For some reason, we truly enjoy reading about major financial frauds, as if it is some kind of entertainment at the expense of someone else’s pain and suffering. These train wrecks, however, can be brutal to those involved and take years to unravel and resolve. There are also bitter lessons to be learned, not just for the wounded, but also for the general public at larger. Make no mistake about it – Major frauds are broad in nature, very sophisticated, and difficult to detect in their early stages.

Over the past decade, U.S. regulators were both shocked and astounded by three major con games — Peregrine Financial Group (PBG), MF Global (MFG), and the Bernie Madoff Ponzi scheme. In each case, the firms were in the money management business, but proprietary trading, while using customer account monies as a bridge for collateral, caused ethical problems down the line when fiduciary safeguards were ignored. In each case, the businesses had long family histories, where the original founders had begun with only the best of intentions. These intentions changed over time, resulting in massive fraud.

In each case, investors have been extremely fortunate due to the aggressive actions of bankruptcy trustees to retrieve stolen assets and provide a substantial recovery pool for client payouts. In most cases of fraud on this grand a scale, there is very little left after court costs, fines, and penalties, such that, as large as these frauds were, there was an uncharacteristically high level of restitution.

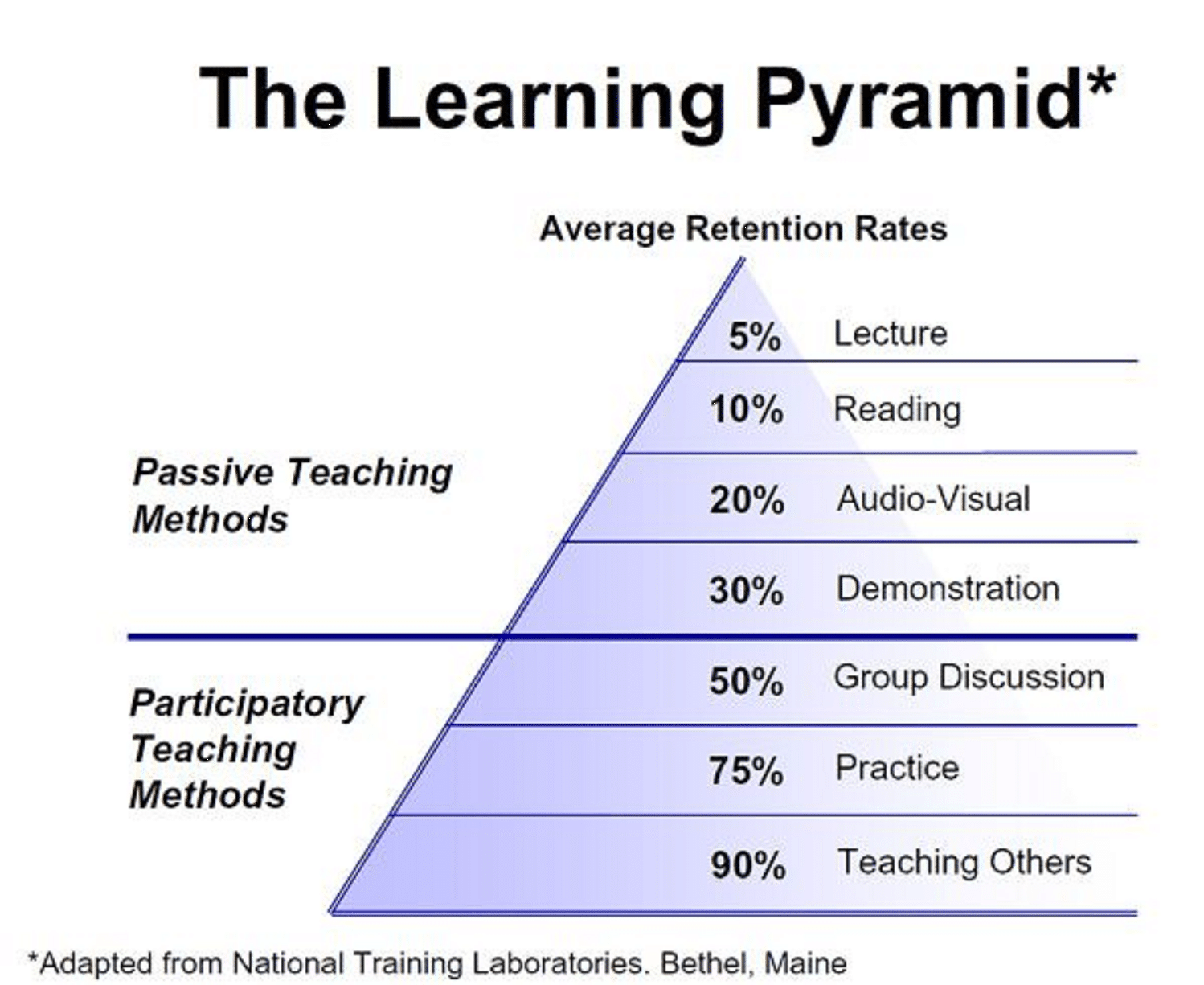

There are also many lessons to be learned when delegating the management of your hard-earned investment capital to a third party. Trust is the major issue. In each case, again, there were signs of financial abuse that were either missed or ignored by both customers and regulatory staff. Learning and retaining, however, are two different things, as this simple diagram attempts to demonstrate:

As much as we try to learn how to manage our investments on our own or to attempt active trading on an individual basis, retaining what we learn over time is difficult at best. Unless we actively participate with the information in some manner, we are continually confronted with how difficult the task is. When most of the investing public reaches this same conclusion, they immediately choose an independent money manger to handle the task of managing their money.

In many ways, this is the right decision to make, but there is still a boatload of risk to be concerned about over time. Who and how do you choose a trustworthy money manager or investment fund, for that matter? If you go with the large national firms, the ones that advertise on television, then will their brand strength may protect you? Unfortunately, smaller boutique firms tend to advertise that they can make higher returns for lower fees, which easily appeals to the greed in each and everyone of us.

The stories that follow will hopefully educate you on the major risks involved and how even family-run operations can break down when the going gets rough. Here then are brief synopses on where these three major frauds have evolved over time.

Peregrine Financial Group (aka, PFGBest)

Known by its detractors as the “best company for making your money disappear”, PFG was the brainchild of Russell R. Wasendorf, Sr., now 67 years of age and serving out a 50-year sentence in Federal prison. Founded in 1980 as an advisory firm in Cedar Falls, Iowa, PFG followed closely the pricing behavior in commodity and other financial markets and sold forecasts of future price action to a loyal customer base. The firm grew quickly, expanding to include customer account management and a broad network of futures and option brokers.

The company earned many awards over the past two decades and was exceeded in size only by MF Global, as one of the largest non-bank, non-clearing Futures Commission Merchants (FCMs). All was good until July 9, 2012 when Black Hawk County Sheriff’s deputies responded to frantic calls from Peregrine headquarters. They soon found an unconscious Wasendorf slumped in his car with a tube connected to its tailpipe. In a suicide note to his family, he admitted his crimes of forgery, embezzlement, and falsifying client account statements.

Although he first pleaded not guilty in court hearings, Wasendorf finally “pled guilty to federal embezzlement charges Sept. 14, 2012, in the Northern District of Iowa, for which he was sentenced to 50 years in prison and ordered to pay $215 million in restitution.” He is currently serving out what is expected to be a life sentence in a high-security federal prison in Terre Haute, Indiana.

Michael Eidelman, the court appointed receiver for the PFG bankruptcy was not hopeful after his initial review of the situation. “He lived very big and very showy, and unfortunately there is very little left. You wouldn’t have thought it would be possible to spend $200 million, but there was a succession of absolutely horrible deals.” Contrary to initial findings, however, Eidelman has been able to recover 49 cents on the dollar to date and, accordingly, former clients have received at least partial account refunds.

MF Global and the missing $1.6 billion

The MFG story is another kettle of fish entirely. Although both stories broke at the same time, the $1.6 billion in missing MF Global funds easily overshadowed the paltry $220 million scandal over at Peregrine. With MFG, you were dealing with a firm with a global footprint, and, as was written in the press, “Some commentators have suggested the failure of MF Global highlights the difficulty in regulating complex global financial firms, the dangers of off-balance-sheet accounting as well as touching on the European sovereign debt crisis.”

MFG was actually spun off in 2007 from the Man Group, a firm with a long-standing history in the sugar trades in England dating back to 1783. MFG was the brokerage end of the business that focused on commodities and global financial services, but within its first year of independence, a rogue trader broke the rules while software controls were under maintenance and lost $141 million. Investigations ensued, and fines were assessed, an early sign that MF Global may be more risky than appeared on paper.

The firm apparently weathered this storm for a few years, but, in 2011, liquidity problems reappeared after the company went overboard betting on sovereign debt issues in Europe, accumulating an enormous debt load to buy bonds that were being beaten down in the markets. It soon came to light that MFG had bet $6.3 billion on securities issued by Europe’s most indebted nations. When these securities fell in value, illegal transfers from customer accounts were made to keep the ship afloat. All came to an end on October 31, 2011. MF Global filed for Chapter 11 bankruptcy protection. Customers sustained losses of $1.6 billion.

Asset liquidation followed. James W. Giddens, the judge acting as trustee for the bankruptcy process, was amazed at how the MFG proceedings achieved a positive result. “The liquidation of MF Global Inc. is now essentially complete. The liquidation’s outcome — with customers and secured creditors completely satisfied and unsecured creditors receiving a near full recovery — was unimaginable when the proceeding began less than four years ago with revelations of a massive segregation failure. More than $8.1 billion will have been distributed to MFG creditors and customers once the final distribution is complete.” Lawsuits are pending, but no one has been incarcerated.

Bernie Madoff – “The largest financial fraud in U.S. history”

Bernard Lawrence “Bernie” Madoff, born in 1938, founded “Bernard L. Madoff Investment Securities LLC” in 1960, a Wall Street market making and asset management firm. In court documents, Madoff claimed to have never actually traded on behalf of his clients, but awarded them higher than market returns for decades. He also claimed that his massive Ponzi scheme did not begin until 1991, but investigators believe that it could have been in effect as early as the seventies.

He employed family members in nearly all of his senior executive positions, but as often happens during a Ponzi scheme, the Great Recession triggered an avalanche of redemption requests in late 2008. He confided in his two sons on December 11, 2008 that he had over $7 billion in liquidation requests that he could not meet and that his entire operation was “one big lie”. His sons notified authorities, and the FBI arrested Madoff the very next day. He confessed, was convicted, and is serving out a 130-year sentence in a Federal prison in North Carolina, where he says he is treated “like a Mafia Don… It’s much safer here than walking the streets of New York.”

Initial estimates of the size of the Madoff con game were put at $65 billion, but this figure includes the fictitious gains that he posted to falsified account reports. A more realistic figure, based on actual cash deposits, is $17 billion. Luckily enough for creditors, the estate for a deceased alleged co-conspirator of Madoff’s, Jeffrey Picower, refunded $7.6 billion in phony profits to the bankruptcy trustee. This incredible amount exceeded the entire total pocketed by the Madoff clan over the life of the Ponzi scheme. To date, roughly 65 cents on the dollar has been refunded to creditors, an amazing victory, but a shortfall of $6 billion still exists. The Madoff family may be ashamed, but its lifestyle has surely been grand.

After roasting Madoff in the press, the spotlight soon focused to the incompetence of our regulators: “The SEC was criticized for its lack of financial expertise and lack of due diligence, despite having received complaints from Harry Markopolos and others for almost a decade. The SEC’s Inspector General, Kotz, found that since 1992, there were six botched investigations of Madoff by the SEC, either through incompetent staff work or neglecting allegations of financial experts and whistle-blowers. At least some of the SEC investigators doubted whether Madoff was even trading.”

Concluding Remarks

Peregrine Financial Group, MF Global, and the Bernie Madoff Ponzi scheme will go down in history as three of the most insidious financial scandals of the past decade even though the roots of each extended well back in time. Each one illustrates that even having the best regulators on the planet will not protect you from outright fraud. Money management firms, unfortunately, present a highly enticing temptation for fraudsters, since client deposits create a level of float that can last for years.

Be careful with third parties that have your deposits. Be ever vigilant and alert to issues that appear in the press, and take action before it is too late. Stay skeptical!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox