The Australian and New Zealand Dollars have kept their positive tones against the US Dollar evident for much of June, with the NZDUSD maintaining the underlying, intermediate-term bullish trend.

AUDUSD is still confined within a broader range, but the firm tone since the Wednesday 15th June FOMC Meeting still keeps a positive AUDUSD outlook within the broader range environment.

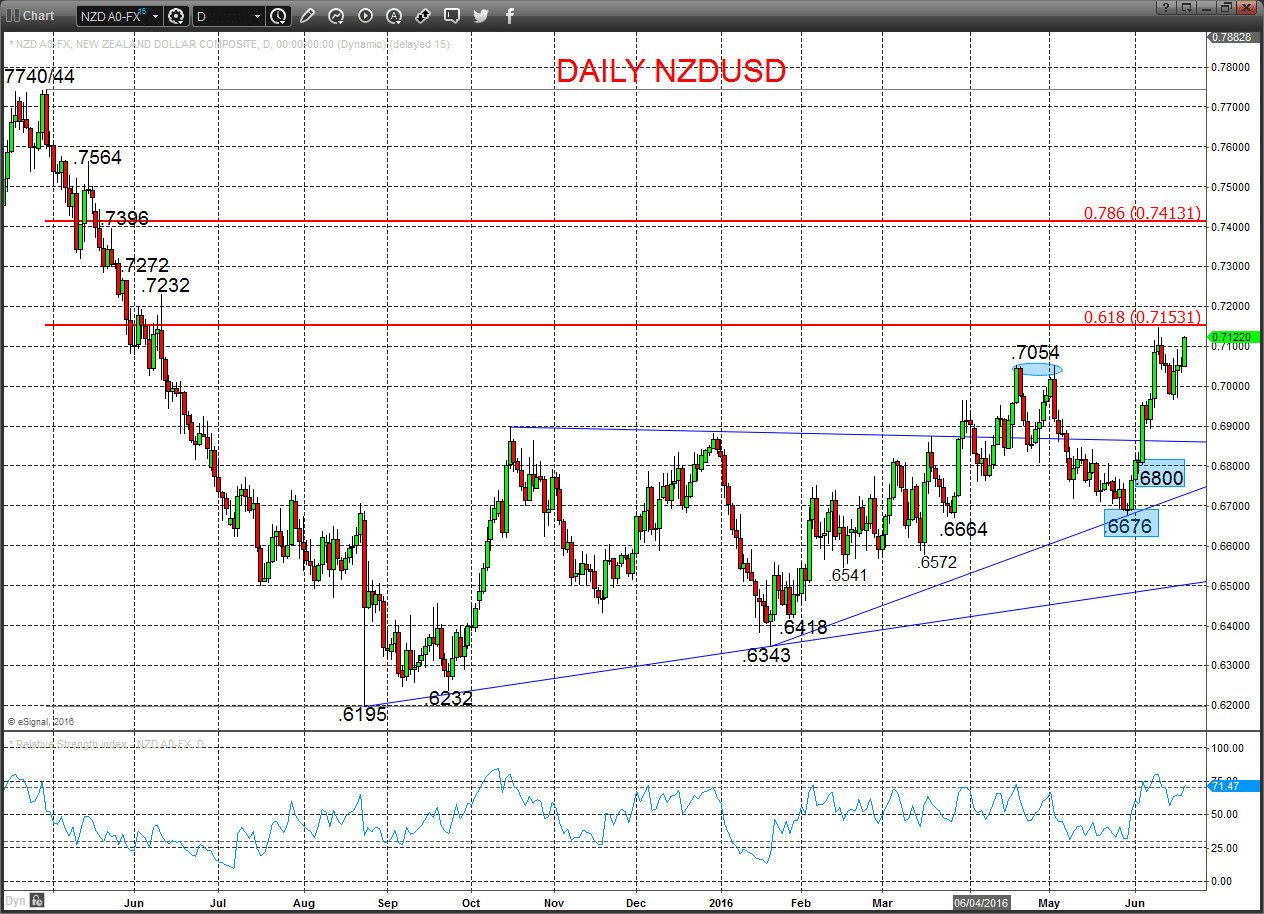

AUDUSD

A firm rebound effort after Thursday spike lower, to recover off of .7284 and push above .7334 and .7774 resistances, to reinforce the intermediate-term range theme, but to now leave an upside bias for Monday.

For Today:

- We see an upside bias for .7455; break here aims for .7471, maybe .7504.

- But below .7350 opens risk down to .7284. Maybe .7275/70

Short/ Intermediate-term Range Parameters: We see the range defined by .7719 and .7141.

Range Breakout Challenge

- Upside: Above .7719 aims higher for .7835/49/78 and .8000.

- Downside: Below .7141 sees risk lower for .7106/.7000/.6971 and .6825.

Daily AUDUSD Chart

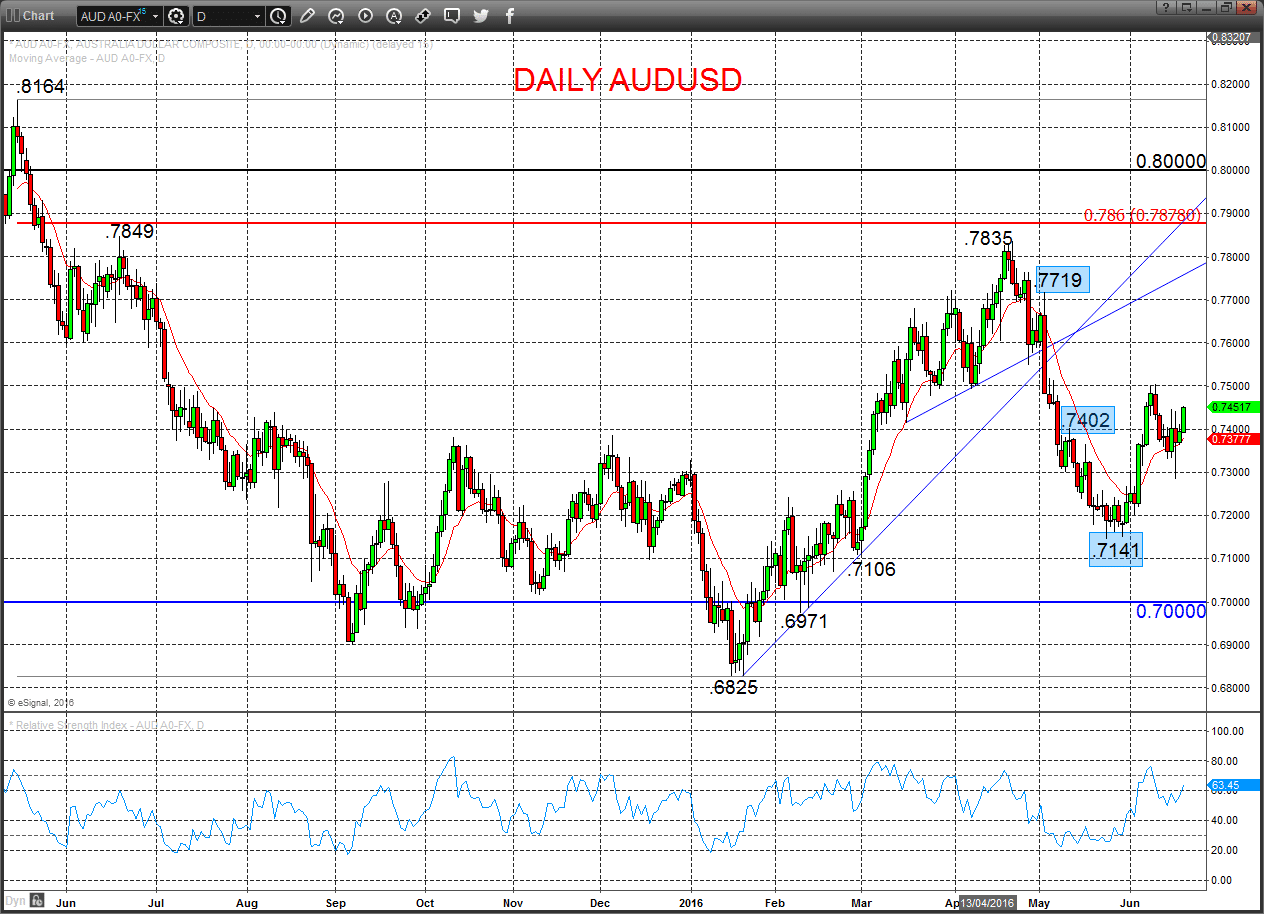

NZDUSD

An erratic Thursday-Friday to leave some upside pressure from the bullish outside pattern Wednesday, to set a bull bias for Monday.

Furthermore, the previous surging rally above .7054, in reaction to the 09/06 RBNZ announcement, produced a shift to an intermediate-term bullish view.

For Today:

- We see an upside bias for .7148/53; break here aims for .7200, maybe .7232/72.

- But below .7000 opens risk down to .6966/60.

Short/ Intermediate-term Outlook – Upside Risks: A shift to an intermediate-term bullish tone above .7054.

- We see a positive tone with the bullish threat to 7232/72.

- Above here targets 7396/7413 and .7564.

What Changes This? Below .6888 eases bull risks; through .6800 signals a neutral tone, only shifting negative below .6676.

Daily NZDUSD Chart