As if there were not enough risk issues to worry about these days, the International Monetary Fund (IMF), in its infinite wisdom, recently released a paper entitled, “Global Financial Stability Report: Navigating Monetary Policy Challenges and Managing Risks.” Chapter 3 of its tome is devoted entirely to the Asset Management Industry and highlights the concentration and growth that have occurred, which pose serious systemic and stability risk for global investors. The concerns raised are not on a fund-by-fund basis, but rather to the contribution that each large asset management firm makes.

Is the world of forex vulnerable to these risks? Yes, in more ways than one. First, it is not that long ago that FX Concepts, the largest currency hedge fund on the planet with $14 billion under management, crumbled beneath a string of unfortunate losses, followed by a whirlwind of withdrawal requests. The fund is now receiving protection under Chapter 11 proceedings, as the bankruptcy court liquidates the remaining assets to pay down a portion of $34 million in existing liabilities. Secondly, fund managers have invested across the globe, investing in less liquid assets that will be difficult to sell in an emergency. One significant event could cause an avalanche of cross-border capital flight and, with it, chaos in the currency markets until a new equilibrium is established.

What is the size and nature of this problematic situation?

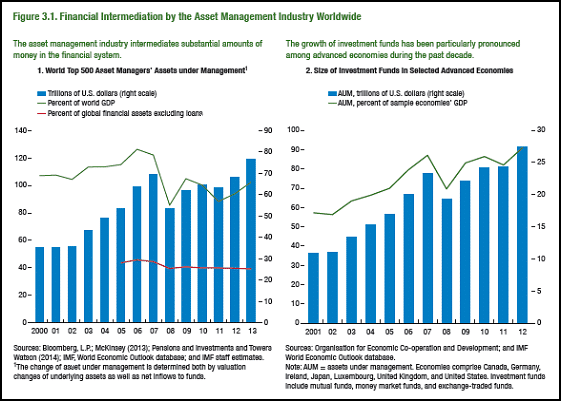

The IMF illustrates the growth and concentration of fund assets with the following two graphics:

Since the millennium crossover, assets under management (AUM) with the 500 Top Managers on a global basis more than doubled in value, while maintaining a steady equivalency with global GDP. The concentration issue becomes apparent, however, when you focus on advanced economies. AUM has nearly tripled, but, when compared to the requisite GDP values, the percentage amount has grown by nearly 60%, rising from 57% to 90% over the twelve-year period. It is evident that fund managers in developed countries have invested heavily in emerging markets, but at what cost?

With zero-interest-rate policies (ZIRP) dominating monetary policy in the developed world, the result has been a continual chase for higher returns around the globe, but without a prudent level of concern for risk that would normally be the case. It is not to say that fund managers are reckless, but, as we learned in early forex training classes, the potential for high returns can only come from assuming a higher degree of risk. Yes, higher returns can be found in developing markets, but this form of the popular “carry trade” has created a financial overhang that some estimate to be $12 trillion. The majority of these investments are in bonds or local equities where daily liquidity is questionable at best, even if a global bank is well positioned in the country.

The IMF is a bit more subtle in how it portrays potential exit risk instability: “The delegation of day-to-day portfolio management introduces incentive problems between end investors and portfolio managers, which can encourage destabilizing behavior and amplify shocks. Easy redemption options and the presence of a “first-mover” advantage can create risks of a run, and the resulting price dynamics can spread to other parts of the financial system through funding markets and balance sheet and collateral channels.” In other words, when fear selling commences, it will be dramatic.

In a way, this news is not new. Several central bankers in their public speeches have noted these concerns, especially those officials in Australia and New Zealand where capital flight could wreak havoc on the local financial markets. But the concerns do not stop there. From a size perspective, the “BRIC” countries (Brazil, Russia, India, and China) have all benefited greatly from the expansion of emerging market investing from developed country investors. There have been negative capital flows of late, but many of these and other similarly situated markets have moved to expand banking liquidity to address the changing tides. The result has been a rush of new buying in local equities, pumping up valuations to “bubble” levels and exacerbating the existing situation.

What corrective measures are offered up as potential solutions to the problem?

