The Dollar Bloc Currencies (AUD, NZD and CAD) have been in consolidation patterns over the past 1-3 weeks against the US currency. However, AUDUSD, NZDUSD and USDCAD have been unable to push through any major USD support factors, which leaves AUDUSD and NZDUSD risks lower and the USDCAD threat higher.

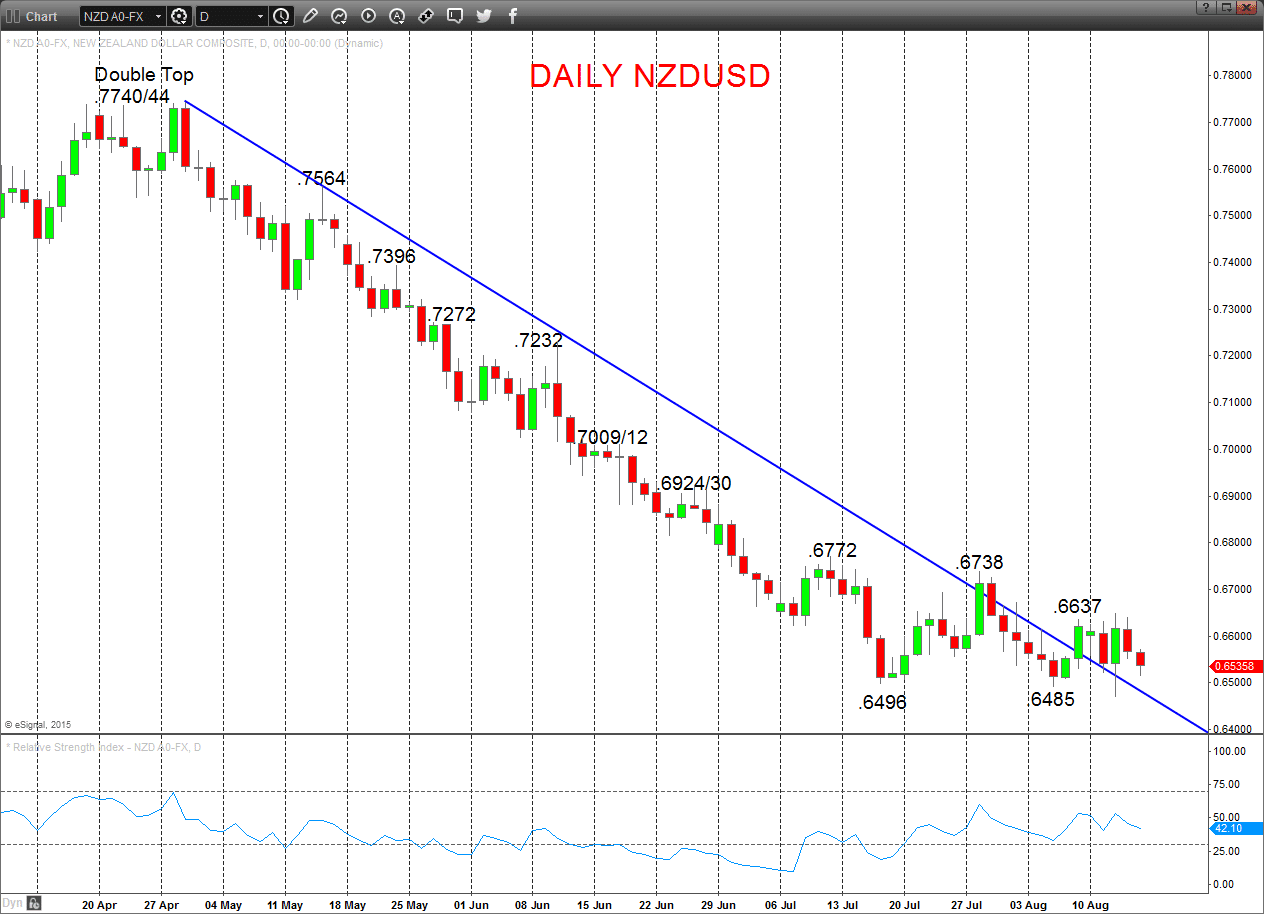

AUDUSD

- A digestion tone Thursday/ Friday, consolidating erratic price action after the Chinese Yuan devaluation, with the break lower to a new cycle low last week negating the positive bias from early August.

- Although we see a consolidation bias again Monday, we see an underlying bear trend intact.

Short/ Intermediate-term Outlook – Downside Risks:

- Whilst below .7499 we see a negative tone resurfacing with the bearish threat to .7269 and .7091.

- Break sees psychological .7000.

Daily AUDUSD Chart

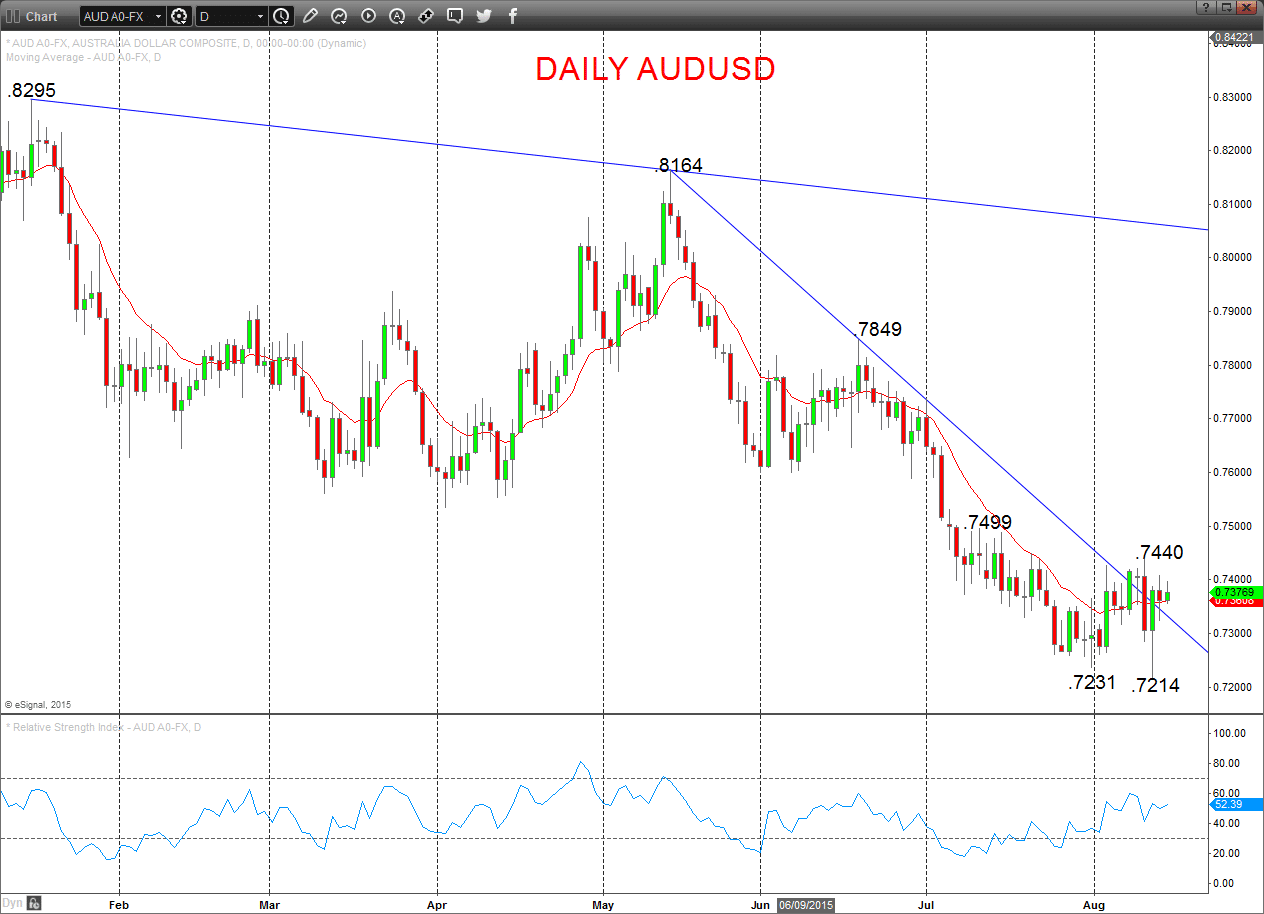

NZDUSD

- The end of week setback from .6623 resistance and push through .6516 support leaves a negative tone for Monday.

- Furthermore, the Tuesday-Wednesday break lower, after the Chinese Yuan devaluation has re-energized the underlying bear theme into August.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to longer term targets at .6404 and .6196/54.

- Overshoot threat is lower to maybe .6000.

Daily NZDUSD Chart