81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Financial press headlines in the forex space of late have been replete with discouraging tales of closures, relocations, major regulatory assessments, shady business practices, and even outright fraud, but there is one exception to this negative diatribe – Plus500. Back in 2015, this broker became the whipping boy for the FCA, as it flexed its muscles in a highly publicized attack on this firm for what appeared to be minor compliance violations. Plus500 shares tanked on the London Stock Exchange. Shareholders shuddered, as roughly $650 million in market value went up in smoke. Merger talks with Playtech ensued, but failed. Plus500 seemed destined for the scrap heap.

Amidst this carnage, however, Plus500 has made an amazing comeback over the past two years. Investors that kept the faith have been rewarded handsomely, as share prices regained their former glory. Headlines now read, “Plus500 sees record Q2 revenues above $100 million on new customer growth,” or better still, “Plus500 Success Story Unabating, Shares Spike 20% as Margins Thicken.” If ever there was an example of disaster and then recovery, the Plus500 tale is worthy of any textbook on the subject. It has faced the Grim Reaper, survived, and then achieved prosperity against all odds.

After its latest earnings release, a very positive one indeed, share prices rose to 745 pence, just shy of its record price of 775 pence, achieved back before the debacle in 2015. As noted in the press, “The company’s market cap is currently £888 million ($1.15 billion). All time highs are within reach once more, just six months after the firm’s share price was halved in the aftermath of the FCA’s decision to review retail foreign exchange and CFD trading.” Did we forget to mention that Plus500 also recovered from a second surprise attack on the forex industry by the FCA last December?

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What happened to Plus500 in 2015 and why was the FCA so bellicose?

2015 was not a good year for the foreign exchange industry. 2014 had just concluded with $5.5 billion in assessments being levied on five global banks (JP Morgan Chase, UBS, Barclays, Citicorp, and RBS) for conspiring in their respective backrooms to fix forex rates to their advantage. The scandal, the largest in forex history, had been ongoing for five years without detection, as regulators turned a blind eye to the activity. When the news broke, public condemnation was meted out on all fronts.

2015 began with Swiss Central Bank officials lifting the Swiss Franc peg to the Euro, without any prior notice and in direct opposition to stated public policy. Brokers and traders were caught flatfooted in a major debacle of immense proportions. Billions were lost in a heartbeat. Brokerages, hedge funds, and financial institutions were not immune to the shockwave that leveled the industry. Closures, mergers, and bankruptcies ruled the headlines. Regulators suddenly had their hands full trying to assess the damage and assure the public that brokers in their jurisdictions were adhering to safety and soundness principles. The casualty rates in the industry were enormous and random.

Amidst this backdrop, regulators were embarrassed. The press had a field day, claiming that regulatory officials had been asleep at the wheel. Reputations had been tarnished, but not for long. The FCA, for one, came out with both fists swinging. Its first victim became Plus500, a fast growing, high-flyer on the London Stock Exchange. During a routine audit in 2014, as many surmised, the management team at Plus500 had been warned that new client identity documentation was sorely in disarray and needed attention. The firm was given six months to clean up its act or else.

The “or else” part of the FCA’s instructions or the conviction of the regulator to follow though with draconian actions must not have seemed convincing to the powers that ruled the roost at Plus500. The firm plodded along and missed the 15 May deadline. The Financial Conduct Authority struck with a vengeance over the weekend, freezing client accounts and blocking any new solicitations by the firm. When word got out on the 18th of May, share values went into a 39% tailspin on the exchange.

Public companies are generally held to a higher standard by the law than most private firms, since investments of ordinary investors are at stake. Executives are particularly focused on reputation risk, as a single bad rumor or story can send stock prices into the tank and create liability lawsuits that will not quit. As a result, the typical reaction of most public boards is that heads must roll in the C-Suite, in accordance with Medieval fashion. Such was not the case with Plus500. The CEO, Gal Haber, was a co-founder, and he had handpicked the chairman, Alastair Gordon, to assist in his venture.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

A rather hurried release read, “Founder and chief executive Gal Haber and chairman Alastair Gordon have retained their positions, but have agreed to waive any approved pay increases until after the current controversy has been fully resolved. According to Gordon, the firm “has taken a number of lessons away from this current situation and is determined to restore Plus500’s business to full health. We assure customers and shareholders that Plus500 has a sustainable business model and is managed and governed by a board which is committed to transparency and robust compliance.”

The firm may have been crippled, but it actually was in good financial condition. It could respond to the FCA and did so by committing more resources to the task, but it would take precious time to work through its documentation backlog before it could again rebuild its client base. Consequently, Plus500 became an enticing takeover target. As we wrote: “Playtech, “the world’s largest online gaming software supplier traded on the London Stock Exchange Main Market,” has gobbled up the firm with a takeover bid of £459.6 million ($702.05 million).”

Plus500 management and board had ostensibly thrown in the proverbial towel and chosen the merger route, as an expedient way to deal with shareholder and customer complaints. A calmness had returned, and everything appeared to be going along smoothly. Teddy Sagi, the Israeli billionaire and precocious founder of Playtech, and his firm had received approvals, many unanimous, to proceed with its merger of Plus500.

In November, unfortunately, the merger fell apart: “A £460 million trading takeover that lit up the City just got killed and shares are crashing — Playtech gives up on £460m Plus500 takeover.” Teddy Sagi had run into regulatory roadblocks on several fronts, due perhaps to Mr. Sagi’s lurid past. It was soon revealed that he was a convicted felon. When Sagi was a young investment manager in the nineties, he had consorted with a group of banking executives to pump-and-dump bond securities for a tidy profit. He confessed and was convicted of bribery, securities fraud, and aggravated fraud, then served a nine-month sentence and was fined NIS 300,000.

Plus500 was suddenly independent and rejuvenated

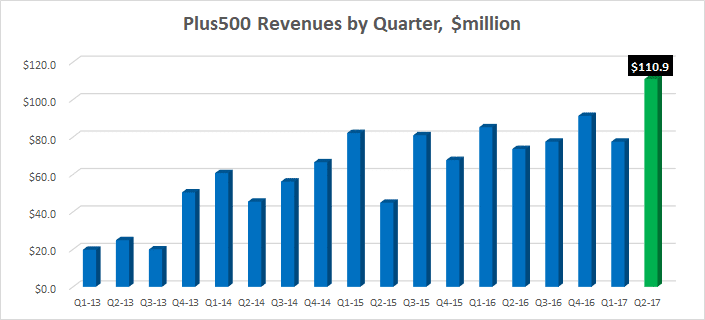

While the press had focused on Teddy Sagi and Playtech, Plus500 was busy in the background repairing its internal damage. When the merger “chains” were released, 2016 became a rebuilding year. Company revenues may have taken a hit in the second quarter of 2015, but after the regulatory shackles were removed, the firm jumped back into action. The firm’s business model was definitely sustainable, as its chairman had assured. That fact is borne out by the chart below:

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Record revenue is the story of today, exceeding $110 million for the second quarter of 2017. At the end of the day, revenue dynamics are the best measure of a company’s true health, and Plus500’s revenues have been growing rapidly for years, indicative of a loyal fan base and an attractive set of products and services. 2016 soon became a year of change, both at the senior executive level and with investors, as well.

In February, CEO Gal Haber announced that he was stepping down after eight years of service. Asaf Elimelech, head of Plus500’s Australian subsidiary, was promoted to CEO of the group, while Haber remained a director on the board. A year later, the chairman, Alastair Gordon, would part ways with the firm, and Penelope Judd, a director at the time, assumed the chairperson’s role.

Changes in senior management can be a healthy move for a fledgling enterprise, but, in the case of Plus500, the engines had already been primed in 2015. Revenues and share prices continued to recover during the ensuing twelve months, until the FCA and CySEC rocked the forex world by proposing new regulations that would constrain marketing practices and restrict prevailing levels of leverage. The surprise came in December. Share prices across the industry were decimated. Revenues in the first quarter of 2017 for the firm also dipped by 15%.

The FCA and ESMA have subsequently agreed to delay implementation of new rules regarding forex and CFD trading until 2018. The Plus500 reaction was supportive: “Plus500 embraces this more coordinated approach by ESMA and the FCA for the betterment of the trading industry and a more unified code of conduct across all European jurisdictions. The group also feels that its business model makes it strategically placed to thrive in a newly revamped playing field, one that will place a greater emphasis on compliant providers.”

Although competitors face many headwinds, analysts view Plus500 as ahead of the pack: “The industry-wide regulatory crackdown and declining trading volumes have been squeezing margins at many FX and CFDs brokers, but Plus500 remains insulated from all that. All time highs are within reach once more, just six months after the firm’s share price was halved in the aftermath of the FCA’s decision to review retail foreign exchange and CFD trading.” Despite several body blows, Plus500 refuses to go down for the count.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Concluding Remarks

Plus500 is once again the “darling” of the analyst community in London. Per one stock reporter: “Plus500 is an incredibly attractive opportunity, but the full effects of the regulatory changes will be unknown for at least another 12 months. Having said that, at 7x earnings and yielding almost 9%, much of the uncertainty is already baked into the share price. Management is planning for what will inevitably happen, but we have no idea how much regulation there will be.”

The forex industry has been in need of a few success stories, and Plus500 has definitely been one of those over the past two years. Can the management team keep steam in the boiler? Per the same analyst: “With the stock so cheap, Plus500 could be worth the risk, but as it’s up 55% in 7 months, I’d wait for a pullback.” Proceed with caution.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox