It is often difficult to recover from a bad first impression, but CySEC, the forex regulator for the island community of Cyprus, is trying its best to do just that. For years, this regulator was lauded for its leniency and its pro-business attitude, but, after the financial crisis that shook the island in 2013, CySEC officials have made a demonstrative attempt to join the ranks of respectable regulators like the FCA and CFTC, choosing to adopt more stringent licensing guidelines and operating regulations for the financial services industry. Their focus of late has been foreign exchange brokers, primarily binary option dealers that proliferate this EU member state to gain easy access to the EU market.

Bank in 2013, we commented, “Attracting clients to sign up with an overseas broker, however, requires a broader set of features and the presence of an active regulatory body to ensure safety, soundness, and integrity, if one is to contemplate dealing with a broker in another legal jurisdiction. Cyprus has opened both doors — flexibility in legal and tax matters and an active regulatory commission on site. Both large and small brokerage firms have set up shop on the tiny island, and new entrants appear weekly.”

The financial crisis of 2013 actually had nothing to do with the forex industry. The two largest banks in Cyprus had invested far too heavily in Greek bonds, which depreciated enormously when default was the only option. One bank was closed, while the other was taken over by the state. Draconian measures followed, and depositors lost millions when haircuts were mandated. Cyprus Investment Firms (CIFs) that did not segregate deposits in offshore banks were driven into the ground.

The reputation of CySEC, as being the perceived lax and lenient friend of island entrepreneurs and marketing executives, was tarnished in the process, but its officials committed to overhaul its regulations and to tighten its regulatory oversight in the months to come. It has slowly made a comeback, but its steady and gradual recovery was once again degraded, when the ugly underbelly of the binary options industry was exposed in a series of articles in the Times of Israel. A tsunami of consumer complaints swamped the desks of every European regulator with the fickle finger of fate pointing at CySEC.

What did CySEC officials do to repair the damage in 2013?

At the end of March in 2013, Cyprus required a €10 billion bailout, arranged by the Eurogroup, European Commission (EC), European Central Bank (ECB) and International Monetary Fund (IMF). Austerity measures would follow. The Bank of Laiki was closed, and the Bank of Cyprus, the largest bank on the island, was allowed to remain open, but only after a 48% haircut on uninsured deposits. The Cypriot economy has remarkably recovered. “In terms of speed, its recovery has been extraordinary,” said Hubert Faustmann, professor of history and political science at the University of Nicosia.

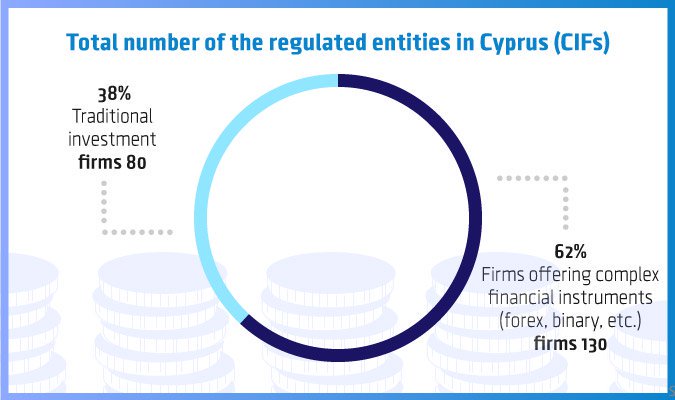

How did CySEC change? As we reported, “CySEC also beefed up its oversight activities. A host of new warnings have been issued to offending firms, and new regulations have been issued and old ones, tightened. The “lax” description that had existed before has now been dropped, and, consequently, new investment capital and license applications have flooded the island.” The exodus was halted, and CIFs now employ an estimated 5,000 workers, as before. Forex related firms still dominate the island’s CIF portfolio, as depicted below:

CySEC’s recovery mirrored that of the Cyprus economy. It quickly went from being the “class clown” to receiving praise for its adoption of more strict regulations. But, all was to change in a heartbeat in 2016, when the sordid business practices of many binary option brokers were exposed: “Praise turned to criticism, however, when the recent tirade over bad practices in the binary options space erupted. CySEC was one of the few major brokers with oversight over the digital arena and became an obvious target for having allowed such bad behaviors to persist and grow well beyond acceptable limits.”

What have CySEC officials done to repair the damage this next time around?

Did the fraudulent binary option business practices originate in Cyprus? From reports on the topic, it seemed that aggressive marketing campaigns and the organized fleecing of unsuspecting customers was performed by “a vast criminal enterprise, employing thousands of people in over 100 companies, many of them in Israel, but also in countries like Romania, Bulgaria, Ukraine and the Philippines.” The names on the storefronts of many of these foreign-based entities, however, belonged to CIFs in Cyprus. The fact that these firms had outsourced these activities to offshore companies, far from the regulator’s eyes, was the poignant issue. CySEC had been none the wiser.