The IMF and other concerned groups and individuals are not suggesting that any funds be closed or directed to seriously modify their operating procedures. As noted in their report, “The analysis shows that larger funds and funds managed by larger asset management companies do not necessarily contribute more to systemic risk: the investment focus appears to be relatively more important for their contribution to systemic risk.”

The general recommendation is that industry oversight should be strengthened. The financial crisis in 2008 highlighted the “too big to fail” risk issue among large banks and insurance companies. The asset management industry was bypassed, so to speak. If poor business practices are creeping into the industry around the fringes, then more regulatory review is in order, if only to influence senior management to take some action to improve their inherent risk and liquidity profiles. New regulations and related audit practices, however, take time to develop and implement. Do we have the time?

Is there a sense of urgency amongst global participants?

The IMF and central bankers down under are a few voices speaking to urgency. The Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) have both recently spoken out on the issue and focused their attention on several of the larger asset managers. While at a speaking engagement in Washington, D.C., this month, Vítor Constâncio, a vice president for the ECB, warned about “the build-up of leverage and the growing exposure to illiquid assets in the asset management sector.” The IMF release also generated a healthy press response, as well.

Yes, the issue is getting attention, but no one is rushing to fix anything. At the same time, new reports suggest that concentration is not decreasing. As the industry grows, large funds tend to make participation easier, along with any redemption processes, but as one analyst points out, “Underlying portfolio liquidity is likely to be deteriorating as they grow.” Regulators have not been quick to respond either. Their concerns have been more with small investors with smaller funds, than the other way around. They perceive the larger funds as safer, more compliant with good business practices and regulations.

The issue is that no one is testing how a fund’s portfolio would react to a crisis situation that might flood the fund manager with redemption requests. The industry has typically used “gating” factors, rules that delay or postpone liquidations, so that they can be handled over time and not all at once. The problem with this approach is that the investor will still have to move to sell other assets, and, in so doing, do nothing more than move the systemic risk to another sector of the market, hopefully, where more liquidity will exist when pinched.

Are there other factors that make the situation worse?

Trading volumes on domestic stock markets in North America and Europe have been on the decline for the past several years, more than likely a response to the increased patronage of stock and bond issues in developing markets by both hedge funds and individual investors. Lower volume might lead to lower liquidity if another “flash crash” were to occur. Concentration also increases when popular fund managers draw a huge following, but, as history tells us, no one can stay on the top of the heap for very long. The law of averages, as well as changing market conditions, can de-throne even the most worthy of recipients.

The number of articles predicting the end of this record bull market are increasing by the day, and one would suspect that the average investor might take heed, but such is not the case, if a recent survey from the “Financial Advisor” magazine is any indication: “While investors may be looking for returns, they are extraordinarily optimistic about their investment prospects in both the short and long term. Respondents say they need 10.1 percent return on their investments, and 81 percent of them feel their expectations are realistic.” These expectations are anything but realistic in today’s low-return environment. In fact, another analyst remarked, “The average investor has reached the “stoopid” bullish level typical of market tops.” And so, we wait.

Concluding Remarks

In the words of the IMF, again, “Financial intermediation through asset management firms has many benefits. It helps investors diversify their assets more easily and can provide financing to the real economy as a “spare tire” even when banks are distressed.” In many ways, asset management firms pose less risk than their banking brethren, but the systemic and instability brought on by rampant growth and concentration is another matter. Not all funds are the same – some pose more risk than others.

The suggestion that more regulation is needed is already receiving enormous pushback from the industry, as could be expected. Lobbying efforts will be stepped up, and, if new rules are adopted, we can expect to see the same resistance that met new regulations proposed by the Dodd-Frank Act and other similar pieces of legislation in other markets. We are seven years hence from the last financial crisis, and banks have continued their trading operations unabated, receiving enormous bonus compensation in the process. Yes, a few major fund managers have been deposed, but the beat goes on.

What can one do to protect against this systemic risk? It is time to review your portfolio to determine if you are overly exposed to what might occur, if and when a “crisis event” might take place. If you have foreign investments, does the risk match the potential reward? What guarantees can your fund manager provide, if you want a quick exit? If your open forex positions are highly leveraged in minor currency pairings, then ask what you might do if the bid/ask spreads became widened to the extreme? At the end of the day, if your gut tells you to back away, then maybe it is time to reconsider. Stay tuned!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox