A very strong/ bullish consolidation theme has materialised for both Cable (GBPUSD) and the EURUSD spot FX rates in the first part of 2017. Latter Q4 2016 US$ bull trends have been neutralised by US Dollar losses in January.

Furthermore, GBPUSD and EURUSD intermediate-term bearish risks have been rejected, whilst the asymmetric threat moving into February is for more bullish themes to surface.

This still needs follow-through rallies, with a more bullish tone for Cable demanding a push above 1.2775 and for EURUSD a push up through 1.0874.

Read more analysis of the forex market

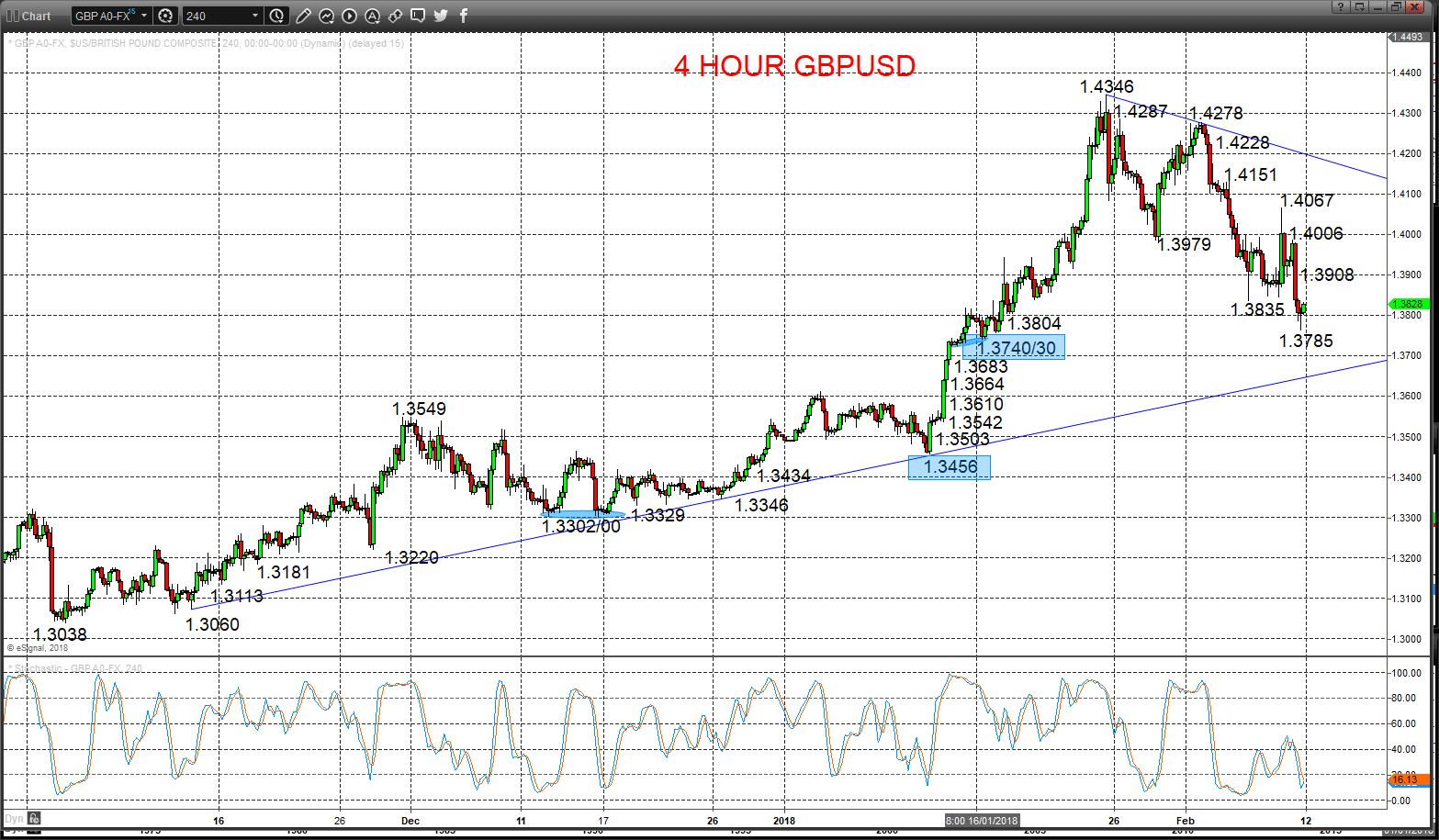

GBPUSD

Despite a setback Thursday-Friday through 1.2550 support, the strong rally from mid-January through multiple resistances from the December-January sell-off, leave a rebound bias Monday.

Furthermore, the push above 1.2432 shifted the intermediate-term outlook back to a neutral range environment (but with intermediate-term risks up to the key 1.2775 level).

For Today:

- We see an upside bias for 1.2605 and 1.2674; break here aims for 1.2724/28, maybe key 1.2775.

- But below 1.2517/15 aims for 1.2470, maybe 1.2417.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.1982 and 1.2775.

Range Breakout Challenge

- Upside: Above 1.2775 aims higher for 1.3000, 1.3121 and 1.3455/3534 area.

- Downside: Below 1.1982 sees risk lower for 1.1943, 1.1880 and 1.1500.

Daily GBPUSD Chart

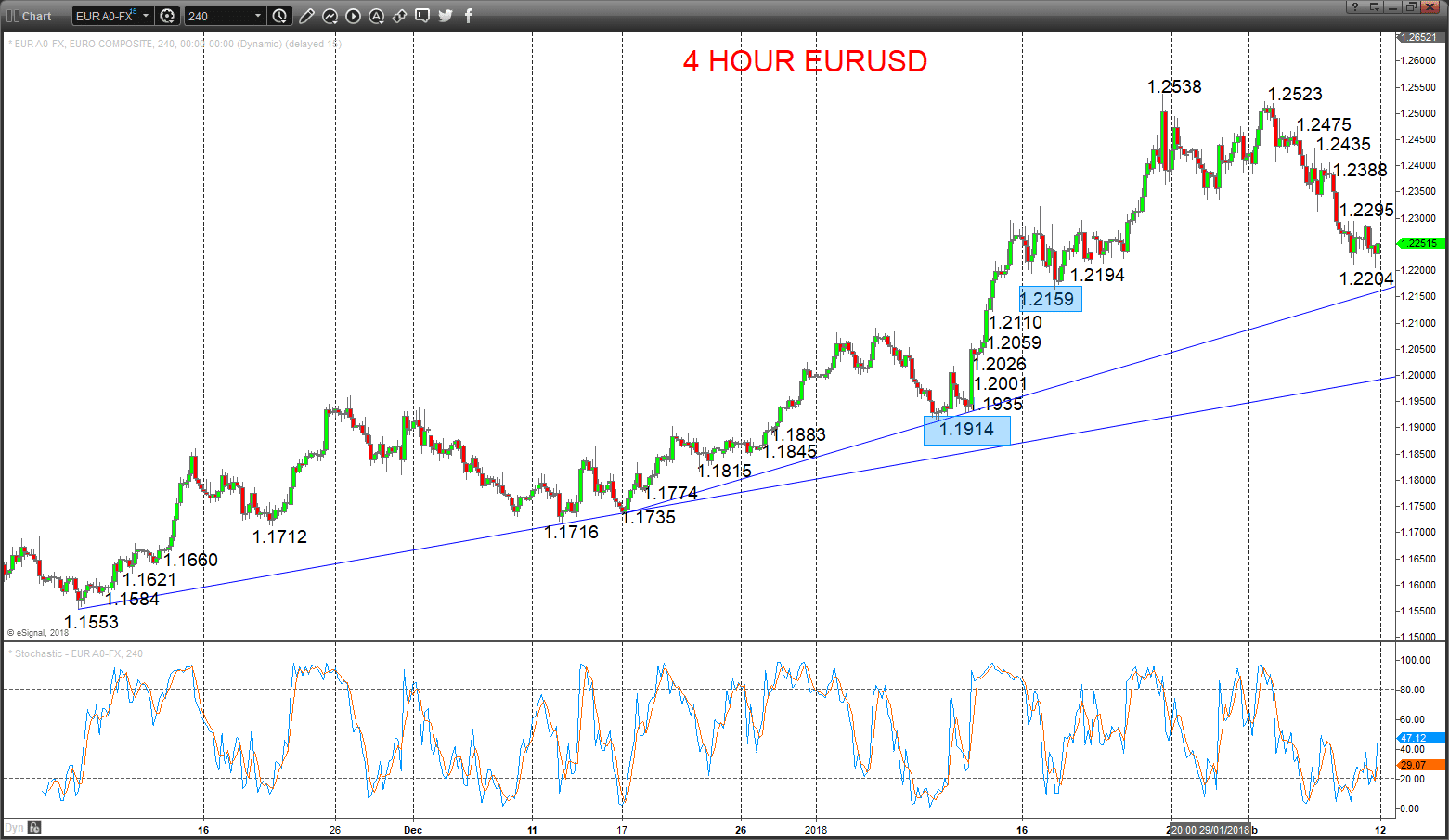

EURUSD

A consolidation Friday after a shift to a slightly more negative near-term tone Thursday below 1.0687, keeping the risk of further losses into Monday.

However, the mid-January push above 1.0653/70 signalled an intermediate-term shift from bearish to neutral, whilst we also see growing Q1 threat for a push up through 1.0874, which would then shift the intermediate term outlook to bullish.

For Today:

- We see a downside bias for 1.0655; break here aims for 1.0623, maybe down to key support in the 1.0588/77/69 area.

- But above 1.0733 opens risk up to 1.0775.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to parity (1.0000) and .9900, maybe as deep as .9610

What Changes This? Above 1.0670 signals a neutral tone, only shifting positive above 1.0874.

Daily EURUSD Chart