Expert’s Viewpoint

Online broker XM has a solid reputation within the trading community for being trustworthy and for offering some of the most cost-effective terms and conditions to clients.

The firm has a global client base made up of beginners and advanced traders who are drawn to the great choice of platforms and high-grade trading framework. As the firm operates in various regions of the world, the exact entity which clients trade through and the regulatory framework they are protected by will be determined by where they live.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

The XM trading experience is one of the best. There is the option to choose between the market leading MT4 and MT5 dashboards, both of which are powerful, robust, and firm favourites in the trading community. There is a focus on trade execution, quality research, and educational support.

Setting up an account is straightforward and there are multiple payment processing options available. The minimum opening balance requirement is low and you can open any of the three accounts XM offers with just $5. Being able to trade in small size can help beginners develop the skills needed to be successful before they scale up their risk-return.

The educational material is well thought out and caters to beginners and more experienced traders and the sites terms and conditions are highly competitive.

There’s a lot to like and not much to dislike. The only downside for many will be the lack of crypto markets but XM is more about providing a quality service to help tip the odds in a clients’ favour. There are after all enough opportunities in the forex, indices, commodities, and stock markets for those who develop the skills to get their decisions right.

In fact, as XM ticks so many boxes, it’s worth visiting the site to set up a Demo account. Spending some time trying out risk-free trading is an excellent way to test your strategies in the markets. You’d also get a better understanding of a broker which is right up there in the broker rankings.

Broker Summary

XM Group is a collection of regulated online brokers. Financial Instruments Ltd was founded in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10).

Financial Instruments Pty Ltd was founded in 2015 and regulated by the Australian Securities and Investment Commission. (ASIC 443670) and XM Global Limited, which is regulated by the International Financial Services Commission with license number IFSC / 60/354 / TS / 19.

The XM family also includes XM Global, a brand owned and operated by XM Global Limited, an authoritative body established in 2017. It is licensed and regulated by the Belize International Financial Services Committee.

Broker Introduction

It’s essential to check the detail of the T&Cs to be 100% sure which entity you will be registered with; however, a rough breakdown is that:

- EU clients – will trade with Financial Instruments Ltd which was founded in 2009 and is regulated by the Cyprus Securities and Exchange Commission.

- Australian clients – will trade with Financial Instruments Pty Ltd, which was founded in 2015 and is regulated by the Australian Securities and Investment Commission.

- Rest of World clients – will trade with XM Global Limited, which is regulated by the International Financial Services Commission of Belize.

CySEC and ASIC are regarded as Tier-1 regulators. IFSC falls into Tier-2 but is considered one of the more robust authorities in that group.

The trading services provided by XM are top-grade, regardless of which entity you are registered with.

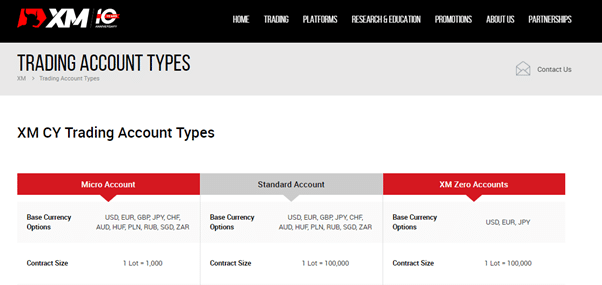

There are three different accounts to choose from. All have the same competitive pricing, all offer an Islamic (swap-free) version, and all have a minimum opening balance of just $5. The broker supports clients in more than 190 countries around the world but US citizens are not eligible.

The Micro and Standard accounts are more ‘entry-level’ in terms of functionality but still have very competitive pricing.

An extensive range of base currency options is a neat feature. Removing the need to convert from one currency to another removes an administrative cost from the equation. Accounts can be opened in a range of currencies including, USD, EUR, GBP, CHF, AUD, HUF, JPY, AUD, RUB, SGD, ZAR, and PLN.

Opening an Account

XM offers one of the fastest routes to setting up a live account. Onboarding starts by clicking on one of the conveniently prominent buttons on the broker’s home page, and stage one involves providing basic contact information, selecting which trading platform you want to use and choosing your preferred account type.

Step two of the onboarding process starts off with new clients being required to select their base currency, preferred leverage terms and confirm they aren’t a US citizen. After that, further information needs to be provided regarding annual income, expected investment amount, source of funds and net worth.

The final stage involves the broker building a user profile so that it can comply with regulatory ‘client care’ protocols. Questions aim to build an understanding of the new client’s knowledge of how markets work and the potential risks involved.

This is all in line with standard market practice and a sign that the broker is well-regulated. There aren’t necessarily any right or wrong answers to the questions asked by the broker and the process is a good way of re-evaluating investment aims.

The broker makes the ambitious claim that signing up to a new account takes only two minutes, and during our testing we found this to be the case. The process is speeded up by there being only two pages to work through. Each page has more questions than at other brokers, but it makes getting through the total number easier to do.

As with other brokers, XM then requires users to verify their account. Some of our testers were asked to go through an additional round of checks related to Common Reporting Standards (CRS) but ticked that box by providing tax id information.

Making a Deposit

Once your account has been verified by the broker, it’s possible to take advantage of an impressive array of payment options. Payments can be made using debit and credit cards, bank transfers or e-Payment agents.

One of the standout features of the platform is the wide number of base currency options available. Funding your account in your own base currency cuts down on frictional forex costs, so the fact that so many are on offer is a big plus point. Those setting up a Micro Account or Standard Account can choose to trade using the following, USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, and ZAR.

Adding funds to an XM account is broken down into three easy-to-follow steps. The first involves selecting the account type and base currency.

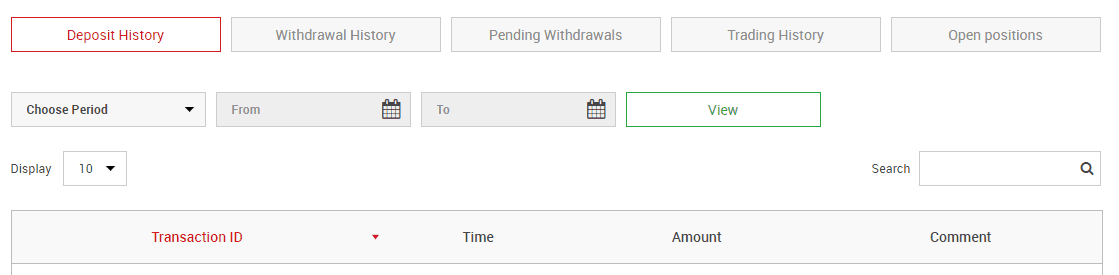

The Deposits section of the site also includes a nice to have monitor, which keeps a clear record of payments into and out of accounts. That’s useful for keeping track of the trading bottom line.

There is one feature of the onboarding process that new clients might want to keep in mind. During the first stages of the process, new clients are asked what payment method they are going to use. Our analysts found that this was binding. So, for example, those that selected debit/credit cards and bank transfer, rather than e-Payment agents, were limited to those options further down the line.

Placing a Trade

XM offers both of MetaTrader’s MT4 and MT5 trading platforms. That means traders get access to a full range of instruments, ranging from stocks and indices to forex and commodities.

The different platforms are offered in a wide variety of ways. Both MT4 and MT5 can be downloaded to desktops, or Android and iOS handsets, and the WebTrader version works wherever there is an internet connection.

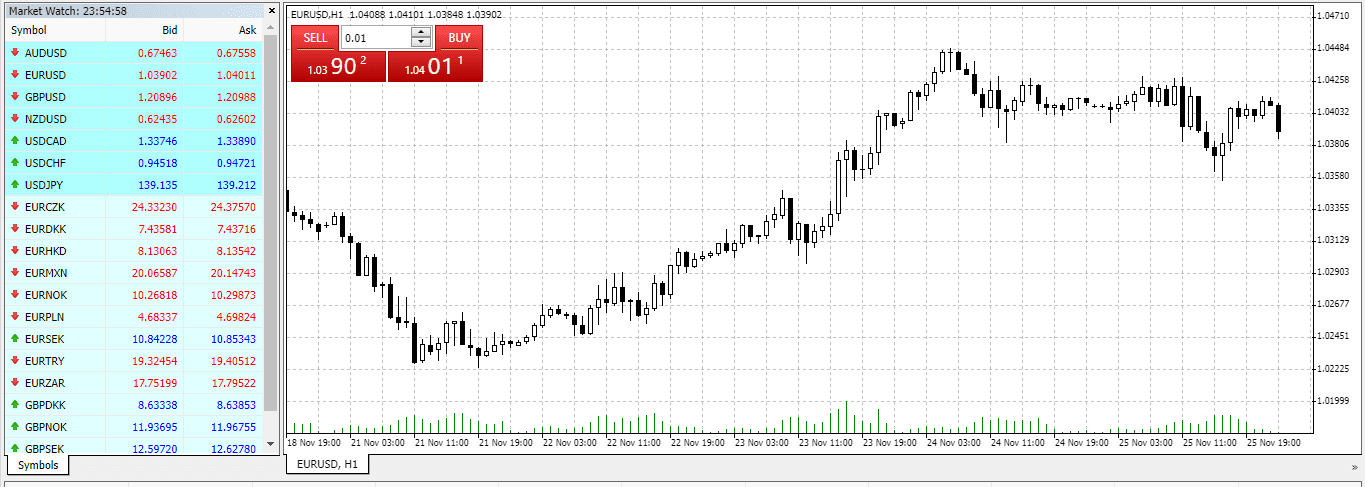

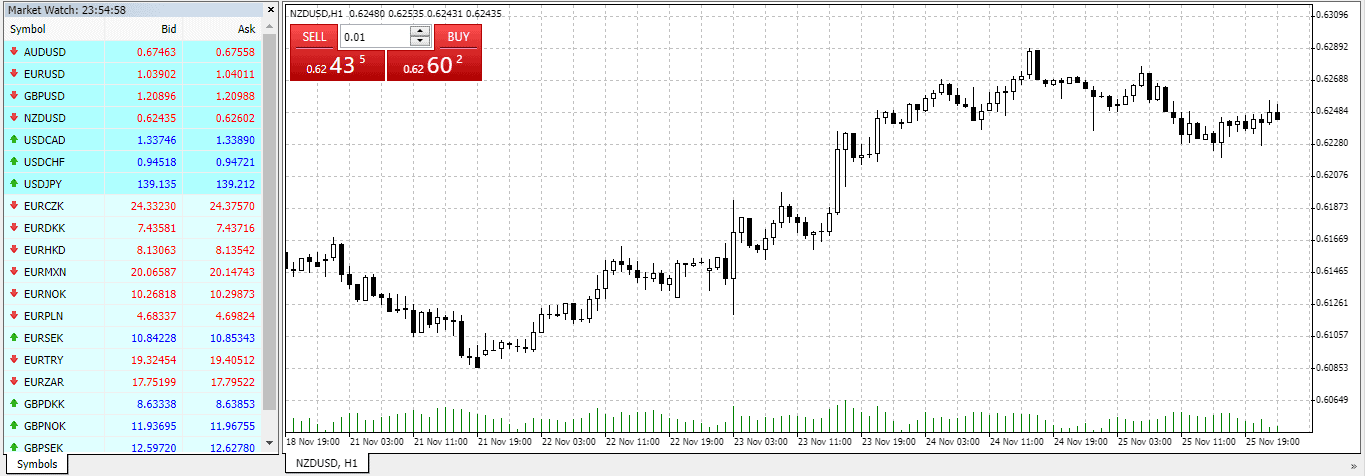

Our test trades on the MT4 platform were in EURUSD and NZDUSD. Both took seconds to book and involved simply navigating to the respective market, inputting the quantity we wanted to trade and clicking ‘Buy’ or ‘Sell’ and then hitting ‘Place Order’.

MetaTrader platforms are renowned for their reliability, which meant we weren’t surprised to see our orders filled and confirmation provided almost instantly.

Contacting Customer Support

XM customer support can be contacted using any of 27 different languages. That is an impressive number when compared to other brokers and reflects the international appeal of the platform.

XM now boasts clients from more than 190 countries and if that level of commitment is important to you and you speak any of the languages that XM provides its services in, it could be the broker for you.

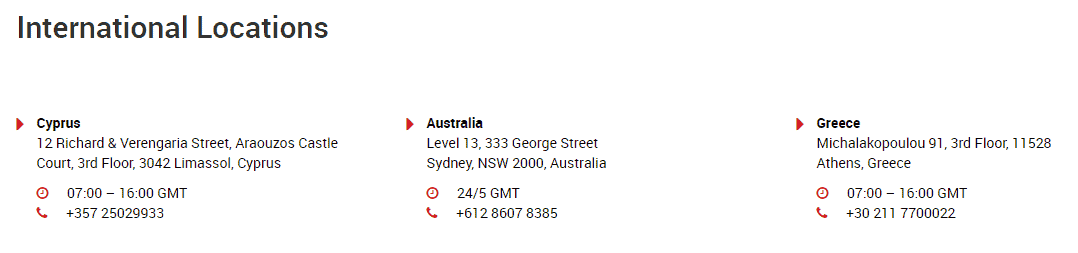

The support team is available Monday to Friday via phone and email. They operate out of a range of locations ranging from Athens to Greece, Sydney and Australia. That ensures round-the-clock coverage and being able to contact a local office can have its advantages.

During our XM review, we posed a variety of different questions and found the response times and approach taken by support staff to be excellent.

Spreads and Leverage

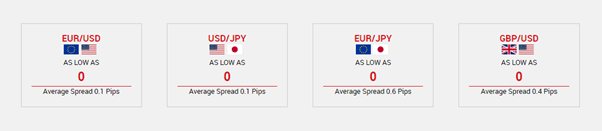

One of the big draws of XM is its tight trading spreads. There are three account types, Micro, Standard and XM Zero. The XM Zero option is a new addition and features ultra-thin spreads, even as low as zero pips in all the major forex pairs.

Experienced traders will share that trading costs aren’t just about spreads; financing costs and quality of execution also needs to be considered and XM rates highly in these areas too. The XM Zero account also comes with features such as VPS trading infrastructure and a ‘no re-quotes’ guarantee.

In line with standard industry practice, leverage is capped at a level set by the regulator. In the EU, for example, the limit is 1:30. Clients outside of Europe might find they can apply even higher leverage than that.

Platforms & Tools

Opening an account at XM will take no more than five minutes. Registration is online and the protocols followed are typical for a regulated broker and include uploading ID to provide proof of residence.

XM supports markets in more than 1,200 financial instruments which can be traded on the ever-popular MT4 and MT5 platforms. XM is particularly good at ensuring that clients can find a platform type which suits them. That is best reflected in the fact that there is a market-leading number of 16 platforms from which to choose. The MT dashboards can be downloaded to Mac or PC; used on Android and Apple handheld devices or accessed in WebTrader format using an internet browser.

Easy access to a variety of platforms gives traders the flexibility to trade from anywhere and at any time. MetaTrader MT4 also supports an unlimited number of demo and real accounts, and Expert Advisors (EAs) for those looking to incorporate the ideas of others in their trading.

Asset groups covered include Forex, Stocks, CFDs, Commodities CFDs, Equity Indices CFDs, Precious Metals CFDs and Energies CFDs.

One area where XM stands out is in terms of quality of trade execution. There are no re-quotes or rejections of trading orders, no hidden fees, or commissions, and 99.35% of orders are executed in less than one second.

Commissions & Fees

Clients can benefit from tight spreads as low as 0 pip on the major currency pairs. The pricing schedules across the three accounts are all competitive and the T&Cs are laid out in a refreshingly clear and transparent manner.

- MICRO account (1 micro lot = 1,000 units of the base currency)

- STANDARD account (1 standard lot is 100,000 units of the base currency)

- XM ZERO account (1 standard lot is 100,000 units of the base currency).

There are generally tight spreads on over 60 currency pairs and the commodities, stocks and indices markets which the broker offers.

XM also provides fractional pip pricing so that clients can trade with tighter spreads and benefit from the most accurate quoting possible.

The process of making deposits and withdrawals is fast and easy. Multiple payment options are supported including, VISA, VISA Electron, MasterCard, Switch, Solo), bank transfer, Neteller, Moneybookers and Skrill.

The recently introduced local bank transfer option enables investors to fund their accounts through their local banks (in 58 countries worldwide) and in their local currencies. There are no hidden fees, or commissions for funds transfers and XM covers all transfer fees.

Account funding is 100% automatic and is processed 24/7, while same-day withdrawals are guaranteed, except for bank wire transfer.

Education

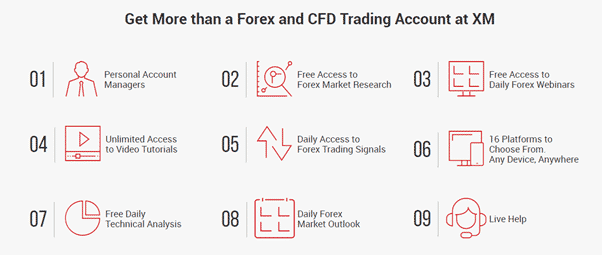

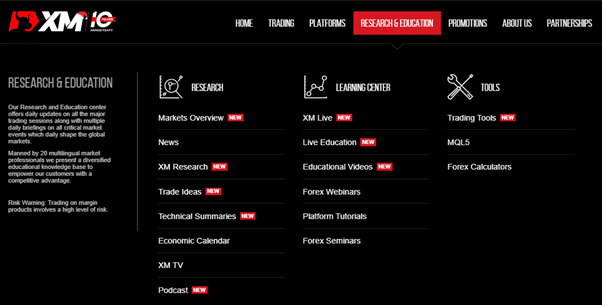

A wide range of educational material is freely available. It covers the basics of ‘how things work’ and moves on to more advanced presentations on trading strategies and advanced analysis.

There are podcasts, free weekly interactive webinars, and Q&A sessions as well as all the research developed and shared by MetaTrader on their MQL5 platform. The neat feature of the educational materials is that is well thought out and offers some structure to new clients starting out on their trading ‘journey’.

The research is designed to help you trade. The multilingual economic calendar, along with forex news and market analysis reports provided by XM’s in-house experts, enables you to follow market changes and to adapt trading decisions accordingly.

Customer Service

Multilingual Personal Account Managers are available to holders of both demo and live accounts. They can be contacted via live chat, telephone, or email in over 25 languages including English, Greek, Simplified Chinese, Traditional Chinese, Bahasa Malay, Bahasa Indonesia, Korean, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Portuguese, Czech, Slovakian, Bulgarian, Romanian, Bengali, Urdu, Thai, Nepali, Tagalog, Vietnamese, Cebuano, and Serbian.

The geographical coverage is impressive but also high quality with professional support available 24-hours a day from Monday to Friday.

Additional extras include Phone Trading. Being able to contact a dealing desk can be a deal-breaker should your IT systems go down. There are also Personal Account Managers to help guide you through the markets.

Compare XM Group with other approved brokers

|  |  |  | |

| Regulation | CySEC, IFSC, ASIC | ASIC, MiFID, FSA, FSCA | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA |

| Customer Support | email, phone | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, cTrader, TradingView | MT4, MT5, WebTrader |

| Minimum Deposit | $5 | $100 | $200 | $100 |

| Leverage | 1:30 *This leverage applies to clients registered under the EU regulated entity of the Group. (up to 1:888 for Pro-Clients) | 400:1 | 1:30 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) |

| Total Markets | 1340 | 1260 | 1200 | 637 |

| Total Currency Pairs | 57 | 55 | 62 | 62 |

| Total Cryptocurrencies | 0 | 17 | 18 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) |

Final Thoughts

XM will appeal to both beginner and seasoned traders. Low-cost trading never goes out of fashion, but XM is much more than a no-frills operation. Registration is available in 23 languages and the fact that trading can be started with a minimum deposit of $5 is a positive feature. Beginners especially are encouraged to start small and to stay that way until their trading results justify scaling up on positions.

XM has been around long enough to be considered established. It still has the feel of a next-generation broker providing clients with a range of progressive and innovative features.

The firm continues to receive recognition in terms of positive client feedback and industry awards. It’s easy to see why.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Broker Details

- Company Name: XM Group

- Founded: 2009, 2015 and 2017

- Country: Cyprus, Australia, Belize

Contacts

12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042 Limassol, Cyprus.

+357 25 02 9933

FAQ’s

How Can I Open A Demo Account With XM?

A Demo account is easy to set up and can be found at the Open An Account section of the XM site. They are free to use, and new clients get $100,000 in virtual funds to practise with.

Does XM Offer An Islamic Account?

Yes. XM offers three types of account, Micro, Standard and Zero. Each one of these three can be set up for Shariah compliant swap-free trading.

What Are The Deposit Options For XM?

Clients of XM can set up their accounts in a wide range of base currencies. USD, EUR, GBP, CHF, AUD, HUF, JPY, AUD, RUB, SGD, ZAR, and PLN can all be used. Funds can be paid in using debit card, credit card, bank transfer or ePayment systems.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts