Both the Australian and New Zealand dollars completed intermediate-term topping pattern against the US currency through mid-November from the significant sell-off seen in these currencies versus the USD after the US Presidential election result.

Despite corrective recovery efforts for both Antipodean currencies from late November into early December, US Dollar strength since the Wednesday 15th December FOMC rate hike has rejected the AUDUSD and NZDUSD rebounds.

This leaves risk for further AUDUSD and NZDUSD losses into the holiday season, into year-end and likely on into January 2017.

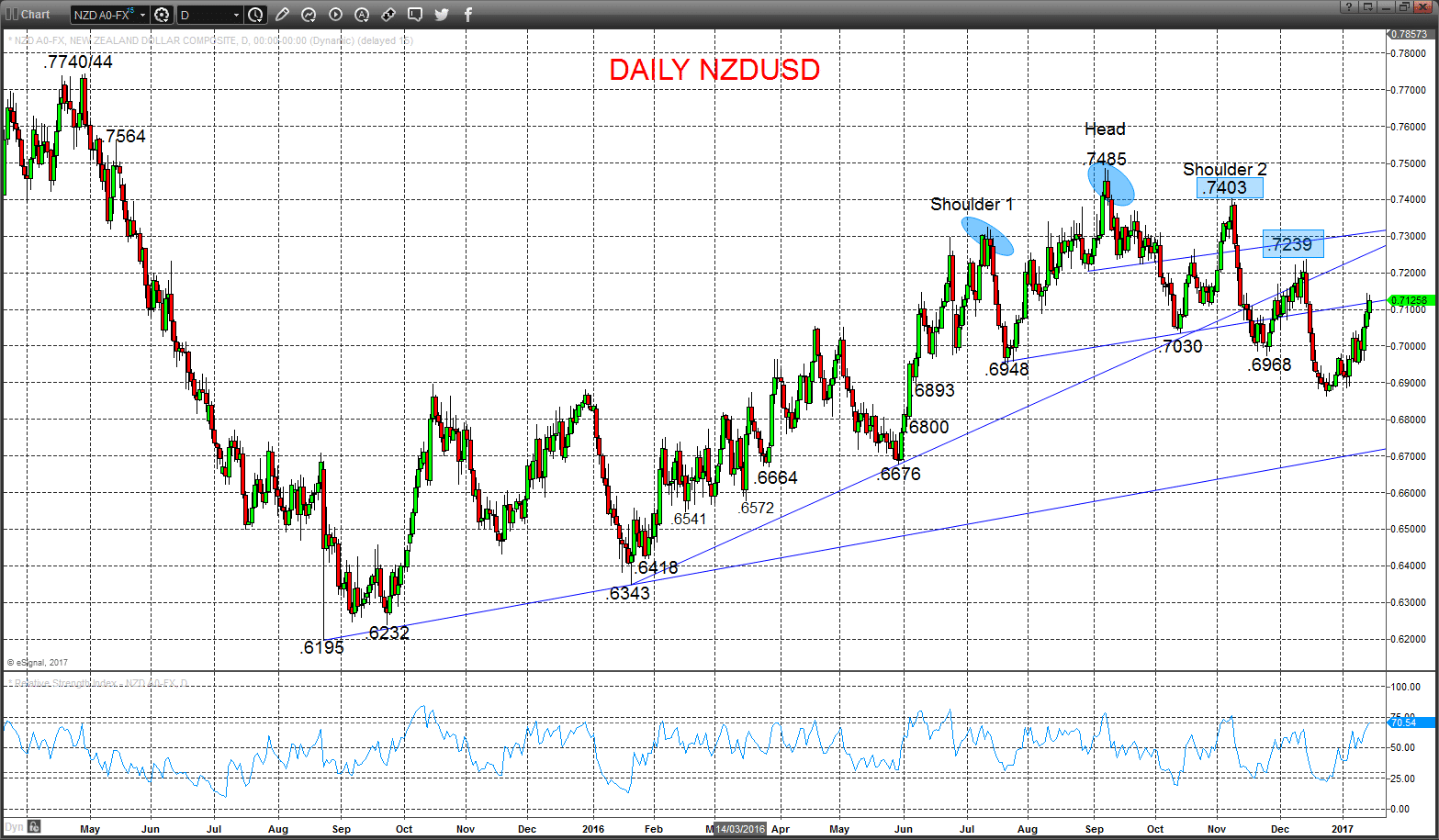

AUDUSD

Another important break lower on Friday down through the cycle low at .7306 and a key support level from June at .7284, which has reinforced the plunge lower after the FOMC decision Wednesday, maintaining the bias lower for Monday.

For Monday:

- We see a downside bias for .7262; break here aims for .7218, maybe as deep as .7141.

- But above .7354 opens risk up to .7369, maybe .7397.

Furthermore, the mid-November break of .7438 completed a multiple peak topping pattern, which leaves an intermediate-term bearish theme.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to .7141.

- Below here targets .7000, .6971 and .6825.

Daily AUDUSD Chart

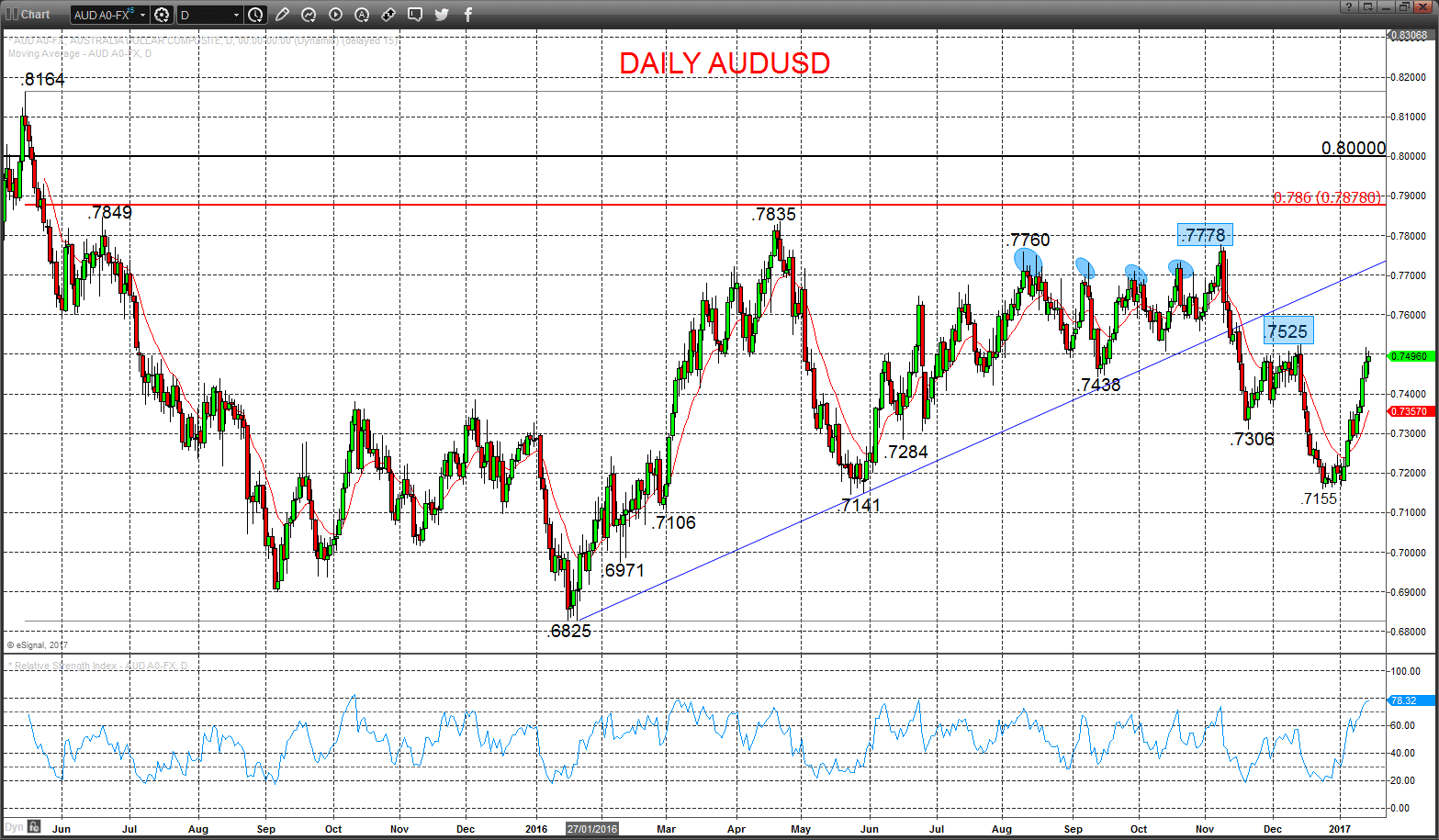

NZDUSD

Once more an aggressive sell off Friday down through supports at .7010 and the cycle low at .6968, reinforcing the bearish outside pattern plunge after the FOMC decision last Wednesday, maintaining the bias to the downside into Monday.

For Monday:

- We see a downside bias through .6927; below here targets .6893, maybe as deep as .6800

- But above .7028 opens risk up to .7050.

Moreover, the mid-November breakdown through the multi-month “neckline” of the Head and Shoulders top from July, signalled an intermediate-term bearish shift, confirmed below .7030.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to .6800.

- Below here targets .6676/64, .6572/41 and maybe as deep as .6343.

Daily NZDUSD Chart