The Australian Dollar and New Zealand Dollar have both maintained upside pressures through mid-July, with the NZDUSD hitting a new 2016 high over the past week and AUDUSD pushing above key .7648, to shift the outlook from more of a range environment to a bullish them into the second half of July.

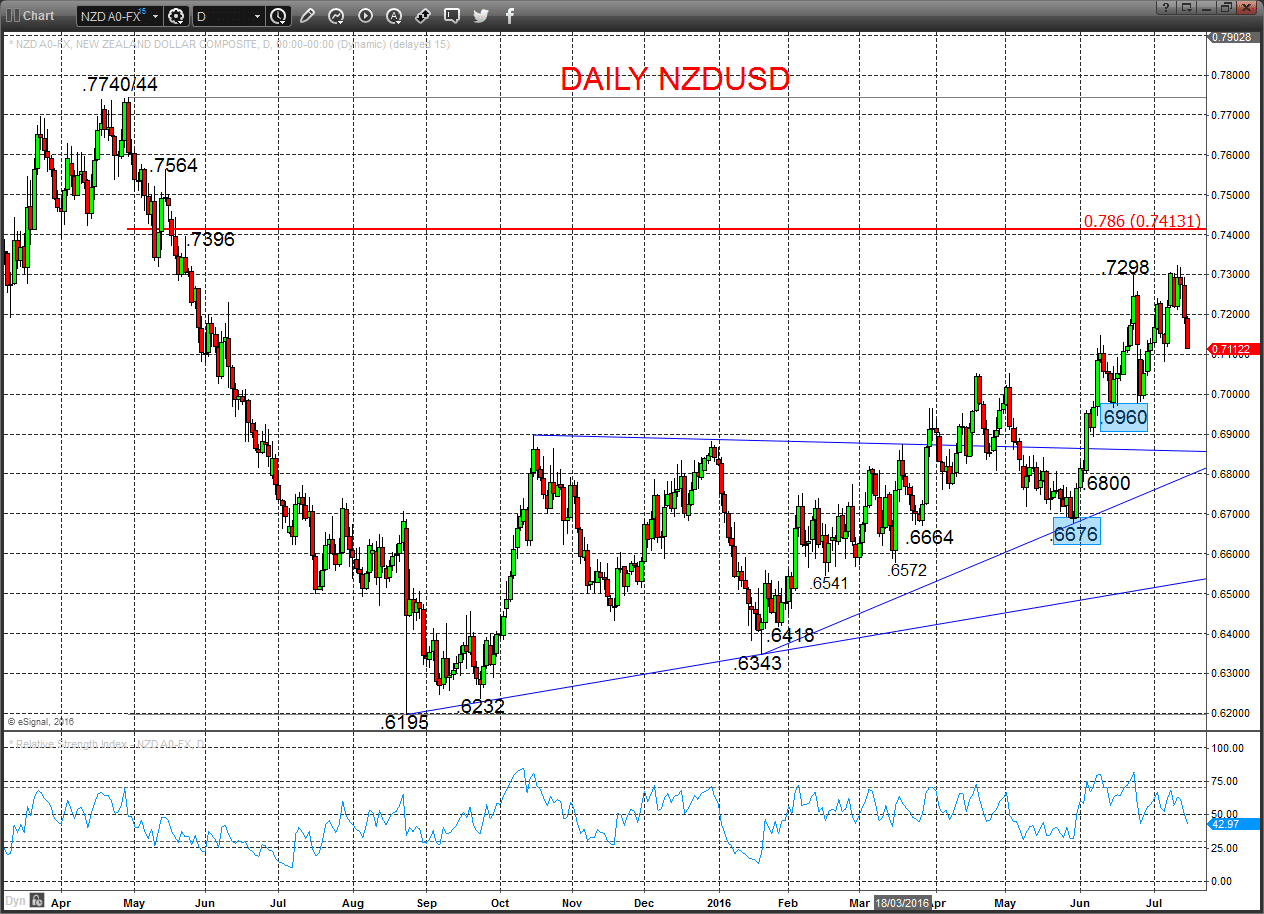

AUDUSD

A new recovery high Friday to reinforce upside pressures from the intermediate-term bullish shift signalled Wednesday, by the prod above .7648.

But then a notable intraday setback for a bearish outside pattern, leaves a downside corrective consolidation tone into Monday.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to .7719.

- Above here targets .7835/49/78 and .8000.

What Changes This? Below .7403 signals a neutral tone, only shifting negative below .7284.

For Monday:

- We see a downside bias through .7555 for .7518/10; break here aims for .7467/66.

- But above .7645 opens risk up to .7676, maybe for .7700 and next key level at .7719.

Daily AUDUSD Chart

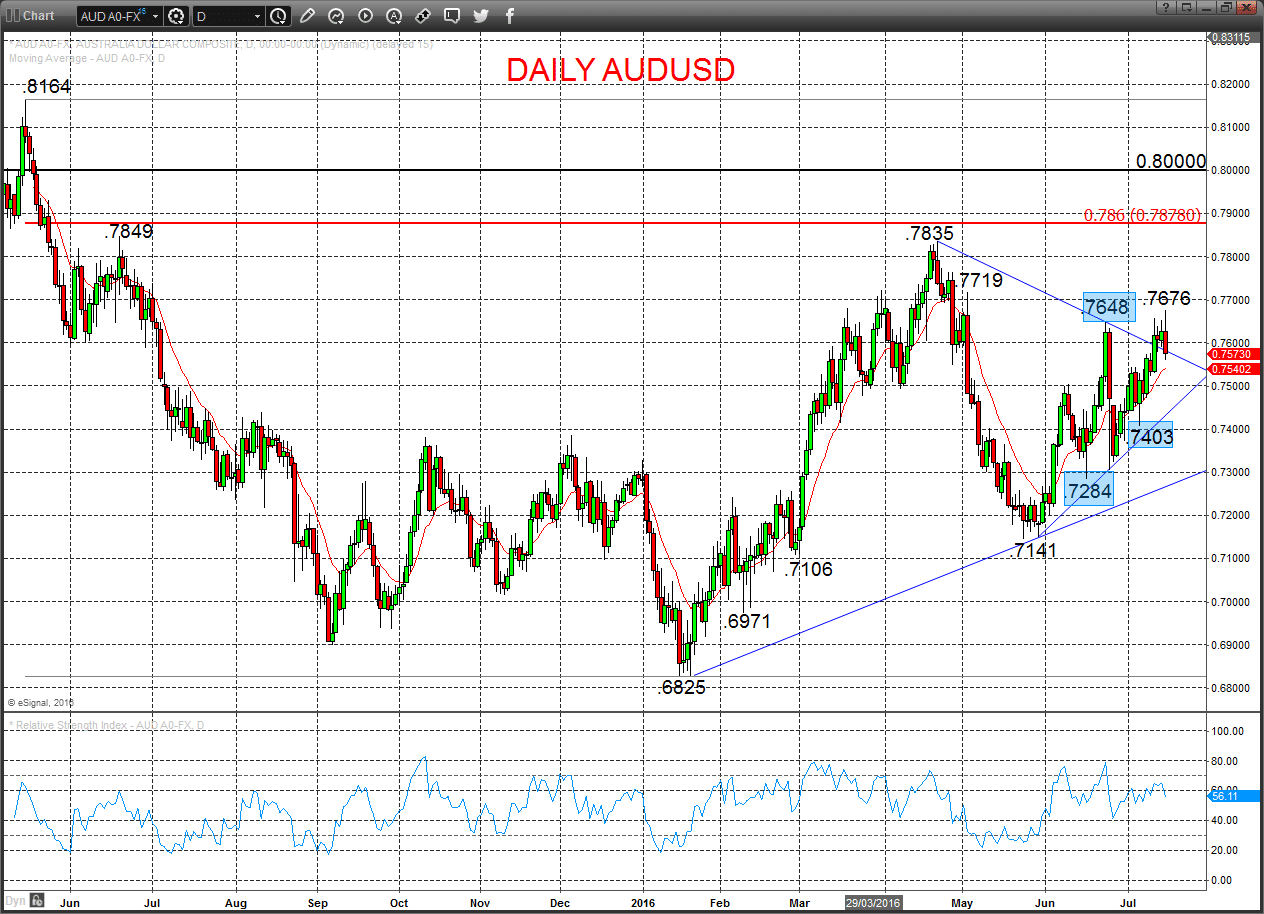

NZDUSD

A more negative consolidation Friday with a push below .7176 and .7132 supports to reinforce the Thursday push back through previously defended support at .7213/12, to set a further downside correction bias into Monday.

However, the new cycle high above .7298 leaves the intermediate-term outlook for July still bullish.

Short/ Intermediate-term Outlook – Upside Risks: A previous shift to an intermediate-term bullish tone above .7054.

- We see a positive tone with the bullish threat to 7298.

- Above here targets .7396/7413 and .7564.

What Changes This? Below .6960 signals a neutral tone, only shifting negative below .6676.7396/7413.

For Monday:

- We see a downside bias for .7100; break here aims for .7075, maybe .7055/53.

- But above .7190 opens risk up to .7244, maybe .7272.

Daily NZDUSD Chart