The FCA in the UK, as well as many other national regulatory bodies, went on the attack, warning consumers to beware of aggressive sales tactics from unauthorized foreign firms. The reckless nature of the situation demanded that operating rules and client acquisition methods be severely tightened. As a result and in almost a coordinated fashion, the FCA and CySEC independently delivered a December broadside to the forex industry. While the FCA muddled through a proposal for comments directed at CFD brokers, CySEC took a more aggressive stance.

The FCA and several other regulatory agencies have limited oversight responsibilities at the moment. Binary options, in these cases, fall under the local Gambling Commission, which is more interested in fee income for the government, rather than curbing the average Joe’s tendency to gamble. CySEC is different. They oversea spot forex, binary options, and CFDs: “Their published circular gives forex and binary option brokers until January 30, 2017 “to take the appropriate measures and actions in order to operate with the new rules”, related to bonuses leverage, and fund withdrawals.”

CySEC ordered brokers to “avoid the practice of offering bonuses that are designed to incentivise retail clients to trade in complex speculative products such as CFDs, binary options and rolling spot forex as it is unlikely that a firm offering such bonuses could demonstrate that it is acting honestly, fairly and professionally and in the best interests of its retail clients”. They also limited leverage to “50:1”, unless the customer requested a higher level after an appropriateness test was performed. Withdrawals must be processed in 24 hours, and negative balance protection must be in place.

What has CySEC done in 2017 to further its goal to protect consumers?

CySEC officials have not chosen to sit on their hands at this juncture. There has been a flurry of activity of late from fining offenders to distributing additional guidelines that must be enacted by the brokerage community post haste. If many firms had underestimated the will of the CySEC Chairperson, Demetra Kalogerou, who could easily pose as a poster model for a Greek Tourist Bureau, then they have quickly recognized that they are dealing with one very determined and no nonsense woman.

In early February, she issued a new circular “relating to sales and marketing practices, outsourcing of third party services, the provision of investment advice and the competence / compliance of sales staff.” Broker staff must NOT:

1) “Make frequent and repeated telephone calls to clients;

2) Use aggressive language;

3) Exercise pressure on clients;

4) Urge or advise clients to invest or to deposit funds;

5) Brokers must not outsource key client-facing functions such as sales and retention to third party providers;

6) Key client-facing functions such as sales and retention much occur in Cyprus, or in another EU country to which that broker’s license has been duly passported.”

Two weeks later, she continued her barrage with a circular directed specifically at binary option brokers. Brokers have three months to comply with these four general principles, detailed in 13 pages of rules and standards for binary options compliance:

1) “Act honestly, fairly and professionally in accordance with the best interests of their clients;

2) Provide adequate information to clients about the financial instruments offered;

3) Execute orders on terms most favourable to clients; and

4) Execute clients’ order, promptly, fairly and expeditiously.”

At a subsequent news conference, Ms. Kalogerou stated that, “CySEC’s vision is to consolidate the Cypriot capital market as one of the safest, most credible and most attractive investment destinations. This can be achieved through effective supervision that would safeguard investor protection and healthy market growth. Our aim is not to destroy the market, which contributes to the economy in general. We became a hub, let us utilise this to our benefit – but we should find ways to bring about full compliance with the supervisory framework. The market as we know it will change.”

What will be the consequences of such an abrupt clampdown on brokers?

It has been known for some time that the European Securities and Markets Authority (ESMA), an independent EU Authority, has been putting pressure on CySEC to “bring its house in order,” a possible reason why so many actions seem rushed at a furious pace. Whatever the reason, there will be consequences. Costs will rise, especially on smaller brokerage firms, leading to a possible exit or consolidation with a larger rival.

Limiting leverage and bonuses attack the very lifeblood aspects of new client acquisition processes, but the new rule that may prove most irksome is the requirement that outsourcing of sales calls must be local to Cyprus or meet very high standards set by CySEC. As one headline purported, “Regulated Brokers Must Give Up Call Centers in Israel.” The level of heat directed by the international regulatory community at both CySEC and the Israeli Securities Authority (ISA) appears to be producing results.

In a recent interview, Sami Mana, General Manager, Leverate, noted that, “What we are witnessing is a change in the DNA of the industry… At the outset, the DNA was originally based on sales people.” It now requires more professional DNA related to trading and markets, not just selling.

Concluding Remarks

Do not attempt to embarrass or harass a regulator. It will come out swinging with every weapon that it has at its disposal, and let the chips fall where they may. CySEC has tried to be a partner and cooperative force in the past with the financial services industry on several occasions, but to its dismay. As a result of leniency in the past, CySEC has had the clear the decks in a radical fashion. Either comply with new rules or go elsewhere. The new rules appear fair and responsible on the surface, but there will be cost factors to overcome and competition to deal with off shore.

As officials have proclaimed, the market will change. Be prepared to adapt, if necessary.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox