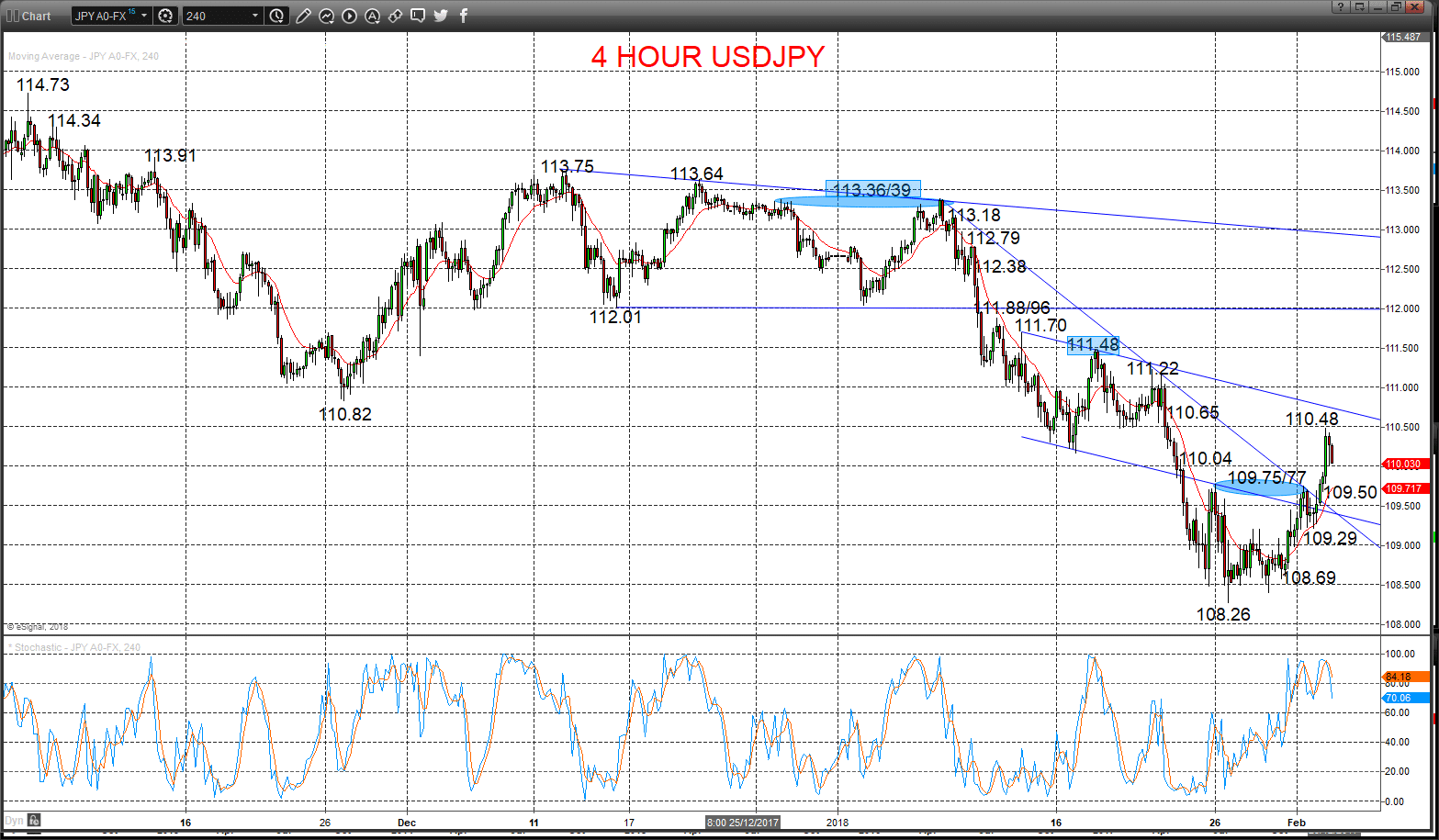

- A notable rebound for USDJPY since the Fed Meeting on Wednesday 14th June, which is questioning the intermediate-term bearish trend, though a shift back to a neutral tone still requires a push above 112.13.

- However, for USDCAD, rebound activity has been lacklustre at best, leaving the intermediate term outlook still bearish into the second half of June.

See all forex articles.

USDJPY – Upside risks

Despite a setback on Friday, the strong push higher from midweek and the Fed Meeting through the downtrend line from mid-May and 110.81 resistance, leaves the threat to the upside into Monday.

Furthermore, risk is now going through push up to challenge 112.13, through which would see an intermediate-term shift from bearish to neutral.

For Today:

l We see an upside bias for 111.42 and the 111.71/80 area; break here aims for critical 112.13.

l But below 110.47 opens risk down to 110.18, maybe towards 109.60.

Intermediate-term Outlook – Downside Risks:

l We see a negative tone with the bearish threat to 108.10.

l Below here targets 107.19, 105.99 and 104.93.

What Changes This? Above 112.13 signals a neutral tone, only shifting positive above 114.37.

4 Hour USDJPY Chart

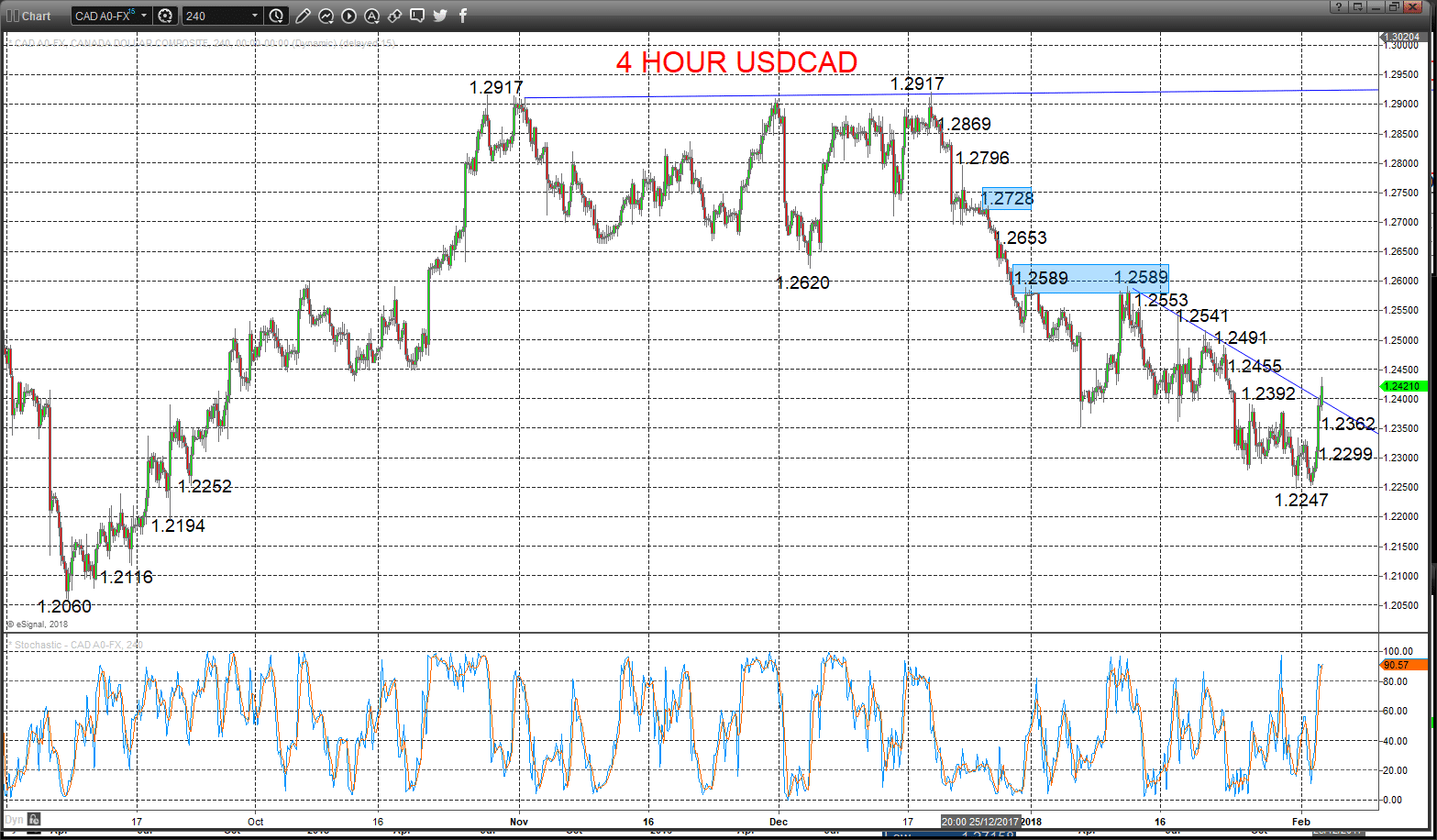

USDCAD – Downside bias

A push lower Friday as expected below 1.3220 support, rejecting the Wednesday-Thursday rebound, maintaining negative pressures into Monday.

Furthermore, the June push below 1.3219 signalled an intermediate-term bearish shift.

For Today:

l We see a downside bias for 1.3200; break here aims for 1.3163/60.

l But above 1.3308 targets 1.3342; above here sees little significant resistance up to 1.3470.

Intermediate-term Outlook – Downside Risks:

l We see a negative tone with the bearish threat to 1.3002/00 and 1.2965.

l Below here targets 1.2759 and 1.2676/51.

What Changes This? Above 1.3050 signals a neutral tone, only shifting positive above 1.3794.

4 Hour USDCAD Chart