the top ten most traded currencies starting with the most common.

1. United States Dollar (USD)

- First issued in April 1792

- Acts as a global reserve currency

- Nicknamed the ‘greenback’

- Used unofficially in numerous countries

- Reflects 2. prices

Although it is most often referred to as simply the ‘dollar’, the United States Dollar has several nicknames, including the ‘greenback’. Regardless of what you want to call it, the USD is by far the single most important currency in the global economy.

It is easily the most actively traded of the 180 possible currencies. And as a sign of its overall dominance in the global foreign exchange markets, eight of the most commonly traded currency pairings involve the dollar.

The USD also acts as the unofficial reserve currency for the world, with nearly every central bank holding large quantities. This is in addition to the many countries that have unofficially accepted it as a local currency—a phenomenon known as “dollarisation”.

Many countries have also officially pegged their currency to the dollar, such as China and Saudi Arabia, which gives the USD unparalleled political power in the global economic system. After all, countries are much less likely to take hostile action against a country whose currency their own is tied to. The benefits of pegging are that it brings stability to the weaker currency and might also increase its attractiveness.

The USD has also come to be used as a standard currency for commodities—particularly crude oil and precious metals—which will daily impact its weakness or strength. As the dollar is so vital to the global financial system in this way, traders pay close attention to news from the US Central Bank.

2. Euro (EUR)

- Introduced in 1999

- Coins and banknotes were first issued in 2002

- Second biggest currency

- Deeply political currency

- Benefits from high liquidity

Since it was first introduced into circulation on the first of January 1999, the Euro has become one of the most traded currencies in the world. The Euro is the official currency of the nations within the Eurozone. However, it is important to note that not every country in the EU has adopted the Euro as their official currency. And given the overall size of the single market and the importance of the EU as a political power, it is also one of the most significant in the global financial system.

As a sign of the political importance of the Euro, several countries in Europe and Africa have pegged their currency to it. It is hoped that they can protect their official currency from wild fluctuations in value by doing so. Because of this, the Euro is currently the second-largest reserve currency. It also benefits from high levels of liquidity, although this makes for often tricky trading conditions.

3. Japanese Yen (JPY)

- Introduced in 1973

- Tied to Japan’s export market

- Third reserve currency

- Influential in the Asia-Pacific region

- Operates under a “dirty float” system

Of the various Asian currencies, the Japanese Yen is the most frequently traded. As the strength of the Japanese economy lies in its manufacturing and exports sector, the Yen has an essential function in the global economy. Forex traders will also keep a close eye on the JPY if they are interested in the Asia-Pacific region as a whole, given how vital the currency is to facilitating trade in this far-reaching region. Currencies paired with the JPY, such as the South Korean won, the Singaporean dollar, and the Thai baht, are also closely watched.

4. Pound Sterling (GBP)

- It dates back to 1489

- Initially denominated in coins but switched to notes

- Managed by the Bank of England

- Historically stable

- Wields considerable influence through the Commonwealth

As one of the oldest continuously minted currencies in the world, the Great British Pound—also known as the pound sterling—is the fourth most valuable currency in the forex market and one of the most traded currencies. The pound sterling has a deep and long history, which partly explains why the UK was so reluctant to give it up when the country was still a member of the European Union.

Forex traders will often look to the state of the British economy and the overall political stability of the UK to price the pound sterling—which helps explain why the value of the pound has fluctuated so considerably over the last few years! However, as a historically strong and important currency, it benefits from extremely high liquidity on the forex markets. It is also an important reserve currency, given its historical importance and the stability of the UK.

5. Australian Dollar (AUD)

- Introduced 1966

- Currency for Australia and its external territories

- Used by three additional states (Kiribati, Nauru, Tuvalu)

- Close ties to commodity prices

- Regulated by the Reserve Bank of Australia

The Australian dollar, also known as the ‘Aussie’, is a major currency in the Asia-Pacific region. Much like its close Commonwealth cousin—the Canadian dollar—it is primarily considered a commodity currency. This means that the value of the Aussie will broadly fluctuate in line with the commodity market.

Another major factor in the value of the Aussie is China. As Australia’s closest trading partner, the two economies have deep links—despite geopolitical tensions flaring at times. As such, the value of the Aussie will often reflect how relations between the two Asia-Pacific economic giants are faring.

6. Canadian Dollar (CAD)

- Introduced in 1858

- Issued by the Bank of Canada

- Close ties to commodity prices

- Impacted by Canadian-USA relations

- Close ties to GBP through the Commonwealth

Also nicknamed the ‘Loonie’, the Canadian dollar is very much a commodity currency. This means that its value will often reflect the current state of the commodities markets as the prices of crude oil, minerals, precious metal, and LNG ebb and flow throughout a given trading period. Canada is one of the biggest commodities exporters, so the CAD will often move in step with commodities prices. Traders who follow the CAD market often lock in trades based on how they think the commodities market will move. Given how closely tied the Canadian and American economies are, the Loonie will often be paired with the USD. As such, the USD/CAD is one of the most traded currency pairs.

7. Swiss Franc (CHF)

- Introduced 1798

- Last Franc currency in use

- Tied to Swiss’ haven’ status

- The official currency of Switzerland and Liechtenstein

- Issued by Swiss Central Bank

The Swiss Franc is the official currency of Switzerland and Liechtenstein. It is often identified by its ticker symbol, CHF, which stands for Confoederatio Helvetica Franc. It has historical links to other ‘franc’ based currencies, although following France’s switch to the Euro, it is now the only franc still issued.

Although Switzerland is a relatively small country in the grand scheme of things, the CHF has nevertheless become one of the most traded currencies in the world.

This status has been achieved primarily due to Switzerland’s status as a financial hub. As a historically stable political and economic environment, the Swiss franc is considered a ‘haven’ currency.

The value of the CHF is also historically tracked with the price of gold, particularly as the Swiss constitution previously required the central bank to hold 40% of its reserves in gold. This requirement was eventually eliminated, as was the brief peg to the Euro the CHF had between 2010 and 20165

8. Renminbi (CNY)

- Introduced in 1948

- Managed under a floating exchange rate

- Tied to global trade

- Issued by People’s Bank of China

- Previously pegged to USD

The CNY, also known by its full name ‘Chinese Yuan Renminbi’, is the official currency of the People’s Republic of China.

Somewhat confusingly, the ‘yuan’ is also the name for a unit of account in China’s financial system, whilst ‘Renminbi’ is the currency’s name.

As one of the world’s largest economies with a staggeringly large population, the CNY is one of the most traded currencies in the world. Much of this importance lies in China’s unique position as a global manufacturing hub with vast export networks across the globe.

The CNY has undergone significant financial reforms over the years as the Chinese economy has matured. It was previously pegged to the US dollar until 1995 when it was allowed to float. However, the CNY does not have a free-floating value. Instead, it is carefully managed through a floating exchange rate. This allows the currency’s value to float within a specifically determined band concerning various other currencies.

As a sign of the growing strength of the Chinese economy, the CNY became the first currency by an emerging economy to be included in the International Monetary Fund’s special drawing rights basket. This essentially gave it the status of being a reserve currency.

9. Hong Kong Dollar (HKD)

- Introduced in 1935

- Previously pegged to USD

- Unofficially used in Macau

- Managed by Hong Kong Monetary Authority

- Subdivided into 100 cents or 1000 mils

The Hong Kong Dollar—also marked as the HKD—is the official currency of Hong Kong. Although the landmass of Hong Kong is relatively small, this has not stopped the currency from becoming one of the most traded currencies in the world. It is used both in Hong Kong and the neighbouring region of Macau.

The HKD is not free-floating and is currently pegged to the USD. This gives it a reasonable degree of stability and ensures that it tends to reflect the current prices of the USD. The value of the HKD will fluctuate within a narrow trading band. Whenever this band’s upper or lower limits are breached, the Hong Kong Monetary Authority will step in and take action.

10. New Zealand Dollar (NZD)

- Introduced in 1967

- Previously denominated as a pound

- Close ties to the Commonwealth

- Impacted by agricultural prices

- Close ties to the Australian economy

The New Zealand Dollar—or the NZD—is the official currency of New Zealand. As a member of the Commonwealth, New Zealand was originally tied to the British monetary format and was thus denominated in pounds, shillings, and pence. However, it switched to a dollar-based value in 1967.

Following this, the NZD underwent some monetary changes, which included being briefly pegged to the US dollar. Since 1985, however, it has been a free-floating currency.

As New Zealand is heavily reliant on certain agricultural exports, the value of the NZD will often fluctuate in line with dairy prices. New Zealand is also a popular tourist destination.

Conclusion

As can be seen, each of these currencies has unique features that impact its value and price daily, reflecting the position of the economy to which it is paired in the global economic system.

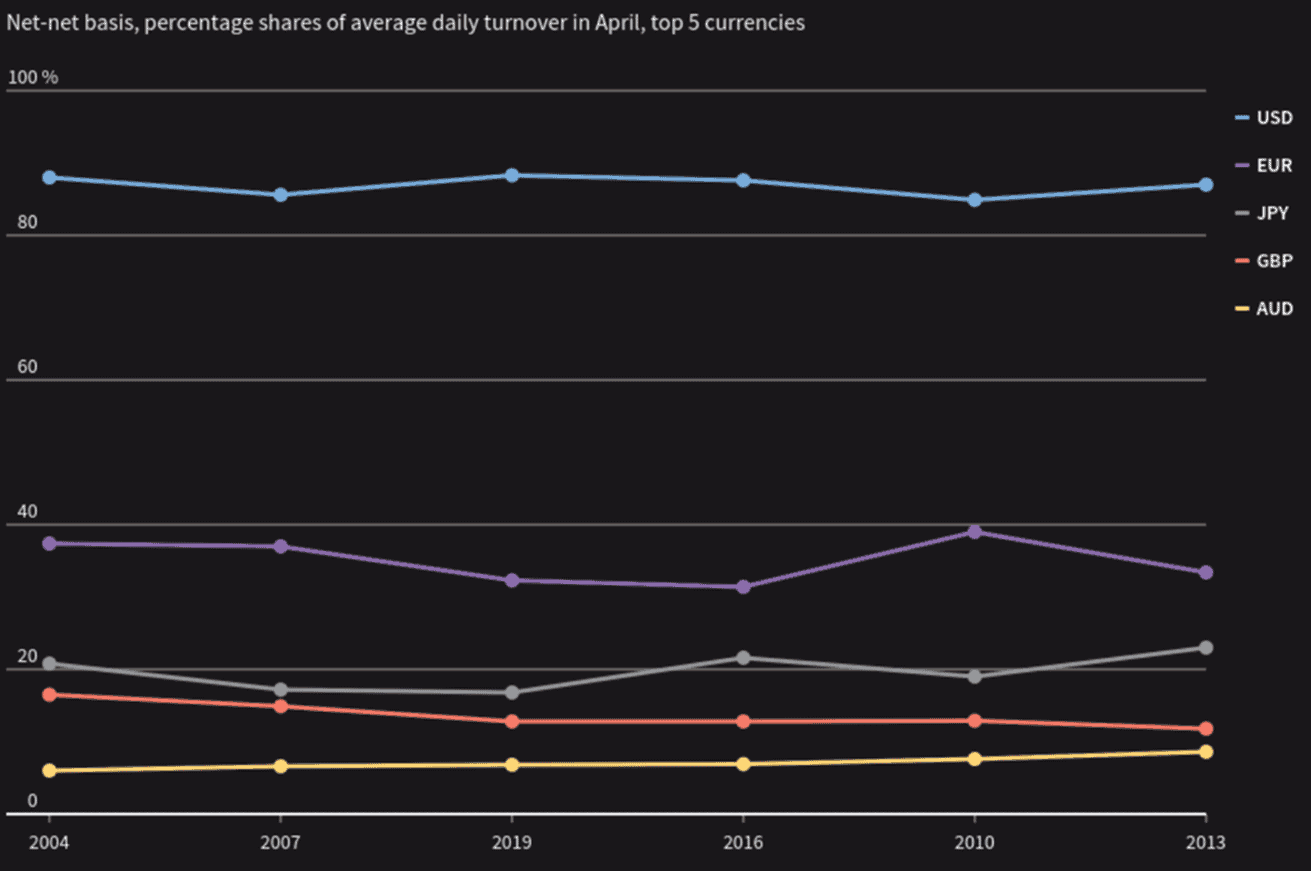

Source Reuters

While this makes the forex markets an often complex and volatile environment in which to trade, these conditions also make it the preferred market of savvy traders.

Getting a handle on the basics of the underlying dynamics of the forex market can take years to master. But with the above information in mind, you should be well on your way to understanding how it works!